As the Brexit deadline comes closer, market watchers are increasingly more pessimistic about a positive Brexit outcome. A breakthrough, particularly on trade, is needed but as negotiations resumed today in Brussels, the mood is a cautious one. The EU wants to avoid sending a wrong message to Britain, as well as to financial market, in regards to a major progress. Both parties hope that by the end of the year they will come to an agreement, but EU members including Germany asked negotiators not to rush into any preparations for documents regarding trade.

EU diplomats are worried about the various scandals which surround Prime Minister May’s cabinet as two top ministers resigned in as many weeks. The sex scandal surrounding Secretary of State for Defense Sir Michael Fallon forced his resignation on November 1st which dealt a big blow to Prime Minister May. Yesterday, International Development Secretary Priti Patel was fired after she held unauthorized meetings with Israeli officials.

There is more and more doubt about who is in charge of the UK government, if anyone, as the scandals pile up especially after a snap election which saw Prime Minister May lose her majority. Her plan to increase her parties majority before Brexit negotiations started back-fired and the in-fighting has increased within the British parliament as well as within her own party. A potential vote of no confidence has not yet materialized, but the cloud of such a possibility does hang over some negotiators minds; especially as less time becomes available to strike a meaningful deal.

PaxForex coverage of market moving events can help forex traders prepare their trading accounts for potential market reactions. In addition, profitable trading recommendations are identified by PaxForex analysts daily in order to assist trader make profitable trading decisions.

The size of the divorce bill has been one major obstacle to advance trade talks, and while Prime Minister May agreed to pay into the EU budget for two years after Brexit for a total of €20 billion, it has not been enough to satisfy EU leaders which hold the final say over when negotiations may move towards trade. While the EU does not seek a definite number on the divorce bill, it want to be reassured that the UK believes it does owe more than the current pledge. Citizens rights have not been sorted out yet and many believed that this would be the easiest issue of them all. While hopes remain for a breakthrough, forex traders should not trade based on hope. Here are three ways to profit from a potential lack of progress in regards to Brexit before the end of this year.

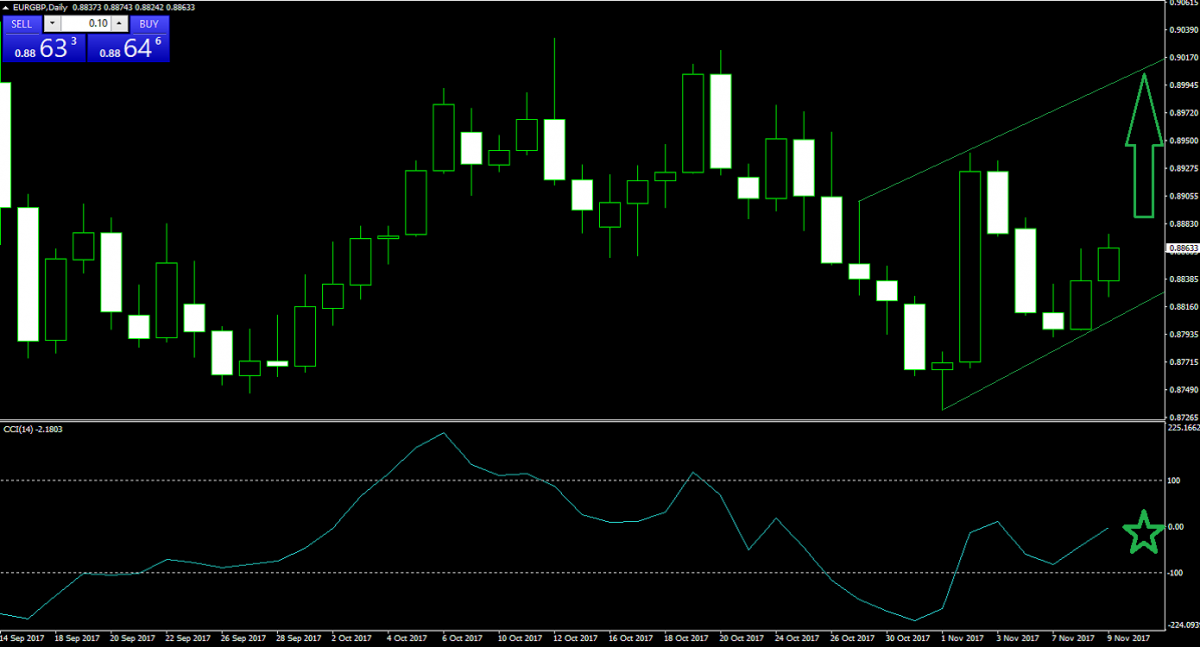

Forex Profit Set-Up #1; Buy EURGBP - D1 Time-Frame

The first trade we will take a look at is the EURGBP which puts the EU against the UK in a direct head-to-head trade. It appears as the EU has the upper hand which is bullish for the EURGBP. This currency pair is trending higher inside a newly formed bullish price channel which should take this currency pair above the 0.9000 mark over the next few trading sessions. The CCI completed a breakout from below the -100 mark which further added to bullish momentum in this trade.

Any pull-back below 0.8850 should be taken as a good long entry opportunity as the downside remains limited. PaxForex offers traders excellent trading conditions which are required in order to grow a successful forex portfolio.

Forex Profit Set-Up #2; Buy GBPZAR - W1 Time-Frame

Not every trader may be pessimistic on the outlook for the GBP and there is a chance for a positive outcome. One of the biggest benefactors of a good Brexit deal would be the GBPZAR which has rallied sharply over the past weeks, but the rally did form a rising wedge chart pattern which is a bearish formation. Last week’s candlestick formed an evening start pattern at resistance which is another sell signal for this currency pair.

In addition to the above to sell signals, the CCI has formed a negative divergence and forex traders are advised to monitor for a breakdown in this indicator below 100 which would ignite additional sell orders. PaxForex offers its traders the option to trade exotic currency pairs such as the GBPZAR, so make sure to open an account today in order to diversify your forex income stream.

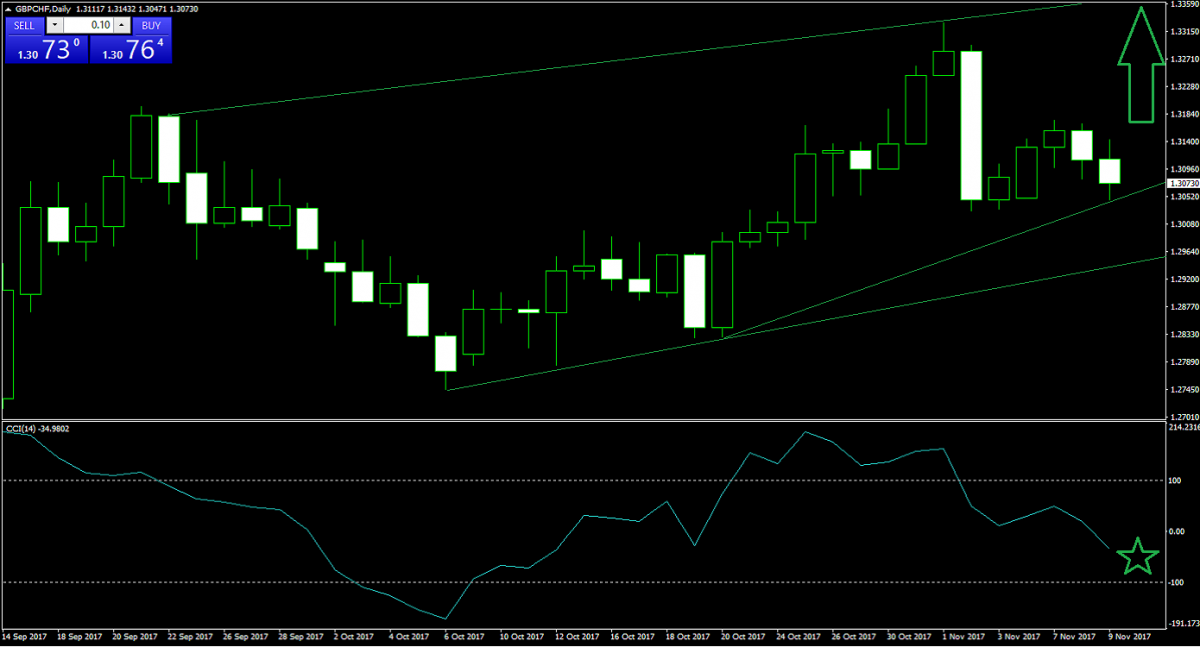

Forex Profit Set-Up #3; Buy GBPCHF - D1 Time-Frame

The GBPCHF adds the save haven status f the Swiss Franc into the expected volatility of the GBP. This currency pair has advanced inside a bullish price channel and is currently bouncing off of an ascending support level inside of it bullish chart pattern. The CCI has dropped below 0 and is now approaching oversold territory. The bearish pressures for this currency pair are fading and bullish pressures are slowly building, any level below 1.3050 represents an attractive long entry for the GBPCHF.

Forex traders should take advantage of tight spreads in order to earn more from each trade. Every pip matters when it comes to trading and PaxForex offers very competitive spreads which together with good leverage can give traders the edge they seek.

To receive new articles instantly Subscribe to updates.