Will today be remembered as the Eve of the US-China trade war of 2018? Tomorrow, Friday 6th 2018 the US is supposed to impose a new set of tariffs on Chinese imports to the US. The 25% tariffs on $50 billion worth of Chinese imports is in response to what the Trump administration has labeled the theft of American intellectual property. $34 billion will be subject to the tariff starting tomorrow with the remaining $16 billion set to take effect on June 15th. China stated that it will response in kind, immediately following the US imposition of the planned tariffs. The first targets will be the US agricultural and automotive sectors in response to US tariffs.

Markets are eager to find out if US President Trump will proceed with the tariffs tomorrow, which he is widely expected to do, and more importantly if he makes good on his threat to target an additional $200 billion worth of Chinese imports and another $200 billion following that. This was something he vowed to do if China decides to retaliate which is all but guaranteed. According to BNP Paribas Asset Management China Senior Economist Chi Lo, 'The tail risk of a Sino-US trade war is getting fatter. The two sides may misjudge each other’s intentions when patriotism takes over rationality, and push themselves into an escalating series of attacks and retaliation.'

The Chinese Yuan has dropped to multi-month lows and Chinese equity markets entered a bear market, classified as a 20%+ drop from its peak, amid worries of how far this trade war may go. The Chinese government is also pushing through a much needed debt-control campaign which is expected to dampen overall GDP growth. According to a Bloomberg Economics calculation, tariffs on $50 billion could decrease Chinese GDP growth by 0.2% and if more tariffs will be applied it could reach 0.5% in 2019. The Chinese government has a 6.5% GDP growth target for 2018, down from 2017’s growth rate of 6.9%. Some economists point to a sub-7% GDP growth rate as a risk of social unrest and economic instability.

The People’s Bank of China has vowed to not weaponize the Yuan which just finished the worst-quarter since 1994. Some market watchers claimed that the PBOC has deliberately allowed the Chinese currency to weaken in order for the Chinese government to have another weapon to fight in the US-China trade war. How can you profit from forex market fluctuations in response to the increased threat of a global trade war? Start by opening your PaxForex Trading Account now!

According to four institutional forex traders who asked not to be named, during the Tuesday morning trading session in Asia, there was mild intervention on behalf of the PBOC as a few major Chinese banks sold the US Dollar and bought the Chinese Yuan. While the PBOC vowed to 'keep the Yuan exchange rate basically stable at reasonable and balanced level', according to PBOC Governor Yi Gang, Shanghai Commercial Bank Head of Research Ryan Lam stated that 'the market sentiment is very one-sided, all the hedging and trading flows are all pointing to further weakening of the Yuan.' The Eve of the US-China trade war may be upon us and here are three forex trades to consider.

Forex Profit Set-Up #1; Buy EURUSD - D1 Time-Frame

The strong US Dollar appears to be nearing and end and many forex traders may decide to take profits now as uncertainty is ahead over the summer months. The EURUSD entered a sideways trend after setting the lower band of its horizontal support area. Price action advanced from the lows and now completed a breakout above support. This resulted in a stark increase of bullish pressures which could start a short-covering rally and push the EURUSD into its descending resistance level. Forex traders are advised to place their buy orders between 1.1640 and 1.1715.

The CCI confirmed the breakout in the EURUSD from its horizontal support area, which took this indicator into extreme overbought conditions. Given the rise in bullish sentiment, new highs for the CCI are expected following a brief pull-back into neutral territory. Download your PaxForex MT4 Trading Platform now an add this trade to your forex portfolio.

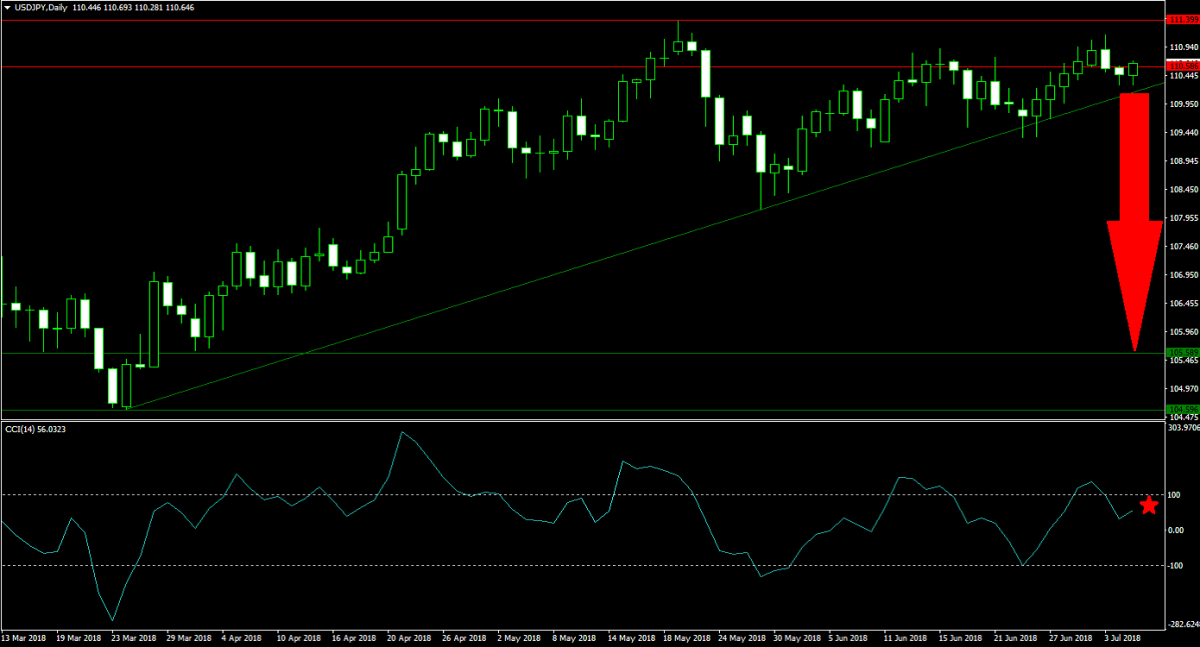

Forex Profit Set-Up #2; Sell USDJPY - D1 Time-Frame

The USDJPY enjoyed a solid advance, but price action struggled once it reached its horizontal resistance area. A pair of breakdowns and lower highs followed which has further weakened the up-trend of this currency pair. An ascending support level is now pressuring the USDJPY for a move, which is anticipated to be to the downside as bearish sentiment outweighs bullish pressures. Forex traders are recommended to spread their sell orders between the ascending support level and the lower band of the horizontal resistance area.

The CCI descended from extreme overbought territory into neutral conditions, but was preceded by an extended negative divergence which represents a strong bearish trading signal. More downside should be accounted for from current levels. Follow the PaxForex Daily Forex Technical Analysis section and receive all our trading recommendations as soon as they are published by our analytics department.

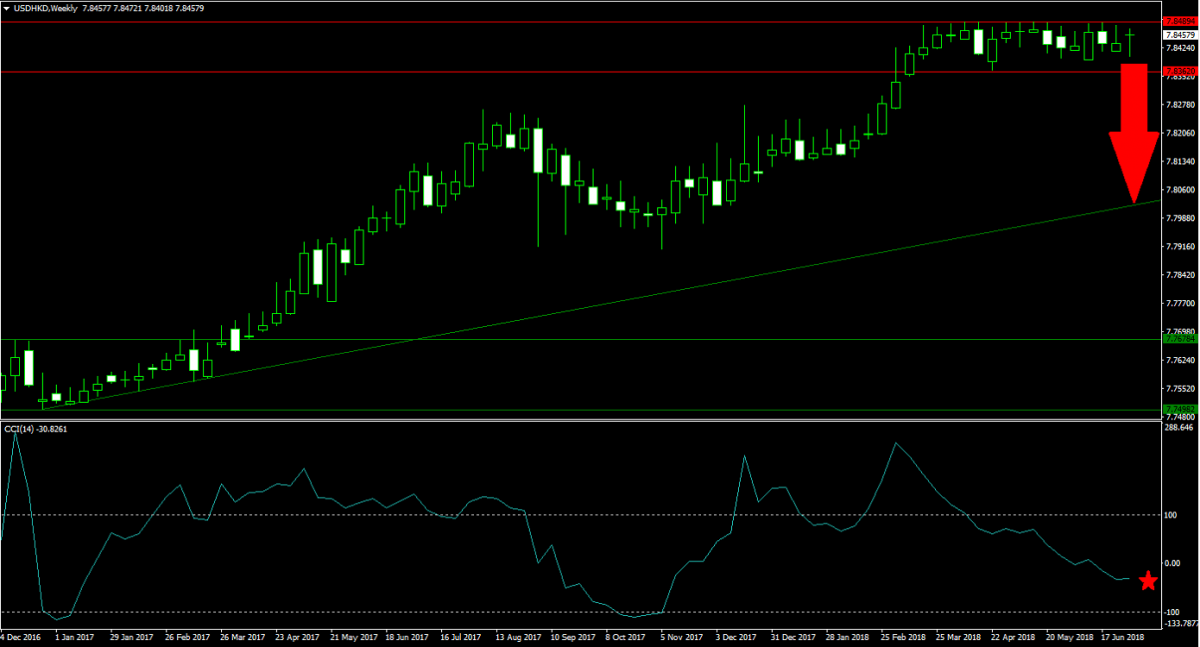

Forex Profit Set-Up #3; Sell USDHKD - W1 Time-Frame

Following a solid advance from its horizontal support area into its horizontal resistance area, bullish momentum is weakening and a sideways trend has emerged. The extended time period the USDHKD has spend in this sideways trend inside of its horizontal resistance area has made price action vulnerable to a sharp corrective phase. A move down into its ascending support level is expected and forex traders should spread their sell orders inside the horizontal resistance area. The USDHKD carries limited upside potential from current levels, but very attractive downside risk.

The CCI already completed a breakdown from extreme overbought conditions and bearish momentum was strong enough to further push this momentum indicator below the 0 mark. This resulted in a sentiment change from bullish to bearish. Earn over 500 pips per month by following the fundamental trading recommendations of our expert analysts published at PaxForex Daily Fundamental Analysis.

To receive new articles instantly Subscribe to updates.