EUR/GBP is one of the most attractive pairs for a novice trader, due to its measured movement since the movement of both currencies is affected by similar factors, which often causes their parallel rise or fall. With superior liquidity and a high volume of continuous trade, it's no wonder that so many people trade the EUR/GBP currency pair. Today we will have a thorough look at trading the EUR/GBP currency pair, discovering its features and trading tips

What is the EUR/GBP currency pair?

EUR/GBP currency pair consists of two popular currencies in the Forex market, the euro and the British pound, they are inferior to the U.S. dollar only in their popularity. The euro in this pair is the base currency and is bought for the British pound. The value of the quote shows how many pounds are given for one euro - at the moment of writing, the price is 0.9026.

The asset is displayed in the standard form - four decimal places, one point being equal to 0.001. The size of one pip with the volume of one lot is $10.

The 4 Main Features of the EUR/GBP

Moderate dynamics and stability allow traders to make more accurate forecasts;

A cross pair can move 70 pips per trading session;

Significant pip price and low spread make trading the EUR/GBP very lucrative;

EUR/GBP is characterized by frequent long periods of falling or rising trends with little fluctuation in the intermediate periods.

EUR/GBP Quick Start Guide: How to Trade

Opening short or long positions on the EUR/GBP pair does not differ from any other financial asset in Forex. With PaxForex you can access the trading platform on any device, including a computer, smartphone (Android or iOs), or tablet. Here are some easy-to-follow instructions for you to open positions in order to take part in trading the EUR/GBP.

How to Buy the EUR/GBP

Login to your trading account in MetaTrader 4 if you have it installed. If not, feel free to use this guide.

Click on the ”Market" tab;

Look for the EUR/GBP symbol, in the list of the symbols on the right side of the terminal;

Click on the asset with the right button and choose New Order from the menu;

In the pop-window choose the volume of a position;

Hit the BUY button marked with a blue rectangle.

Each time you place a BUY order do your due diligence analyzing the market situation so you have confirmation that the price of the asset will rise/drop, depending on the direction you choose to trade the EUR/GBP. Otherwise, you will not enjoy your trading experience, unless you like losing money, of course.

How to Sell the EUR/GBP

Login to your trading account in MetaTrader 4.

Click on the ”Market" tab;

Look for the EUR/GBP symbol, in the list of the symbols on the right side of the terminal;

Click on the asset with the right button and choose New Order from the menu;

In the popup window choose the volume of a position;

Hit the SELL button marked with a red rectangle.

As you see, buying and selling EUR/GBP currency pair is extremely simple and even intuitive. In the same way, you can trade any other assets available. In order to get started just create a PaxForex live account and take advantage of financial markets right now!

The Main Influencing Factors on EUR/GBP

Just like most other Forex currency pa irs, the EUR/GBP is extremely sensitive to some external factors, and economic data announcements have a tangible impact on the short-term rate.

Traders should monitor the GDP of both the UK and the EU as well as updated monetary policies, inflation, and any economic or political events that could influence the market sentiment, making traders place either SELL or BUY EUR/GBP trades.

Apart from these factors, we should not forget about the interest rate of the given country which is of great importance for Forex traders. Cutting interest rates leads to increased business activity and increases inflation, while the national currency rate falls. An increase in interest rates, in turn, leads to a decrease in business activity, a decrease in inflation, and the exchange rate.

The European Central Bank

European Central Bank (ECB) - the central bank of the Eurozone, as well as the currency regulator, which monitors the credit and monetary policy of the region, and controls the stability of the euro. Forex traders are especially looking forward to its decisions every first Thursday of the reporting month, as it has a special impact on the rates of EUR and other major currencies in the market.

The main function of Christine Lagarde, the head of the ECB, is the implementation of monetary policy, determined by the Governing Council. Also, the president of the European Central Bank has a great influence on the approval of QE programs and asset purchases. That is why her statements and speeches are closely followed by currency traders.

At the moment of writing the interest rate is 0.00%.

The Central Bank of England

Among the main tasks of the Bank of England are maintaining price stability in the country, as well as supporting the government's economic policy. Also, the Central Bank is responsible for the stability of the rate and the purchasing power of the national currency - pound sterling. Since 1997, the Bank of England is an independent body, which independently formulates the monetary policy of the UK.

The Head of the Bank of England, Mark Carney, also heads the Monetary Policy Committee (MPC), which decides on the level of interest rate and other monetary policy issues in Great Britain.

For now, the interest rate is 0.1% since it was cut in May due to the coronavirus outbreak.

Trading the EUR/GBP

As noted earlier, this currency pair is the most attractive for beginners in Forex, it is quite rare to see rapid trend movements, which allows you to calmly assess the situation and make an informed decision. Trend movement in one session usually does not exceed 70 points, and then in exceptional cases. However, given the high cost of a point, even such a trend can bring considerable profit.

Trading the EUR/GBP with Expert Advisors

An Expert Advisor (EA) is a program that automatically places and closes positions according to a predefined logic, in accordance with the trading system. Very often you can find such a name as a trading robot.

The main purpose of any EA is to simplify the decision-making process, up to its full automation. Such a robot connects to the MetaTrader 4 trading terminal and can trade for you in automatic mode according to the specified settings, including the symbol (EUR/USD, EUR/GBP or it can be even multi-currency program), Stop Loss/Take Profit levels. and the minimum/maximum lot size.

In case you have an EA handy specially written for the EUR/GBP currency pair, you can always use it on your MT4 account. If you still don`t have a trading terminal installed, it's time to do that, just follow this link.

Scalping the EUR/GBP

Scalping is in steady "demand" among beginners and Forex professionals, including the ones willing to trade the EUR/GBP. The possibilities of this method allow to quickly increase capital on small deposits and promptly test various trading strategies.

The characteristic feature of scalping is, first of all, a large number of trades. Usually, in 1 day a trader can open and close from 30 to 1000 positions. In most cases, when scalping is performed, M1 (1 minute) and M5 (5 minutes) charts are used. For successful trading, a scalper needs high leverage. The vast majority of scalpers use 1:200 - 1:500 leverage.

In order to start scalping make sure to choose the most liquid currency pairs due to their low spreads. For example, on EUR/GBP PaxForex offers spread as low as 2 pips.

Swing Trading the EUR/GBP

As you probably know, swing trading is a method that is based on fluctuations at the moment of trend formation. In general, it is a set of strategies whose main purpose is to enter a trend at the moment of its reversal (when it is formed) and make a profit. The risk in this case should be minimal. For these reasons, the main features of swing trading are the use of trading time frames day/week and strict risk management.

Swing trading can last a little more than a day, or even a week.

A swing trader using this set of strategies will rather explore multi-day charts. This is in order to catch higher price movements/vibrations than day trading. That is why the EUR/GBP currency pair is a good choice since it`s volatile enough and rather predictable.

In terms of time, the swing trader is interested in long-term stock trends. He is quite able to keep positions for whole days, weeks, and in some cases months, not just hours. This can mostly depend on the market sentiment, which is influenced by such things as the price of the asset. The only disadvantage of this trading approach is the swap (the commission deducted from trader`s account for keeping position open overnight and is based on the difference in interest rates of the countries whose currencies are traded) for all the trades are being held for a long time. For you to be able to keep track of the possible swaps, navigate to PaxForex Forex trading conditions.

Strategy for Trading the EUR/GBP

Choosing the right strategy can be quite challenging, especially for beginners who know nothing about the trading itself. So how do you choose the right strategy for forex trading that suits you?

Keep in mind that strategy must be in line not just with your personal preferences, but also with your beliefs.

As an option, you can take from the system only some elements that you like (some indicator or method of analysis) and thus, leaving the best, after some time you build your own method.

For you to begin with something, here is a strategy of EUR/GBP trading. You can use it as an example or a template for you to adjust it. And for testing purposes, we recommend you to try it out on the demo account so you lose nothing but time and gain experience.

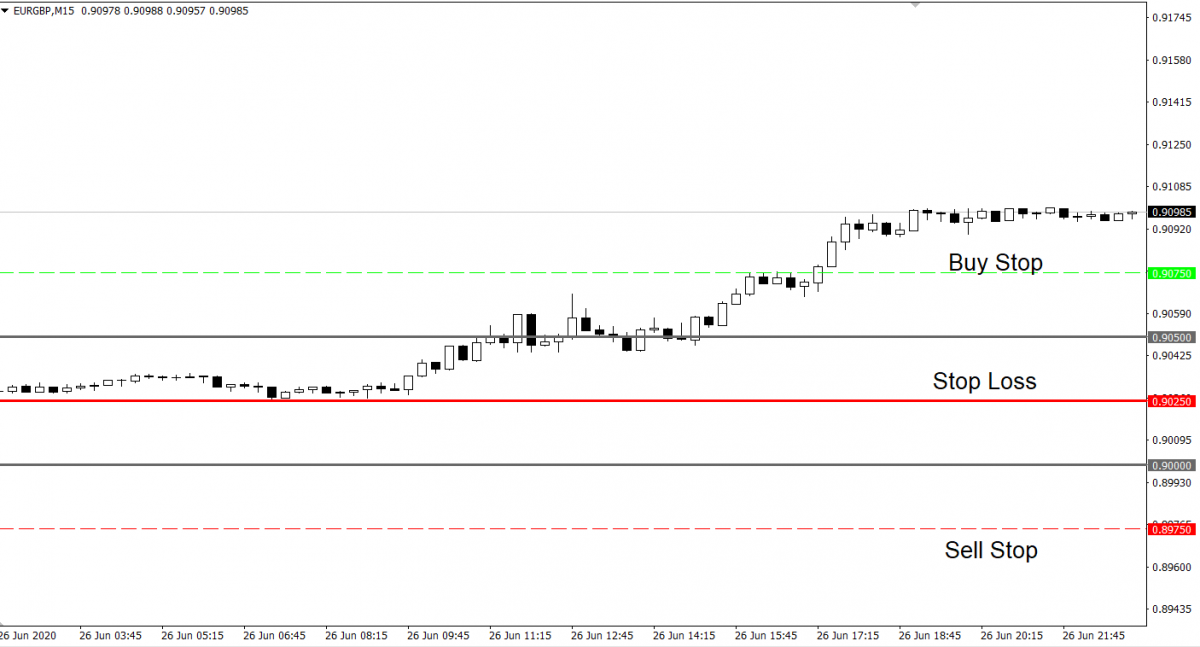

EUR/GBP Trading Strategy

Strategy refers to trading on volatility breakout. Trading is carried out on EUR/GBP pair and it is enough to perform some drawing on the chart. In some ways, it is similar to a trading strategy on the double zero levels. It is about using a pattern based on the psychological importance of price levels with "round figures". Quite often there are strong support and resistance levels near these levels, where Stop Losses and Take Profits of a large number of Forex traders accumulate. Breaking through these levels is often accompanied by strong price movements due to the triggering of these very stops.

So, it is best to start trading at five o'clock GMT. To do this, open a fifteen-minute chart M15 of the currency pair EUR/GBP and set two horizontal lines through those levels that end at 00 or 50 (for example, 1,3000, 1,3050, etc.) and which are closest to the price (one line from above, as well as one line from below the current quote).

If the price fluctuates exactly at the level of 50 or 00, then we take this level as a basis and draw above and below the price (but this does not happen often).

Once the levels have been set, we place pending Sell Stop and Buy Stop orders at a distance of 25 points from our highest level and 25 points from the lowest level, respectively.

We will place a Stop Loss at 50 points and Take Profit at 25 points. You can use a trailing stop to ensure your positions.

If there are still orders that have not been opened within a day - we remove them and set new ones.

Trading Trends in the EUR/GBP

Trend trading involves opening positions at a rebound from the trend line and closing a position at the opposite trend line.

In the classic trend trade means: in an uptrend - only buying, in a downtrend - only selling. Flat means the possibility of both buying and selling.

For an uptrend: A buy trade opens when a support line bounces off and closes near the trend resistance line.

For downtrend: A Sell trade opens when a resistance line bounces off and closes near the trend support line.

For flat: A buy position opens when a support line bounces off and closes near the resistance line. A Sell position is opened mirror wise.

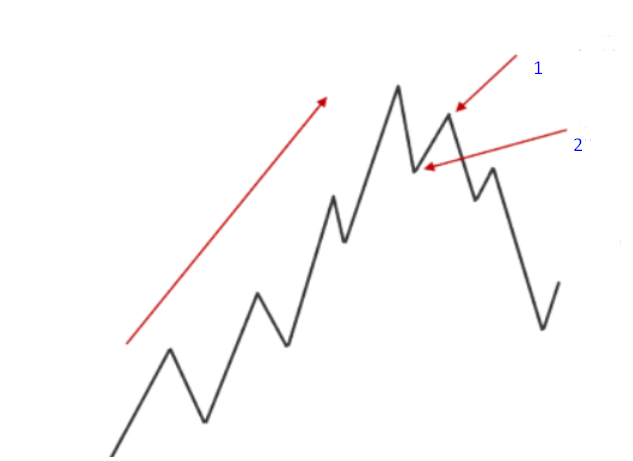

Determining the trend by the peaks and troughs according to the Dow theory (Price Action).

The idea itself is certainly not new and not so radical as to speak about any revolution in trading.

The peak and trough analysis is a technique originally presented as a principle of Dow's theory that still works now, while the theory itself may have lost some of its brilliance. As per the majority of traders, peaks and troughs are the cornerstones of all technical analysis.

When we look at any chart, we can see that the price does not go in straight lines, but moves zigzag-wise. During the trend, the rally is replaced by a correction, in which a part of growth is lost. Then a new rally and again correction, and so on. These are the peaks and troughs.

As long as the price moves in a series of increasing peaks and increasing troughs, the trend is considered undamaged. But as soon as the rising peaks and troughs are replaced by the falling ones, the trend is reversed.

A screenshot shows a succession of rising peaks and troughs. When the price is unable to make a new high (1), it is a signal that the trend is probably about to change. However, this will not happen until the price falls below its previous base (2) and we see a falling peak and trough. According to this technique, the trend has changed to bearish.

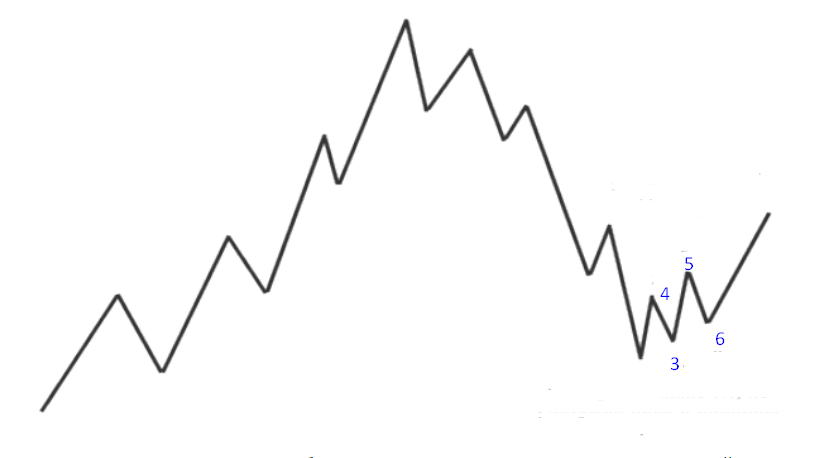

In a bearish EUR/GBP trend, prices continue the downward rotation of peaks and troughs (see the screenshot above), until the last price in the last trough can update the next minimum (3). The subsequent movement leads the price above the previous maximum (4), and a succession of descending peaks and troughs changes into increasing ones. The signal appears (5) when it becomes obvious that the price has made a new high. At this point, we do not yet know where the next peak will appear, but we do know for sure that it will be higher than the previous peaks and troughs.

As we can see from the chart behavior in point 10, nothing prevents the price from falling below the trend reversal signal (5), but the chart will still be evaluated as an uptrend.

How to identify the EUR/GBP trend

In order to determine the EUR/GBP trend or lack thereof, we can apply some technical analysis methods:

Evaluation of the currency pair chart. When the maximum prices with each new time frame decrease, it is a downtrend. When the lower prices go up, it is an uptrend. If the rate is fluctuating in the same range it is a flat or a missing trend.

Comparison. The trend is determined by comparing several charts of currency pairs in which the base currency is the same, for example, EUR/USD, EUR/GBP, EUR/CHF, EUR/NZD. If in most cases the trend is the same, then we can talk about the rise or fall of the dollar.

● Building a trend line.

Using trend indicators.

Example of a EUR/GBP Trade

Let's say you are sure that the EUR/GBP will rise and you place a BUY order when the price is 0.9000. With the volume of 0.1 lot, 1 pip will cost £1. If the price increases by 50 pips to 0.9050 and the EUR/GBP trade is closed, your profit will be £50 (50 pip x £1).

Or, you feel like the price is about to drop and the place a SELL order at 0.9000. If the price decreases by 45 pips, dropping to 0.8955 and you close your EUR/GBP trade, your profit from this position will be £45 (45 pips x £1).

The possible losses can be calculated the same way:

Assume you open a long position with the EUR/GBP with 0.1 lot at 0.9000 and it is closed 21 pips lower on the 0.8979. From the simple calculation, we see that the loss will be £21 (21 pips x £1)

Best Time to Trade the EUR/GBP

The largest movement on the EUR/GBP is observed at the European session after 7 a.m. GMT, that's when the London exchange starts its work. Therefore, if you are a supporter of quiet trading, choose the American or Asian session, they are dominated by other currency pairs, and for EUR/GBP there is usually some lull.

The Fundamental Factors of EUR/GBP Analysis

Fundamental analysis a very helpful tool since it analyzes such price drivers as macroeconomic indicators and reports. Since timing is the number one thing in trading, you should always keep up to date and the economic calendar is exactly what you need. With its help, you can check all the events influencing the market, as well as filter the information by currency/country/level of importance. In order to follow the EUR/GBP news, choose in the “country” tab the United Kingdom and Euro Zone.

EUR/GBP Forex Correlation

Correlation is a relationship between the rates of the respective currencies, i.e., when the price of one pair rises or falls at the same time the price of another pair, and between these two indicators, sometimes there is a time gap, which allows to predict the EUR/GBP trend movement and get a good profit.

Correlation of currency pairs can be both negative and positive, depending on the currencies that are part of one or another pair. The statistical ratio is indicated by the corresponding coefficient, the value of which is in the range from -1 to +1.

In case currency pairs move in one direction, the correlation is positive and the coefficient value is equal to +1, it indicates a simultaneous movement that is 100%. And if they move in contrary directions, then it's another way around and this type of correlation is called negative.

The easiest way to determine the presence of the relationship is to run two or more charts in the trading terminal at the same time, you will immediately see all the regularities. There are also special formulas or technical calculators, using which you only need to select the desired currency pair, and the program will display the list of available currencies with the coefficient.

Here are the assets correlating with EUR/GBP:

positive

AUD/USD 87.7

EUR/USD 87.6

NZD/USD 84.1

EUR/JPY 83.1

AUD/JPY 79.4

negative

USD/CAD -85.6

USD/DKK -87.8

GBP/AUD -90.8

GBP/CAD -93.1

GBP/NZD -94.5

As you see, it is quite easy to choose the most dependent pair according to your preferences, with the right direction of correlation on currency pairs.

The correlation can be used in two ways, firstly, to reduce risks through EUR/GBP hedging.

Secondly, if you observe the currency pairs' charts for some time, you can determine a certain pattern of how much the trend on one chart is ahead of another. This is the whole secret of trading on this strategy, you observe one currency pair, and the trades are executed in another one. Sometimes this approach brings a good profit in its application.

Conclusion

All in all, EUR/GBP is one of the best options for traders for it is stable and liquid enough to boost the trading performance. With the strategies and analyzing methods, we have discussed today one can start trading right away!