Brexit is roughly 13 months away and many items remain unchecked. A two-year transition period has been all but agreed on which means that in 2021 the UK will have completed Brexit. British Prime Minister Theresa May had a very challenging premiership so far and is trying to balance her cabinet which is comprised of Brexit hardliners as well as those in favor of a very soft Brexit. Since the referendum is appeared as the soft Brexit crowd had the upper hand, but this week a change has appeared on the horizon which could result in more clarity on Brexit.

Rather than spending time and energy on what the UK will no longer have, such as access to the single market and the customs union, senior officials in Prime Minister May’s cabinet will focus on the upside of Brexit in order to deliver a clear message of the benefits to the UK economy and its citizens. Two sources noted that once the transition period is over in 2021, plans are being drawn to end important European Union regulations. The financial sector as well as the agriculture sector are top priorities and should experience a great boost once EU regulations no longer apply. This will counter any potential short-term negative impacts of Brexit post 2021.

While the customs union remains a key issue to address as the UK decides on the type of free trade deal it seeks from the EU, Prime Minister May is launching a government wide push across all departments in order to identify all the benefits Brexit will bring and how the economy can be restructured to foster growth moving forward. The new freedom to strike trade deals is a top priority for the UK post Brexit. The Irish border needs to be addressed as well as it would be the only land-border the UK will share with the EU. Another key benefit of Brexit is the reduced economic costs which are set to boost GDP.

There are many profitable trading opportunities centered around Brexit and PaxForex traders are provided the research and analysis in order to capture them. Volatility, especially in the British Pound and the Euro, are set to increase. Open your PaxForex trading account today and profit from our expert analysis provided daily. Join our growing community of profitable forex traders and find out why the prefer to grow their account balance at PaxForex.

Over the weekend Prime Minister May promised that the UK would not be in a customs union with the EU. This has been a red line for those in favor of Brexit. As we get closer to Brexit, more of they key unanswered questions will be resolved which will allow business as well as traders to get more clarity on Brexit and plan accordingly. The push to focus on the upside of Brexit is likely to generate more positive results throughout 2018. It appears as if the Brexit tide is turning which will lift all ships who are aligned with it. More clarity on Brexit is definitely a positive development and here are 3 ways how it can boost your forex profits.

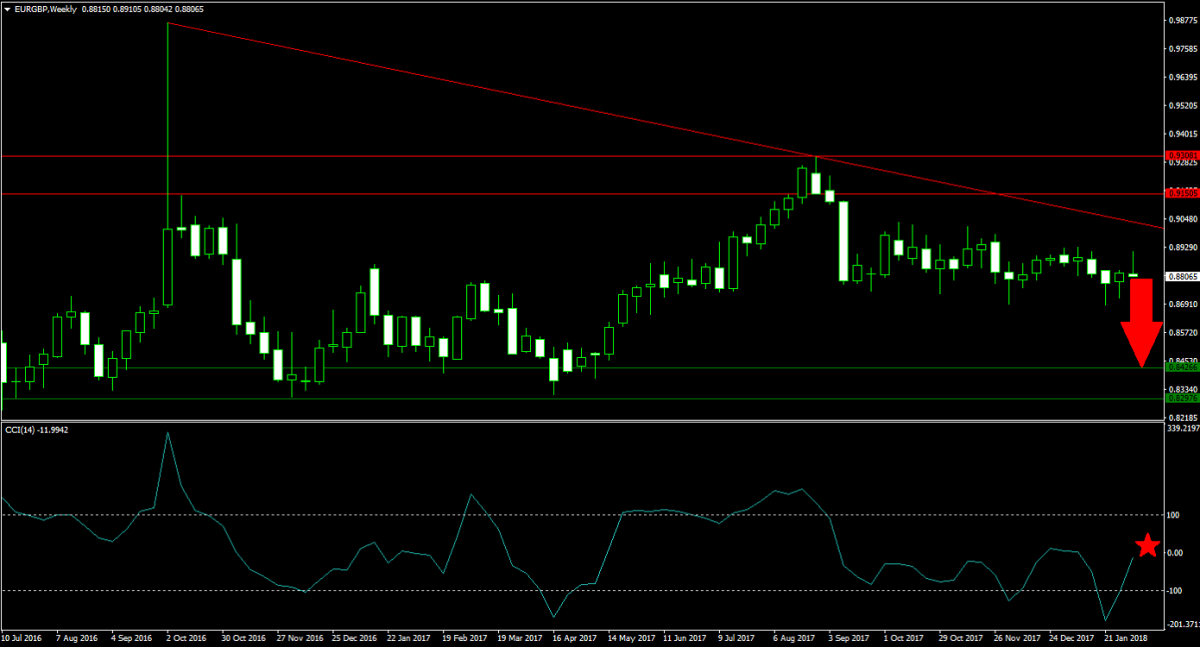

Forex Profit Set-Up #1; Sell EURGBP - W1 Time-Frame

The EURGBP is set to experience price action swings as more details about Brexit emerge. This currency pair is on a downward trajectory as several bearish factors as adding selling pressure. From a fundamental aspect, the Euro has rallied on the back of sound economic data but traders started to take profits as a peak is the data is predicted. From a technical perspective, the EURGBP completed a breakdown below its horizontal resistance area and is additionally being pressured lower by it descending resistance level. Forex traders are therefore advised to sell any rallies above 0.8980 in this currency pair.

The CCI briefly collapsed deep into extreme oversold conditions, below the -100 mark, but has now reversed and is approaching the 0 level. Any potential short-term rally will give this momentum indicator a boost and forex traders should take advantage of short entry opportunities as a result of it. Deposit funds into your PaxForex trading account and add this trade to your forex trading account before it accelerates to the downside.

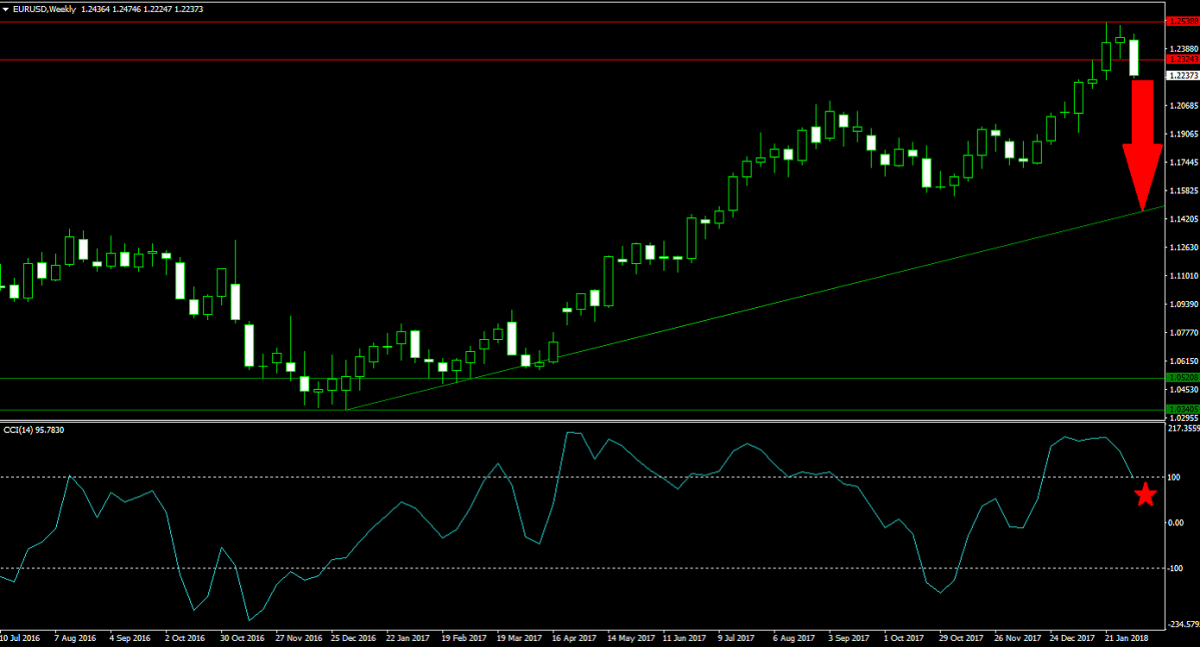

Forex Profit Set-Up #2; Sell EURUSD - W1 Time-Frame

The EURUSD is at a much earlier stage of its pending correction than the EURGBP and therefore comes with greater profit potential. Price action just completed a breakdown below its horizontal resistance area which ended a major move to the upside. Profit taking in the Euro as well as short-covering in the US Dollar are expected to push this currency pair back down into its ascending support level. This level can trace its origin to the lows of its last major contraction. Short entries above 1.2240 are recommended in order to take advantage of the pending contraction.

The CCI, a momentum indicator, also pushed below the 100 level which ends its excursion into extreme overbought territory. A further contraction is expected which will push the CCI below the 0 level from where a momentum change to bearish will occur and more downside should be accounted for. The PaxForex Daily Forex Technical Analysis section provides forex traders the most lucrative technical trades each day.

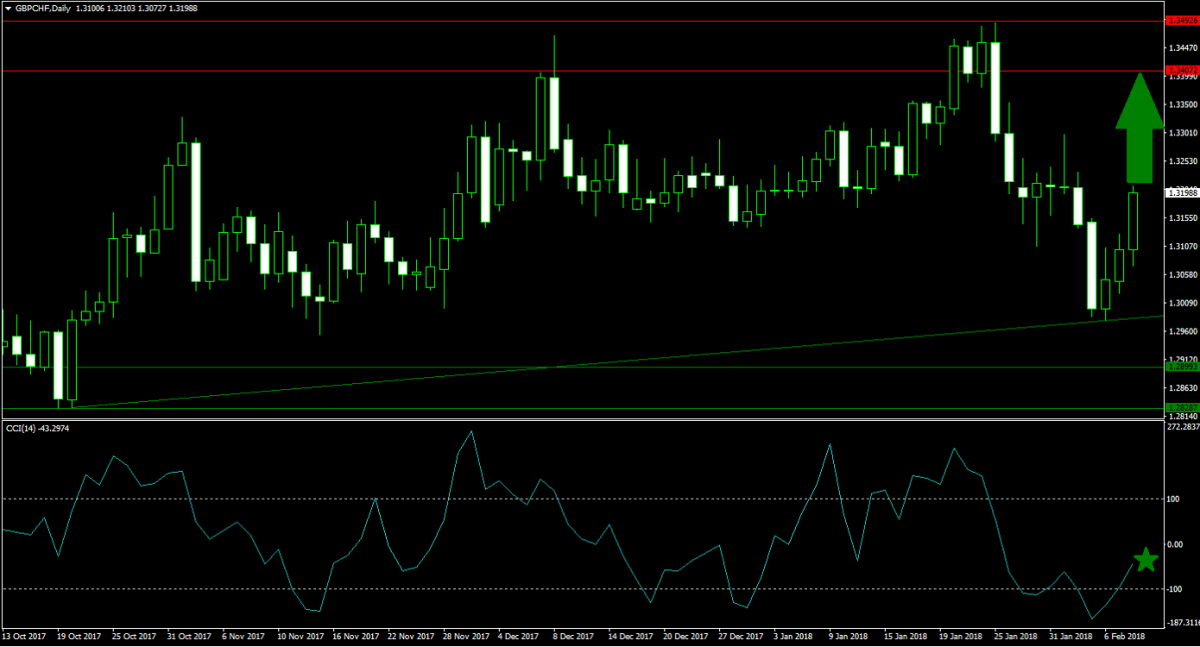

Forex Profit Set-Up #3; Buy GBPCHF - D1 Time-Frame

The GBPCHF has ended its move to the downside which materialized after this currency pair completed a breakdown below its horizontal resistance area. The correction was ended after price action met its ascending support level which allowed the GBPCHF to bounce to the upside. Forex traders should expect price action to resume its advance until it can challenge its horizontal resistance area once again. As a result buying any potential dips from current levels is advised. This trade offers attractive upside potential with limited downside risk.

The CCI confirmed the momentum change from bearish to bullish as it broke out from extreme oversold conditions, identified with a reading below the -100 level. This momentum indicator is now on its way to the 0 mark and a breakout above this level will invite further buy orders in this currency pair. Add over 500 pips in profits to your forex account every month with the Daily Fundamental Analysis provided by the PaxForex Analytics Department.

To receive new articles instantly Subscribe to updates.