Yesterday marked the first FOMC meeting chaired by Jerome Powell, the new US Federal Reserve Chief. As market participants and Fed watchers widely anticipated, he kicked of his first FOMC meeting with a 25 basis point interest rate increase to 1.75%. The Fed also confirmed that it wants to hike three times in 2018 while signalling that more interest rate hikes are expected in 2019 as well as 2020. The US Dollar sold off after the announcement which many viewed more dovish than was anticipated.

Many expect a more hawkish Fed under Powell who wants to normalize monetary policy and also reduce the bloated balance sheet the Fed accumulated under the two previous Fed Chiefs Bernanke and Yellen. This could prove more challenging than many currently foresee as the US simultaneously is implementing tax cuts at a time borrowing costs are also set to increase. The bond market points towards a sharp rise in global borrowing costs moving forward. This will have an impact on forex markets as traders will make the necessary adjustments in their portfolios. Central bank policy divergence is also set for a return which will further move currencies.

At the same time the Powell Fed is on a mission to normalize US monetary policy, President Trump is due to announce $50B worth of new tariffs against over 100 Chinese goods. The new tariffs are in response to what the Trump administration estimates to be economic damages as a result of intellectual property violations. Former Vice Commerce Minister of China, Wei Jianguo, stated that 'If Trump really signs the order, that is a declaration of trade war with China.' Global policy makers have warned against trade wars as they are likely to derail an ageing global economic recovery.

With the post-crisis global recovery in the end phases, central bank monetary policy divergence and a global economy on the bring of trade wars, the forex market will offer traders plenty of opportunities. Open your PaxForex Trading Account today and prepare your forex portfolio for volatility induced profit opportunities. Take advantage of our expert analysts which stand by to guide traders through stormy waters.

China currently imports over $140B worth of goods and services from the US. The US agricultural sector is especially at risk and could become the first US victim of a trade war with China. Soybeans, sorghum and pork are easy targets for the Chinese government. Chips, aircraft and consumer goods are also on the list of retaliatory targets should President Trump sign the new tariffs later today as he is expected to do. Here are three forex trades to boost your pips after Powell Fed hikes and as President Trump is on the verge to sign new tariffs against China.

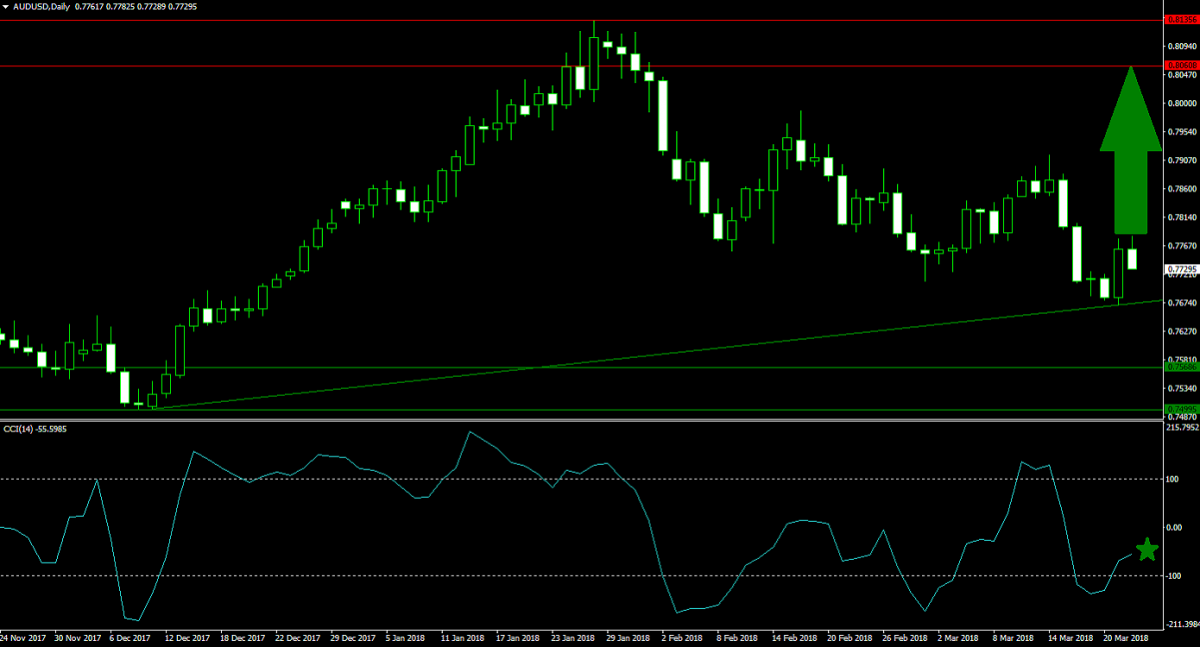

Forex Profit Set-Up #1; Buy AUDUSD - D1 Time-Frame

The AUDUSD halted its correction down from its horizontal resistance area as it reached its ascending support level. This support level originates from the lower band of its current horizontal support area and is expected to reverse price action. The Australian Dollar is set to capitalize on a trade war between the US and China. Forex traders are recommended to place their buy orders at the ascending support level of the AUDUSD.

The CCI briefly dipped into extreme oversold conditions below 100, but has recovered quickly and is now trending higher. A push above the 0 mark is further expected to attract more buy orders into this currency pair. Follow the PaxForex Daly Forex Technical Analysis and get the trading day’s most profitable technical trading set-ups.

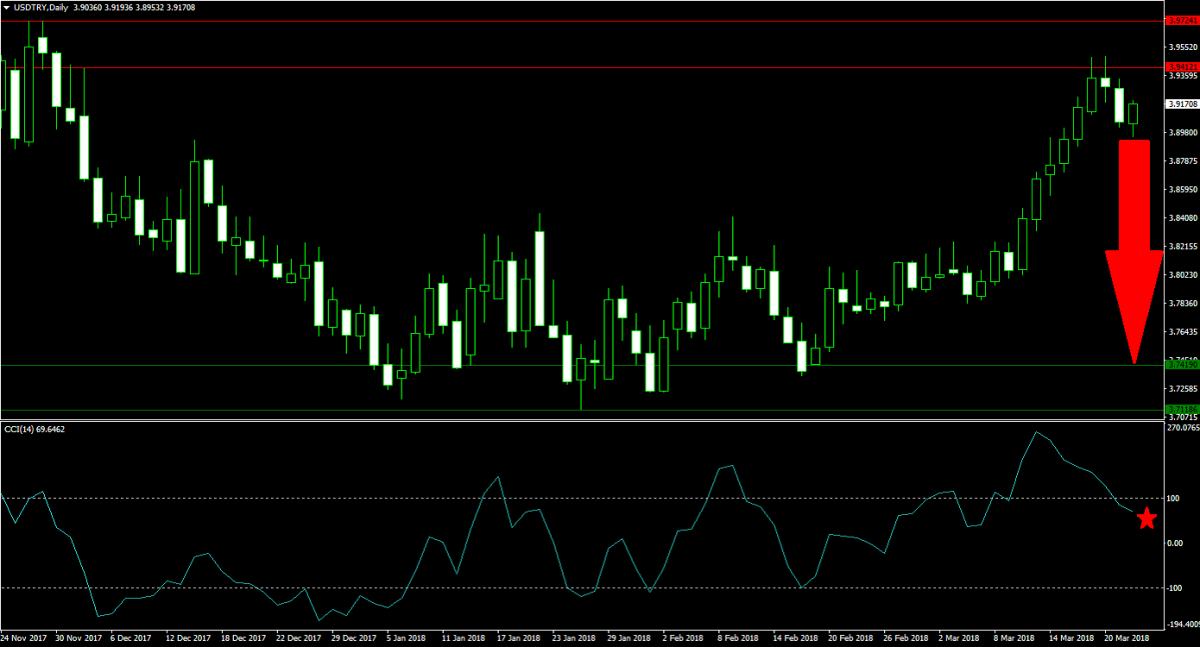

Forex Profit Set-Up #2; Sell USDTRY - D1 Time-Frame

Price action in the USDTRY has reversed after the horizontal resistance area rejected a continuation of the up-trend. The US Dollar is set for more downward pressure as a results of tariffs and rising borrowing costs. A full reversal of the most recent advance should not be ruled out and forex traders are advised to place their short entries between 3.9150 and 3.9400. This will reduce the overall risk profile for this trade and also increase profit potential.

The CCI already completed a breakdown below 100 which took the USDTRY out of extreme overbought conditions with more downside expected. This technical indicator is set to drop into negative territory as a result of the increase in selling pressure. Download your PaxForex MT4 Trading Platform and add this currency pair to your account before it will accelerate to the downside.

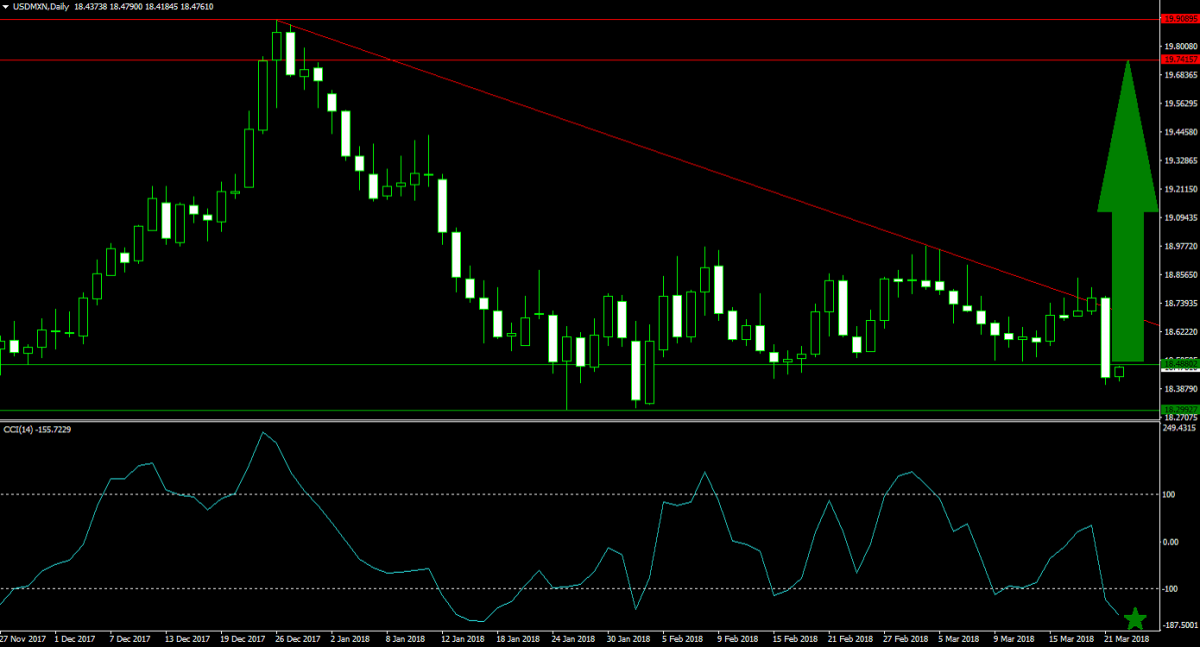

Forex Profit Set-Up #3; Buy USDMXN - D1 Time-Frame

While the US Dollar is set for more selling pressure against other major currencies, US Dollar bulls may find refuge in the USDMXN. Any negative impact on the US economy as a result f a trade war with China may cause greater economic damage to Mexico. Price action is currently trading inside of its horizontal support area following a steep sell-off. Forex traders are recommended to spread their buy orders inside the 18.3000 and 18.4880 zone.

The CCI, a momentum indicator plunged well below the -100 level and the USDMXN is now in extreme oversold territory. A breakout from current conditions is likely to follow and ignite a short-covering rally. Subscribe to the PaxForex Daily Fundamental Analysis and earn over 500 pips per month with the help of our expert analyst who scan the forex market for the most profitable trades each trading day.

To receive new articles instantly Subscribe to updates.