The Turkish Lira has been under severe pressure all year long. It reach an all-time low against the US Dollar and has contracted in value against all major currencies. On the surface it would appear that Lira bulls, if there are any out there, may have to endure more uncertainty which could continue the downside pressure on the Turkish currency. Turkish President Recep Tayyip Erdogan has called snap elections which are scheduled for June 24th. He is widely expected to win the election and he aims to turn Turkey into a full presidential system which would consolidate power.

Many traders are concerned about how President Erdogan will influence the Turkish central bank. While he claims that the central bank is independent, he also states that following the transition to a presidential system, the central bank can’t ignore the President. Erdogan commented that ‘When the people fall into difficulties because of monetary policies, who are they going to hold accountable? They’ll hold the president accountable. Since they’ll ask the president about it, we have to give off the image of a president who’s influential on monetary policies.'

Erdogan wants the central bank to lower its key interest rate from the current level of 13.5%. The CPI stands at 10.9%. Forex traders often sell a currency if interest rate cuts are on the horizon and buy it when an interest rate increase is expected. Traditional thought also suggests that high inflation can only be countered by increasing borrowing costs. Erdogan has a different point of view and blames the central bank for the rise in prices due to their interest rate increases. Central bank governor Murat Cetinkaya disagrees and is in line with his global central bank colleagues that higher interest rates will benefit the Lira.

Can Turkish President Erdogan Rescue Lira? The conventional approach taken by the central bank under governor Cetinkaya has not strengthened the Turkish Lira. Is President Erdogan right with his point of view? Can his unorthodox approach rescue the Turkish currency? Get the latest trading recommendations on all currencies from our expert analysts by following the PaxForex Daily Fundamental Analysis and the PaxForex Daily Forex Technical Analysis and add over 500 pips per month to your trading account.

Turkey relies on foreign capital inflow to finance its operations and uncertain times usually leads to an exodus of foreign investors. This has been evident so far this year as the first-quarter current account deficit came in above $16 billion or roughly twice the level it was in the previous year. Turkey needs to make drastic changes in order to turn their situation around. Forex traders should be prepared for volatility, not only in the Turkish Lira but in other currencies which face economic or political challenges on the periphery such as the Polish Zloty and the South African Rand. Can Turkish President Erdogan rescue the Lira? Time will tell and here are three forex trades which will keep your portfolio on the profitable track.

Forex Profit Set-Up #1; Sell USDTRY - D1 Time-Frame

This currency pair advanced from its horizontal support level, driven by a combination of US Dollar strength coupled with Turkish Lira weakness. The USDTRY has now recorded an all-time low and while plenty of uncertainty remains, the bull run has been extended and is ready for a short-term reversal on the grounds of profit taking. Forex traders should spread their sell orders inside the horizontal resistance area in order to reduce their risk profile.

The CCI is trading above and below extreme overbought conditions which resulted in the formation of a negative divergence. This is a strong bearish trading signal pointing towards a potential change in price action in the USDTRY. Open your PaxForex Trading Account now and enter this trade to your portfolio before it will accelerate to the downside.

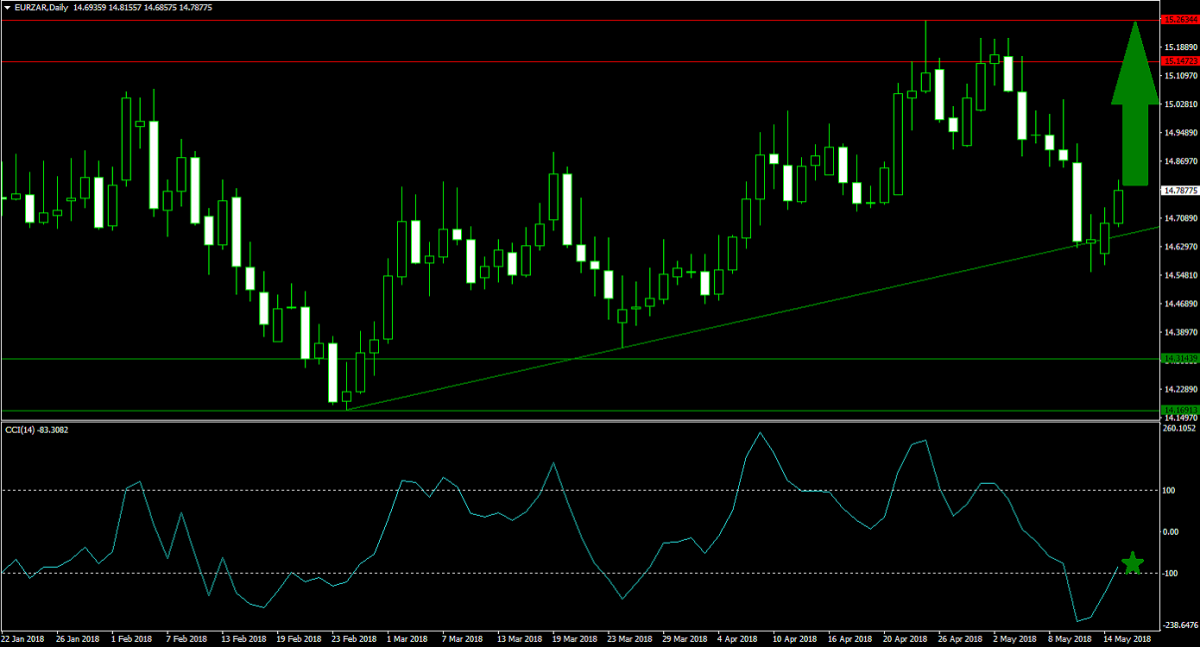

Forex Profit Set-Up #2; Buy EURZAR - D1 Time-Frame

Many forex traders may overlook the EURZAR, but given the economic challenges facing South Africa it is worth a closer look. Following the corrective phase, this currency pair contracted from its horizontal resistance area into its ascending support level which halted the descend. Price action bounced off of support levels and is now predicted to challenge resistance once again. Forex traders are recommended to buy the dips in the EURZAR.

The CCI plunged deep into extreme oversold territory, but has since quickly recovered. Momentum in this technical indicator is set to push it above the 0 level which will result in a bullish momentum shift. Download your PaxForex MT4 Trading Platform today and access the global forex market in order to generate daily profits.

Forex Profit Set-Up #3; Sell AUDPLN - D1 Time-Frame

Remaining with our theme of overlooked currency pairs, the AUDPLN is ready for a counter-trend move. Price action spiked from its horizontal support area into its descending resistance level which is located just beneath its horizontal resistance area. This trade carries very limited upside risk, but plenty of downside potential especially with Australia’s banking crisis looming. Forex traders are advised to place their sell orders at its descending resistance level.

The CCI has pushed below the 100 mark and is out of extreme overbought conditions as a negative divergence formed. More downside is expected from this momentum indicator as the AUDPLN is set for ore bearish sentiment driving price action. Make a deposit into your PaxForex Trading Account and profit from this trade.

To receive new articles instantly Subscribe to updates.