After UK voters decided to leave the European Union, the unthinkable happened for many pro-EU leaders: Article 50 was triggered. Article 50 is the former notification of a member country to leave the world’s largest trading bloc within 24 months. Once British Prime Minister Theresa May send a letter to the President of the European Council Donald Tusk and divorce talks started, mane abandoned the British Pound and called for a much weaker currency exchange rate against major peers.

The most extreme forecasts called for the Euro to be more valuable than the British Pound and therefore a EURGBP breaching above 1.0000 while calls for parity in the GBPUSD were also communicated to forex traders. The EURGBP spiked to an intra-day high of 0.9865 and the GBPUSD plunged to an intra-day low of 1.1456 in October of 2016. Fast-forward to the first-quarter of 2018 and the British Pound has become the best performing G10 currency as it accelerated against all other major currencies.

This is one of the biggest signs that Brexit is severely misunderstood and that the doom forecasts for the British Pound were driven more by emotions rather than reality. Forex traders should never make a trading decision based on emotions and neither should analysts. It is safe to say that the majority in the business community disliked the Brexit vote outcome and their anger is evident in the past predictions about the British Pound as well as in many of its future forecasts. While the British currency is taking a short breather from a phenomenal run, it has plenty of room to resume its advance.

PaxForex offers traders unbiased and profitable recommendations each trading day in order to boost its client’s profits. Take advantage of the PaxForex Daily Fundamental Analysis as well as the Daily Forex Technical Analysis and earn over 500 pips every month through the hard work of our expert analysts who scan the forex market daily for profitable trade set-ups.

Of course not every forecast for the British Pound was bearish and there is always another side to the trade. The bullish predictions which call the GBPUSD as high as 1.4800 by the end of 2018 point out that a hard Brexit is unlikely thanks to the transition period which was agreed upon. Another key bullish driver is the more hawkish tone out of the Bank of England which seeks to tighten monetary policy. Currently the biggest risk to the British Pound appears to be any potential fallout from the trade war between the US and China. Here are three forex trades which will allow traders to ride the British Pound higher.

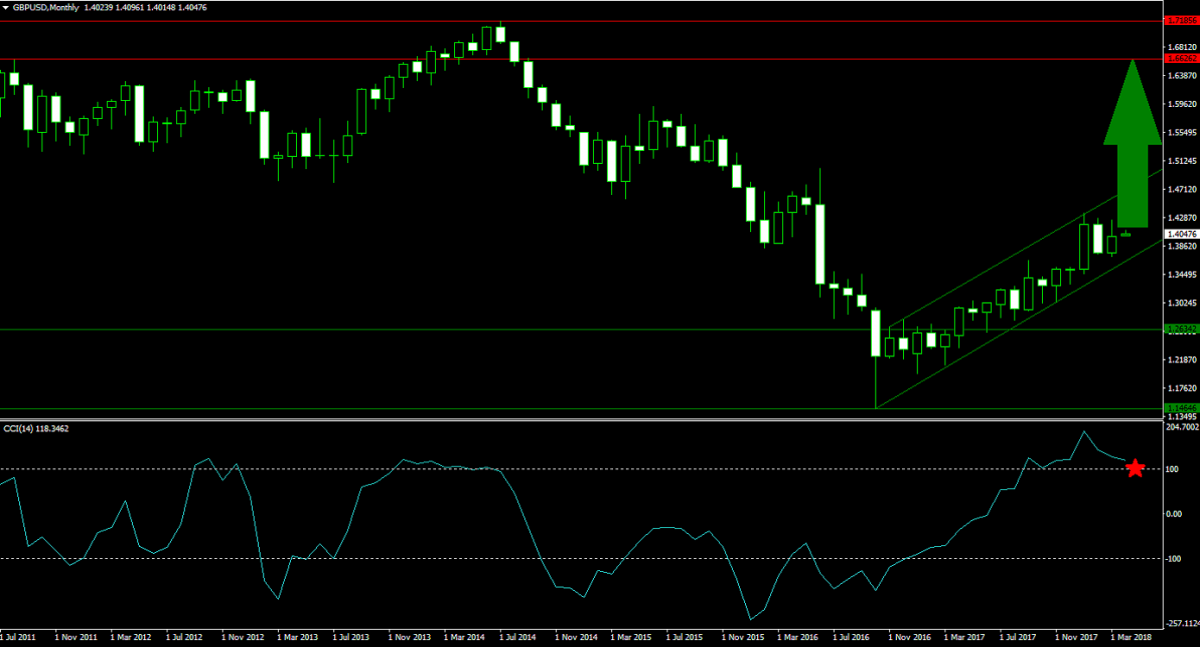

Forex Profit Set-Up #1; Buy GBPUSD - MN Time-Frame

The GBPUSD has gathered the most attention by analysts who called it up to 1.4800 by the end of the year. Following its October 2016 intra-day high this currency pair accelerated to the upside which led to a breakout above its horizontal support area from where price action continued its advance. This currency pair is now trending higher inside of a bullish price channel which is expected to push the GBPUSD further to the upside. Forex traders are advised to buy any dips into the ascending support level of its bullish chart pattern.

The CCI is currently trading in extreme overbought conditions above the 100 level, but started to retreat from its high. Any dips in price action will drop the CCI into neutral territory between 0 and 50 from where another advance is expected. Open your PaxForex Trading Account today and add this currency pair to your portfolio.

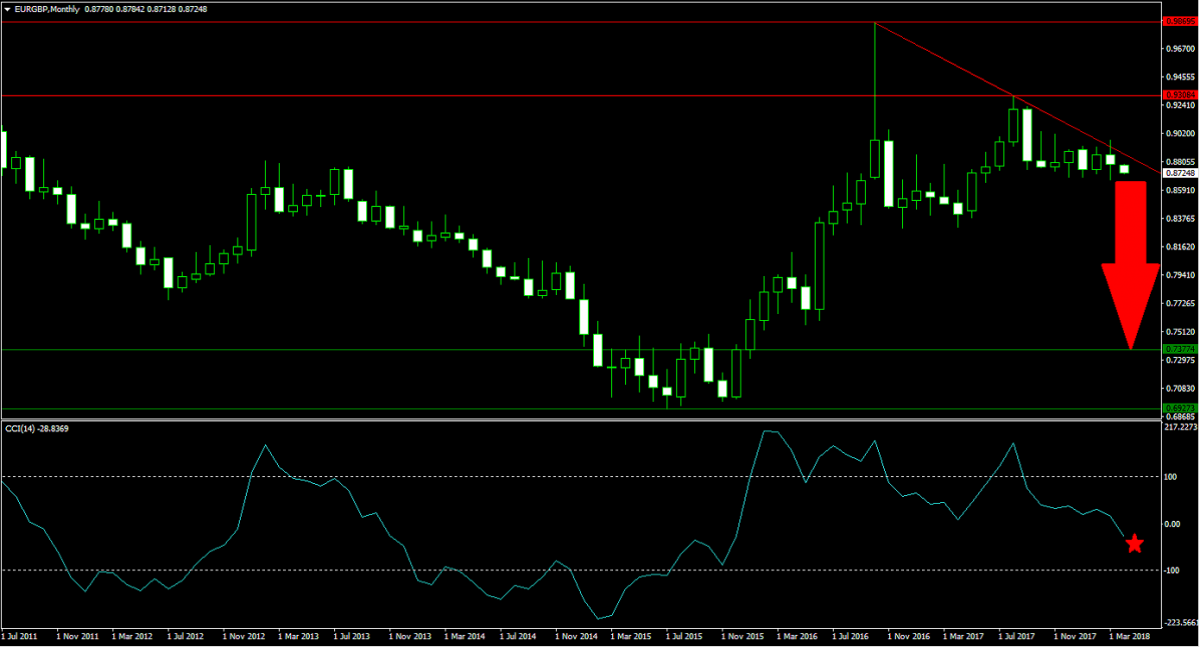

Forex Profit Set-Up #2; Sell EURGBP - MN Time-Frame

This currency pair will have the biggest impact from Brexit as its puts both currencies directly involved in the divorce, the Euro and the British Pound, against one another. Following the breakdown from its horizontal resistance area as well as a second failed attempt to push the EURGBP higher, bearish pressures have taken over. A descending resistance level is set to further extend the correction and price action face little support on the way to the downside. Forex traders are recommended to sell advances into its descending resistance level.

The CCI retreated from extreme overbought conditions and bearish momentum was strong enough for a bearish crossover below the 0 mark. This momentum indicator is set to resume its downtrend in accordance with price action for the EURGBP. Download your PaxForex MT4 Trading Platform today in order to access this currency pair before it accelerates to the downside.

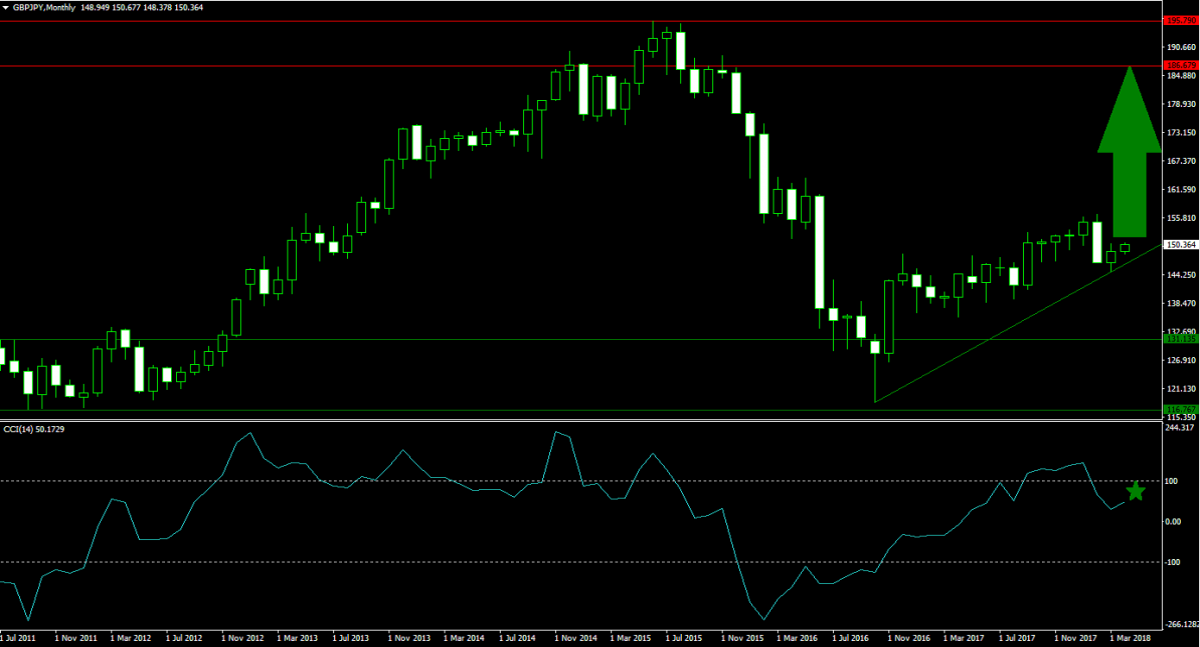

Forex Profit Set-Up #3; Buy GBPJPY - MN Time-Frame

Price action in the GBPJPY has been to the upside after a successful breakout above its horizontal support area resulted in a momentum shift from bearish to bullish. Little resistance remains in the path for this currency pair to advance into its horizontal resistance area. An ascending support level is additionally providing bullish pressures and forex traders should place their buy orders during retreats to its ascending support level.

The CCI already corrected from extreme overbought conditions above 100 into neutral territory. This technical indicator is now ready to accelerate to the upside from current levels as the GBPJPY is set to advance. Fund your PaxForex Trading Account now and enter this trade to your portfolio in order to profit from its attractive upside potential.

To receive new articles instantly Subscribe to updates.