The ripple effects of the US-Sino Trade War of 2018 are already being felt across industry groups. The US officially fired the first shot last week on Friday by imposing 25% tariffs on $34 billion worth of Chinese goods which are imported to the US, with another $16 billion set to receive the same treatment on July 16th. China has made good on their promise for a tit-for-tat retaliation and US President Trump responded as he vowed by asking the USTR office to identify another $200 billion worth of Chinese goods for a 10% tariff starting August 31st.

Now the US and China have roughly seven weeks to find a solution which is acceptable by both sides or risk escalating the trade war to the next level. Supply chain disruptions, a decrease in corporate profits and an increase in the prices for consumers will slowly make their way through the global economy. Both sides have a strong nationalistic agenda which means the US and China need to come out victorious. China has taken the position of the defender in this trade war which made the US the aggressor.

Following the list for the next round of tariffs, China left the door open for talks. Wang Shouwen, the Chinese Vice Minister of Commerce, stated that 'We should sit down and try to find a solution to this trade problem.' Lindsay Walters, a White House spokeswoman, responded that 'The Trump Administration remains open to further discussions with China, but it is important that China finally address the longstanding concerns that have been repeatedly raised.'

In the meantime, forex traders are unsure how to position their portfolios. Currency volatility is hovering near 2018 lows. Developed market currencies have not responded as the trade war started as many try to determine if a trade war would also translate into a currency war. Analysts at banks admitted that they are puzzled over the price action moves in the US Dollar, the Chinese Yuan and the Japanese Yen. Open your PaxForex Trading Account now and let our expert analysts guide you through the forex market.

Commerzbank admitted that it is essentially clueless where the US Dollar is headed from current levels while Rabobank is puzzled when it comes to the direction of the Chinese Yuan. Societe General is struggling with the Japanese Yen. Standard Bank’s Head of Currency Strategy, Steve Barrow, summed it up by noting that 'A problem that we have found all this year is that the sharp and sudden sentiment shifts caused primarily by trade tensions are stopping many currencies from trending in a clear way and that has made position-taking more difficult. There are few signs of this abating and, perhaps not too surprisingly, our currency indicators tend to be both mixed and weak.' Currency volatility contracts amid trade war, but here are three forex traders which will add pips to your portfolio.

Forex Profit Set-Up #1; Sell USDJPY - D1 Time-Frame

The Japanese Yen is considered a safe haven currency and during times of increased global tensions or uncertainty, forex traders often flock to the Japanese currency. The USDJPY advanced over the four trading sessions, despite a deepening of the US-Sino Trade War. The Japanese Yen is bound to catch up and return to its roots as price action is in the process of validating its current horizontal resistance area. Forex traders should spread their sell orders between the upper and lower band in order to reduce risk in the USDJPY.

The CCI has spiked deep into extreme overbought conditions, supporting the recent advance in price action. The move higher took this indicator near levels of its previous high from where a contraction is expected to follow. Download your PaxForex MT4 Trading Platform today and enter this trade to your forex portfolio before a breakdown materializes.

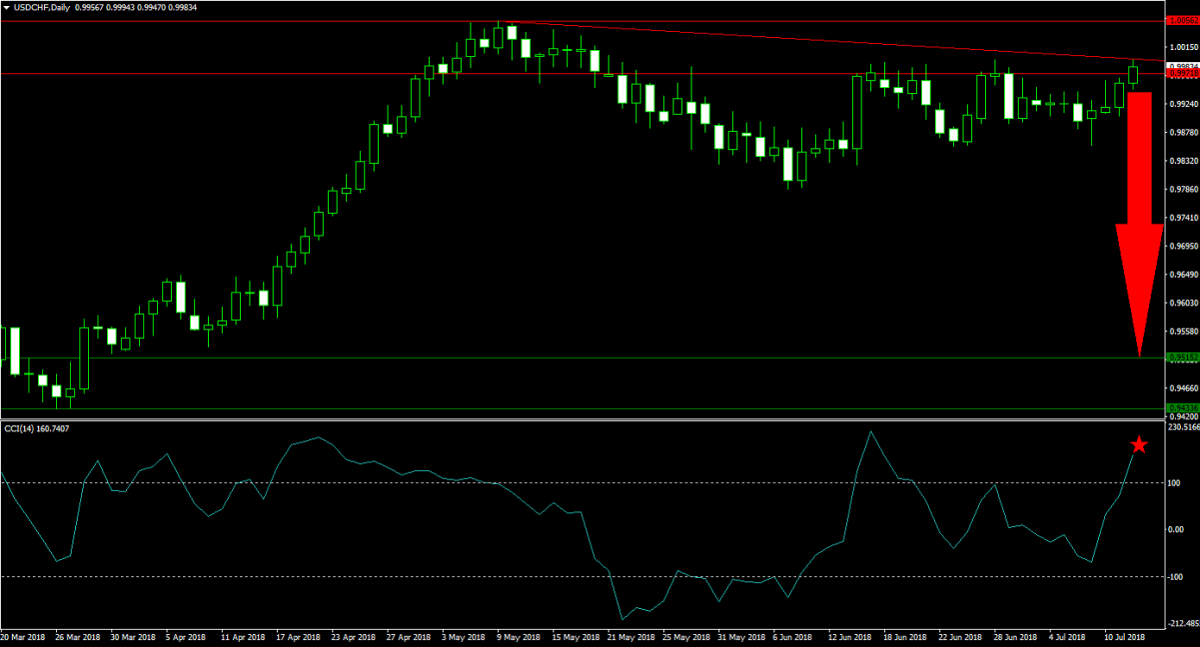

Forex Profit Set-Up #2; Sell USDCHF - D1 Time-Frame

Another safe haven currency is the Swiss Franc, which followed the Japanese Yen lower over the past four trading days. Price action is now trading back inside its horizontal resistance area where it is additionally met by its descending resistance level. Currency volatility has been depressed, but sentiment changes occur rapidly which makes the USDCHF ripe for a contraction as forex traders will seek the safety of the Swiss Franc. Short positions between the lower band of its horizontal resistance area and its descending resistance level are recommended.

The CCI is trading in extreme overbought territory after four days of gains in the USDCHF, but a shallow negative divergence has emerged which suggest a weakening of bullish momentum. Earn hundreds of pips every month, simply by following the trading recommendations posted by our experts at PaxForex Daily Forex Technical Analysis.

Forex Profit Set-Up #3; Sell USDHKD - W1 Time-Frame

The USDHKD has been confined to a trading range inside of its horizontal resistance area as the US-Sino Trade War is starting to unfold. Pressures are growing for price action to make its next move. The upside potential from current levels remains limited, but the USDHKD carries an attractive downside risk. A move below the lower band of its horizontal resistance area could ignite a profit taking sell-off. Forex traders are recommended to stagger their short positions inside the horizontal resistance area.

The CCI, a momentum indicator, is advancing towards extreme overbought conditions with the formation of a negative divergence further raising bearish momentum. As big bank struggle to understand the current stage of the forex market, allow our expert analysts to guide your portfolio through the muddy waters. Follow PaxForex Daily Fundamental Analysis and remain ahead of the crowd and on a profitable path.

To receive new articles instantly Subscribe to updates.