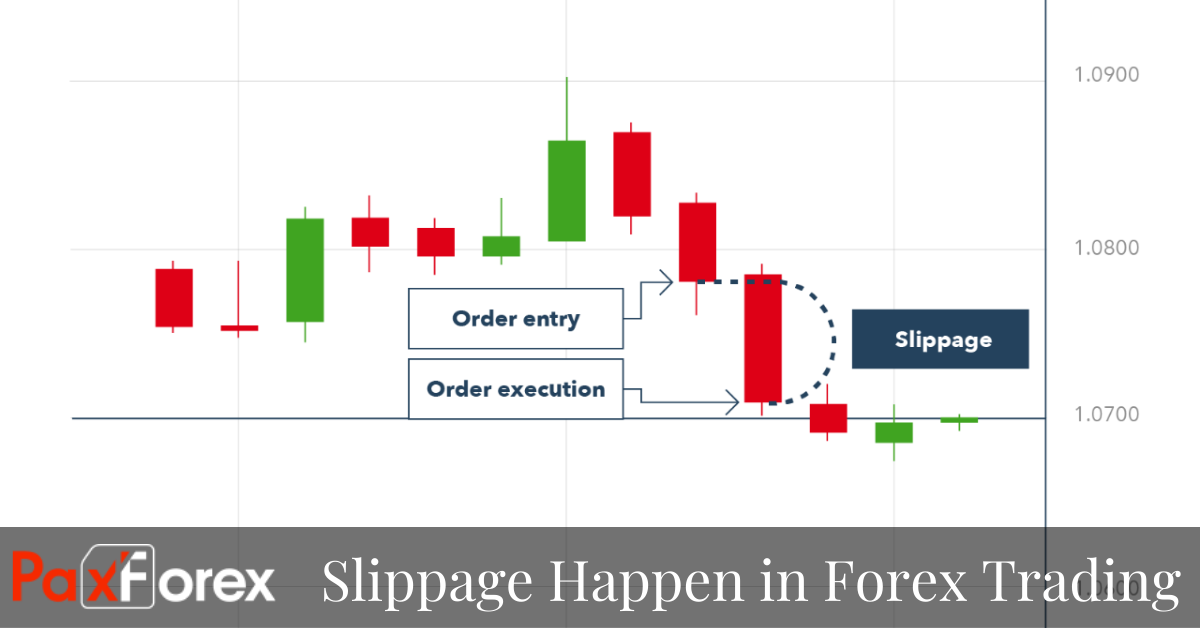

One of the major costs of forex trading you can encounter beyond the commission or spreads is the slippage that can occur when placing trades. Slippage is the delay that can occur between the time you place your order and the time the order is executed at the exchange or execution venue. The more latency in a traders systems or brokers, the larger the time between the order being placed and execution the larger chance for slippage to occur in online trading.

Although it is habitually considered bad, slippage doesn’t necessarily give a negative or positive connotation to the final outcome of the trade. Slippage is the difference between the price specified when the trader sends the request for the trade and the price at which the actual transaction takes place when the deal is executed. Slippage usually occurs during highly volatile periods in the market when the number and volume of orders suddenly increases.

Slippage frequently happens while in periods of biggest movements, whenever market trades are utilized, also whenever large positions are made when there might not be sufficient interest at the preferred price level to keep up the estimated price of position. Also, sometimes only we might see Slippage, especially when any important financial or economic news released during news sharp rise/fall in the market price, and sometimes you open the position at the different price but due to sharp movement your order filled at the different price.

For retail forex traders, it might be tempting to blame their brokers for not obtaining the desired price when slippage occurs. However, in a sense, slippage is verification for traders that they are operating in a real market environment and not an artificial one that could be manipulated by brokers and dealers. Sometimes, when a market is less active and less liquid, the next available price will need to be offered not by another retail or institutional customer, but by a market maker.

Some brokers and dealers may also offer a “market range” feature on their order platforms that allows traders to select the amount of slippage they are willing to accept on a specific order. They may enter a range of several pips or zero pips. If the range of slippage accepted is not available, the trade won’t be executed. Market range features often allow traders to specify only negative slippage. Thus, any positive slippage that goes in the trader’s favor would still be allowed to occur.