UK Prime Minister Theresa May scored a minor political victory as a panel of important Tory MP’s decided to keep the rules on a leadership challenge unchanged. As more members from her own party seek to replace her, especially since she reached out to Marxist opposition leader Jeremy Corbyn, May is trying to see through a Brexit compromise which can be passed by Parliament. Her hated Brexit deal which she negotiated with the EU over the past two years was rejected three times and was the sole issue which united politicians from all parties.

The 1922 Committee, which is a group of influential Tory backbenchers, asked her two week’s ago to outline a clear plan for her departure and Graham Brady, the Chairman of the key 1922 Committee, told reporters that May has agreed to meet him next week in order to discuss her departure. Following the announcement of the meeting, the Tory and the Labour party issued press releases which highlighted their commitment to reach a Brexit compromise which will pass Parliament. May stated that she will step down once the deal is approved. Her party tried to oust her last December, but failed to secure the majority required. Under party rules, another leadership challenge cannot take place for twelve months.

This rule can be changed by the 1922 Committee, but it refused to change it last month which bought May a few more week’s of time for her cross-party negotiations. A growing number of Tory’s are angered and wish for May to depart as soon as possible. May has crossed plenty of her red lines and many Brexiteers already feel betrayed. They claim that May is not delivering on the vote of the people and follows the agenda of the EU. Nadine Dorries, Tory MP who called for May's resignation, added “We need to make sure we get a final decision soon. Because everybody needs it.” May is now rumored to agree to a temporary customs union with the EU. This is something the EU ruled out, as it wishes for a permanent one, and something her own Tory party rejects as it will prevent the UK from striking its own trade deals which was a key component of Brexit.

The British Pound has been under heavy selling pressure over the past four trading sessions, but has this taken the British currency into attractive buy territory or is the Brexit uncertainty to great of a risk? Open your PaxForex Trading Account today and build a profitable forex portfolio with the help of our expert analysts who work hard so that you may earn the easy profits!

A lot of attention is now placed on next week’s meeting between May and Brady who himself has labeled the last two meeting with her as “good”. He noted “It is the intention to have a further vote probably on second reading of the Withdrawal Agreement Bill before the European elections take place, and hopefully in the much nearer future than that. That’s my understanding.” EU parliamnetary elections start on May 23rd and many have labeled May 22nd as the final date for Brexit to be delivered. A failure to do so would force the UK to participate in EU elections and bound them a lot closer than many want. It is the hope of the EU that this would reverse Brexit altogether and complete the betrayal of the vote which May has been often accused of. May scores minor victory, but here are three forex trades for major profits!

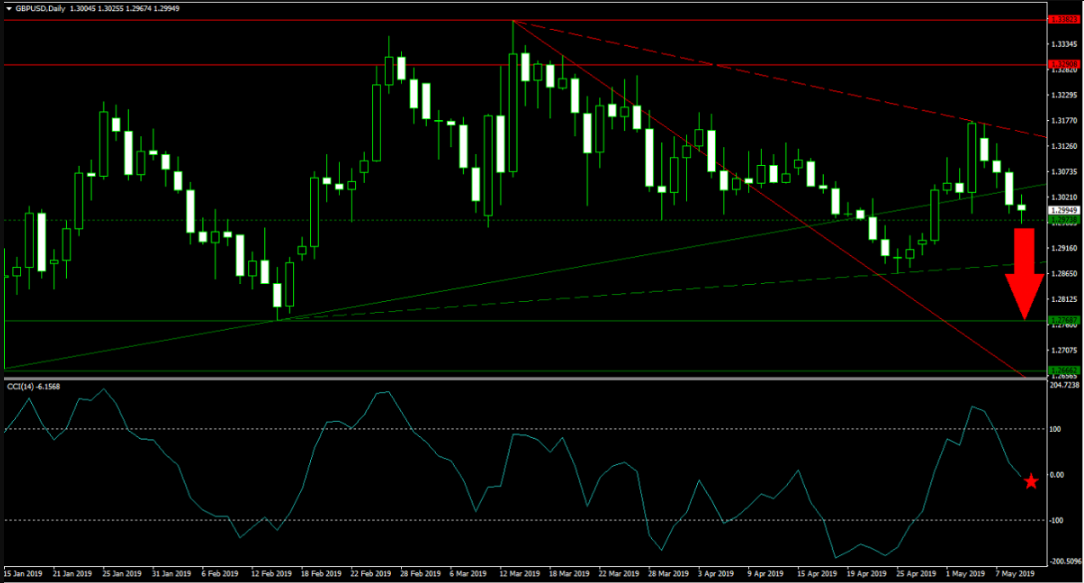

Forex Profit Set-Up #1; Sell GBPUSD - D1 Time-Frame

As the GBPUSD completed a breakdown below its primary ascending support level, bearish momentum rose sharply. This is expected to lead to more downside in the the short-term as Brexit missteps can’t be ruled out as the key May 22nd deadline approaches. Price action is currently trading above and below its next horizontal support level, but as bearish momentum is accelerating, a new breakdown is favored. The GBPUSD could push below its secondary ascending support level and into the upper band of its next horizontal support area. Forex traders are advised to sell any rallies into its secondary descending resistance level.

The CCI dropped from extreme overbought territory and has also breached the 0 mark to the downside. This resulted in a bearish momentum change which is expected to lead to more downside. Download your PaxForex MT4 Trading Platform now and join our fast growing community of profitable forex traders!

Forex Profit Set-Up #2; Buy GBPJPY - D1 Time-Frame

British Pound bulls will find a great trading opportunity in the GBPJPY. While the Japanese Yen is traditionally known as a safe-haven currency which performs better during times of uncertainty, this currency pair led developments and is now expected to lead to a price action reversal on the back of a short-covering rally. The Japanese Yen attracted bids as tensions in the US-China trade war increased. Price action was able to bounce higher after reaching its secondary ascending support level which intersected its horizontal support level. With bearish momentum weakening, a spike above its primary descending resistance level is favored to extend into its secondary descending resistance level. Forex traders are recommended to buy any dips from current levels.

The CCI has moved deep into extreme oversold conditions and recorded a new 2019 low. This momentum indicator is now anticipated to claw its way back above the -100 level from where new GBPJPY long orders are likely to enter the market. Subscribe to the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the forex market!

Forex Profit Set-Up #3; Sell GBPPLN - D1 Time-Frame

While Poland has a range of issues with the EU, Brexit is a more pressing concern as EU parliamentary elections are roughly two weeks away. The Polish Zloty may strengthen into the elections as a likely change in the EU parliament will be beneficial to Poland. At the same time Brexit uncertainty is expected to rise. The GBPPLN was unable to recover its losses after a breakdown below its horizontal resistance area. The primary and secondary descending resistance levels added to bearish momentum and price action dropped below its secondary ascending support level. The path is now clear for the GBPPLN to extend its contraction into its next horizontal support level. Selling any rallies into its secondary descending resistance level is the favored trading approach.

The CCI started to accelerate to the downside after trading in extreme overbought territory and as this technical indicator moved below the 100 mark, bearish momentum increased. A push below 0 is anticipated to follow shortly. Follow the PaxForex Daily Forex Technical Analysis and simply copy the recommended forex trades of our expert analysts into your own portfolio!

To receive new articles instantly Subscribe to updates.