Just as traders and investors once again were motivated to hope that the trade war between the US and China will be resolved sooner rather then later, US President Trump steers the process in a different direction. After warning China against retaliating against his tariffs, which China did Monday morning before equity markets opened for trade in Asia, Trump increased tensions by signing an order which will restrict Huawei and ZTE from selling their 5G equipment to US carriers. In addition the US Department of Commerce put Huawei on a blacklist which may rule out any business sales to US companies. This would deal a devastating blow to Huawei which could find itself on a similar spot ZTE was in just a few months ago. At that point Trump came to the rescue in a sign of goodwill to get a trade deal done.

US companies will now need a special license to sell equipment to Huawei which could limit the global roll-out of 5G networks where the Chinese company is leading efforts. Roger Sheng, a Gartner analysts, noted that “The impact is well-beyond its 5G ambitions because without these American suppliers like Qualcomm and Marvell, it can’t even keep a normal operation.” This will anger China beyond a doubt and if the US actively seeks to move against Chinese based companies, President Xi could direct the PBOC to sell US Treasuries. This would not only harm the US Dollar directly, but will also increase borrowing costs for US companies as well as consumers. Trumps current trade policy is already applying pressure on retail sales and if the next round of tariffs will kick in at the end of next month, it could crush consumer spending.

While the threat of China dumping part or all of its $1.1 trillion it holds in US Treasuries is nothing new, it is once again gaining steam. Most analysts believe this would be done in order to harm the $15.9 trillion US Treasuries market, but China may be motivated by a different driver. The Chinese Yuan is weakening as the trade war is intensifying and China could use its US Treasury holdings in order to support its currency and economy should the need arise. Gene Tannuzzo, Columbia Threadneedle Investments Deputy Global Head of Fixed Income, added “If the capital account is leakier than they want it to be and they have to defend the yuan, then they’d need to be selling Treasuries.”

How will the US react if China will find itself in a position to defend its currency and sell US Treasuries? How will the US central bank be forced to react as borrowing costs will surge? The risk of China dumping US Treasuries is not priced into markets yet. Open your PaxForex Trading Account today and start building a profitable forex portfolio with the help of our expert analysts!

Some argue that China selling US Treasuries may not lead to a rise in yields, which move opposite to price, as other investors would go bargain hunting. In addition, the US Fed is scheduled to add to it balance sheet and provide a floor under price depreciation. Mark Sobel, a former US Treasury official, stated “Whenever tensions emerge between the U.S. and China, questions arise as to whether China would sell off its Treasuries in retaliation. This has been the dog that didn’t bark.” Maybe China has cried wolf once too many times, but the situation is more severe that it has ever been. Will China sell US Treasuries? Sebastien Galy, Nordea Investment Funds Senior Macro Strategist, added “If there is no trade deal, China’s currency will come under further pressure and that’s a problem for their funding, so they will need hard currency to intervene to prevent the weakening.” Here are three forex trades will boost your profits as the threat of China dumping US Treasuries intensifies.

Forex Profit Set-Up #1; Buy AUDUSD - D1 Time-Frame

The Australian Dollar is the top Yuan proxy currency used by forex traders and as the Chinese government may feel compelled to stabilize the Chinese currency, the Australian Dollar is expected to advance. The AUDUSD started to stabilize inside of its strong horizontal support area. Additional support is provided by its primary descending resistance level which turned into support. With the size of the Chinese war chest which totals over $3 trillion, price action in this currency pair is anticipated to complete a successful breakout which will clear the path to the upside until the AUDUSD can challenge its next horizontal resistance level. Forex traders are recommended to buy any dips down into the lower band of its horizontal support area.

The CCI is trading in extreme oversold territory, but has moved well off of its previous low. A positive divergence has emerged which is a strong bullish trading signal expected to force a move above -100 which will further attract buyers. Download your PaxForex MT4 Trading Platform and join our fast growing community of profitable forex traders!

Forex Profit Set-Up #2; Sell EURSGD - D1 Time-Frame

The Euro is collateral damage in the US-China trade war as the domestic economy is too weak to support a strong currency. This has made the Eurozone heavily dependent on trade with both, the US and China, and the longer this trade war lasts the more downside pressure the Euro will face. The EURSGD offers forex traders a great trading opportunity to profit from this. Price action was rejected by its secondary descending resistance level which pushed this currency pair below its horizontal resistance level. As bearish momentum is on the rise, the EURSGD is favored to complete a breakdown below its primary ascending support level and descend into the upper band of its horizontal support area. Forex traders are advised to sell any rallies into its secondary descending resistance level.

The CCI already dropped below 100 and out of extreme overbought conditions which has further increased bearish pressures. This technical indicator is now expected to move below the 0 mark for a bearish momentum shift. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market yielding over 500 pips in profits per month!

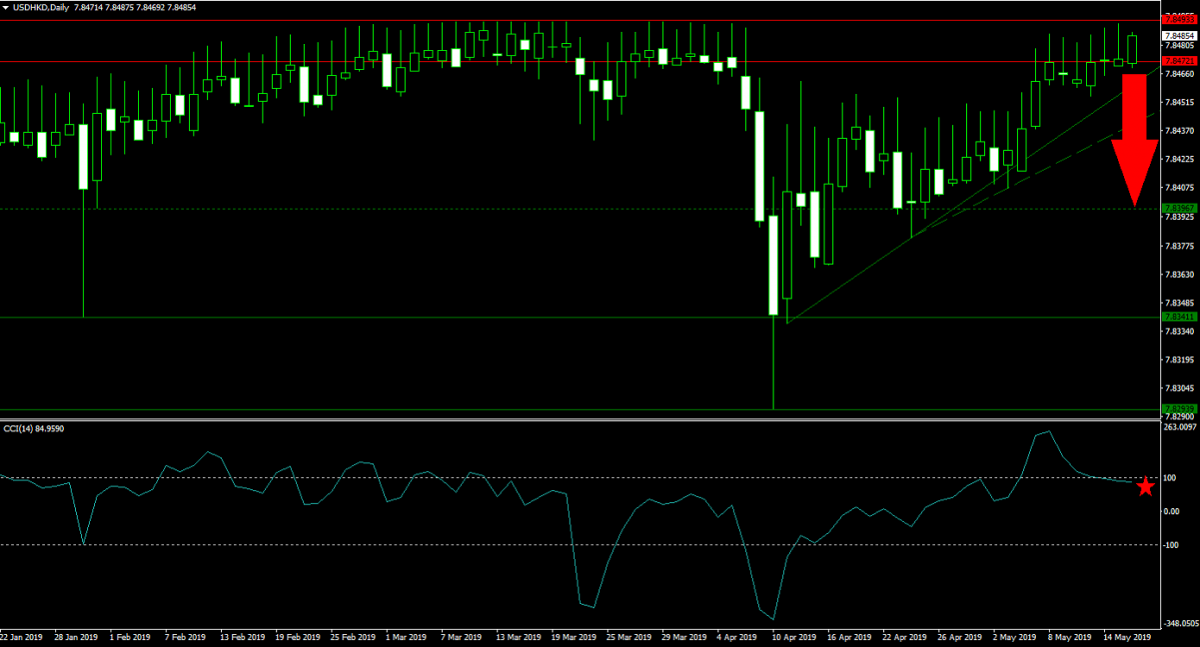

Forex Profit Set-Up #3; Sell USDHKD - D1 Time-Frame

The horizontal resistance area in the USDHKD has prevented this currency pair from moving higher and kept price action in check. As President Trump’s trade policy is starting to hurt consumers as evident in yesterday’s advanced retail sales report, the US Dollar is likely to come under pressure. A breakdown below its horizontal resistance area is anticipated to lead to a further double breakdown below its primary and secondary ascending support levels. This will clear the path for the USDHKD to accelerate down into its next horizontal support level. Spreading sell orders inside its horizontal resistance area is the favored trading approach.

The CCI already completed a breakdown out of extreme overbought territory which added to bearish sentiment. This momentum indicator is now anticipated to extend its descend until it will drop below the 0 level. Subscribe to the PaxForex Daily Forex Technical Analysis and simply copy the recommended forex trades of our expert analysts into your own trading account!

To receive new articles instantly Subscribe to updates.