Theresa May, the Prime Minister of the UK, has had a turbulent 2017. Last week she returned from Brussels and celebrated what many called a breakthrough victory. Apparently enough concessions have been made that the EU announced the divorce proceedings can now move on the the much anticipated trade deal. The Brexit bill as well as the Irish border have held trade negotiations hostage as the time to March 2019, the date when the UK is supposed to officially leave the European Union, is ticking down. The business community inside the UK as well as the EU have been waiting for much more clarity on how Brexit will be implemented. The two year transition period which has been floated around is a much welcome piece of the puzzle as it will give everyone time to adjust.

Today, the final EU summit for 2017 will commence and May was supposed to celebrate last week’s so called victory with her EU counterparts. Instead of a celebratory May in high spirits, she will have to face the summit suffering an embarrassing loss at home yesterday. The House of Commons voted against May’s Brexit vision and now the UK government will have a vote on the final Brexit plan which she will bring back from Brussels. What makes this defeat worse is that it was handed to her by her own party as 11 rebels crossed the lines and voted against May’s argument. Next week discussions about what kind of trade deal the UK seeks from the EU will start.

At the same time May is battling rebels at home from within her own party, the EU is drawing Brexit battle lines which are set to hurt the UK where it matters most; its powerful financial system. The EU is set to offer London inferior access to its market, if any at all. Right now it appears that the only banking deal the UK will get is that its banks will be allowed to have a physical presence on EU soil under strict EU supervision. This would make operating a smart financial firm impossible. The UK was looking for a so called ‘Canada, Plus, Plus, Plus’ deal which has already been rejected by the EU. The Canadian trade deal took years to finalize and represents the best trade deal ever offered by the EU.

As Brexit negotiations are set to enter the next phase, volatility in the British Pound is set to increase. Forex traders will have many trading opportunities which will arise. Don’t miss out on profitable trades and follow the PaxForex Fundamental Analysis and Trading Recommendations sections; our expert analysts cover the forex market around the clock in order to find the best forex trades for you.

While the EU appears to be on a path to punish the UK for leaving in order to scare other countries from exiting the bloc, this could be a double edged sword. Borrowing costs in the EU will rise if the UK financial powerhouse will not be allowed to supply the financial fire power and expertise. What many fail to account for is that if France, Germany, Italy or Spain would have been able to accommodate the finance needs of the EU economy, than they would have done so. German mid-size companies may suffer the most which will undoubtedly have a ripple effect across the EU. It would be in the best interest of the EU as a whole to strike a mutually beneficial deal for both economies long-term rather than to focus on a short-term agenda to punish the UK for voting to leave. The next phase of talks will be interesting and here are three trades for May’s Brexit defeat and your British Pound forex trades.

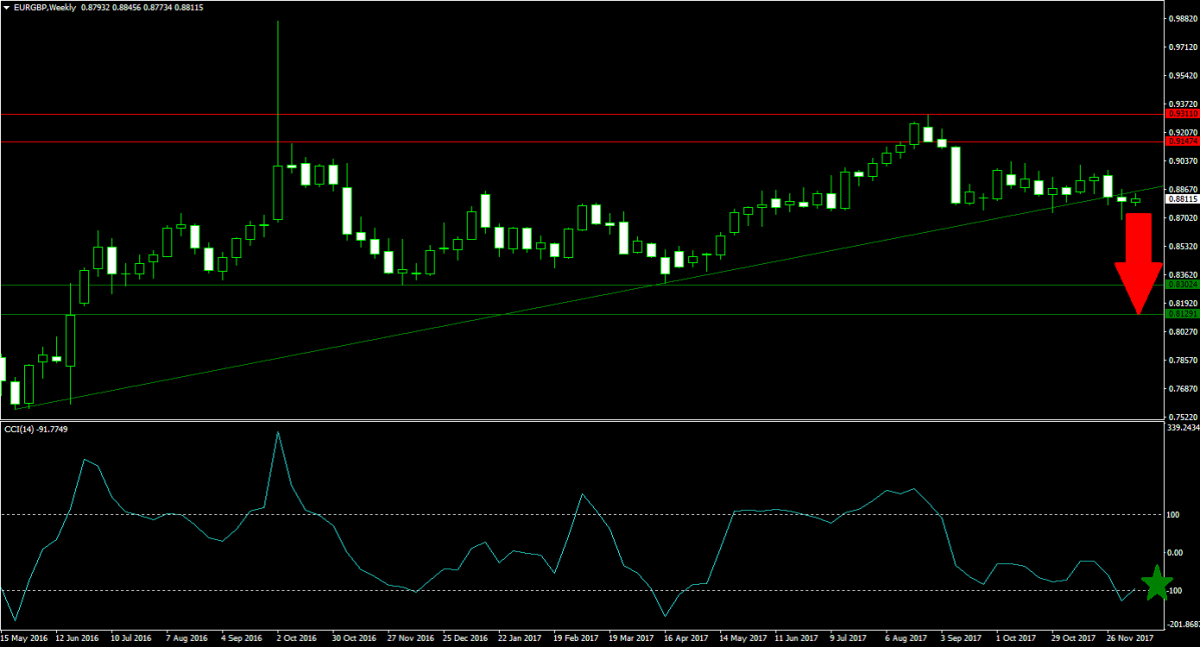

Forex Profit Set-Up #1; Sell EURGBP - W1 Time-Frame

The biggest Brexit trade is obviously the EURGBP and while there may be many bearish uncertainties surrounding the British Pound, this currency pair was recently rejected by a strong horizontal resistance area which pushed it below a very solid ascending support level visible on the W1 chart last week. Should the EURGBP remain below this level next week, forex traders should anticipate a strong rally in the GBP which will push this currency pair back down into its next horizontal support area. Any level below 0.8870 represents a solid short entry into this trade.

The CCI recently broke out from extreme oversold conditions below the -100 mark. This indicator may drift higher over the next few trading sessions which would make a resumption of the down trend in the EURGBP more likely. Open your PaxForex trading account today and enter this trade before the next leg lower unfolds.

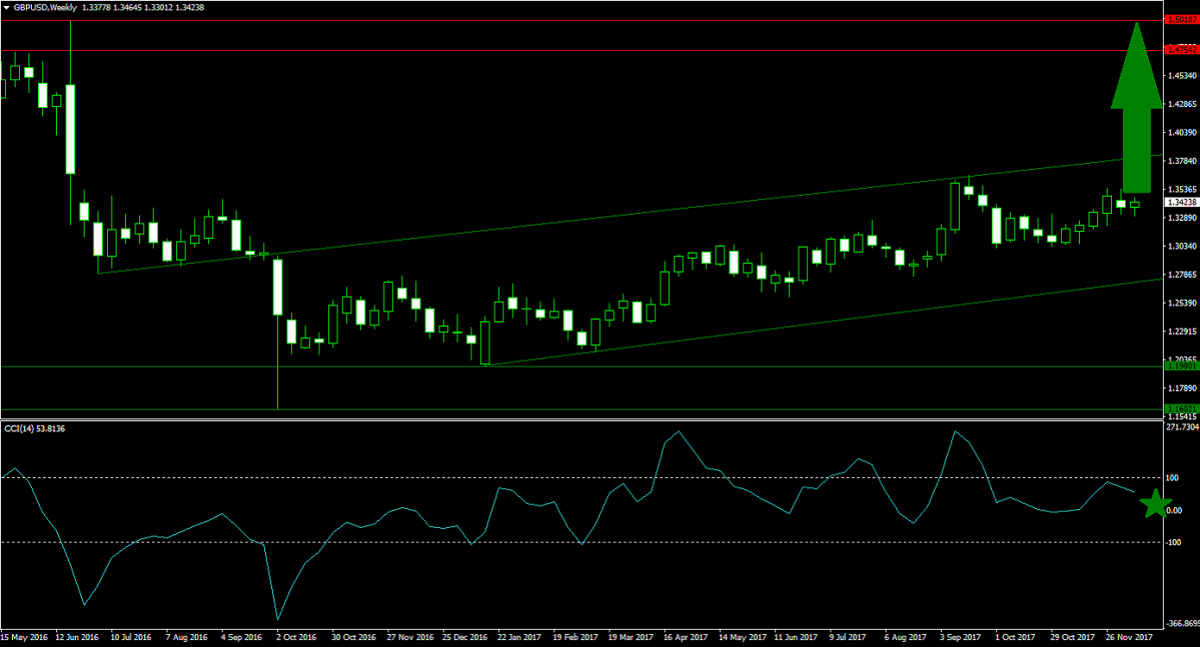

Forex Profit Set-Up #2; Buy GBPUSD - W1 Time-Frame

Taking the other side of the EURGBP short trade would be this GBPUSD long recommendation. Looking at the W1 chart, a confirmed bullish price channel has pushed this currency pair to the upside. This trend is expected to continue as the US Dollar is likely to face a challenging period of its own while Brexit will become more visible which is expected to force a breakout from its current pattern and up into its next horizontal renaissance level. Levels below 1.3400 represent good entries into this trade.

The CCI trended lower after reaching extreme overbought conditions with a reading above 100. This move has eased pressures for a corrective phase and can allow the GBPUSD to continue its general move to the upside. Download your MT4 trading platform and access this currency pair as well as many more in order to build a profitable forex portfolio.

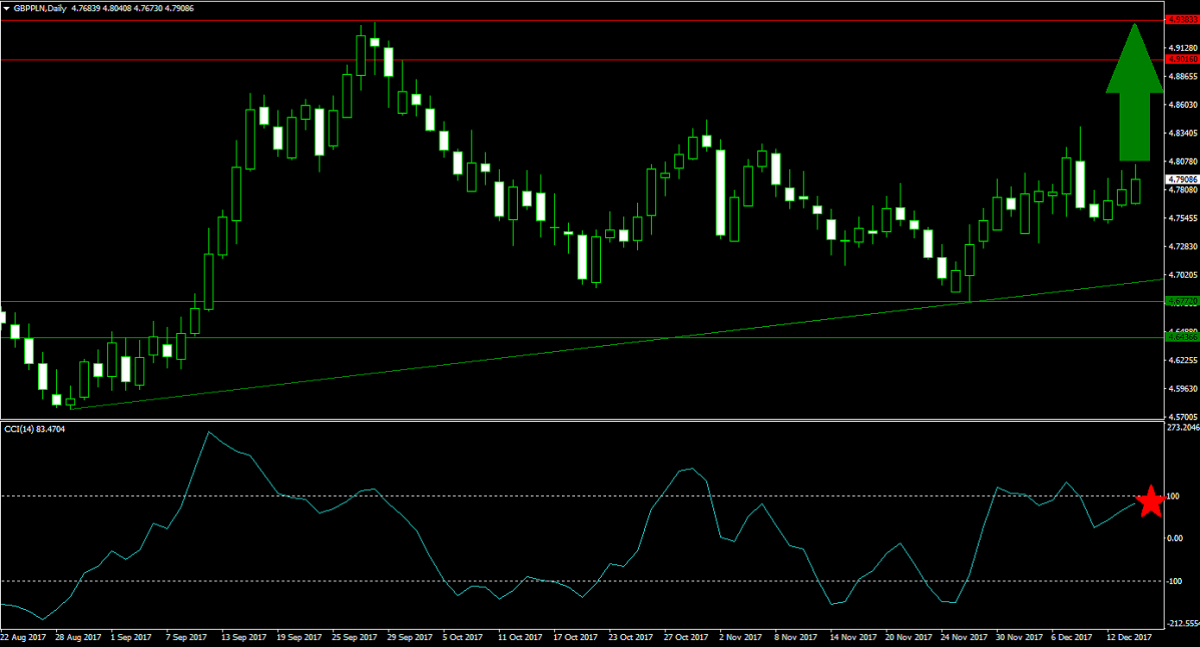

Forex Profit Set-Up #3; Buy GBPPLN - D1 Time-Frame

Nothing can spice up your forex account like an exotic currency pair while the UK economy is maneuvering through unchartered territory. The GBPPLN offers forex traders a currency pair with good upside potential, especially if this week’s EU summit will surprise to the upside, with limited downside risk. Price action shows this trade in the middle of an advance after bouncing higher from its horizontal support area which was intersected by its ascending support level. Place your long orders below 4.7900.

The CCI dropped below 100 and is currently advancing; should it touch the 100 mark forex traders are advised to wait for retreat below this mark before entering new long positions. Don’t miss out on this profitable trade and join the growing number of ten of thousands profitable forex traders who enjoy PaxForex great trading conditions.

To receive new articles instantly Subscribe to updates.