As the annual Conservative Parry conference drew to a close last night, Theresa May entered the stage to the tunes of Abba’s “Dancing Queen” with a few moves and a smile of her own. Unlike last year, when had a cough which would not stop and a stage collapse to deal with amongst other things, she was able to enjoy one hour of calm as she delivered her closing speech. That is one hour in the past seventeen months where things seemed to go her way.

Underneath it all, it may have been a mixed performance overall which was overshadowed by the fact that she plans to rush a Brexit deal through parliament in two weeks after presenting it to them. This means members of Parliament would vote on accepting or rejecting it by the beginning of December if the current timetable holds. May would like to rush it in order to deny rebels to block the deal, but she will also deny Parliament to properly evaluate the deal she will bring back from Brussels.

May has now to either show that she can deliver or she will be ousted. Many expected a leadership challenge during the conference by Boris Johnson, but the name which was mentioned more often was that of Labour Leader Jeremy Corbyn. Johnson asked the party to supper May, but force her to abandon her “Chequers” plan in favor of her “Lancaster” speech. May still lacks support in her own party, doesn’t have a clear majority in Parliament after her 2017 gamble and now attempts a hail mary play in order to win or lose it all.

The British Pound has weakened as uncertainty is rising about the prospects of a Brexit deal with the EU. Time is running out and both sides are increasing contingency plans for a no deal Brexit. With these types of negotiations, forex traders are advised to wait until the end as deals are often reached in the eleventh hour. Open your PaxForex Trading Account now and create a market beating forex portfolio.

On the positive side for May, she did pledge to end the austerity which has drive many younger voters into the Labour camp and old-school socialist Corbyn. May noted that “A decade after the financial crash, people need to know that the austerity it led to is over and that their hard work has paid off.” Former Education Secretary Justine Greening added that “Labour’s solutions are simplistic and beguiling but counter-productive. It’s a really hard-left Labour Party at the moment and I don’t think that’s what people want. People just want practical solutions to the problems they’re facing in life.” "Dancing Queen” May plans Brexit rush through Parliament and here are three forex trades to rush pips to your portfolio.

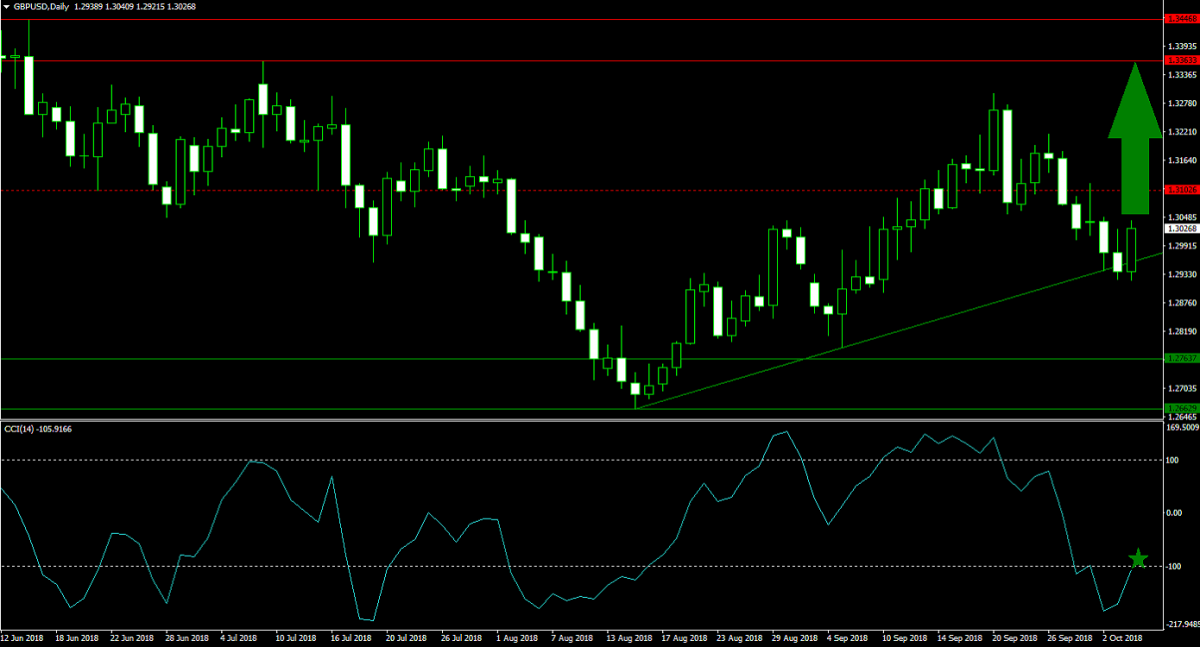

Forex Profit Set-Up #1; Buy GBPUSD - D1 Time-Frame

After this currency pair completed a breakdown below its horizontal support level and turned it into a horizontal resistance level, the GBPUSD was able to capitalize from its primary ascending support level and reverse direction. This caused a spike in bullish sentiment which is expected to push price action to the upside. A breakout above its horizontal resistance level is expected to take the GBPUSD back into its next horizontal resistance area. Buying the dips into its primary ascending support level is recommended.

The CCI dropped into extreme oversold territory, but has recovered from its lows and is now advancing. A push above the -100 level could trigger a short-covering rally which will further boost price action. Download your PaxForex MT4 Trading Platform now and start building a portfolio which will increase your monthly revenue stream.

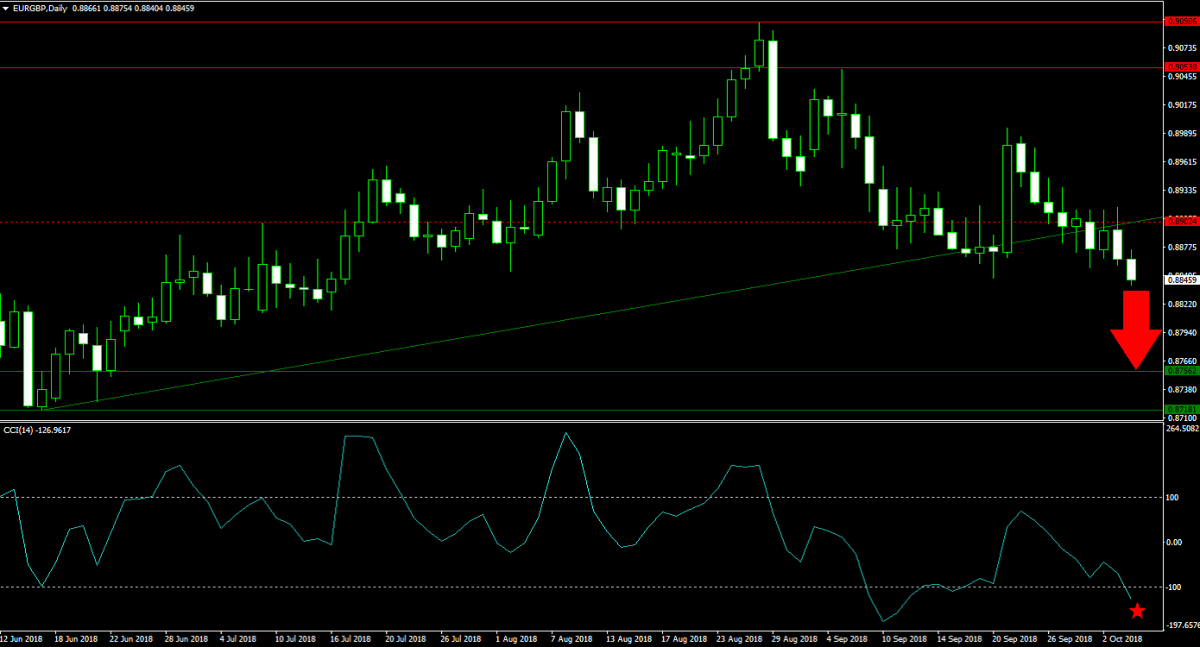

Forex Profit Set-Up #2; Sell EURGBP - D1 Time-Frame

The Euro remains under pressure which is expected to force the EURGBP further to the downside. A build-up in bearish sentiment occurred after this currency pair completed a double breakdown; first below its horizontal support level turning it into resistance and then below its primary ascending support level. The path is now clear for the EURGBP to extend is slide into its next horizontal support area. Forex traders are advised to sell the rallies in in this currency pair.

The CCI has entered extreme oversold conditions, but remains off of its lows which suggests that there is more downside potential. The formation of a positive divergence, usually a bullish trading signal, is dismissed as bearish momentum is elevated. Subscribe to the PaxForex Daily Fundamental Analysis and earn over 500 pips per month with the help of our expert analysts.

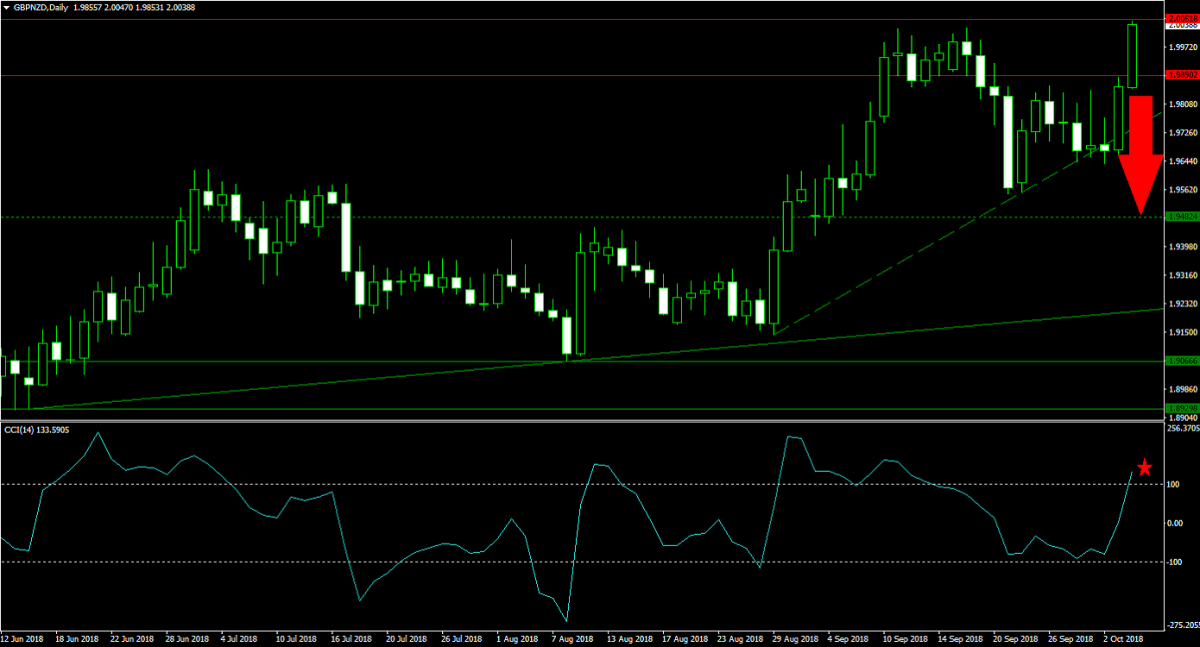

Forex Profit Set-Up #3; Sell GBPNZD - D1 Time-Frame

The GBPNZD spiked from its secondary ascending support level into the upper band of its horizontal resistance area. Bullish momentum is fading and may not suffice a breakout which leaves this currency pair vulnerable to a counter-trend correction on the back of profit-taking. The GBPNZD is expected to complete a double breakdown from current levels and descend back into its horizontal support level. Forex traders are recommended to spread their sell orders inside the horizontal resistance area.

The CCI moved into extreme overbought territory and may advance further above the 100 mark before reversing direction. A push below 100 is expected to attract new sell orders which will force price action lower. Follow the PaxForex Daily Forex Technical Analysis and never miss out on a profitable trading opportunity. Our experts do the hard work so that you can reap the easy rewards.

To receive new articles instantly Subscribe to updates.