Between understanding technical market fluctuations and determining how politics will affect the currency market to figuring out how to manage leverage and when to enter and exit for maximal profits, the forex markets can be extremely confusing, and there can be just as much potential for loss as there is for gain. For this reason alone, many potential traders prefer to employ the services of an account manager, rather than taking the risk into their own hands.

Between understanding technical market fluctuations and determining how politics will affect the currency market to figuring out how to manage leverage and when to enter and exit for maximal profits, the forex markets can be extremely confusing, and there can be just as much potential for loss as there is for gain. For this reason alone, many potential traders prefer to employ the services of an account manager, rather than taking the risk into their own hands.

With a good understanding of the market dynamics, the owner of a trading account can have a clearer idea whether another person could do a better job trading the market than they could themselves. Opening an account with a competent forex account manager is not only potentially useful for trading novices, but it could be an ideal solution for an investor familiar with the market, but that knows their limitations as a trader and prefers that their trading be handled by a professional.

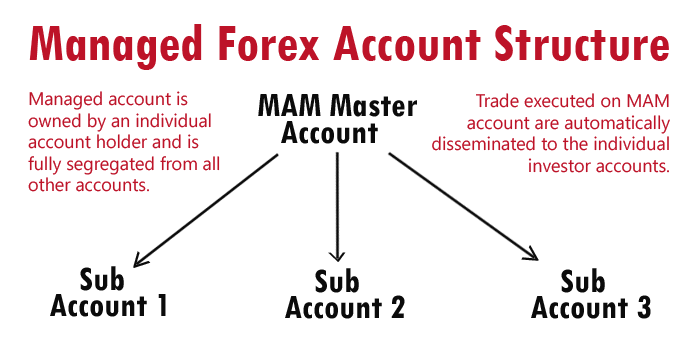

There are companies that also offer managed forex account services. Included in this category are hedge funds. These companies usually pool together funds from several investors and trade them in one central account. The relationship between forex investors and the managing companies is usually a formal one, with a fixed set of fees which are not limited to a share of the profits. In addition, the minimum investment amount is usually large, which effectively locks out many retail traders. The advantage of using this model of forex account management is that the operators of such managed forex account services are usually professionals who have been well trained in the art of forex trading.

Trading with a forex managed accounts service may have some powerful advantages, but risk can lurk in the corner in various forms. A managed forex accounts provider may be very profitable and all, but what if the trusted manager falls ill and is absent to trade. Another facet of this problem happens because previous results are not always indicative of future outcomes. It is probable for even a profitable account manager to hit a rough patch. And if you sign up with the service while the losing streak commences, the trader comes off poorer. Always, such traders would remove, and if the losing streak ends, the trader is then in a position not to be able to benefit from the lucrative streak.

It is imperative that the investor performs the necessary checks, and the best way to do this is to use the PAMM account model. This tests the skill of the manager in real time, providing an opportunity to evaluate the manager’s current trading results. A critical consideration to take into account when choosing a forex fund manager is to compare the track records of several competing funds. You will probably want to see how each potentially suitable managed forex fund performs in terms of its overall profitability, the consistency of its profits and the depth of its drawdowns.