US President Donald Trump is scheduled to announce his administrations decision on Iran today at 2p.m. It is no secret that the preferred option of President Trump is to pull out of the deal. France and Germany tried without success to convince the US to remain in the deal and honor the past negotiations. Iran said that if the US pulls out, they would no longer be bound by the deal and may restart its nuclear program. President Trump has labeled the 2015 Iran deal under previous US President Obama the ‘worst deal ever’.

It is rumored that the UK and Israel are making their final attempts to sway the decision their way, but it is generally predicted that President Trump will announce an US exit from the Iran deal. The official deadline for an announcement according to US law is May 12th and there are some who believe that President Trump will keep the US in the deal in order to give negotiators more time to make adjustments. According to Trump, the current deal doesn’t address Iran’s ballistic missile program as well as its involvement in regional conflicts. Iran said that adjusting the deal is not acceptable.

Oil prices have increased as the most likely outcome could lead to reimposing sanctions on Iran. This would have a ripple effect throughout asset classes. The Turkish Lira could face the biggest fallout should Iranian oil shipments be sanctioned once again. The 10%+ contraction in the currency this year against the Euro and the US Dollar on the back of worries about Turkish monetary policy and inflation could be accelerated further. The Japanese Yen as well as the Swiss Franc could also see a sharp increase in bearish sentiment as they react more to commodity related developments than their counterparts.

What will the fallout be if the US decides to pull out of the Iran deal? What will happen to price action of President Trump surprises markets by remaining in the deal? PaxForex has the market covered, both from a fundamental aspect at the PaxForex Daily Fundamental Analysis and from the technical side at PaxForex Daily Forex Technical Analysis. Our expert analysts work hard in order to identify the most profitable trades each day.

The Turkish Lira, The Japanese Yen and the Swiss Franc are the three currencies which are expected to face the biggest bearish impact from reimposed Iran sanctions. Forex traders should expect the biggest bullish impact in the Canadian Dollar, the Russian Ruble and the Norwegian Krone. All three are countries are big oil exporters and should see an increase in buying pressure as the oil price will advance. Forex traders should be prepared for an increase in volatility and here are three forex trades worth a look for how reimposed Iran sanctions may impact the forex market.

Forex Profit Set-Up #1; Buy EURTRY - D1 Time-Frame

This currency pair is ready for a breakout above its horizontal resistance area should the US announce a retreat from the current Iran deal. The EURTRY is currently trading just below the lower band of its horizontal resistance area while an ascending support level is applying upside pressure. Forex traders should seek to buy the dips in the EURTRY even if the US decides to remain in the deal as monetary policy worries out of Turkey will remain in focus.

The CCI has advanced into extreme overbought territory, but remains well below its previous high which means there is more upside in this technical indicator. Open your PaxForex Trading Account now and enter this trade to your forex portfolio before the expected breakout will materialize.

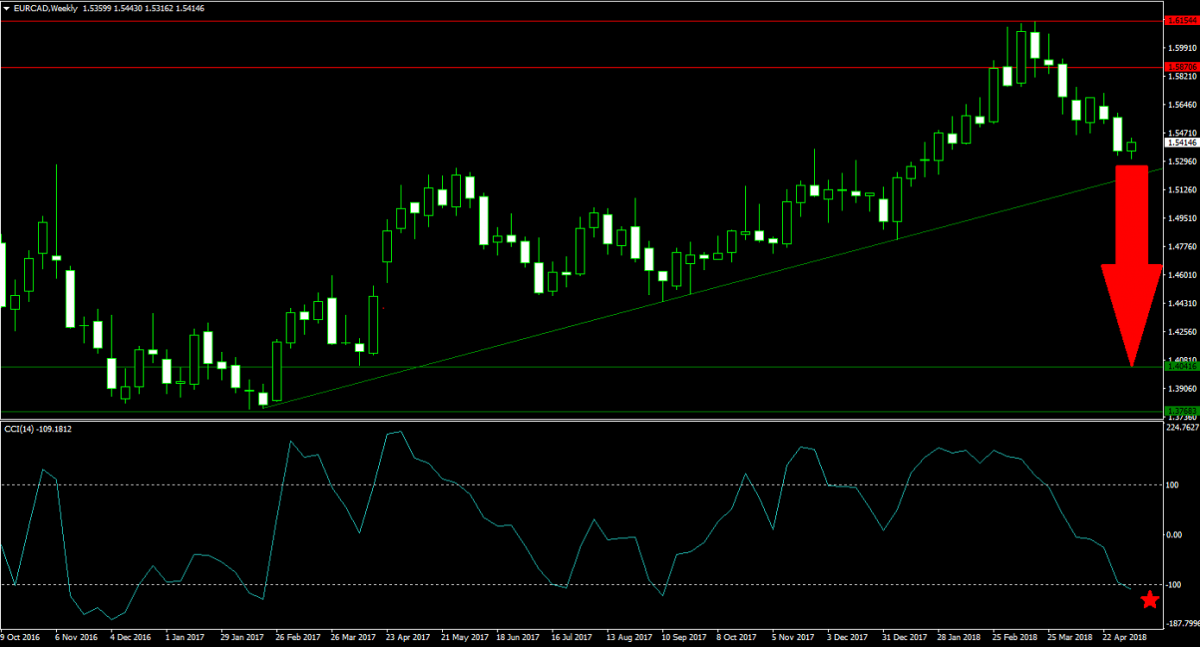

Forex Profit Set-Up #2; Sell EURCAD - W1 Time-Frame

The EURCAD has already started to retreat from its latest intra-day high and price action dropped below its horizontal resistance area. This currency pair is now approaching its ascending support level and bearish sentiment may be strong enough to force a breakdown. Following a sustained breakdown, the EURCAD is cleared to extend its correction until it will reach its horizontal support area. Forex traders are advised to sell the rallies.

The CCI has dipped into extreme oversold conditions, but has more room to the downside especially with a pending breakdown in price action. Diversify your Bitcoin and Ethereum holdings with a deposit into your PaxForex trading account. Access the forex market and earn more per trade in the real economy.

Forex Profit Set-Up #3; Sell GBPNOK - W1 Time-Frame

Price action for the GBPNOK is at an earlier stage of its corrective phase as compared to the EURCAD. This currency pair just dropped below its horizontal resistance area while a descending resistance level is providing additional bearish pressures. The GBPNOK is set to accelerate to the downside until it can challenge its horizontal support area. Forex traders are recommended to sell the rallies.

The CCI, a momentum indicator, has descended below the 0 level which resulted in a momentum change from bullish to bearish. More downside is likely as this currency pair is on track to move lower. Download your PaxForex MT4 Trading Platform today, make a deposit and enter this trade before it will accelerate to the downside.

To receive new articles instantly Subscribe to updates.