Brexit is 113 days away, but British Prime Minister Theresa May has only five days to get her Parliament to vote for her Brexit deal. It appears rather unlikely that she will be able to convince her own party to back her deal. May has deployed her Chief Whip, Julian Smith, in order to talk so called rebels into voting for May’s deal. The backdrop is that he comes empty handed which means there is little hope that those opposed to the deal will simply change their mind. They are against it for a reason and unless the reason changes, there is nothing there to change their mind.

While the exact number of rebels is unknown, estimates pin it above 100. This means that May’s government needs something fundamentally big in order to convince them to back her deal. In order for this to happen, the deal needs to change and the EU is very unlikely to give further concessions to May. One Tory MP stated that all Smith was able to do in meetings is listen to the criticism of May’s Brexit deal as he had nothing to counter. Her own cabinet is rumored to have advised her to cancel the vote on her Brexit deal as it has little to no chance of passing.

The EU will have another summit on December 13th through December 14th where May could try and convince the EU for changes to the deal. The alternative would be no deal, the UK will leave the EU in 113 days and trade will be governed by WTO rules in the same manner as with other trading nations. Edward Leigh, a Tory MP Brexit supporter, stated that “I don’t know how I’m going to vote next week. I’m looking for a lifeboat from the government in the next few days.”

Forex traders will tread lightly around the British Pound as uncertainty is elevated. While many predict the British Pound to plunge if a no deal Brexit materializes, such a move may be short-lived as it will also support British exporters. The British Pound appears rather mispriced as traders have not been able to accurately manoeuvre through uncharted territory. Are you on the right side of the trade? Take the first step today with a PaxForex Trading Account!

Adding pressure on May is the Democratic Unionist Party which props up May’s government. The DPU stated it will vote against the Brexit deal and that the party would support a no confidence vote in May. Liam Fox, the UK Trade Secretary, outlined the risks of voting against the current Brexit deal. He noted that “I think there is a real danger that the House of Commons, which has a Remain majority, may attempt to steal Brexit from the British people, which I think would be a democratic affront.” May faces an impossible task, but the below three forex trades face possible moves in price action for your account.

Forex Profit Set-Up #1; Buy GBPUSD - D1 Time-Frame

The GBPUSD was punished for the uncertainty about a Brexit deal, but the horizontal support area held up and allowed price action to stabilize. This currency pair is now ripe for a short-covering rally as it is attempting to push above the upper band of its support area. A breakout will face no obstacles until the GBPUSD will accelerate into its secondary descending resistance level. Forex traders are recommended to enter their long positions just below the upper band of its horizontal support area.

The CCI already moved out of extreme oversold conditions as bullish momentum is on the rise. Preceding this move was a shallow positive divergence which further boosted momentum and is likely to extend. Download your PaxForex MT4 Trading Platform now and plant a seed which you can grow into a recurring income stream with the help of our expert analysts.

Forex Profit Set-Up #2; Buy GBPAUD - D1 Time-Frame

This currency pair is at a more advance bullish stage than the previous one, but with plenty of upside potential. The Australian Dollar, a Chinese Yuan proxy, has greater fundamental issues than the British Pound. Price action completed a double breakout, above its horizontal support area and above its primary descending resistance level, and is now free to extend its bullish move. The next resistance level awaits at its horizontal resistance level and forex traders are advised to buy the dips in the GBPAUD.

The CCI, following the formation of a positive divergence, accelerated out of extreme oversold territory and past the 0 mark for a bullish momentum change. More upside in the GBPAUD is therefore anticipated. Follow the PaxForex Daily Fundamental Analysis and allow out expert analysts to direct you through the forex market for over 500 pips in monthly profits.

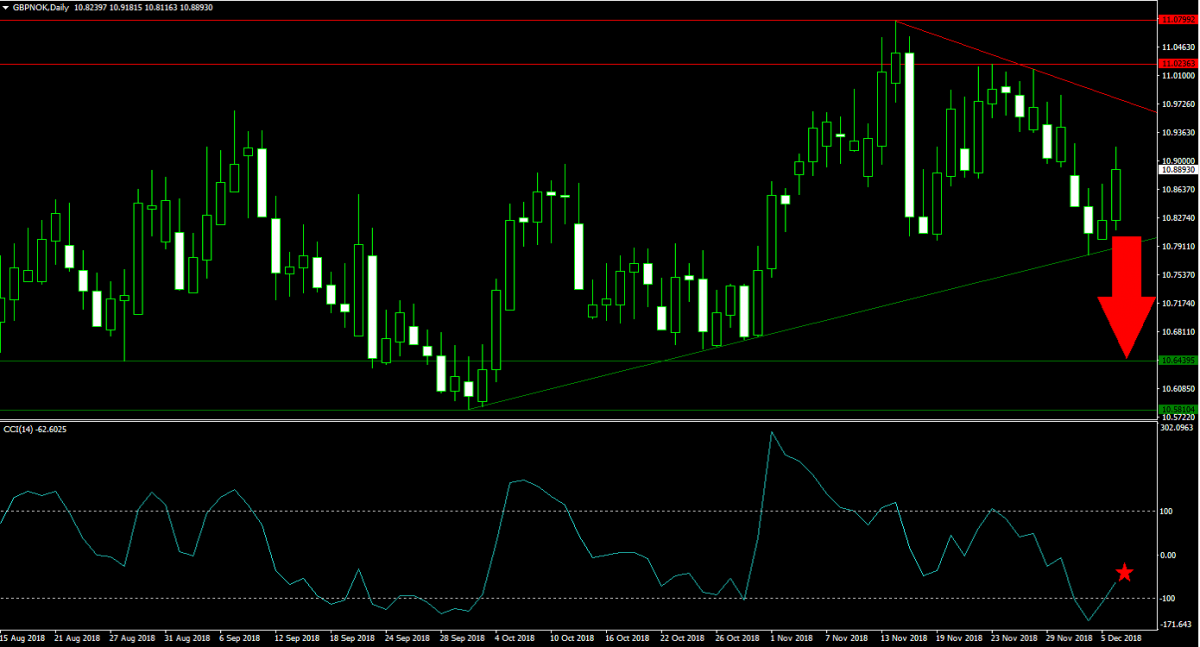

Forex Profit Set-Up #3; Sell GBPNOK - D1 Time-Frame

Forex traders who prefer to remain on the short side of the British Pound trade or who seek a smart hedge against the above long recommendations can add the GBPNOK to their forex portfolio. This currency pair is currently trapped between its primary descending resistance level and its primary ascending support level. With prospects for the Norwegian currency fundamentally stronger, a breakdown is expected. This may take the GBPNOK back down into its horizontal support area and forex traders should sell the rallies from current levels up into its primary descending resistance level.

The CCI did move out of extreme oversold conditions, but a negative divergence has formed which suggests that this currency pair has further to fall, making a breakdown the most likely outcome. Subscribe to the PaxForex Daily Forex Technical Analysis where our expert analysts provide you with accurate trading recommendations which you can simply copy into your trading account. We do the hard work so you can enjoy easy profits.

To receive new articles instantly Subscribe to updates.