While low level Chinese and US delegations are meeting in Washington, round two of the trade war kicked off. The US decided to follow through on its initial $34 billions worth of tariffs with the announced second phase worth $16 billion. This completed the $50 billion worth of tariffs the US announced and further escalates trade tensions. China has retaliated as expected and applied the same 25% tariff on the same amount of imports from the US. In addition, China stated that it will file a complaint with the World Trade Organization about the new tariffs which took effect just after 12am local Beijing time.

The meetings between David Malpass, the US Treasury Undersecretary for International Affairs, and Wang Shouwen, the Chinese Vice Commerce Minister, will continue today with no expectations for a positive outcome. This marks the first face-to-face meetings between both countries since June. Initially, China vowed to purchase more American goods in order to de-escalate tensions. US President Trump than changed course and imposed the first round of 25% tariffs on $34 billion worth of Chinese imports. This was seen as a stab in the back in Beijing and relations soured since then.

Analysts are conflicted on the potential impact on global GDP, but the trade war is currently the number one concern amongst many. Moody’s Investors Service stated that 'US trade tensions with China are more likely to worsen this year, weighing on global growth in 2019. Most of the impact of the trade restrictions on economic growth will be felt in 2019. Any additional tariffs would be a material downside scenario.' It is very likely that the trade war will only increase in scope as Trump threatened tariffs on all Chinese imports which would result in Chinese retaliation becoming asymmetrical as it imports less than the US.

Will the US Dollar be able to handle a prolonged trade war? Forex traders will react to developments fast and volatility is expected to increase. Can the Japanese Yen and the Swiss Franc fulfil their save haven status as they have in the past? How about Gold or Bitcoin and Ethereum? Open your PaxForex Trading Account today and let our expert analysts guide you through the stormy waters of the US-China trade war.

The US currently feels as if they have the upper hand in the trade war as the US economy expanded at a strong pace in the past quarter while the Chinese economy slowed down. This has also been reflected in the respective equity markets. Scott Kennedy, a US-China Relations Expert at the Center for Strategic and International Studies, noted that 'Here we are three months later and if anything during that time the hawk’s position has been consolidated because we drove over the cliff and discovered our car can fly with the U.S. economy still doing fairly well and President Trump still popular among Republicans.' Round two of the US-China trade started and here are three forex trades to add to your trading account.

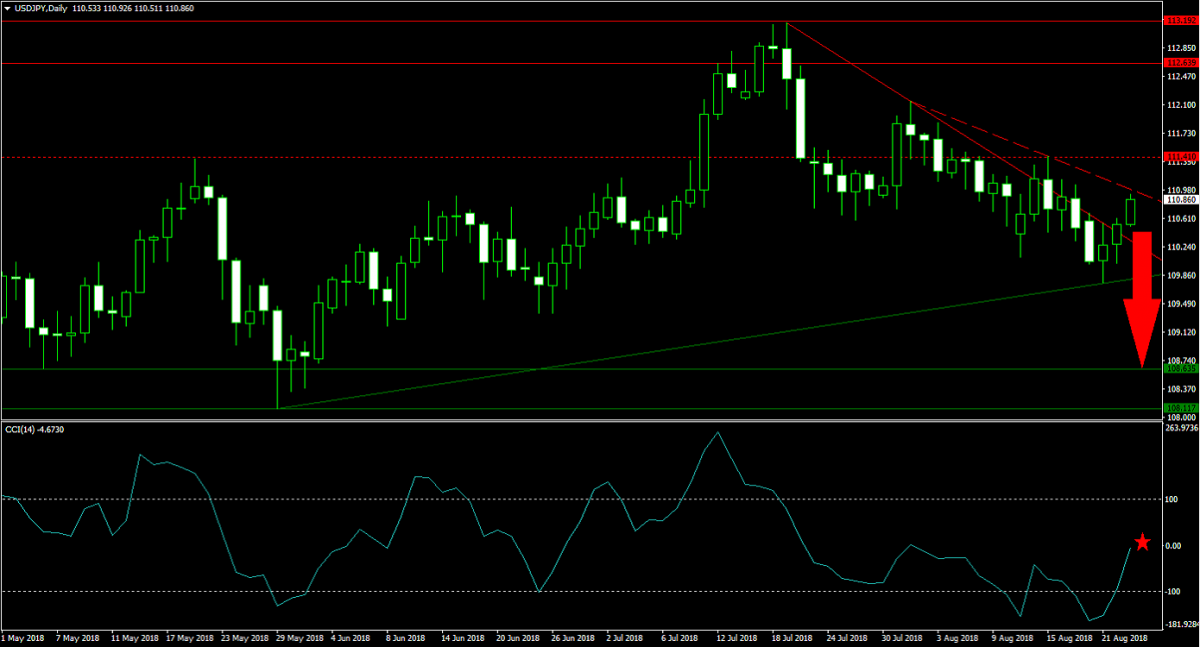

Forex Profit Set-Up #1; Sell USDJPY - D1 Time-Frame

The US currency enjoyed a good period of strength, but is vulnerable to a price action correction as well as a few Trump tweets as he is openly criticizing the US Fed, interest rate increases as well as the current value of the US Dollar. The USDJPY was able to reverse after touching its ascending support level which led to a push above its primary, steep descending resistance level. This currency pair is now being tested by its secondary descending resistance level and expected to drop back down into its horizontal support area. Forex traders are recommended to sell the USDJPY up to its next horizontal resistance level.

The CCI has recovered from extreme oversold territory, but momentum was unable to complete a crossover above the 0 level and is now faced with a double resistance level. A reversal is expected to follow. Subscribe to the PaxForex Daily Forex Technical Analysis section and copy our technical trading recommendations into your own forex trading account!

Forex Profit Set-Up #2; Buy GBPCHF - D1 Time-Frame

After accelerating to the downside, the GBPCHF has stabilized inside of its horizontal support area. Given the sharp drop in the British Pound, a short-covering may be imminent. The secondary descending resistance level started to intersect the upper band of its horizontal support area and price action is expected eclipse both from where it can move up into its primary descending resistance level. Bullish momentum may suffice to extend the expected advance in the GBPCHF into its next horizontal resistance level and forex traders should spread their buy orders inside its horizontal support area.

The CCI formed a positive divergence, a strong bullish trading signal, as it moved out of extreme oversold conditions. The rise in bullish momentum is expected to carry this technical indicator above the 0 mark. Make a deposit into your PaxForex Trading Account now and enter this currency pair to your forex portfolio before it will complete a breakout and accelerate to the upside.

Forex Profit Set-Up #3; Buy EURCAD - D1 Time-Frame

As the US remains looked in NAFTA renegotiations with Canada and Mexico, and the US-China trade war is threatening global growth, demand for commodities is expected to weaken. This would have a negative impact on the Canadian Dollar. The EURCAD just completed a breakout above its horizontal support area as well as above its secondary descending resistance level. Forex traders are advised to buy the dips in price action as the EURCAD is expected to advance into its primary descending resistance level which intersects its next horizontal resistance level.

The CCI confirmed the breakout with an advance from extreme oversold territory and a push above the 0 level. This momentum indicator is now expected to advance further until it will reach extreme overbought levels. Follow the PaxForex Daily Fundamental Analysis and let our expert analysts guide your trading account through the forex market. Earn over 500 pips per month with ease and comfort.

To receive new articles instantly Subscribe to updates.