Later on today the UK Parliament is set to vote on the Brexit deal which May has tried to modify following her historic defeat week’s earlier. The UK and EU have been in heated discussions, but UK officials emerged late Sunday and labeled the negotiations “deadlocked” as the EU refuses to make changes to the Irish backstop issue at the heart of the current impasse. Yesterday some MP’s urged May to scrap this evening’s vote as not enough changes have been secured from the deal which was voted down. With time running out, May decided to fly to Strasbourg, France in order to meet with European Commission President Jean-Claude Juncker.

Two hours of discussions led to a press conference close to midnight where the two announced revisions to the Brexit deal, especially to the Irish backstop. May flew to France in order to secure to key concessions from the EU in regards to the Irish backstop. First she wanted the UK to receive unilateral powers to exit the backstop; she also asked for a time limit to be agree upon. The EU could not deliver on those two key demands, but agreed to add three documents in which it provides legal clarifications and where it states that the Irish backstop is limited. It also gives the UK the option to exit it, if a panel of independent arbitration judges agrees that the EU is trying to keep the UK tied to its rules indefinitely.

Some key statements in the revised Brexit deal state that “persistent failure to comply with a ruling may result in temporary remedies” and that both parties have the “ultimately have the right to enact a unilateral, proportionate suspension of its obligations under the Withdrawal Agreement”. Maybe the most important addition is the wording that if the EU and UK are unable to reach a full trade agreement, “nothing in the Withdrawal Agreement would prevent it from instigating measures that could ultimately lead to disapplication of backstop obligations”. Are the last minute Brexit changes enough for May to win the votes in Parliament tonight?

The British Pound surged after the announcement that the EU has given May Brexit changes to present to Parliament. Analysts are now split on if the rally can be extended with Parliament’s backing off the revised deal or if the British Pound will crash in the event of another defeat for May. Open your PaxForex Trading Account today and join our fast growing community of profitable forex traders!

Juncker made it clear that this is as good as it will get from the EU side. He added that “The choice is clear: it is this deal, or Brexit may not happen at all. Let’s bring the U.K.’s withdrawal to an orderly end. We owe it to history.” May stated that “Now is the time to come together, to back this improved Brexit deal, and to deliver on the instruction of the British people.” Did the EU give May enough to bridge the divide in her own Conservative Party which enjoys a slim majority thanks to the support of the DUP? The changes didn’t go as far as Attorney General Geoffrey Cox negotiated for last week. He is expected to give his opinion later today and before the vote. One-third of May’s party voted against her last time around, will this time be different? The EU agreed to last minute Brexit changes and here are three forex trades which will help you grow your account balance!

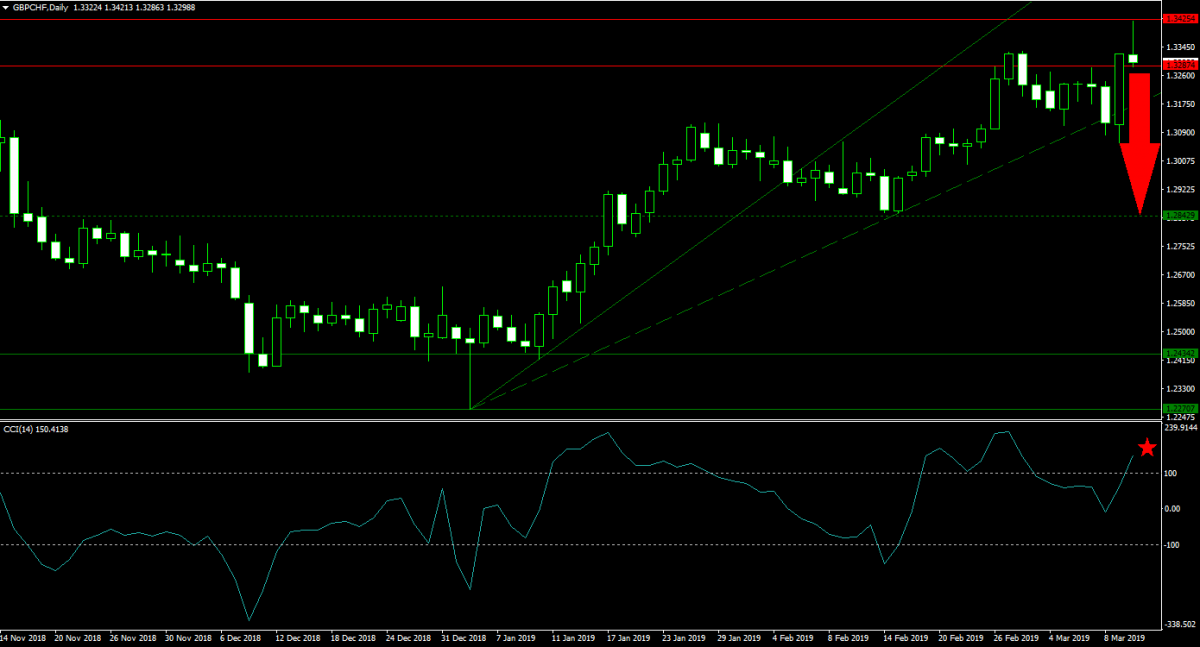

Forex Profit Set-Up #1; Sell GBPCHF - D1 Time-Frame

Last night’s spike in the British Pound took the GBPCHF to the upper band of its horizontal resistance area. While traders welcomed the news of an amended Brexit deal, May has to push it through Parliament which remains a challenge. The Swiss Franc is a safe haven currency and forex traders are likely to realize floating trading profits. A price action reversal is expected to result in a breakdown below its horizontal resistance area as well as below its secondary ascending support level. The sell-off is anticipated to touch the next horizontal support level and forex traders are recommended to sell the rallies into the upper band of its horizontal resistance area.

The CCI accelerated from negative territory into extreme overbought conditions, but remained off of its previous high. This resulted in the formation of a negative divergence, a bearish trading signal, and a momentum reversal is likely to follow. Download your PaxForex MT4 Trading Platform now and take the first step towards a profitable forex portfolio!

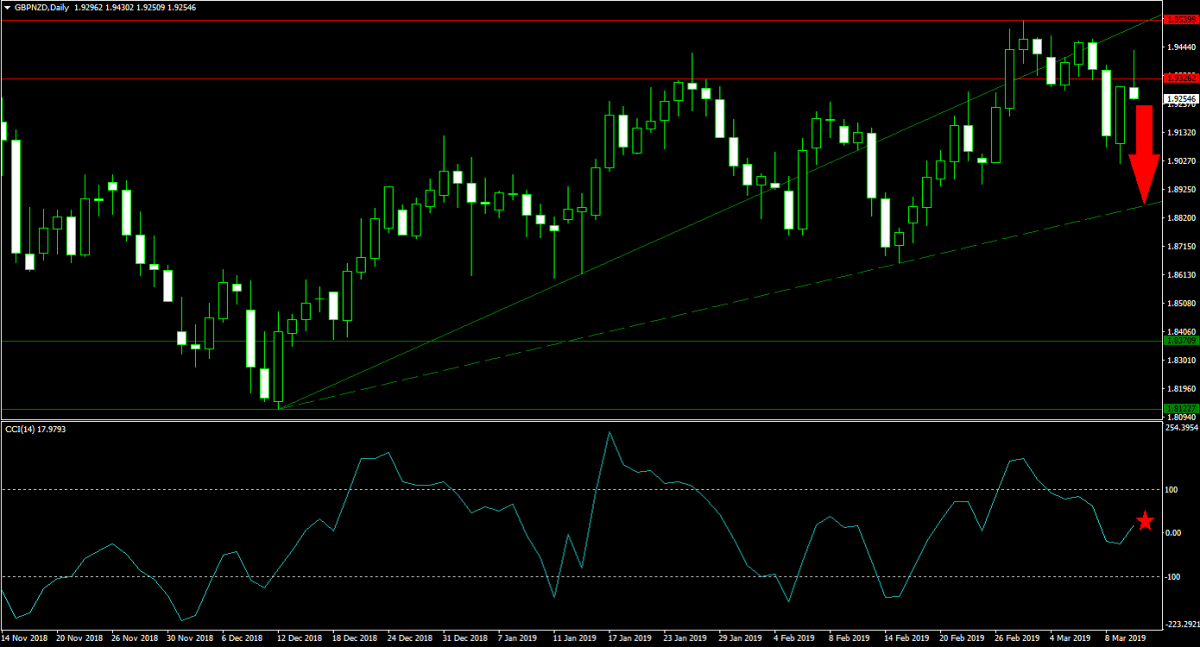

Forex Profit Set-Up #2; Sell GBPNZD - D1 Time-Frame

Even if May’s revised Brexit deal get approved, the British Pound could come under temporary selling pressure. This is known as “buy the rumors, sell the news”, which means that traders entered their buy orders based on hopes for a positive outcome and then sell once the outcome has been announced. The GBPNZD already failed to extend its rally and bullish momentum is fading. The emergence of an inverted hammer candlestick formation below the lower band of its horizontal resistance area suggests a reversal may be imminent. A sell-off down into its secondary ascending support level is expected and selling the rallies up into its primary ascending support level, which now acts as temporary resistance, is the favored trade.

The CCI retreated from extreme overbought territory and with a bearish momentum shift pending, this technical indicator is trading above and below the 0 mark. A push lower from current levels is likely to trigger a sell-off in the GBPNZD. Follow the PaxForex Daily Fundamental Analysis where our expert analysts guide you to over 500 pips in profits per month!

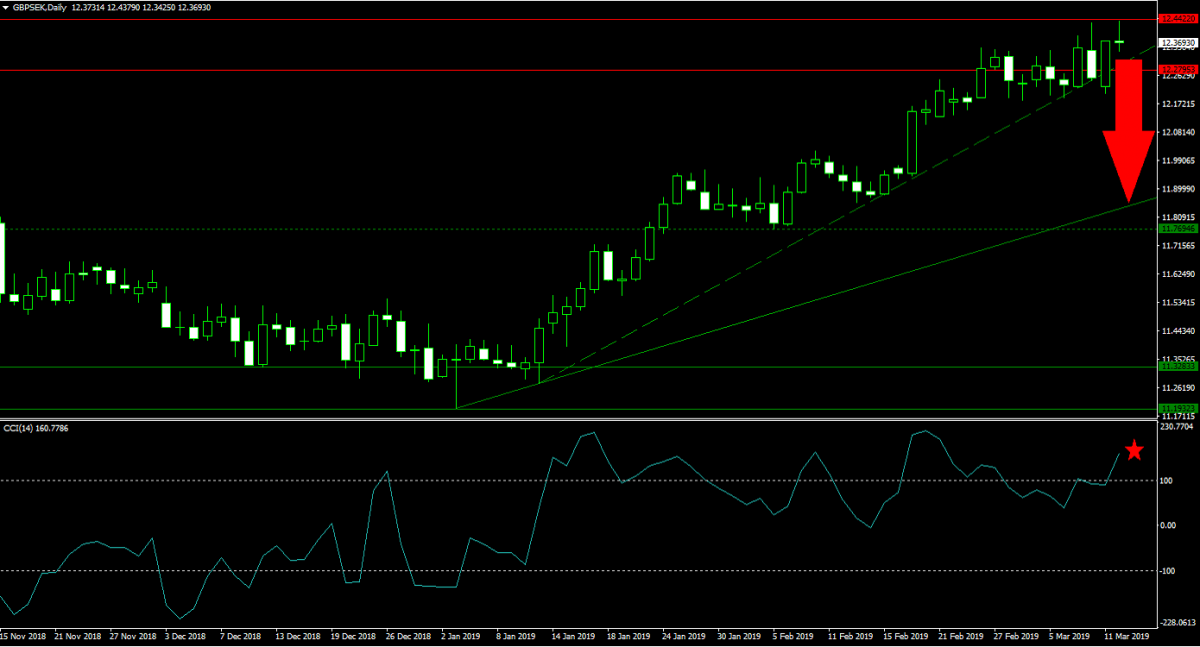

Forex Profit Set-Up #3; Sell GBPSEK - D1 Time-Frame

Sweden remains without government and the UK is days away from Brexit. The strong rally in the GBPSEK is starting to show signs of exhaustion as price action is struggling inside of its horizontal resistance area. Today’s vote in Parliament on May’s revised Brexit deal may offer forex traders an excuse to book profits and wait out the next few days. Volatility is expected to surge regardless of the outcome of the vote. A breakdown below its horizontal resistance area is expected to take the GBPSEK down into its primary ascending support level which is located just above its next horizontal support level. Forex traders are advised to spread their sell orders inside the horizontal resistance area.

The CCI recovered from a breakdown below extreme overbought conditions, but has recorded a lower high and a negative emergence formed as a result. This bearish trading signal is likely to lead the next sell-off in this momentum indicator. Subscribe to the PaxForex Daily Forex Technical Analysis and simply follow the recommended trades of our expert analysts to a profitable outcome!

To receive new articles instantly Subscribe to updates.