With many equity markets at or near all-time highs and bond markets in rally mode of their own, a growing risk which could derail the overall bullishness across asset classes has emerged. The price of oil has largely been ignores by many analysts, economists and traders which has created a dangerous scenario. Oil is used in a wide range of industrial applications and used to be a gauge for the health of the global economy. In addition it was a key driver for inflation and inflationary pressures, but currently it has been reduced to a mere footnote when the health of the global economy assessed.

Inflation has been absent in the recovery from the 2009 lows after the last global financial crisis. Despite the money central banks have printed and induced into the economy, inflation has remained absent and there are no signs of inflationary pressures. We are approaching nearly a decade of ultra-low interest rates and many have forgotten about the inflation risk which may be posed by oil. The fundamental news flow surrounding oil have been bullish which will support an extension o the price of oil which is hovering near six month highs. The clearest sign that investors and traders don’t foresee higher oil prices is the disconnect between the price of oil and publicly listed oil companies which are lagging price action by a degree not seen since 2009.

The US decided to cut off Iranian oil exports and will punish any country which will purchase Iranian oil. This coupled with sliding production in Venezuela and the rising risk to Libyan oil production are likely to support higher prices. Lisa Shalett, CIO of Morgan Stanley Wealth Management, pointed out that “While year-over-year price gains for oil and gasoline seem benign, if they remain at current levels, there will be much tougher year-over-year comparisons by the fourth quarter. That could prove challenging for many asset classes which have yet to price the risk.” The forgotten inflation risk is also evident in thinking of the US Fed which is not only planning to introduce further stimulus, but is also contemplating an interest rate cut as soon as this year.

OPEC plus Russia will meet in June in order to discuss keeping production cuts in place which is expected to further boost oil prices. The risk of higher inflation due to an extended period of elevated oil prices would come at the same time the global economy may be headed for a recession. How will this impact the forex market and its commodity currencies? Open your PaxForex Trading Account now and learn why a growing number of successful traders prefer PaxForex over other brokers!

While asset classes have undoubtedly enjoyed a goldilocks economic scenario, a growing number of indicators point towards a potential stagflation which could begin as soon as the fourth-quarter of 2019. Shalett added “Markets continue to celebrate gains in every asset class as a validation of central bank forbearance and the resumption of Goldilocks conditions. If oil remains at current levels through year-end, headline CPI could breach 3 percent, creating a problem for the Fed, cutting into consumer purchasing power, pressuring corporate profits and imperilling the growth in China and the emerging markets.” The longer a potential problem is ignored, the bigger its impact will be. Oil becomes the forgotten inflation risk, but here are three forex trades to ride the wave to the upside.

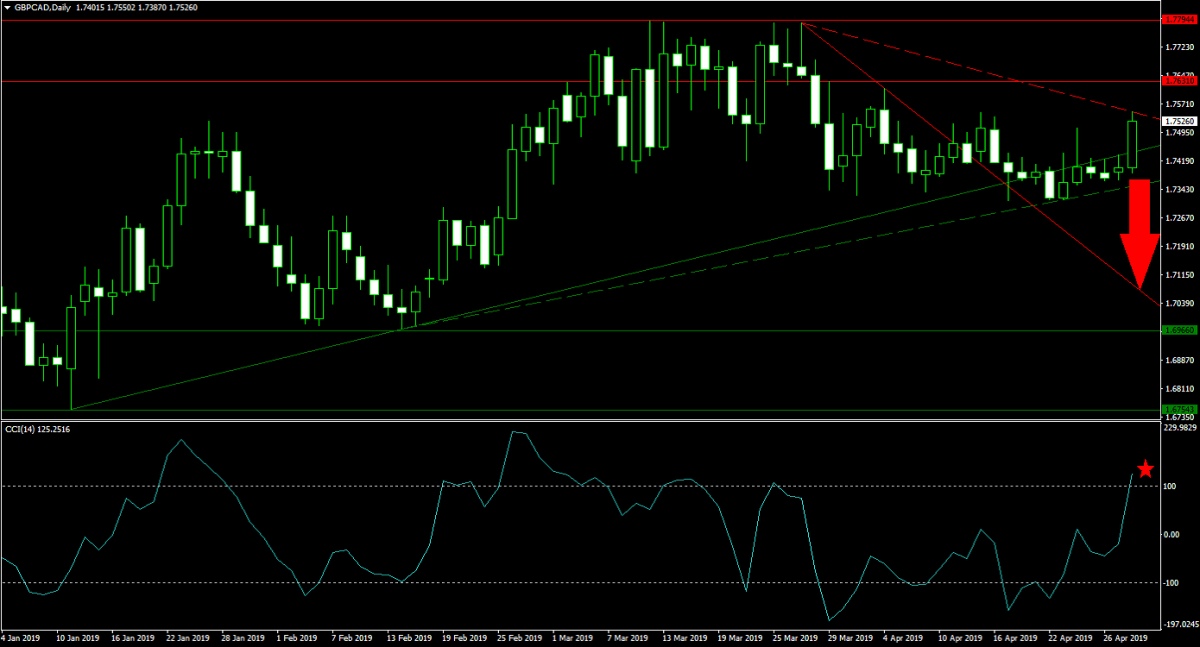

Forex Profit Set-Up #1; Sell GBPCAD - D1 Time-Frame

Higher oil prices will support a stronger Canadian Dollar which has been punished by lack of economic performance as evident in today’s GDP figures. At the same time the British Pound is clouded in extended Brexit uncertainty. The GBPCAD was able to recover after reaching its secondary ascending support level, but the combination of higher oil prices and Brexit uncertainty favors a price action reversal. Bearish pressures are on the rise after this currency pair reached its secondary descending resistance level. The GBPCAD is expected to complete a double breakdown, below its primary and secondary ascending support levels, and accelerate to the downside until it will reach its primary descending resistance level which acts as temporary support. Selling rallies into the lower band of its horizontal resistance area is the favored trading approach.

The CCI has spiked into extreme overbought conditions, but with fading bullish momentum is anticipated to reverse below the 100 level. This is likely to attract new sell orders and initiate a sell-off on the back of profit taking. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market yielding over 500 pips in monthly profits!

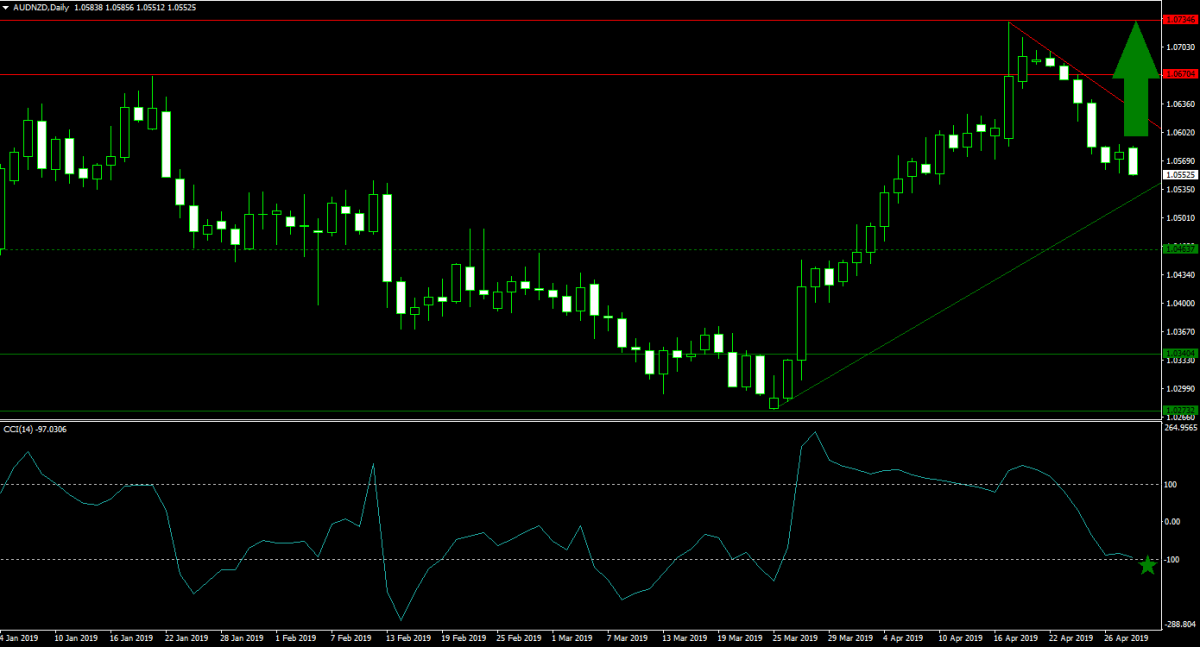

Forex Profit Set-Up #2; Buy AUDNZD - D1 Time-Frame

Australia and New Zealand are heavily reliant on the commodity sector, but Australia is by far the bigger commodity exporter and has the bigger economy. The Australian Dollar is now predicted to approach the end stage of its sell-off against the New Zealand Dollar. Price action started to break down after rising to the upper band of its horizontal resistance area from where a sharp sell-off unfolded. This currency pair is now expected to stabilize as its steep, primary ascending support level is closing the gap. The AUDNZD is favored to reverse it losses and complete a breakout above its primary descending resistance level which will clear the path for an extension of its advance into the upper band of its horizontal resistance area. Forex traders are advised to buy any dips down to its next horizontal support level.

The CCI is trading close to extreme oversold territory and is expected to briefly slide below the -100 mark before staging a recovery. This would represent an excellent buying opportunity in the AUDNZD. Download your PaxForex MT4 Trading Account today and join our fast growing community of profitable forex traders!

Forex Profit Set-Up #3; Sell EURCHF - D1 Time-Frame

As oil has become the forgotten inflation risk, the Swiss Franc has become the forgotten commodity currency. It is often only remembered as a safe haven currency, but the Swiss Franc has a great deal of exposure to the commodity sector. The EURCHF has been pushed higher over the past three trading sessions on the back of mixed economic data out of the Eurozone. Price action is trading in-and-out of its horizontal resistance area from where its primary descending resistance is exercising bearish pressures. As the global economy shows further signs of easing and with oil prices at elevated levels, the EURCHF is predicted to reverse course and complete a breakdown below its next horizontal support level and back down into its primary ascending support level. Forex traders are recommended to sell any rallies into the upper band of its horizontal resistance area.

The CCI already completed a breakdown below extreme overbought conditions and a negative divergence led the push to the downside. This momentum indicator is expected to extend its contraction below the 0 mark. Subscribe to the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades of our expert analysts into your own forex trading account!

To receive new articles instantly Subscribe to updates.