The 44th G-7 Summit will take place on June 8th through June 9th in Charlevoix, Canada. Some market participants already refer to it as the G-6 + the US, given US President Donald Trump’s protectionate stance and imposed tariffs on its trading allies. The G-7 is comprised of Canada, France, Germany, Italy, Japan, the UK and the US. The European Union, the world’s largest trading bloc, is also represented. The G7 represents 46% of global nominal GDP and 32% of global purchasing power parity.

The G-6 was displeased with Trump’s withdrawal of the US from the Paris Climate Accord, but the final move which angered allies was the imposed tariffs on steel and aluminum imports on the grounds of national security. Initially the Trump administration gave special exemptions which expired on May 31st and now key allies are trying to negotiate a permanent exemption while threatening retaliatory tariffs if the US maintains its course. While Trump has made plenty of last second U-turns on his approach, the US stands to lose credibility as a reliable partner which each turn.

German Chancellor Angela Merkel and French President Emmanuel Macron have already warned Trump that they won’t sign a joint G-7 statement at the end of the summit unless the US will grant major concessions to Germany, France and the EU. In addition, Macron has stated that other G-7 members need to unite and confront the US over imposed tariffs as well as other geopolitical and economic issues. Merkel has called for the EU to step up and take a more active role and noted that Europe can’t rely on the US as a partner any longer.

As the US is staging a trade war with its major allies as well as China, the US Dollar stands to become the biggest loser. The US currency enjoyed a seven week rally which followed five quarters or fifteen week’s of contraction. Is this the final stretch for the greenback? Will price action return to its long-term bearish pattern? Open your PaxForex Trading account today and get access to the forex market in order to take full advantage of daily trading opportunities.

Italy will arrive with its new populist leadership and the G-7 never dealt with this type of scenario before. While the UK and Japan have been more quiet as the rest of the G-6 in regard to Trump’s tariff and withdrawal from the Iran nuclear deal, Canadian Prime Minister Trudeau appears to have enough of the US President after he also started renegotiating NAFTA and even considers two separate trade deals with Canada and Mexico. Will there be progress and a joint statement or is the rift too big to fix for the time being? Here are three trades to consider when assessing the G-7 and your forex portfolio.

Forex Profit Set-Up #1; Buy EURUSD - D1 Time-Frame

After a heavy sell-off in the EURUSD, driven by a combination of an economic slowdown in the Eurozone and a strong rally in the US Dollar, this currency pair staged a breakout above its horizontal support area. Following the confirmation of support, price action pushed higher on the back of a bullish sentiment change coupled with a short-covering rally. More upside should be expected in the EURUSD and forex traders are advised to buy the dips in this currency pair.

The CCI has spiked into extreme overbought conditions above 100, but minor dips in price action will push this technical indicator into neutral territory while maintaining a positive reading. Get each trading day’s most profitable technical trading set-ups by subscribing to the PaxForex Daily Forex Technical Analysis. Profit with the help of our expert analysts.

Forex Profit Set-Up #2; Sell USDCAD - D1 Time-Frame

NAFTA may be torn into two separate trade deals, but the US Dollar may ultimately pay the price while the Canadian Dollar commodity export machinery will benefit. Following the US Dollar seven-week rally, the USDCAD is trading in-and-out of the lower band of its horizontal resistance area. As bullish momentum is receding a breakdown may materialize and push this currency pair to the downside. Forex traders should spread their sell orders between the lower band of its horizontal resistance area and its ascending support level.

The CCI already retreated from its most recent high, deep in extreme overbought territory, and pushed below the 100 mark. Downside momentum is likely to take this indicator below the 0 mark from where a bearish sentiment change will be confirmed. Download your PaxForex MT4 Trading Terminal now and enter the USDCAD to your portfolio.

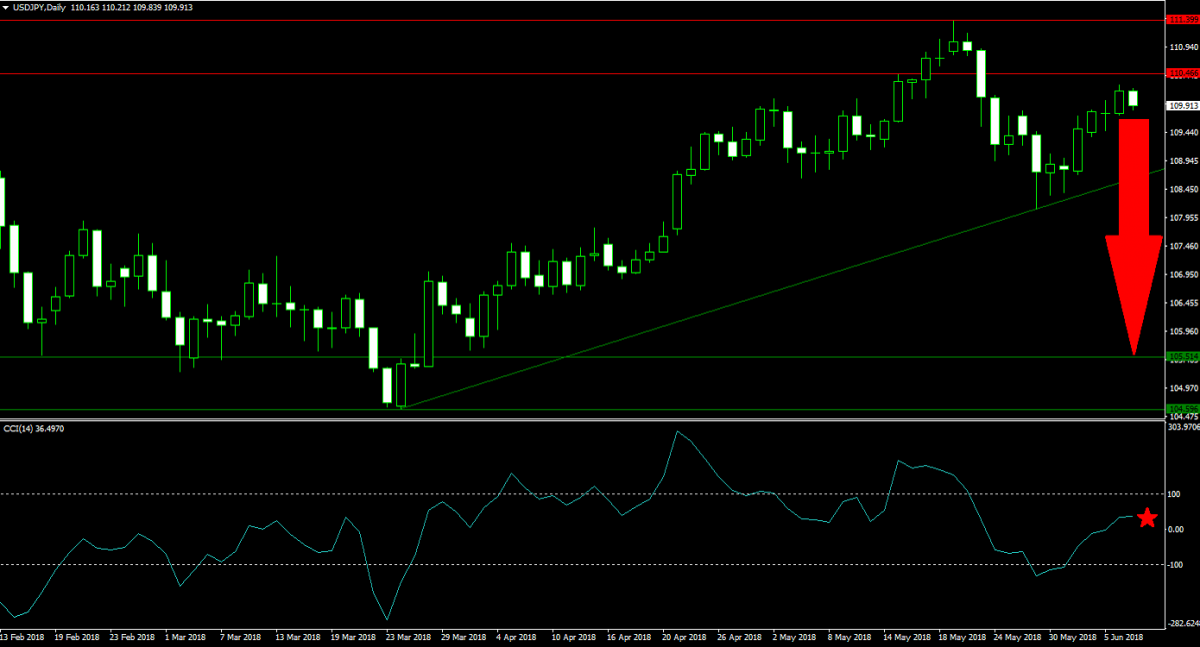

Forex Profit Set-Up #3; Sell USDJPY - D1 Time-Frame

As uncertainty increases, forex traders like to boost their Japanese Yen holdings as a safe haven trade. Price action in the USDJPY already broker its uptrend with a breakdown below its horizontal resistance area. A bounce off of its ascending support level has created a head-and-shoulders chart formation which is a bearish reversal pattern. Forex traders are advised stagger their short positions just above and below the lower band of its horizontal resistance area.

The CCI initially formed a negative divergence, a bearish trading signal, and dropped from extreme overbought levels above 100 to extreme oversold conditions below -100. A reversal followed and this momentum indicator has now ran into its extended negative divergence pattern which signals more downside. Subscribe to the PaxForex Daily Fundamental Analysis and receive the latest fundamental trading set-ups from our expert analysts which will yield you over 50 pips per month in profits.

To receive new articles instantly Subscribe to updates.