Japanese candlesticks, including forex candlestick patterns, are a form of charting analysis used by traders to identify potential trading opportunities based on historical price data. Forex candlestick patterns, are fairly visual compared to other forms of technical analysis and offer information on open, high, low and close prices for the financial instrument you wish to trade. Japanese candlesticks are especially useful in offering insight into the short-term price movements of the markets – a valuable tool for day trading strategies.

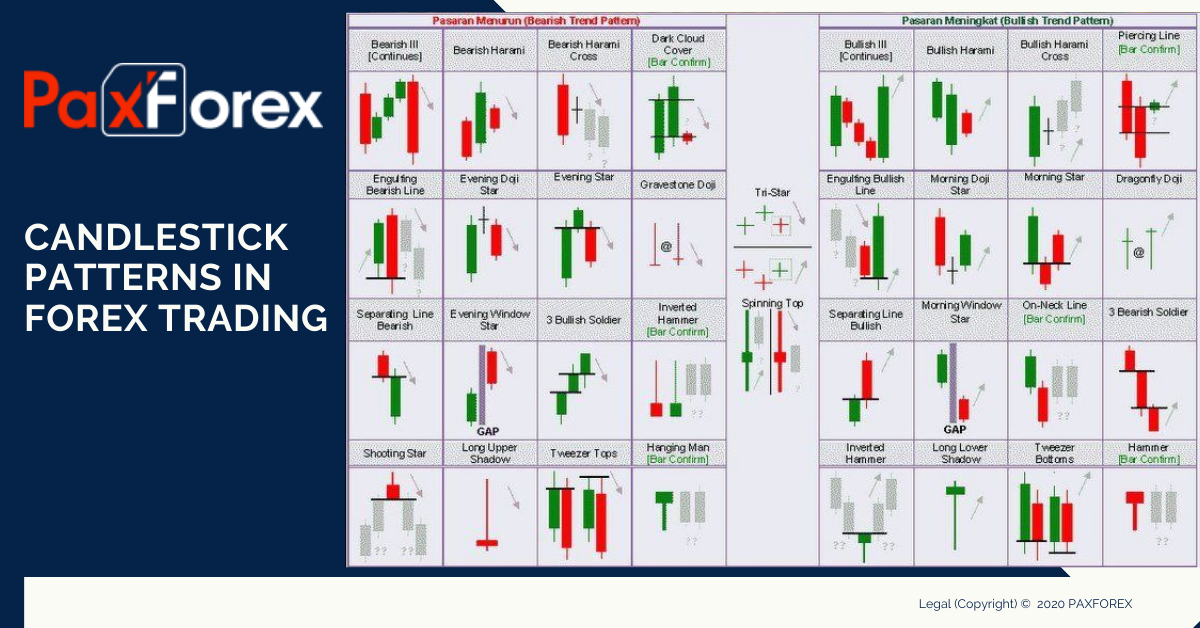

Candlestick patterns fall into two categories: continuation patterns and reversal patterns. As their names imply, a continuation pattern shows the prolonging of a trend, while a reversal pattern indicates a turnaround of a previously established trend. Depending on the number of candles that make up a particular configuration, candlestick patterns also fall into several different types that can convey useful market information to the trader looking to perform technical forex analysis. The simplest type of candlestick pattern consists of only one candlestick, while other patters are made up of several candles.

One of the most significant goals of technical analysis is to identify changes in direction of price action. Because candlesticks give visual insight into what the market is market psychology, one of the most useful aspects of candlestick analysis is its ability to suggest changes in the sentiment of the market, and reversals in trend. We call these candle formations Reversal Patterns. Important to note is that with candlesticks a reversal pattern does not necessarily suggest a complete reversal in trend, but merely a change or pause in direction.

Japanese traders that invented the system gave their patterns colorful names. Each of these patterns incorporates sound trading principles which underline the classic interpretation of each particular candlestick chart pattern. Having an ability to recognize and understand the interpretation of multiple candlestick patterns is a powerful trading tool for any financial market. Furthermore, for traders in the forex market, knowledge and understanding of candlestick patterns adds extra depth to their knowledge of technical analysis and their ability to use it effectively while trading currencies.

Forex candlestick patterns are crucial for the price action technical analysis of currency pairs. The candlestick pattern indicators form on the Japanese candlestick charts that visualize the price action of forex pairs. These are some of the names of the candlesticks patterns: The Doji Candlestick Patterns – Doji, Long Legged Doji, Dragonfly Doji, Gravestone Doji, and Four Price Doji, Tweezer Tops and Tweezer Bottoms, The Hammer Candle Pattern Family: Hammer, Inverted Hammer, Shooting Star, and Hanging Man, Three Inside Up and Three Inside Down, Evening Star and Morning Star Candle Patterns.