On September 24th the Trump administration will impose a 10% tariff on $200 billion worth of Chinese goods. This will be increased to 25% in 2019 and comes on-top of the $50 billion worth of goods which are already under a 25% tariff. President Trump vowed to impose a tariff on the remaining $267 billion worth of Chinese goods, if China decided to retaliate. China vowed to retaliate as it has when the Trump administration announced the initial tariff on $50 billion worth of Chinese goods.

The reason the latest round of US tariffs will start with a 10% tariff and then increased next year to 25% is to give US merchants a chance to alter their supply-line out of China and find a replacement. China stated before that it will not be pressured by the Trump administration. After matching the first round of 25% tariffs on $50 billion worth of goods, China retaliated in kind. Economists now expect China to impose a 25% tariff on $60 billion worth of US goods.

The initial market reaction was rather muted across asset classes. One reason being that many traders already discounted this move by the Trump administration and priced them in. China is prepared for a long trade war and US President Trump may have overplayed his hand. Former President George W Bush’s Council of Economic Advisers, Philip Levy, noted that 'The president is enamored of tariffs. He realizes a full-on trade war might shock farmers and markets, so he makes claims that these are part of a negotiation. But he kills all attempts to negotiate.'.

Will the impact on US consumers be too high? The Trump administration has not published the full lists of 5,000 tariffed items, but items for children, their parents and the companies supporting them received an exemption. Apple also received one for some of its products. What will happen to the US Dollar moving forward? Open your PaxForex Trading Account now and start building your portfolio with our help.

Some remain hopeful that the US and China can resolve their issues before 2019. A strategist at Central China Securities, Zhang Gang, pointed out that 'The tariff rates will only be lifted to 25 percent, in January so there’s still time and room for China and U.S. to engage in negotiations. The US moves are completely uncontrollable but China can manage its policies to counter the impact and stabilize its economy.'. It appears that for now, trade talks may be cancelled. From Trump to China with love: $200 billion worth of new tariffs and here are three forex trades for great profits.

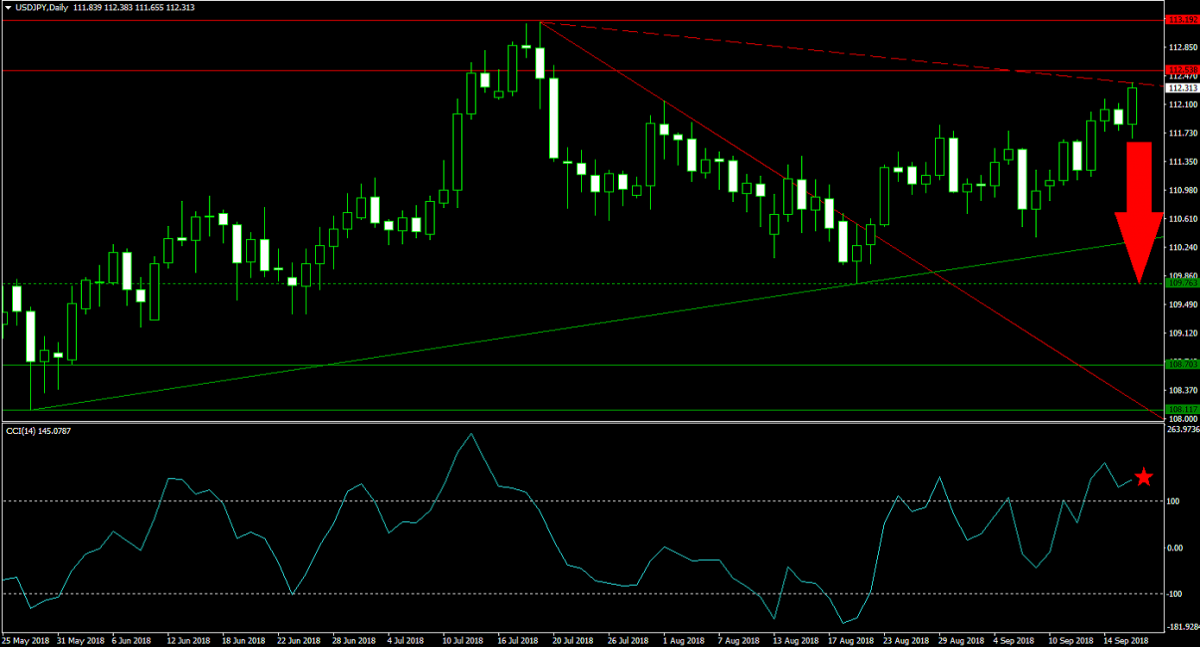

Forex Profit Set-Up #1; Sell USDJPY - D1 Time-Frame

Over the past few months, the US Dollar has attracted bids regardless of how the trade war developed. Forex traders did not flock to the Japanese Yen to seek haven. This has pushed the USDJPY into its secondary descending resistance level which is located just beneath the lower band of its horizontal resistance area. Bullish sentiment is expected to fade and price action in the USDJPY to recede back into its next horizontal support level. Forex traders are advised to sell the rallies in this currency pair.

The CCI has pushed into extreme overbought conditions, but remained well below its previous high. A breakdown from current levels is likely to follow. Subscribe to the PaxForex Daily Fundamental Analysis section and allow our expert analysts to steer your portfolio through the profitable world of forex trading. Earn over 500 pips per month, simply by following our daily recommendations.

Forex Profit Set-Up #2; Buy AUDCHF - D1 Time-Frame

The Swiss Franc was able to mount a rally against the Australian Dollar which pushed price action into its horizontal support area. Some forex traders feared that the Australian Dollar will suffer more than it has as a result of its close relationship to commodity exports to China. Following the most recent drop, the AUDCHF is expected to complete a breakout above its secondary descending resistance level and advance back into its primary descending resistance level. Buy orders in this currency pair are recommended.

The CCI has already completed a breakout from extreme oversold territory which was preceded by a positive divergence, a strong bullish trading signal. With bullish momentum accumulating, more upside in this technical indicator should be accounted for. Download your PaxForex MT4 Trading Platform and find out why more and more profitable forex traders are proud to call PaxForex their home.

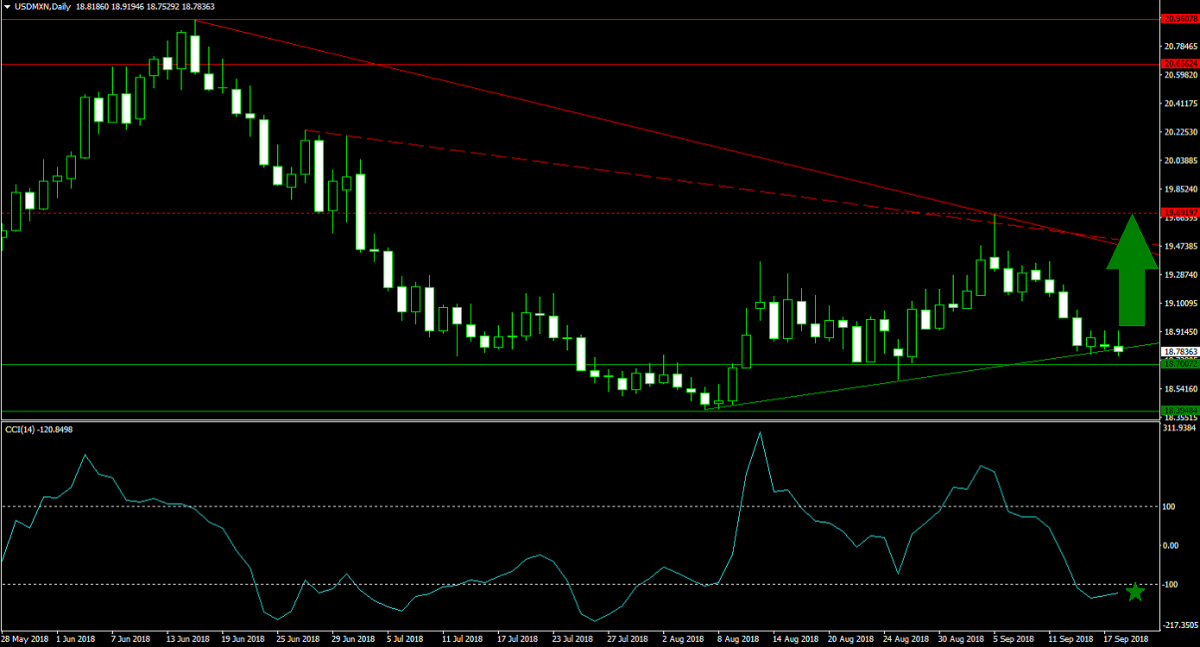

Forex Profit Set-Up #3; Buy USDMXN - D1 Time-Frame

Following a renegotiated trade agreement between the US and Mexico, slated to replace NAFTA, the Mexican Peso was able to rally which pressured the USDMXN close to its horizontal support area. Its primary ascending support level is intersection this support level. Price action started to form a series of three bullish candlestick patterns and this currency pair is anticipated to accelerate into its horizontal resistance level. Forex traders are recommended to buy the dips in the USDMXN.

The CCI dropped into extreme oversold conditions, but remains short of its previous low. A push above the -100 mark is likely to draw in more bids which may ignite a short-covering rally. Follow the PaxForex Daily Forex Technical Analysis and never miss out on a profitable trading set-up. Let our expert analysts do the hard work so you can earn profits the easy way; through the help of PaxForex.

To receive new articles instantly Subscribe to updates.