The Dow Theory has been around for over 100 years and while it is not always 100% accurate, it is something most equity analysts, investors and traders pay attention to. While it is applicable to equity markets only, in today’s interconnected financial markets it is important to have a broad view and deep understanding in order to spot profitable trading opportunities. The Dow Theory doesn’t impact the forex market directly, but ripple effects will be send through the system and it is wise to fully understand what caused the waves in order to trade profitably.

What is the Dow Theory? The Dow Theory focuses on the Dow Jones Industrial Average, a list of the 30 biggest US listed companies, and the Dow Jones Transportation Average, a list of 20 of the biggest transportation companies. It states that if either index reaches a new all-time high, the other needs to confirm it shortly after in order to confirm a bullish trend. A failure to do so signals a bearish trend is ahead. As the Dow Jones Industrial Average hit a new all-time high, the Dow Jones Transportation Average decreased by 3.59% relative to the Dow Jones Industrial Average. This offers one of the strongest bearish trading signals which further highlights a weakening US economy. The US Federal Reserve has opened the door for interest rates cuts and in combination with a bearish equity market, it could send the US Dollar tumbling.

While the US central bank is not watching equity markets directly and claims to be data dependent as well as independent from the White House, a sell-off in equity markets will increase attacks by US President Trump who now seeks to stack the FOMC with members who favor his view on monetary policy. He thought he did so by appointing Fed Chair Powell, but he has been severely disappointed by him. Another indicator supporting the Dow Theory is the Federal Reserve Bank of Atlanta’s GDPNow index which currently stands at 1.61%. This compares with a reading above 4.0% twelve months ago. Inflationary pressures are also absent as a gauge measuring future inflation expectations, break-even rates on 5-Year US Treasuries, decreased to 1.6% and further away from the Fed’s 2.0% target.

Central banks have grown more aggressive in devaluing their currencies in response to the risk of a global recession which is highlighted by the Dow Theory. How will this impact your forex investment? Open your PaxForex Trading Account now and create a profitable forex portfolio with the guidance of our expert analysts!

With a global currency war brewing, Deutsche Bank Strategist Alan Ruskin noted “With a currency war most likely to be fought on USD/CNY and EUR/USD terrain, one approach would be to steer clear of the direct conflict. By far the most direct and simple way to trade the complexities of a currency war is by going long gold.” US President Trump raised the spectre for interference in the forex market in order to weaken the US Dollar. Hedge Fund Manager Ray Dalio added “Investors that will most likely do best will be those that do well when the value of money is being depreciated and domestic and international conflicts are significant, such as gold.” The Dow Theory and the forex market, its correlation and how to spot future trend are key to a successful forex portfolio; here are three trades to turn theoretical profits into actual profits!

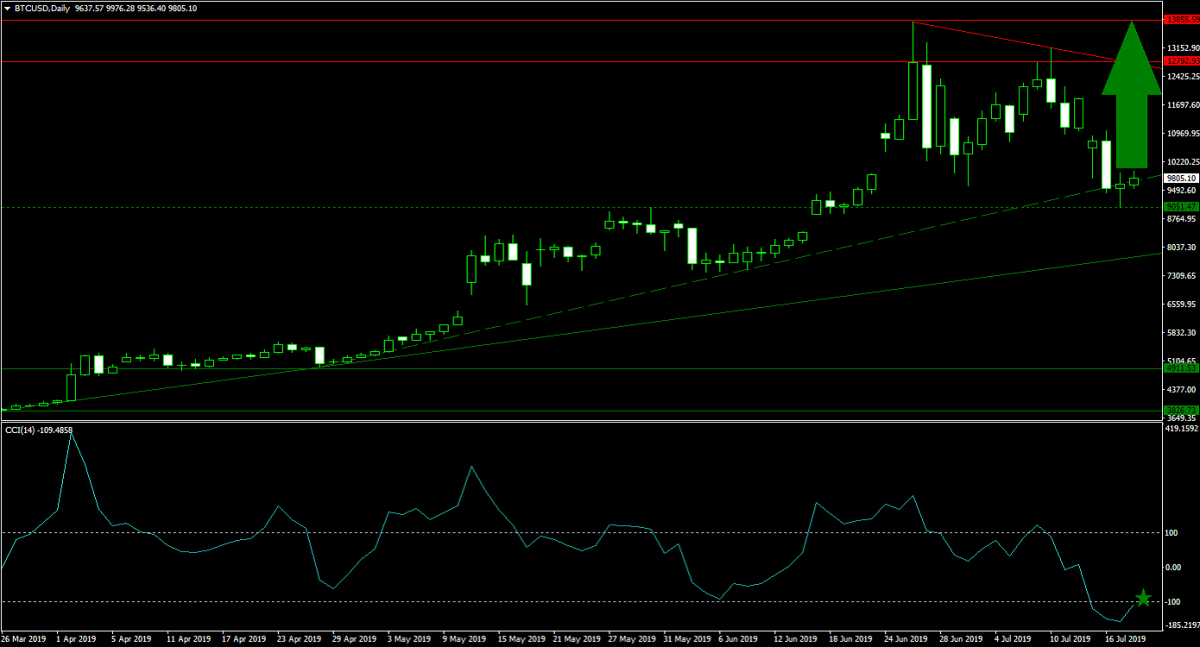

Forex Profit Set-Up #1; Buy BTCUSD - D1 Time-Frame

Gold is expected to continue to rise as bullish momentum is accelerating and the same applies to Digital Gold or Bitcoin. The most recent correction presents traders an excellent opportunity to diversify their forex trades and reduce risk. BTCUSD descended from its horizontal resistance area down into its next horizontal support level from where bearish pressures are being depleted. This cryptocurrency is now trading above-and-below its secondary ascending support level which is expected to guide price action to the upside. Buying any dips from current levels in BTCUSD down to its primary ascending support level remains the favored trading approach.

The CCI is trading in extreme oversold conditions, but reversed from its intra-day low. The increase in bullish momentum is now anticipated to extend above -100 from where the next wave of buy orders is likely to enter the market. Download your PaxForex MT4 Trading Platform today and join our fast growing community of profitable forex traders!

Forex Profit Set-Up #2; Sell USDCHF - W1 Time-Frame

Switzerland continues to rank as the number one economy in the world and the Swiss Franc benefits from favorable economic conditions as well as the safe haven status of its currency. The US central banks is faced with a slowing economy, supported by the Dow Theory, and likely to ease monetary policy which will further support the sell-off in the USDCHF which accelerated after the breakdown from its horizontal support area. Price action slid below its primary ascending support level and turned it into resistance. This currency pair is now favored to push below its secondary ascending support level and into its next horizontal support level. Forex traders are advised to sell any rallies in the USDCHF into its primary descending resistance level.

The CCI pushed out of extreme oversold territory, but bullish momentum is fading. This technical indicator is now expected to reverse direction and record a lower low. Subscribe to the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you to over 500 pips in monthly profits!

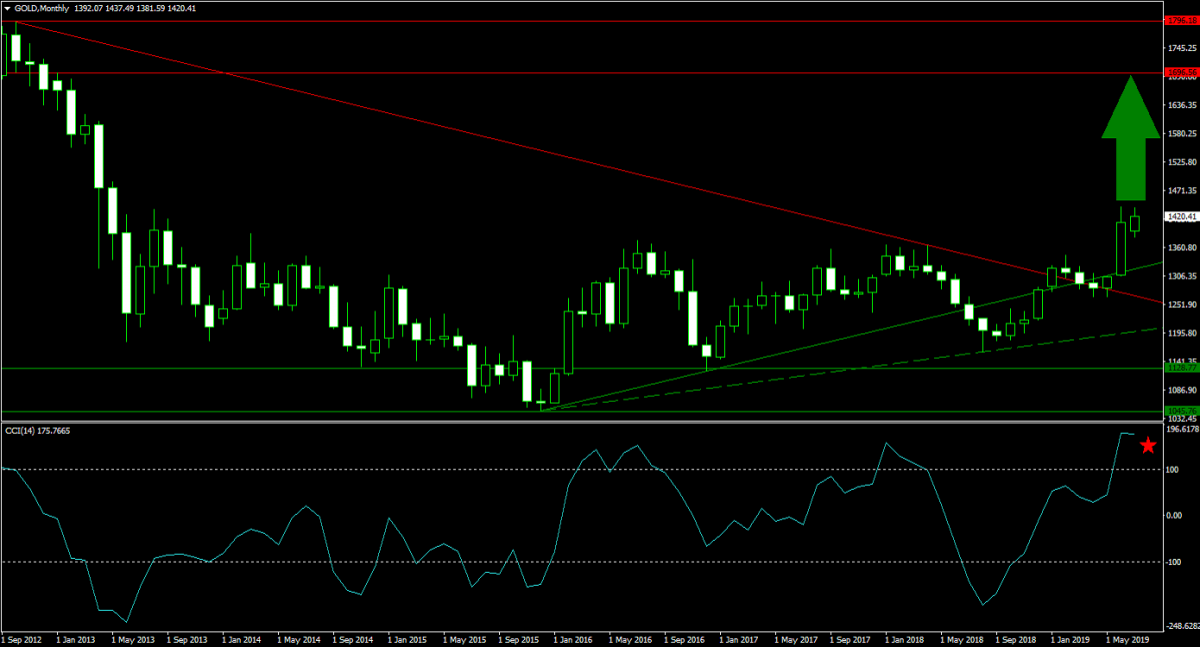

Forex Profit Set-Up #3; Buy Gold - MN Time-Frame

Gold has shined so far this year and rallied over 10%, but this precious metal may just get started. Given the current geopolitical and economical conditions, a perfect storm has been created to push price action further to the upside. Bullishness spiked after a breakout above its horizontal support area. This was followed through by additional breakouts above its primary ascending support level as well as above its primary descending resistance level which now acts as support. The path is now clear for Gold to challenge its next horizontal resistance area. Forex traders are recommended to buy any dips down to its secondary ascending support level.

The CCI spiked deep into extreme overbought conditions and has confirmed the new highs in price action. Any temporary pull-back below 100 will represents a great buying opportunity. Follow the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades of our expert analysts into your own portfolio!

To receive new articles instantly Subscribe to updates.