The EURUSD is the most traded currency pair and one thing most can agree on is that the US Dollar is currently overvalued. This is where the agreement ends. According to one analysis conducted by the International Monetary Fund, the US Dollar is trading 11% above its 10-year average (in real effective terms). The OECD concluded that the EURUSD is 15% below purchasing power parity data it calculated which suggests that a rally in this currency pair may be looming. The US Federal Reserve’s own Trade-Weighted Dollar Index is only 4% away from its all-time record high which was recorded in 2002.

Forex traders have plenty of data points which highlight that the US Dollar is overvalued, but some analysts expect the gains to continue. Kit Juckes, Global Strategist at Societe Generale, pointed out that 'There’s more negatives on everything else. The US is a relative stability story. It makes it hard for markets. It’s hard when the thing you want to buy is already expensive.'. This would suggest that forex traders buy the US Dollar not because they believe it is strong, but rather because everything else they look at is weak. This justification for buying assets usually results in heavy losses to traders.

Many may ignore the negative impacts on the US economy, and therefore its currency, from a pro-longed trade war with China. While this threat has driven the US Dollar to the upside amid emerging market turmoil, it is not the type of driving force which yields consistent returns. Once the US consumer is forced to pay more as a direct result of the trade war, US economic figures will follow suit. On the other side of the trade, the situation in emerging markets may be nearing its end phase and the EU is on course to deal with a no-deal Brexit and an uncooperative Italian budget in a much better fashion that currently priced in.

The Bloomberg Dollar Spot Index advanced 6.5% over the past four-and-a-half months and also suggest an overvalued US Dollar. The Federal Reserve has increased interest rates, but could stop rather soon as the US economy is slowing down. This could negate the current interest rate differential some forex traders aim for. Open your PaxForex Trading Account today and decide how you want to trade the overvalued US Dollar.

UBS takes a different point of view. The head of Global Emerging Markets Equity Strategy, Geoffrey Dennis, is bearish on the US Dollar and stated that 'Long-term, currencies cannot stay out of equilibrium forever.'. It is important to keep in mind that the current tariffs imposed in the US-China trade war have resulted in capital inflows in the US Dollar, but that the next round of tariffs is very likely to have the opposite effect and result in capital outflows as forex traders account for the negative impact on the US consumer. Here are three forex trades to help you determine how to trade the overvalued US Dollar.

Forex Profit Set-Up #1; Buy GBPUSD - D1 Time-Frame

Positive Brexit news announced yesterday dominated trading desks around the globe amid new hopes that a deal will be reached between the EU and the UK. The GBPUSD completed a breakout above its horizontal support area. Adding to bullish sentiment, the primary ascending support level intersected the secondary descending resistance level which is expected to force a breakout above the primary descending resistance level. The GBPUSD is ready to accelerate back into its horizontal resistance area and forex traders are advised to buy the dips down to its primary ascending support level.

The CCI has retreated from extreme overbought conditions, but remains well in positive territory which suggests more upside for this currency pair. Subscribe to the PaxForex Daily Fundamental Analysis and let our expert analysts guide your forex portfolio through the exciting world of forex trading. Earn over 500 pips per month, simply buy following our fundamental trading set-ups.

Forex Profit Set-Up #2; Sell USDCAD - D1 Time-Frame

As the US has negotiated a new trade deal with Mexico, Canada has not yet been included. Despite this development, the Canadian Dollar is anticipated to gain ground against the US Dollar as the drivers which boosted the greenback are ripe for a reversal. The USDCAD surged past its primary descending resistance level, but ran out of steam at its secondary descending resistance level. Forex traders are recommended to seek short entry opportunities near current levels as the USDCAD is anticipated to reverse down into its next horizontal support level which is being enforced by its primary ascending support level.

The CCI advanced into extreme overbought territory, but started to retreat from its high as a negative divergence formed. A push below 100 is set to ignite a steeper sell-off in this currency pair. Follow the PaxForex Daily Forex Technical Analysis and copy-paste our technical trading recommendations into your own forex trading account. Let our expert analysts do the work so you can reap the rewards!

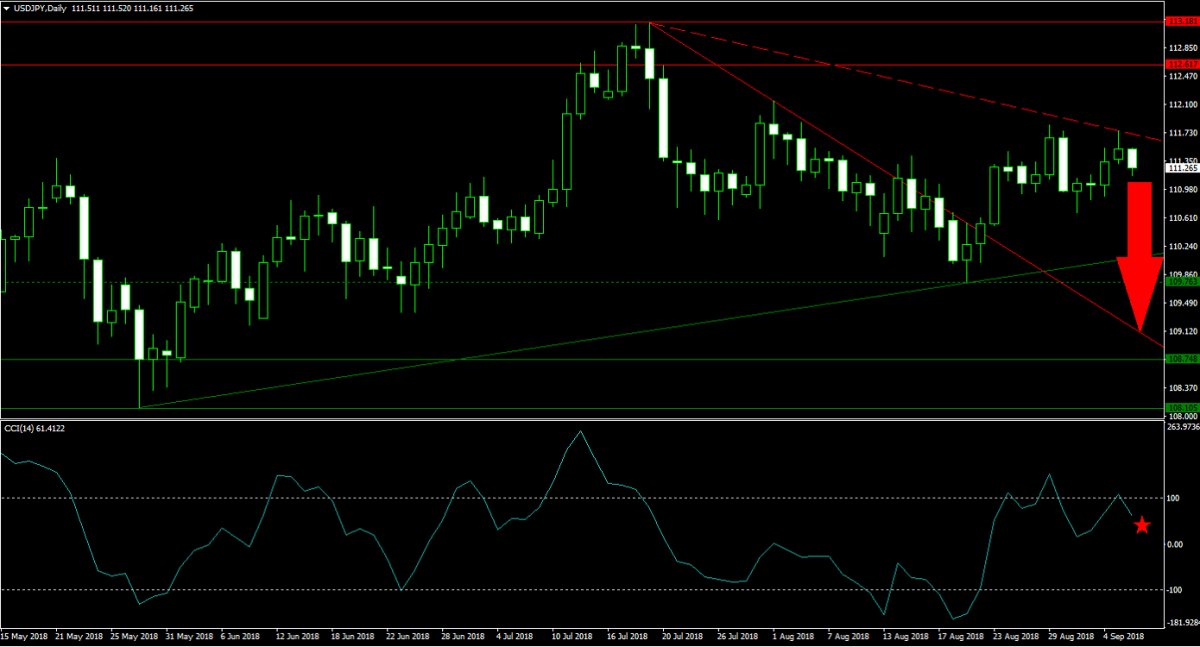

Forex Profit Set-Up #3; Sell USDJPY - D1 Time-Frame

The Japanese Yen is a safe-have currency and usually attracts forex traders who seek quality and safety. Over the past few months the US Dollar enjoyed capital inflows, but as the trend is expected to reverse the Japanese Yen may become the prime beneficiary. The USDJPY failed to push above its secondary descending resistance level and reversed course. With bearish sentiment on the rise, this currency pair is expected to descend and push below its primary ascending support level as well as below its horizontal support level until it will reach its primary descending resistance level. Forex traders are advised to sell the rallies.

The CCI has already completed a move out of extreme overbought conditions which added to a rise in bearish momentum. The high this momentum indicator recorded also represented a lower high, further pointing towards a collapse of the move to the upside. Download your PaxForex MT4 Trading Platform now and make a deposit using a wide range of options which include Bitcoin and Ethereum.

To receive new articles instantly Subscribe to updates.