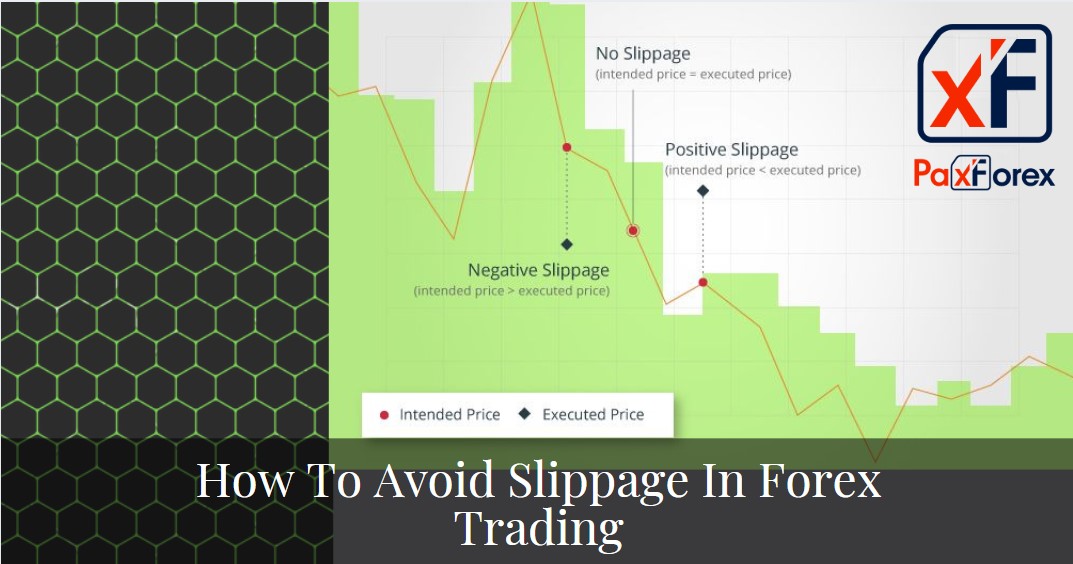

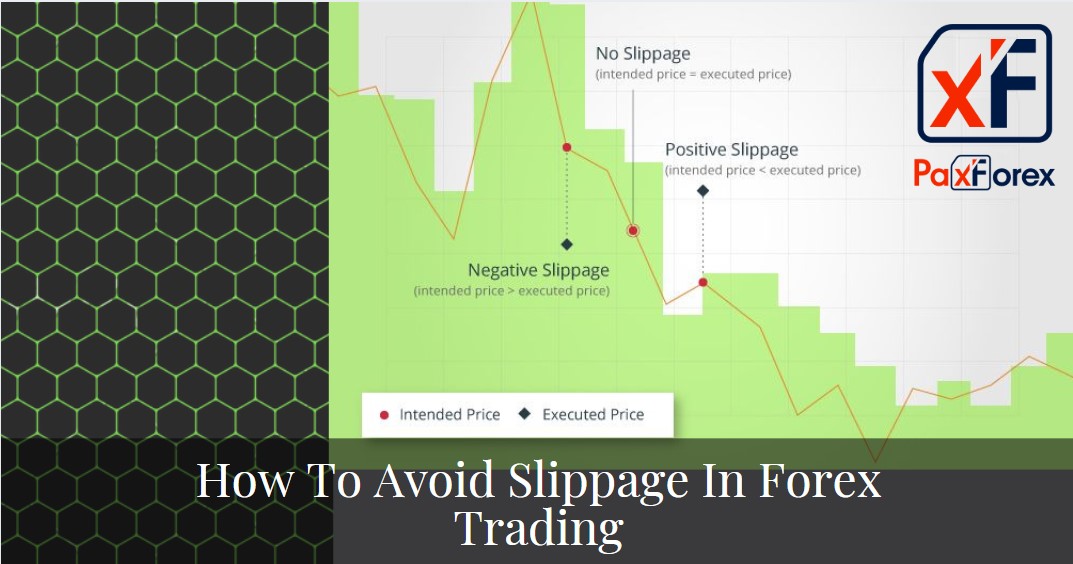

There is no single experienced Forex trader who has not heard of "slippage". Slippage happens when a trade order is filled at a price that is different from the requested price. This commonly happens throughout high volatility as well as periods whereby orders cannot be equaled at desired prices.

- Consequence #1 (NO SLIPPAGE)

The order is opened, and the best possible buy price being proposed is 1.3650 (precisely what we requested), the order is then filled at 1.3650.

- Consequence #2 (POSITIVE SLIPPAGE)

The order is opened, and the best possible buy price being proposed quickly changes to 1.3640 (10 pips below our asked price), the order is then filled at the better price of 1.3640.

- Consequence #3 (NEGATIVE SLIPPAGE)

The order is opened, and the best possible buy price being proposed quickly changes to 1.3660 (10 pips above our asked price), the order is then filled at the price of 1.3660.

Besides slippage, there is also the concept of requoting. Keep in mind: slippage and requoting are not the same thing.

Requote means that there is no such price when you place a certain order.

Here comes the message about the new price. You decide to open a trade and click "Buy". And at that moment the old price is no longer valid. You can try again but at the new price. This is the requote.

How are the concepts considered related to each other? It is very simple - setting the slippage parameters will help you to evade requotes at all.

Many traders begin to ascribe slippage to things that are not always inherent to it. For example, this is often seen as a broker's selfish intentions. But it is not. If there is slippage during trading, then the market is genuine. All ECN accounts "suffer" from slippage. That is, if your account goes to the interbank level in full or in part, then you cannot avoid slippage. You can't say for sure that slippage is critical. It's more of a norm. It is not necessary to trade on any account like "Standard" or market ECN, STP or others. Slippage should not be discarded, on the contrary - try to use it as an advantage.

Like we have already mentioned before, a phenomenon that only confirms the reality of the market. And it can be influenced. Next, let's talk about how to do it.

1. Take care of the connection

Get a good connection to the network. Install a wired connection for this purpose since it is much more reliable than wireless options (such as Wi-Fi). And while you're working, turn off all programs that require an Internet connection.

Scalping enthusiasts should take the most responsibility for the quality of the Internet connection. Programs like Skype or any other messenger during a trading session should be closed.

2. Terminal settings

New orders should be opened with settings of maximum deviation from the requested price. It is also possible to set the maximum value of slippage. If the price goes beyond the named limits, the order will simply not be executed.

3. The implication of pending limit orders

Pending orders are of different types. There are Stop orders, and there are Limit orders, whose name ends with the Word Limit. The last type of order serves for entering the market on a rollback at the most favorable price at that moment. The main thing to remember is that the Limit order is much more likely to be executed at a requested price than a stop order. We can say that Limit pending orders are a kind of liquidity reservation. But only if your account has access to the interbank level.

4. Switching to higher timeframes

Slippage becomes an unpleasant phenomenon for a trader who trades on minute charts. In the case of switching to daily intervals, the negative effect of slippage decreases in several times.

5. How to avoid Forex slippage on news

As soon as another political and financial news appears on the first positions of Internet publications, the probability of slippage grows several times. The answer to the question asked in the subtitle "How to avoid slippage Forex on the news?" asks itself - no need to trade 30-40 minutes before the news release. And you should start trading half an hour after the news release.

6. Replace your broker or type of account.

The most unreliable way, although having, let's say, questionable popularity as a kind of panacea for slipping. If you still want to resort to it, then try to analyze the validity of this measure as fairly as possible. Otherwise, in pursuit of the best broker and the right type of account you can lose a lot of time and money. By the way, often such a "race" leads to even worse results than before.

7. Filtering news by volatility.

Let us say you are interested in trading during periods of the highest market activity. There are regular news releases, which on average lead to a 15-point slippage. Now we will talk about how to use this phenomenon with minimal damage. The average value of your profit is 45 pips. Then such slippage leads to a 30 percent drop in profits. The main thing is to determine how this or that news affects the movement of the rate. For example, some of them change the price by 25 points, others - by 50 points. Open those positions that give more movement. Then the part of losses will be significantly reduced. For example, from possible 30%, you will lose only 17.

In other words, using the influence of news with a high level of volatility in trading, you will save a significant part of your profit.

Most traders work only in an active market and focus on the news with certain volatility. For example, their release leads to an average movement of 30 points. Notice the days when the volatility of news of this type reaches maximum values and trade only on these days. Then you can kill two birds at once - increase profits and reduce losses simultaneously.

Below regular market circumstances, the more liquid assets will be less inclined to slippages like the EUR/USD and USD/JPY. Although, when markets are volatile, like before and during a significant data announcement, even these liquid instruments can suffer slippage.

Conclusion

Today we have reviewed the concept of slippage in the Forex market and learned whether it is good or bad. There is no need to fight against slippage, it is better to adapt trading to this phenomenon. In higher timeframes, the slippage in Forex is not felt. However, when trading on less timeframes, you can apply several actions, which we described above.

We are one of the fastest growing Forex Brokers in the Market. Trade with PaxForex to get the full Forex Trading experience which is based on...

- The Reliability on all Assets in the Market

- Trusted Worldwide for over a Decade

- Live Multi-Lingual Online Support 24/5