This year’s G20 Summit will be hosted by Japanese Prime Minister Abe in Osaka Japan. It will start on Friday, June 28th 2019 at 0915 local time with a pre-summit press conference and end on Saturday, June 29th 2019 at 1345 local time with a closing session. While several key global issues are on the agenda, forex traders will likely focus on bilateral sidelines meeting which will be held throughout the summit. The most important one will be the meeting between US President Trump and Chinese President Xi, where hopes ride high that both leaders will put an end to the trade war which has weakened the global economy which is already on the brink of a recession.

The US Dollar rallied as US Treasury Secretary Mnuchin stated that a deal is 90% complete and there is a path to complete it. While it initially pushed financial markets higher, this may not last as sentiment is growing that no deal will be reached. Uncertainty lingers and forex traders are expected to be cautious. JPM Equity Portfolio Manager Lilian Leung added “We don’t have a 100% clue about what is going to be reached in the G-20 meeting, but we still believe in the medium term there will be some constructive agreement being reached, but we don’t know if its going to be within this week.” Everyone who is investing in forex will need to account for unexpected developments this weekend.

The US-China meeting is not the only one of importance. Outgoing UK Prime Minister May will meet Russian President Putin in an attempt to get relations back on the right track. Yuri Ushakov, a Kremlin aide, noted “The leaders will talk over sensitive questions – as you know there are many of them. If any kind of opportunity can be found in our relations with Britain to establish new cooperation, then we will only welcome that.” The last meeting between the two leaders occurred at the G20 Summit in Argentina. Given the state of the geopolitic theatre, any warming of relations will be a welcome development.

Do you know how to trade forex as the outcome of the G20 Summit in Osaka is filled with hope and ripe for disappointments? Will safe haven currencies like the Japanese Yen and Swiss Franc continue to outperform? Open your PaxForex Trading Account now and allow our expert analysts to guide you through the forex market yielding over 500 pips in monthly profits!

Trade is expected to be the biggest area of focus and the EU, represented by President of the European Council, is likely to be very vocal on the topic. A joint statement by Tusk and Juncker communicated the goals of the EU at the summit and read “We will call on the G20 leaders to step up action to avoid the existential climate threat, to engage in delivering free and fair global trade, to decrease inequalities, harness the effects of digitalization and to promote a sustainable development.” We are at the eve of the G20 Summit of 2019 which will take place in Osaka, Japan and here are three forex trades to add to your portfolio in order to capture more pips as global leaders meet!

Forex Profit Set-Up #1; Buy GBPNZD - D1 Time-Frame

As hopes for a positive G20 outcome increased, the New Zealand Dollar attracted buyers which pushed the GBPNZD into its horizontal support area. Bearish pressures are now fading and this currency pair is ready for a short-covering rally. Forex traders are expected to book floating trading profits heading into the weekend which is likely to push price action above the upper band of its support area. A double breakout, above its primary ascending support level and its secondary descending resistance level will clear the path for a rally until the GBPNZD can test its next horizontal resistance level and forex traders are recommended to buy and dips in this currency pair down to the lower band of its horizontal support area.

The CCI has recorded a new low deep inside extreme oversold territory, but started to stabilize from where a reversal is anticipated. A move above -100 could trigger a spike in price action to the upside. Download your PaxForex MT4 Trading Platform and join one of the prime MetaTrader4 brokers in the forex market!

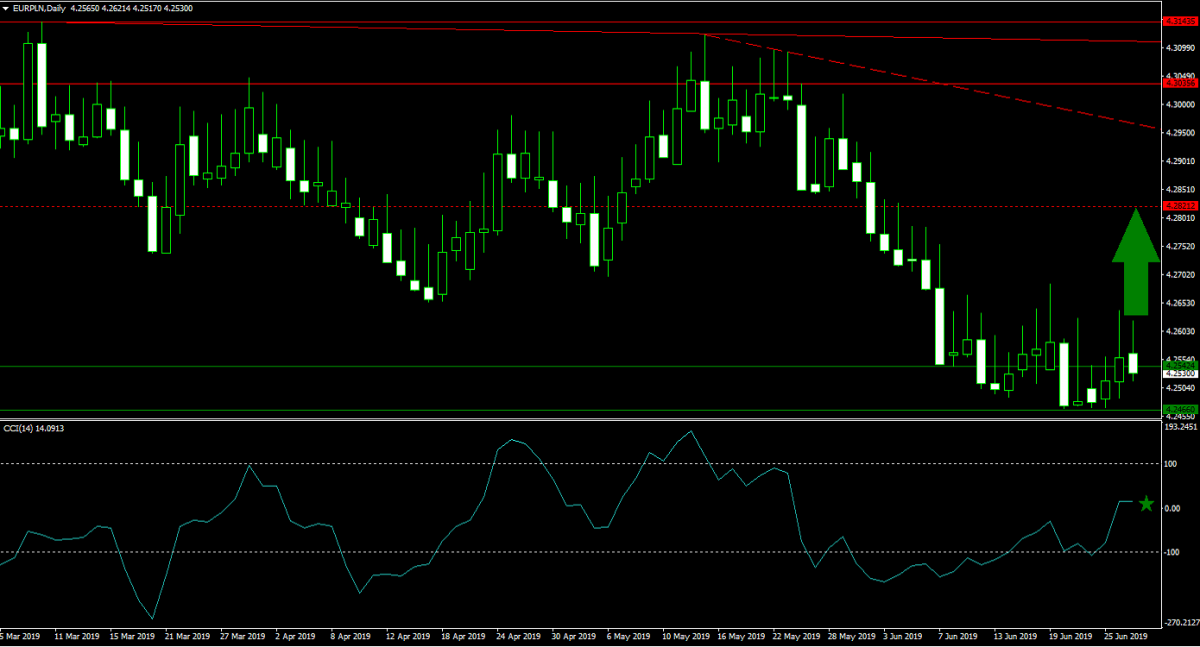

Forex Profit Set-Up #2; Buy EURPLN - D1 Time-Frame

Price action is currently depleting bearish pressures as the EURPLN has reached its horizontal support area. Economic data out of the Eurozone continues to clock in below expectations which has raised the spectre for the ECB to increase its stimulus. Forex traders who seek to reduce their exposure to the short Euro trade have a great trading opportunity in the EURPLN. There is no resistance in the way until the EURPLN can challenge its next horizontal resistance level which results in attractive upside potential and limited downside risk. Forex traders are advised to spread their buy orders inside of the horizontal support area.

The CCI already moved out of extreme oversold conditions and bullish momentum elevated this technical indicator above the 0 level for a bullish momentum crossover. More upside is now favored. Follow the PaxForex Daily Fundamental Analysis and find out why more profitable forex traders are proud to call PaxForex their prime broker!

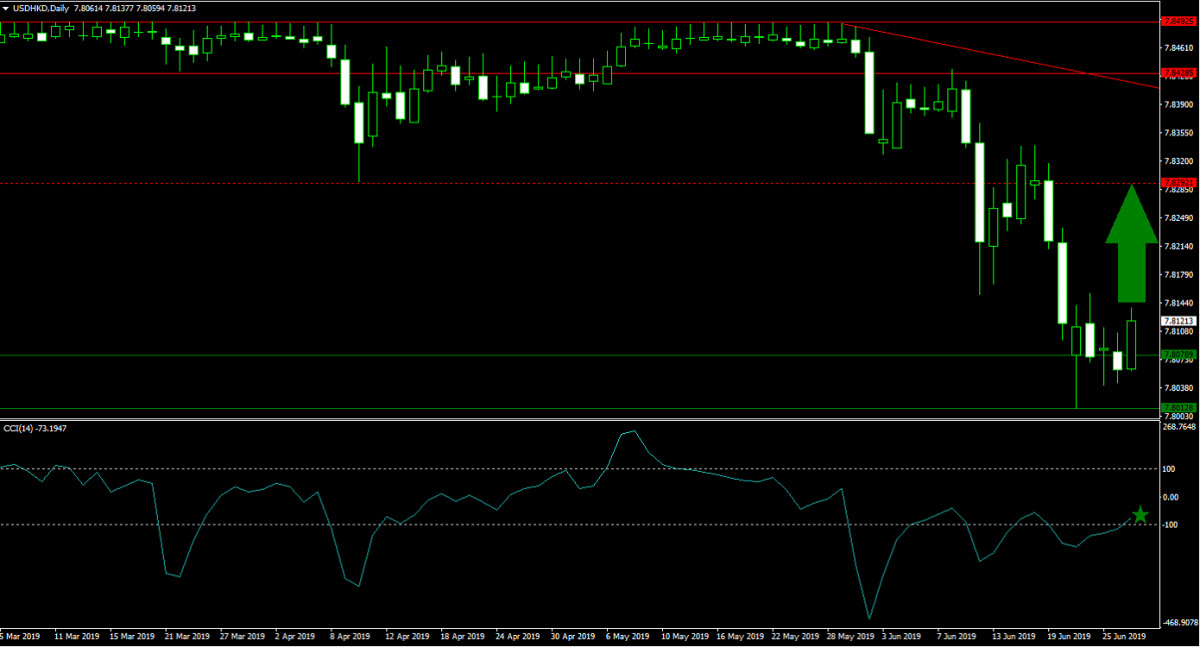

Forex Profit Set-Up #3; Buy USDHKD - D1 Time-Frame

The Hong Kong Dollar broke out of his narrow trading range and rallied sharply against the US Dollar. This has pushed the USDHKD to the downside and back into its horizontal support area. Price action now stabilized and started a price action reversal which took this currency pair back above its horizontal support area. The path is now clear to extend this breakout into its next horizontal resistance area. A short-covering rally is expected to add volume to the upside trade and buying any dips in the USDHKD down to the lower band of its horizontal support area remains the favored trading set-up.

The CCI just eclipsed the -100 mark and exited extreme oversold territory. This has further attracted buy orders as this momentum indicator is advancing. Subscribe to the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades of our expert analysts into your own trading account!

To receive new articles instantly Subscribe to updates.