Public interest in trading forex has grown considerably in recent years with the advent of online forex trading. Most online forex brokers now allow retail traders to deal currencies in much smaller amounts in the spot currency market. However, so many individual traders might wish to explore their options for trading spot currencies and foreign currency futures. Furthermore, since considerable differences exist between dealing currency futures and forex trading in the spot market, it makes sense for traders to learn about the characteristics, benefits and drawbacks of each market.

Retail spot forex trading is usually the go-to markets for many retail traders who do not have a large enough capital that they can risk. With many retail forex brokerages, offering trading forex for as little as $100, the high use of leverage has become one of the main attractive points for the retail category of traders. With high leverage comes the risk of losing a significant capital as well. It is for this reason that in 2010, the Commodities and Futures Trading Commission (CFTC) introduced new rules for U.S. based forex brokerages limiting leverage to 1:50, from 1:200 in a bid to keep private traders losses more manageable.

Spot forex differs as the underlying currencies involved in a deal are exchanged immediately when a trade is successfully placed. Rather than waiting for the expiry date a trader will typical Buy or Sell a specific amount of a currency pairing immediately. This allows for traders to immediately profit off any fluctuation in currency prices. Whenever someone goes to change up one currency into another currency they are participating in the spot market. In addition to foreign exchange, precious metals tend to be traded as a spot instrument.

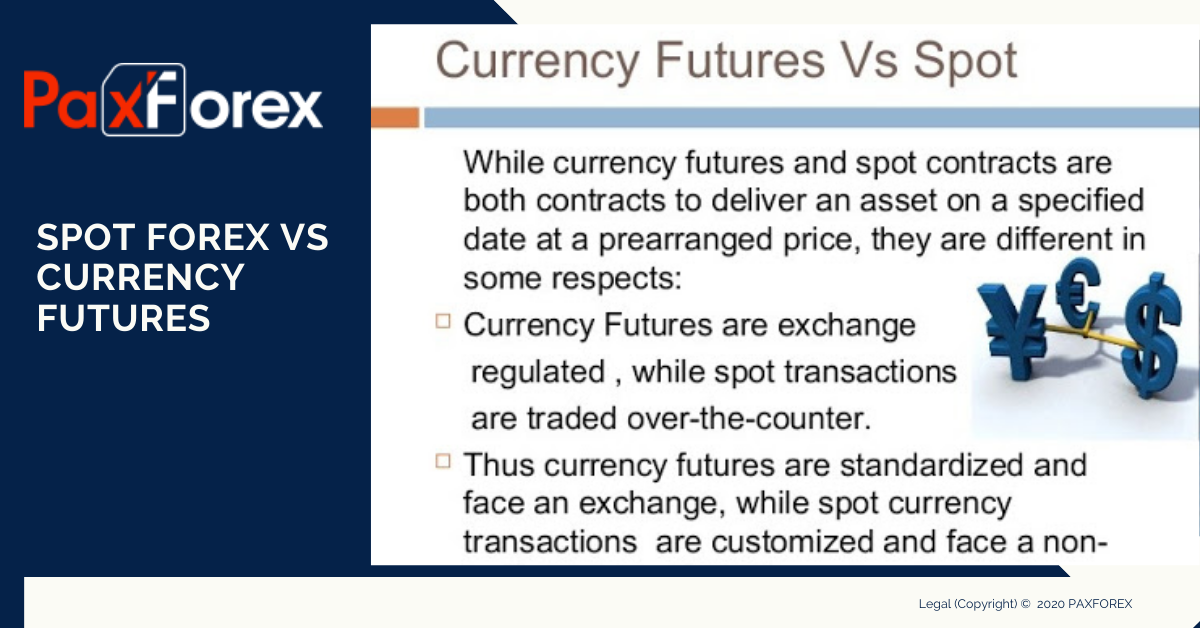

The main difference between currency futures and spot FX is when the trading price is determined and when the physical exchange of the currency pair takes place. With currency futures, the price is determined when the contract is signed and the currency pair is exchanged on the delivery date, which is usually sometime in the distant future. In the spot FX, the price is also determined at the point of trade, but the physical exchange of the currency pair takes place right at the point of trade or within a short period of time thereafter. However, it is important to note that most participants in the futures markets are speculators who usually close out their positions before the date of settlement and, therefore, most contracts do not tend to last until the date of delivery.

Forex and futures trading have unique attributes that can make each of them useful and profitable depending on traders’ short- and long-term financial goals. Forex trading may be more accessible for beginning traders, because it requires a smaller amount of initial capital and more limited exposure to long-term risk. In some cases, the two types of financial trades can be used simultaneously to an advantage, especially by more experienced traders who have become familiarized with the characteristics of each.