The European Union is extremely frustrated with Italy and now decided to express their frustration with economic estimates. The European Commission released a report with their estimates for GDP growth across the EU and stated that it currently expect the Italian GDP to expand at 1.2% in 2019. This is below the Italian government’s GDP estimate which shows a growth rate of 1.5%. According to the European Commission report, Italy’s debt-to-GDP ratio will increase to 2.9% in 2019 and to 3.1% in 2020 while rejecting Italy’s estimate for a debt-to-GDP ratio of 2.4%.

The report further stated that due to an expected increase in Italian government borrowing costs, its outlook faces “high uncertainty amid intensified downside risks” which further divided the EU from Italy. Lorenzo Codogno, a London School of Economics Visiting Professor who used to be the Chief Economists at the Italian Ministry of Economy and Finance, added that “Even the EU forecasts themselves look too optimistic. The impact of higher borrowing costs on the banks’ loan rates is set to limit economic growth even further.”

The European Commission also labeled Italy as one of the “high-debt Euro area countries where disruptive sovereign-bank loops could also re-emerge in case of doubts about the quality and sustainability of public finances.” The EU has asked Italy to revise its budget and submit it by the November 13th deadline. Italian Finance Minister Giovanni Tria confirmed that the Italian government has not prepared to revise it budget, but added that it will seek a dialogue with the European Commission.

With Italian bond yields rising, how will the Euro react to a deeper standoff between the EU and Italy? Latest Eurozone economic data points to a steeper slowdown in the Eurozone economy which continues to pressure the Euro, especially after the ECB is expected to exit its quantitative easing program next month. Open your PaxForex Trading Account now and join our growing community of profitable forex traders!

It is unlikely that both sides will come to an agreement by the November 13th deadline as Italy’s government commented on numerous occasions that it will serve the Italian people first and not Brussels. EU Economic Commissioner Pierre Moscovici added earlier today that “I hope we will come up with a common solution, but if you’re talking about splitting things down the middle, I don’t see how that’s possible. We need to get closer together, but we need to respect the rules.” As the EU-Italy standoff intensifies, take a look at these three forex trades in order to intensify your profits!

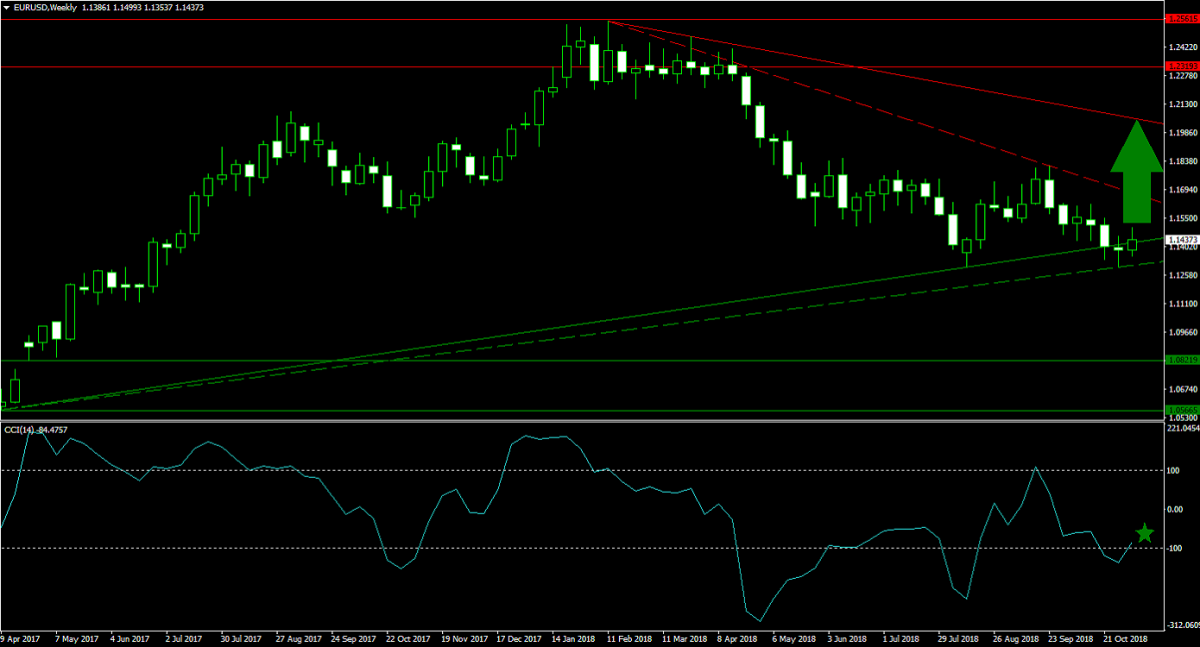

Forex Profit Set-Up #1; Buy EURUSD - W1 Time-Frame

This recommendations is partially about pending US Dollar weakness than expected Euro strength, but also partially about a short-covering rally from a technical perspective. The EURUSD found support at its primary and secondary ascending support level which deflated bearish sentiment. A breakout above its secondary descending resistance level is anticipated to follow which will take this currency pair back into its primary descending resistance level. Forex traders are advised to buy the dips in the EURUSD down into its secondary ascending support level.

The CCI already pushed above extreme oversold territory after a strong positive divergence formed. This represents a very bullish trading signal and supports upside in price action from current levels. Subscribe to the PaxForex Daily Fundamental Analysis and earn over 500 pips per month with the help of our expert analysts.

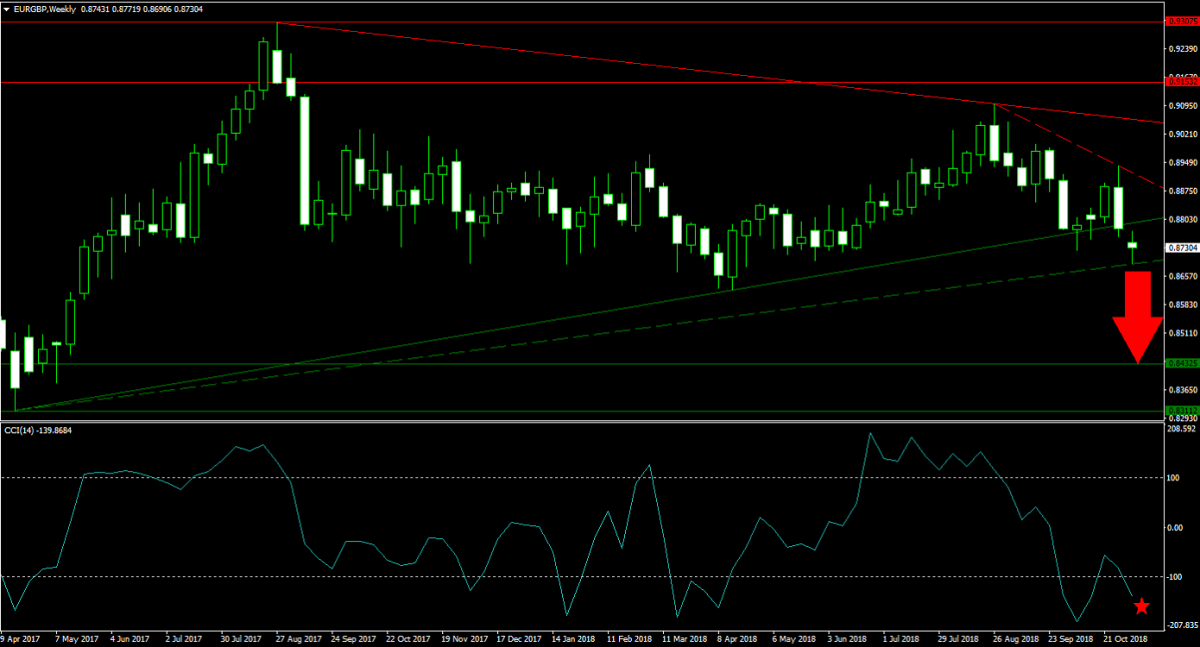

Forex Profit Set-Up #2; Sell EURGBP - W1 Time-Frame

As the British Pound moves up and down with news surrounding Brexit, the EURGBP has endured an increase in volatility but with a general trend lower. Eurozone weakness has trumped Brexit concerns and this trend is expected to continue. Price action was rejected by its secondary descending resistance level and temporarily stabilized at its secondary ascending support level. A breakdown is expected to take the EURGBP back down into its next horizontal support area and selling the rallies is favored from current levels.

The CCI entered extreme oversold conditions, but remains off of its previous lows. There is room for this momentum indicator to descend which would include a breakdown in price action. Follow the PaxForex Daily Forex Technical Analysis published by our expert analysts and earn more pips per trade.

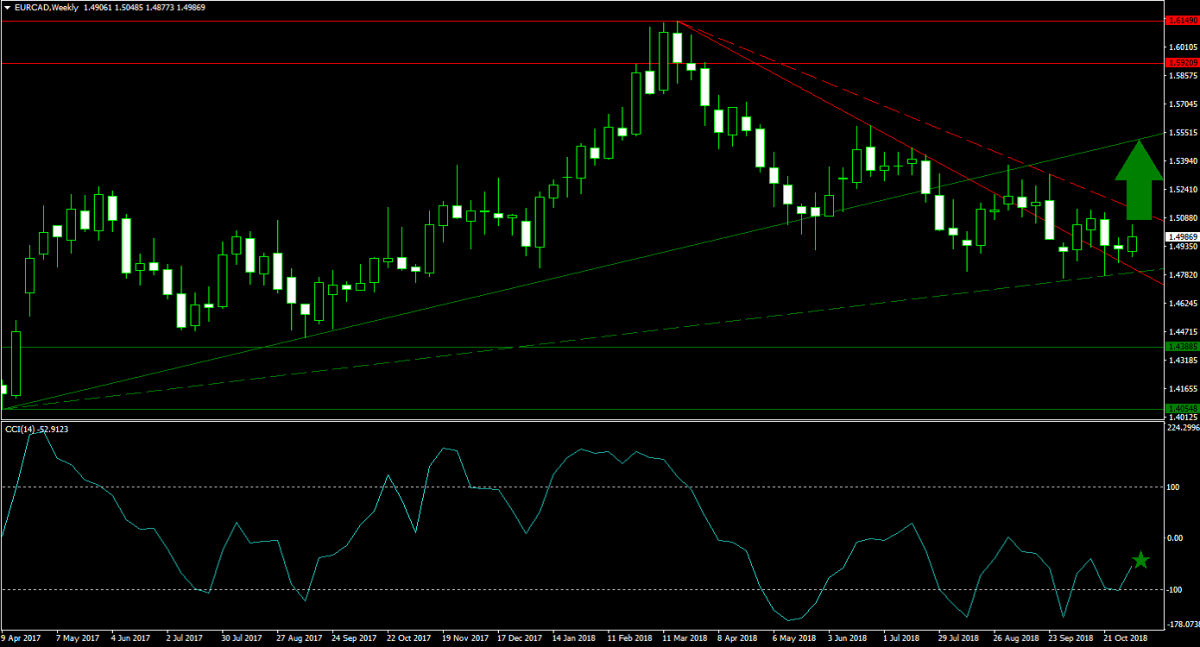

Forex Profit Set-Up #3; Buy EURCAD - W1 Time-Frame

The Canadian Dollar is expected to weaken with the price of oil and other commodities which would support a higher EURCAD. Price action took advantage of its secondary ascending support level and reversed direction which took this currency pair above its primary descending resistance level. Bullish momentum is anticipated to suffice another breakout above its secondary descending resistance level which will take the EURCAD back into its primary ascending support level. Forex traders are advised to buy the dips.

The CCI has exited extreme oversold levels and is now ascending with enough bullish momentum which could push this technical indicator above the 0 mark. This would result in a bullish momentum shift and support further upside in price action. Download your PaxForex MT4 Trading Platform now and start building a profitable forex portfolio with our help!

To receive new articles instantly Subscribe to updates.