Probably you`ve seen one of the action trade positions in a narrow range when you were expecting the breakout/breakdown? From a historical point of view, it does make sense since in cases when the price is restrained by a narrow range usually there is a sharp spike (either up or down) after that. It`s a great opportunity to significantly increase the account balance, one just needs to place orders according to the direction.

The ones who monitor charts for these "spikes" are acknowledged that if it begins to move there is no way to catch up with it due to rapidly it soars or plunges. Consequently, most of the traders are left with nothing because they couldn`t react fast enough.

The next thing happening is that traders that have not managed to catch the wave become obsessed with the idea to break even.

Essentially it leads to a disastrous result, as the sharp price movement tends to slow down, normally at about the time when traders commence following the trade, and this is when the price reverses, taking down all the Stop Losses and reducing the account balance.

The desire to hit the big time attracts a lot of traders which makes them trading breakouts/breakdowns since the reward potential is really amazing. Once applied to real-life it doesn`t seem to be that easy. For those who are still eager to succeed in taming big move following a tight trading range, there is a perfect method called "Pop ‘n’ Stop". Complying with risk management, the rejection bar candlestick pattern is added to the price movement.

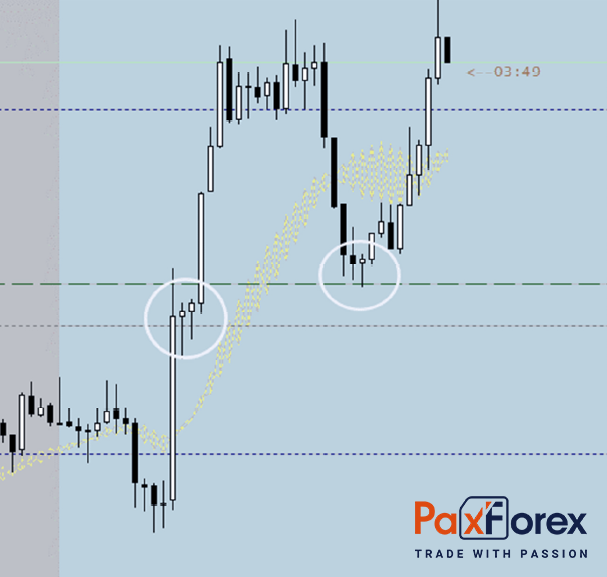

The screenshot attached above displays a narrow trading range followed by a breakout at the very beginning of the trading session, shown on the blue background and beginning close to the left side. As we know, in terms of the technical analysis it makes no difference for us why this breakout happened: either some natural disasters or important fundamental indicator has been published or just because of a lot of huge participants changing positions from short to long. Notwithstanding what precipitated the breakout, price movement first popped out of its narrow range and then suspended briefly which has been checked by the first white circle. Because of such performance, the strategy got its name - Pop ‘n’ Stop.

Right after the brief pause, two upward rejection bars appeared near a round number, indicated by the grey dotted line. It is known to be a rational price movement following a long and quick candlestick set into one direction; the correction to the spot of breakout happens because of the fast movement which crossed an area of moderate order activity and gaps form. As statistics shows, those gaps will be fulfilled once trading action recovers to regular.

- Part of the day: A still edge into the beginning of a trading session usually accompanies numerous positions being opened which prompts a spike in volatility;

- Range: Price movement was restricted by a tight range;

- Pop ‘n’ Stop: Price movement created a Pop ‘n’ Stop pattern that assures extra monitoring for trading signals as at the moment it could go in either way;

- Candlestick pattern of rejection: subsequent the breakout, price movement developed a rejection bar candlestick pattern at the round number which was replaced by a second rejection bar candlestick pattern.

In such a situation there are several options of how to trade: most traders would place a limit buy order several pips before the rejection bar candlestick pattern; risky ones would preserve this framework with the help of Stop Losses set beneath the tail of the rejection bar and a more hidebound trader would place the Stop Loss just under the highs of the narrow trading range.

Another possible trade set-up is marked by the second white circle. Again, an upward rejection bar established by the principal level, indicated by the dashed line, which outlines the junction of a monthly pivot level as the Pop ‘n’ Stop pattern developed to the left.

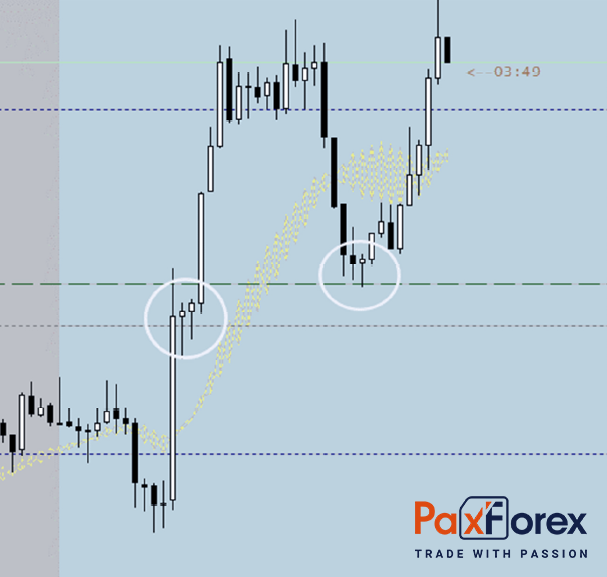

On the second screenshot, we can see two likely trade set-ups for a breakout succeeded by a breakdown. An upward rejection bar (marked by the first white circle) that developed in the zone of the polarity indicator apparent in yellow and a round number from a preceding trading range. The price movement popped and then developed another range on top of it.

Another white circle shows that the movement to the upside is tapering off as a downward Harami candlestick pattern developed succeeding a strong upward candle. The ones who placed buy orders in the area marked by white circle now got the approval to either close those positions or to modify their stops to the top.

The latest sign for the short position is presented by the downward rejection bar with a pretty long thread from the highs of the breakout, symbolizing that the upside potential is completed.

Those traders who are fancy to trade breakouts/breakdown should agree that Pop ‘n’ Stop is a quiet attractive approach to adopt.

Here are some essential moments to remember:

- The abovementioned strategy is somewhat risky as traders assume that the gap will not be fulfilled. Decreasing the risk by implementing the candlestick bars of rejection is extremely advised.

- It is recommended (since it`s much more successful) to apply the Pop ‘n’ Stop strategy right after some influential reports or announcements which bring a breakout/breakdown of a narrow trading range and in the direction of the previous trend.

- Having enough margin is highly recommended since it should let the directional movement "do the job", otherwise the trade is doomed to failure.

- Regularly keep an eye on major news announcements which could prompt gaps to be fulfilled and market sentiment to reverse direction.

- Don’t let greed overwhelm you since Pop ‘n’ Stop scalping breakout approach is meant for short-term trading. Setting tight Stop Losses and Take Profits is urged. Forex traders should not anticipate a ratio higher 2:1 beside a more modest limit of 1.5:1.

- This trading strategy may be combined with a counter-move strategy, as shown by the second white circles in both screenshots, in cases when a price movement reversal compensating the gap.

We are one of the fastest growing Forex Brokers in the Market. Trade with PaxForex to get the full Forex Trading experience which is based on...

- The Reliability on all Assets in the Market

- Trusted Worldwide for over a Decade

- Live Multi-Lingual Online Support 24/5