British Prime Minister Theresa May was able to put out yet another fire and survive to fight another day. The Tory rebellion has been put to rest, at least for now. Rebels pushed for an amendment to the current Brexit legislation in order for Parliament to have a meaningful vote on the final deal May will bring back from Brussels. Pro-Brexit lawmakers as well as May rejected such an amendment as it weakens their negotiating power with Brussels. Brexit is roughly nine months away and May is expected to have a final divorce deal this fall.

The amendment was defeated as lawmakers voted 319-to-303 against it. Tory rebels, who had the numbers to pass the bill if they voted with the opposition, voted in favor of May and didn’t break ranks. Some wonder what price she had to pay for her victory. Leading the rebellion was Tory lawmaker Dominic Grieve who noted after the vote that 'I’m completely comfortable'. The opposition had a different point of view with Labour lawmaker Ian Murry referring to it as 'total capitulation' and 'a waste of everyone’s time'.

It appears as if the pro-Brexit camp prevailed. The EU has asked for more preparations of a no deal Brexit and yesterday’s victory gave the Brexit forces much needed tailwind. Jacob Rees-Mogg commented that 'The government stood firm today and was able to win the vote comfortably'.May was under increased pressure to confront the rebels from Brexiteers, citing that they don’t have the numbers to soften Brexit trough the amendment even if all rebels voted with the Labour party. Following the victory and rejecting the amendment, some now call on May to reverse earlier concessions made to rebels.

Despite May’s victory, the British Pound resumed its slide against major currencies. A growing number of forex traders are concerned that the Bank of England may not increase interest rates in August amid an economic slowdown. Will the British Pound resume its drift lower or Is the British Pound ready to resume its powerful advance it enjoyed prior to its most recent corrective phase? Open your PaxForex Trading Account now and take advantage of the countless trading opportunities presented in the forex market.

With the rebellion on ice, the full attention can now be applied to Brexit negotiations with the EU. The Irish border issues continues to plague divorce talks. The EU has showed little real interest in reaching a fair deal as it tries to scare other countries from attempting to leave the largest trading bloc in the world. The risk for a no deal Brexit has increased, which may give the necessary push to advance talks and reach an agreement which works for the EU, the UK and most important for the business community. May ends Tory rebellion with key Brexit victory and here are three forex trades which every trader should take a look at.

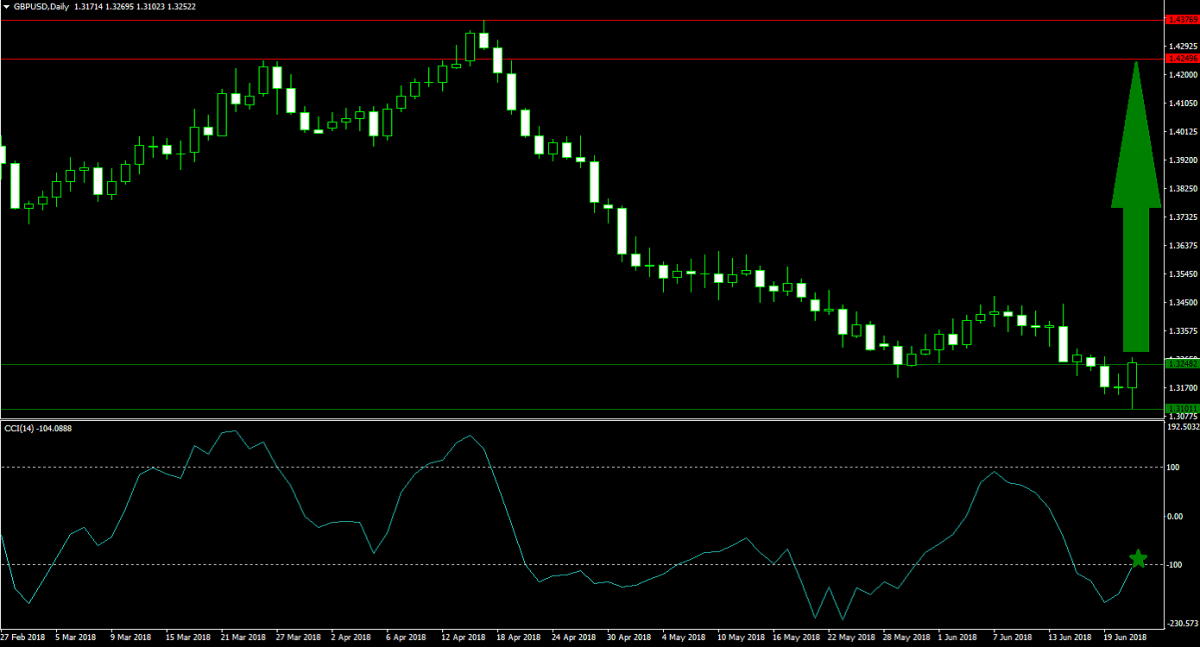

Forex Profit Set-Up #1; Buy GBPUSD - D1 Time-Frame

A combination of US Dollar strength and British Pound weakness resulted in a corrective phase which took the GBPUSD from its horizontal resistance area down to its horizontal support area. Following today’s more hawkish tone from the Bank of England, price action was able to end the downtrend as bullish sentiment rose. This currency pair is now on the verge of a breakout which should see the GBPUSD accelerating to the upside. Forex traders are advised to spread their bur orders just above and below the upper band of its horizontal support area.

The CCI remains in extreme oversold territory, but has recovered from its lows and is now pending a breakout above the -100 level. In addition a positive divergence has formed which resulted in a strong bullish trading signal. Subscribe to the PaxForex Daily Fundamental Analysis and let our experts guide your portfolio through the forex market into sustained profitability.

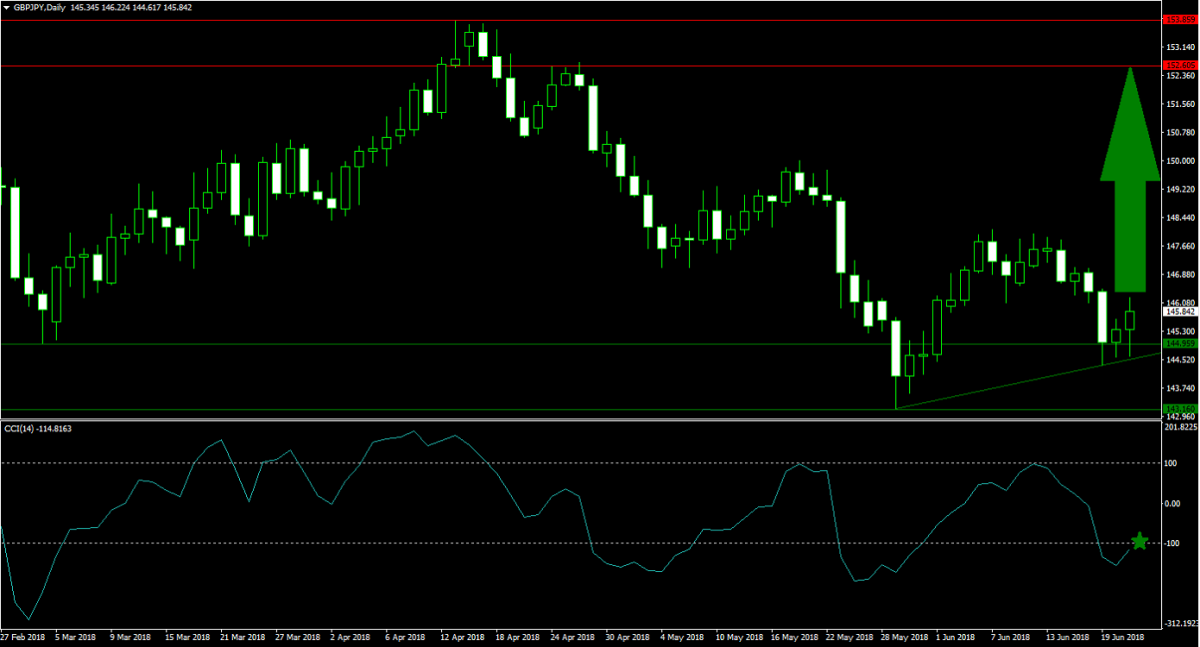

Forex Profit Set-Up #2; Buy GBPJPY - D1 Time-Frame

Forex traders who are looking for a more advanced bullish British Pound trade can take advantage of the GBPJPY. This currency pair already completed a breakout above its horizontal support area which resulted in a bullish momentum spike. An ascending support level provided additional bullish pressures which a should further drive price action in the GBPJPY to the upside. Forex traders should seek their entry points between current levels and just above the upper band of its horizontal support area.

The CCI is trading in extreme oversold conditions with a bias to the upside. Momentum should be strong enough to allow this technical indicator a breakout above -100 which will attract more buy orders. Download your PaxForex MT4 Trading Platform now and enter this trade before this currency pair will advance into its horizontal resistance area.

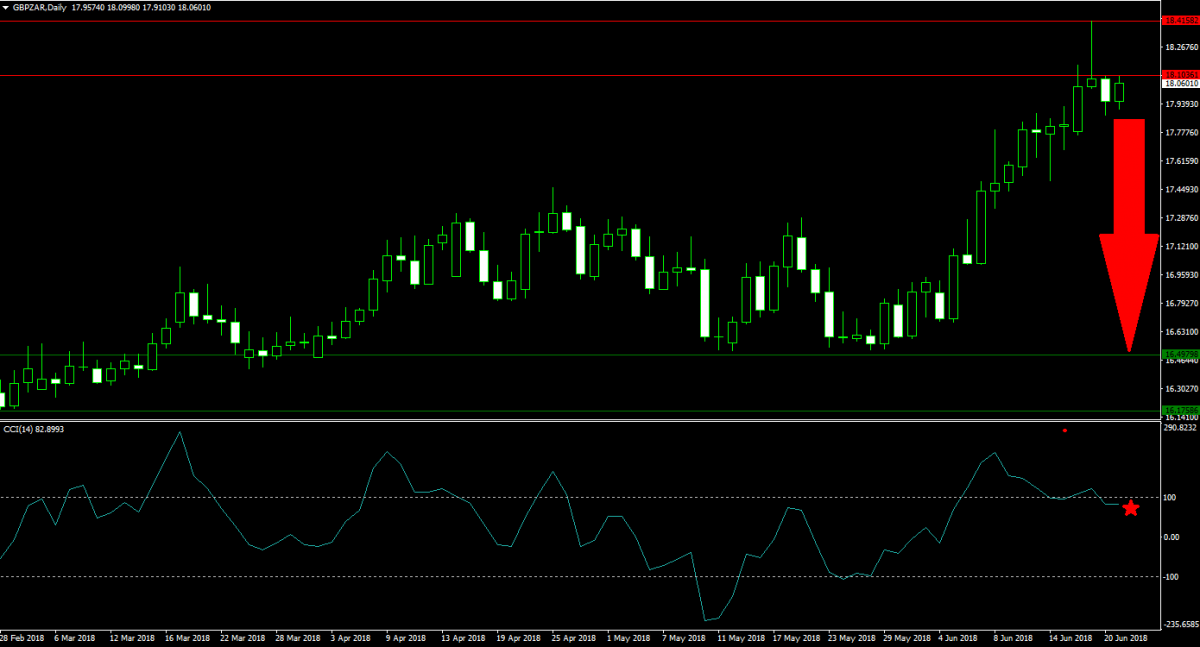

Forex Profit Set-Up #3; Sell GBPZAR - D1 Time-Frame

A great hedge to the above two bullish trades in the British Pound is a short position in the GBPZAR. This currency pair already advanced from the upper band of its horizontal support area into its horizontal resistance area. Price action was unable to resume the advance and the GBPZAR is currently trading just below the lower band of its horizontal resistance area. A rise in bearish sentiment is expected to force a corrective phase and forex traders are recommended to enter their short positions just above and below the lower band of its horizontal resistance area.

The CCI already completed a breakdown from extreme overbought territory which further added to bearish momentum. A negative divergence preceded the breakdown. Follow the PaxForex Daily Forex Technical Analysis and get the most profitable technical trading set-ups delivered from the desk of our experts directly into your inbox.

To receive new articles instantly Subscribe to updates.