Just a little over a week ago on the weekend of Friday, July 6th, UK Prime Minister Theresa May gathered her cabinet at her ‘Chequers’ country residence in order to put her foot down on a soft version of Brexit. Many claimed it was a make or break moment and as Monday approached it was hailed as a success and that her Conservative Tories rallied behind her in order to deliver a united front on her version of Brexit to her EU counterparts. The EU welcomed the softening of the tone, but as her White Paper was released things changed quickly.

Brexit Secretary Davis resigned the same weekend and Foreign Secretary Johnson followed suit on Monday. Both are key figures in the Brexit movement and it represented the first time where two key cabinet ministers resigned out of protest in modern UK political history. Over the course of last week, seven junior ministers joined the ranks of resignations which brought the total tally to nine. This left May scrambling to replace key figures, but her problems only grew from there.

Yesterday she bowed to pressures from pro-Brexit Tories and agreed to amendments on the key customs bill. This now favors a hard Brexit which voters asked the government to deliver and it passed the House of Commons late Monday, but with a majority of only three votes. Another minister quit, the first in favor of a soft Brexit but three opposition Labour rebels voted with May to pass the legislation. George Freeman, a Tory lawmaker, posted that 'Brexit is coming home to roost. And it won’t be easy or pleasant.'

With political turmoil on the rise, one of the most unlikely beneficiaries may be the British Pound. The UK economy has remained resilient, even in the face of a hard Brexit or no deal Brexit and the British currency has stabilized at a solid horizontal support area. Price action started to advance and the political theatre in London has done little to spike volatility. The Bank of England meeting in August could ignite a rally, failure to increase interest rates a sell-off. Open your PaxForex Trading Account now and take advantage of the trading opportunities in the forex market.

As the likelihood of her ouster increases, May proposed to send lawmakers on their summer vacation one week early. Her idea was ridiculed by critics and showed her weakening stance in Parliament. Today’s vote will be on the trade bill, and pro-EU Tories are furious at May. Only seven rebel votes are needed, if all opposition parties join in, to defeat May’s government. Can and will UK Prime Minister May survive? How long can she fight to stay alive? We are in for a very interesting political drama in London this summer and here are three forex snacks to keep the profits going!

Forex Profit Set-Up #1; Buy GBPCHF - D1 Time-Frame

While the British Pound is under the influence of bullish as well as bearish pressures right now, the Swiss Franc may become one of the biggest currency victims of the US-Sino Trade War. The GBPCHF has already completed a breakout above its horizontal support area which resulted in a bullish sentiment change. The path is now clear to the upside with little resistance in the way. Forex traders should seek to buy the dips down to the upper level of its horizontal support area.

The CCI has confirmed the breakout and briefly spiked into extreme overbought territory from where it has since retreated into neutral conditions which further supports more upside in the GBPCHF. Subscribe to the PaxForex Daily Fundamental Analysis and let our expert analysts guide your through the forex market, earn over 500 pips per month simply by following our trading recommendations.

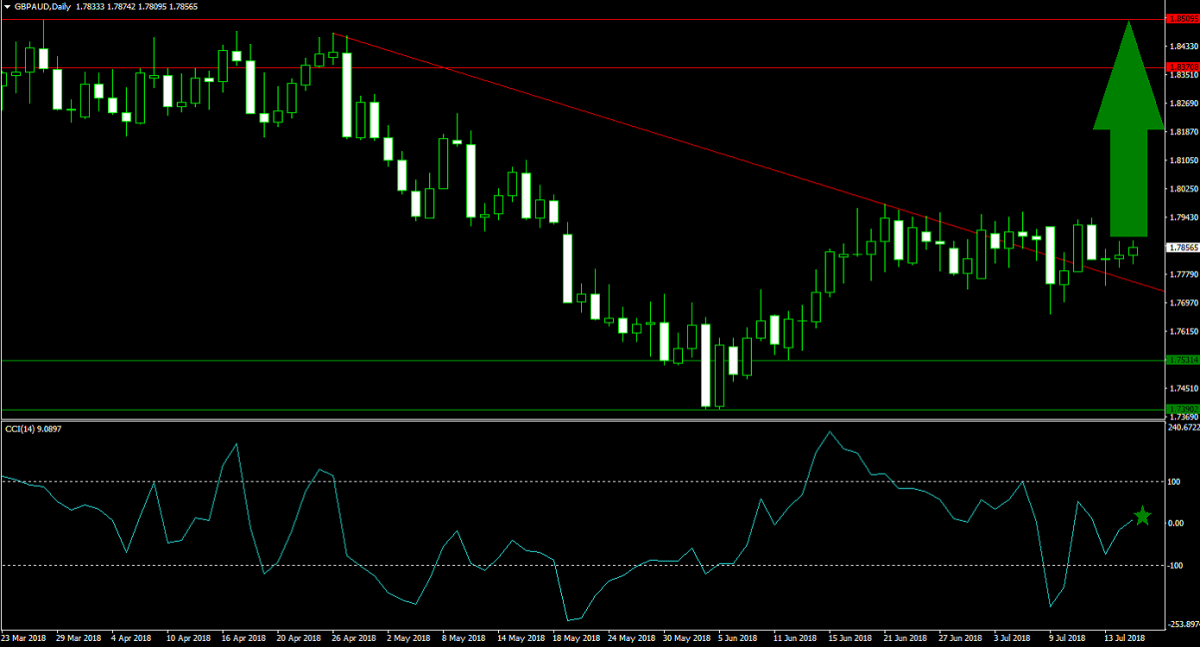

Forex Profit Set-Up #2; Buy GBPAUD - D1 Time-Frame

The GBPAUD is at a more advanced phase of its advance following a successful breakout above its horizontal support area as well as above its descending resistance level. The Australian Dollar could weaken further as a fallout from the US-Sino Trade War due to its dependence on commodity exports to China. With no resistance in the way until price action can challenge its next horizontal resistance area, forex traders are recommended to buy the dips down to its descending resistance level.

The CCI has recovered from a short excursion into extreme oversold conditions and is now advancing to the 0 level. A push above this mark will result in a momentum change to bullish and further support an advance in the GBPAUD. Download your PaxForex MT4 Trading Platform today and enter this trade to your forex portfolio.

Forex Profit Set-Up #3; Buy GBPNOK - D1 Time-Frame

Scandinavian currencies face great, indirect exposure to the fallout of the US-Sino Trade War due to their small size and open markets. This is likely to pressure the Norwegian Krone to the downside at the same time the British Pound could be lifted by the Bank of England. The GBPNOK just pushed above its horizontal support area which cleared the path for an advance into its descending resistance level. Forex traders are advised to spread their buy orders from current levels down to the upper band of its horizontal support area.

The CCI rallied from extreme oversold territory and bullish momentum was strong enough to carry it above the 0 mark as well. This further shifted overall momentum in the GBPNOK to bullish. Follow the PaxForex Daily Forex Technical Analysis and receive our daily technical trading set-ups directly in your inbox, never miss a profitable trade.

To receive new articles instantly Subscribe to updates.