The trade war between the US and China is not the only headwind facing Chinese economic worries. While the trade war, which is increasing in scope and size, will have a negative economic impact, it is not the biggest issue clouding economic and fiscal stability. As the economy is metamorphosing from an emerging one into a developed one, the same threat other developed countries struggle with is rearing its ugly head: debt. The biggest question remains if China will follow into the footsteps of its peers or if it will manage its debt in a smart fashion.

The US has possibly taken the worst of all approaches when it comes to its total debt level which exceeds 100% of GDP. The US is home to history’s largest ever debt pile as the twin deficits, the current account deficit and the trade deficit, keep adding to it every month. This influences everything from monetary policy to the US Dollar. US President Trump decided to wage a trade war with the hope to impact the trade deficit with China, who is the largest creditor to the US. The biggest threat is that a trade war will backfire and do more harm than good which is the current consensus.

As China is largely expected to come out of the trade war unscathed, President Xi Jinping addressed the Chinese Central Committee for Financial and Economic Affairs yesterday and outlined the risk of debt to financial stability. President Jinping outlined local governments as well as state-owned enterprises during his speech. In the aftermath of the last financial crisis in 2008, China went on a borrowing spree which took the debt-to-GDP level above 250%. This has left the financial system extremely vulnerable and volatility in the Chinese Yuan has increased.

Forex traders can profit from the Chinese debt reduction campaign which will have ripple effects across the currency market. The Australian Dollar, the Canadian Dollar, the New Zealand Dollar as well as the Swiss Franc will face the biggest impact due to their reliance on commodity exports and commodity trading. Open your PaxForex Trading Account today in order to position yourself for an increase in profitable trading opportunities with the help of our expert analysts.

Market participants are likely to make portfolio adjustments in reaction to how China reduces its debt at the same time it needs to maintain a GDP growth rate of above 6.0% in order to avoid social unrest. For the 12-months-ending February, the debt of state-owned companies has swelled to $17 trillion, just below the total US debt pile. According to BOC International China analyst Ye Bingnan 'The financial regulations will continue to tighten especially over the shadow banking system, off-balance-sheet financing, internet finance and financial group giants. The policy makers target stabilization and a gradual decline in the macro leverage ratio.' China’s debt problem may spill into the forex market and here are three trades to capture the profits as a result of price action adjustments.

Forex Profit Set-Up #1; Buy AUDCHF - D1 Time-Frame

This currency pair just pushed above of its horizontal support area for the third time since its most recent contraction and has now replaced enough bearish pressure with bullish momentum. The AUDCHF is now approaching its descending resistance level from where a breakout is expected to accelerate this currency pair back into its horizontal resistance area. Forex traders should spread their buy orders between 0.7305 and 0.7375.

The CCI has recovered from a short dip into extreme overbought levels below the -100 mark and has also eclipsed the 0 level. This led to a bullish momentum shift and created the final buy signal for this trade. Follow the PaxForex Daily Forex Technical Analysis and profit with our expert analysts who outline the trading day’s best technical forex trading opportunities.

Forex Profit Set-Up #2; Buy NZDJPY - D1 Time-Frame

Price action has completed a breakout above its horizontal support area and is now expected to drift into its descending resistance level which originated at the intra-day high prior to the latest contraction in the NZDJPY. A successful breakout above it will clear the path into its horizontal resistance area, partially fueled by short-covering. Forex traders are advised to sell any dips in this currency pair in order to capture the expected surge to the upside.

The CCI is on a solid move to the upside following a bullish momentum shift as a result of the recovery from extreme oversold territory below -100 to a push above 0. This technical indicator is predicted to resume its upward trajectory. Make a deposit into your PaxForex trading account today and add this trade to your portfolio. Diversify your Bitcoin and Ethereum holdings and convert them into real cash trading the forex market.

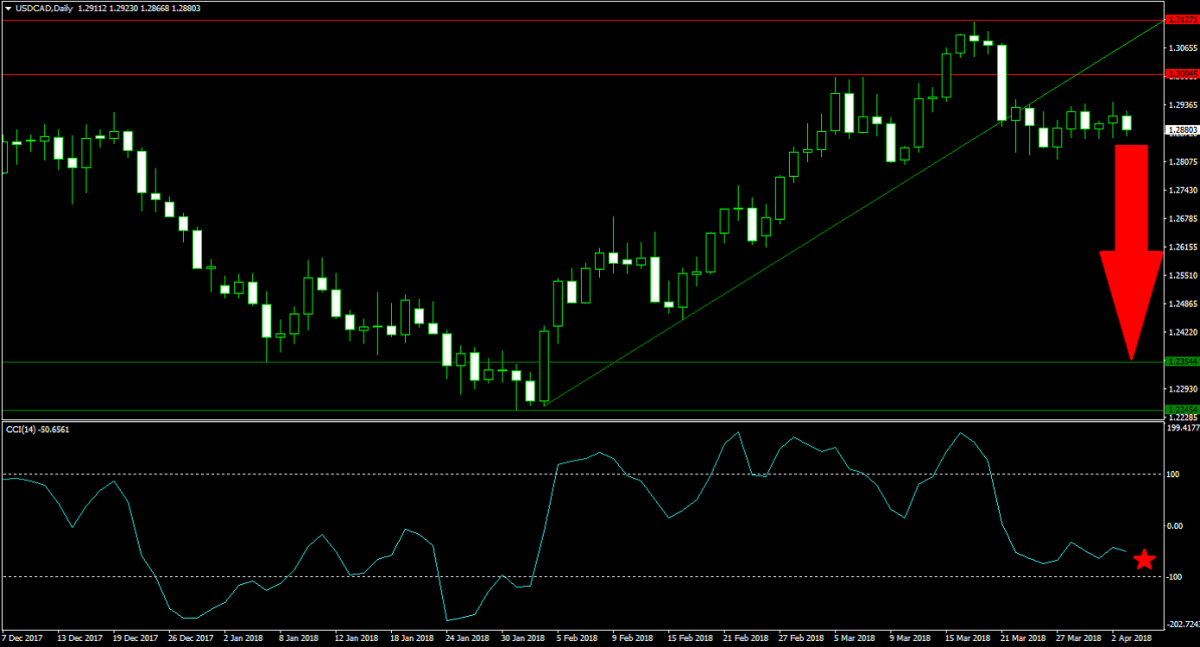

Forex Profit Set-Up #3; Sell USDCAD - D1 Time-Frame

The USDCAD has ended its advance and completed a double breakdown, initially below its horizontal resistance area and then below its ascending support level. This has resulted in bearish momentum taking over and this currency pair is now set to correct into its horizontal support area. Forex traders are recommended to sell any short-term rallies between 1.2880 and 1.3000. This trade has plenty of downside potential with limited upside risk.

The CCI has dropped from extreme overbought conditions above 100 to below 0 which resulted in a bearish momentum shift. This momentum indicator is expected to contract further alongside price action. Earn over 500 pips ever month with the help of our expert analysts and follow the PaxForex Daily Fundamental Analysis section.

To receive new articles instantly Subscribe to updates.