Brexit is inching closer, day-by-day, and the civil servants in charge of negotiation a deal are more or less on vacation for a few weeks. Maybe a breather is what they need, maybe they are not concerned about it given the UK’s team is led by a 'Remainer' or maybe it is a brilliant strategy to force the EU to come back from its break and actually negotiate. Barnier, the EU’s chief negotiator, resembles UK Labour Leader Corbyn as both like to vote against everything without offering a better alternative. Repeating the same thing over and over in the hope that it starts to sound right is pointless. Since the vacuum begs to be filled, a no deal Brexit may be closer to reality than many pro-EU individuals currently imagine.

Over this past weekend, UK International Trade Secretary Liam Fox put the likelihood of a no deal Brexit at 60%. Several bank analysts noted that the British Pound may fall back down to the 1.2000 level against the US Dollar. The same analysts also claim that if a no deal Brexit can be avoided, the GBPUSD could surge past 1.3900 and beyond. When it comes to EURGBP, analysts look at the 0.9250 level as a top with a few isolated calls for parity. While the British Pound has been unable to capitalize on the Bank of England’s interest rate increase last week, the sell-off has been mild compared to 2016 levels and price action is currently trading at solid support levels from where it could mount a quick comeback once the noise quiets down.

A no deal Brexit would mean different things to different industries, companies and individuals. While the media focuses only on how bad a no deal Brexit would be, one has to understand that not a single business person is part of negotiations. The task has been placed on civil servants, many who favor to remain in the EU, who have no clear knowledge of what Brexit may accomplish. A doomsday scenario has been created, maybe in the hope to scare the public into reversing Brexit. The only businesses which are being mentioned are those who would suffer from losing access to the single market, little is talked about the 70% of the UK economy which has zero sales in the EU. There are always two sides to each coin, and the not-so-free media focuses on one side only.

Forex traders can profit both ways, the only important fact is to be positioned on the profitable side of the trade. Forex traders can chose to believe the fear tactics in the media, pay attention to analysts who claim the British Pound could plunge or rally, or take a deeper look at price action while trying to understand what a no deal Brexit, a soft Brexit or a hard Brexit may look like. Open your PaxForex Trading Account now and position yourself for a profitable Brexit outcome, regardless of what politicians decide to do.

Peter Hargreaves, who has been one of the biggest Brexit supporters and financial backers, summed it up best by stating in an interview that 'There isn’t one person on our Brexit team that has a clue. None of them are brave. None of them have done a deal. None of them know the art of the deal. And the amazing thing is they’ve never ever asked any of the people that really are great businessmen. They’ve left it to civil servants and not one of them has done anything of any worth in their lives. Theresa May was a Remainer, the people that are doing the transactions don’t want Brexit. We should have a team that want Brexit and want us out of the EU. The best option is no deal.' While no deal Brexit chatter is making the rounds, here are three forex trades which will make you profits.

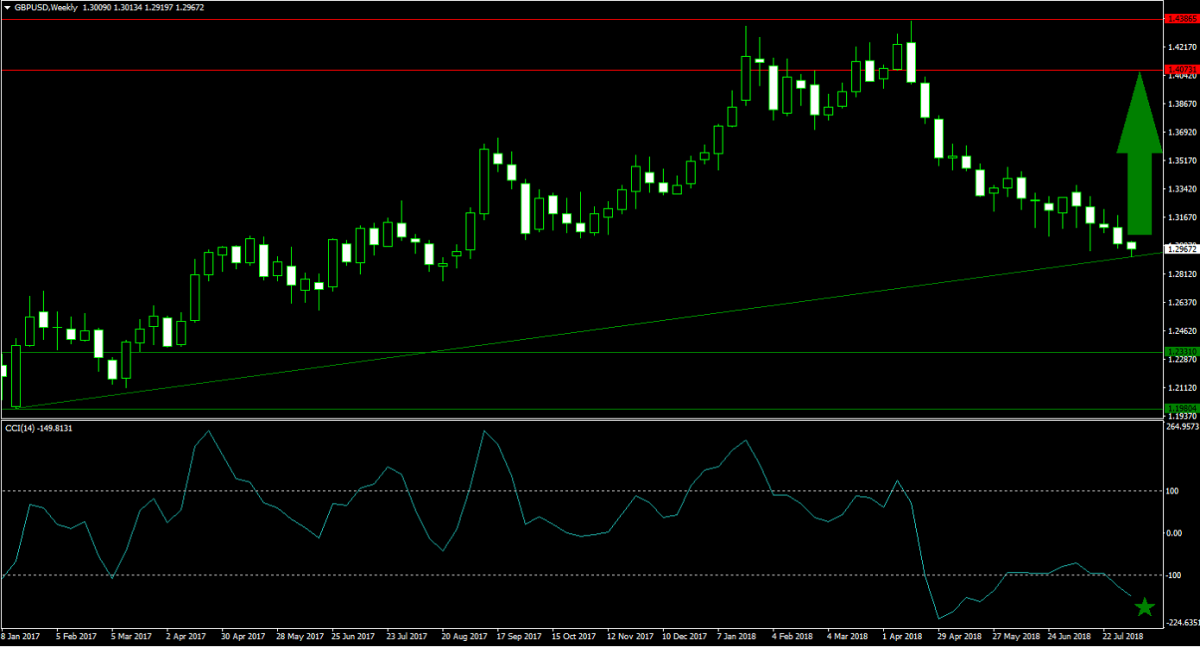

Forex Profit Set-Up #1; Buy GBPUSD - W1 Time-Frame

Following two failed attempts at a breakout above its horizontal resistance area, price action in the GBPUSD entered a healthy correction. This currency pair is now being met by its ascending support level which originated at the intra-day low of its horizontal support area. Political noise is expected to impact price action short-term, but the GBPUSD is positioned for a short-covering rally from near current levels. Forex traders should place their buy orders just above and below the ascending support level.

The CCI is trading in extreme oversold conditions and formed a positive divergence which represents a strong bullish indicator. A push above -100 is expected to ignite a move to the upside. Subscribe to the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market, yielding you over 500 pips per month.

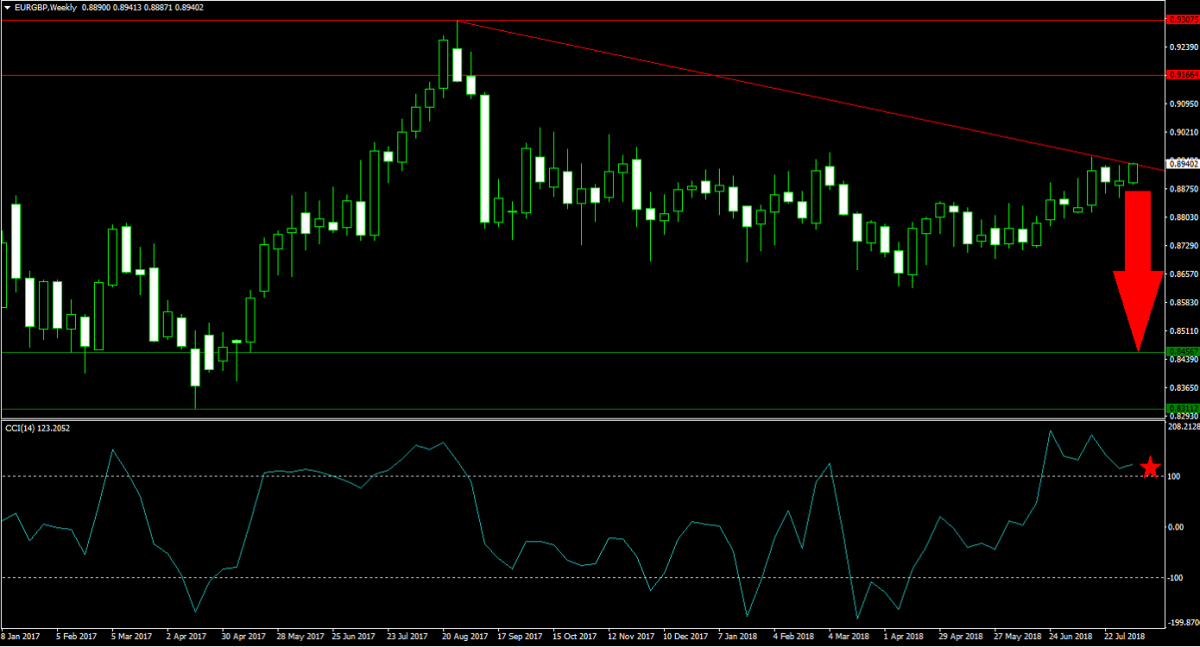

Forex Profit Set-Up #2; Sell EURGBP - W1 Time-Frame

The Euro was able to advance against the British Pound, but as negotiations for a Brexit deal have been stuck some negotiating capital is returning to London from sources like Italy inside the EU and potentially the US outside the EU. The EURGBP is now being pressured to the downside by its descending resistance level which has kept price action in check since this currency pair reached its most recent intra-day high. Forex traders are recommended to sell the EURGBP around current levels as limited upside potential is met with attractive downside risk.

The CCI has spiked into extreme overbought levels, but is off of its highs with downside momentum on the rise. A move below 100 is anticipated to attract more sell orders in this currency pair. Follow the PaxForex Daily Forex Technical Analysis section and never miss a profitable opportunity in the forex market again.

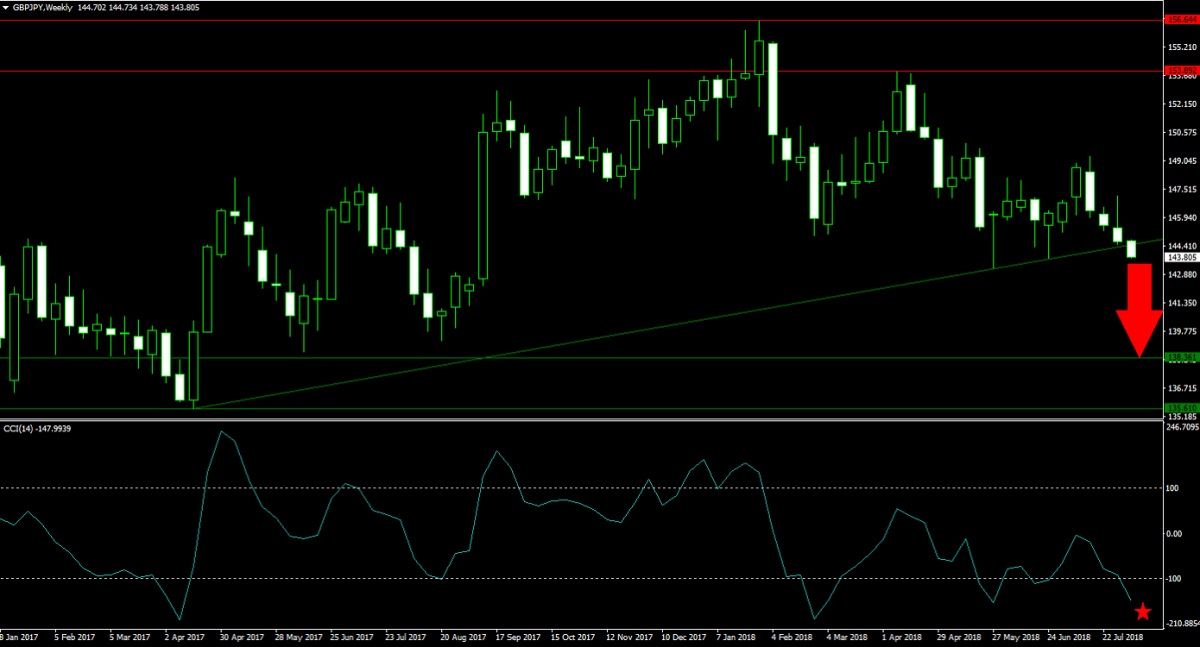

Forex Profit Set-Up #3; Sell GBPJPY - W1 Time-Frame

While the Japanese Yen has struggled this year to fulfil its traditional safe-haven status, over the course of this summer this may change. A short position in the GBPJPY offers forex traders who are long on the British Pound an excellent hedge. Price action started to push below its ascending support level this week, with more downside expected as no deal Brexit chatter is making its rounds around trading desks. A move into the upper band of its horizontal support area is expected and forex traders are advised to sell the GBPJPY from current levels up to its ascending support level.

The CCI has dipped into extreme oversold territory, but with strong bearish momentum persistent forex traders should expect a new low in this technical indicator. Download your PaxForex MT4 Trading Platform today and access the exiting world of forex trading. Find out what more and more profitable forex traders prefer to call PaxForex their home!

To receive new articles instantly Subscribe to updates.