Less than twelve months away from Brexit, business in the UK could soon receive a bit of news they have all been waiting for; the transition period. After the Brexit referendum, those UK businesses exposed to the EU have pleaded for a transition period in order to adjust to aftermath of Brexit. It was rumored that such a period will be agreed on, but no official announcement has been made. David Davis, the UK Brexit Secretary, will go to Brussels on Sunday and is scheduled to meet with his EU counterpart, Michel Barnier, on Monday.

Many may remember the negotiations last year which always resulted in joint news conferences between both top negotiators and little substance. This caused a great deal of embarrassment for both sides and a meeting now could suggest that the successful announcement of a transition period of two years is very likely next week. There is a degree of caution until more details are unveiled as some suggest that it may not be as good as many have pleaded for.

The EU and the UK have had very little agreement so far, and many already expect a transition deal. The details are now crucial and forex traders should brace for a potential increase in volatility. Any announcement will not be legally binding until the Brexit treaty is signed next year. This means that things could change until the last minute. The biggest threat right now remains the Irish border which will be the only land border the EU and the UK will share.

The British Pound as well as the Euro should be monitored at the start of next week as negotiators are set to work throughout the weekend in order to announce a transition deal. Volatility as well as trading volumes could surge as details will trickle through as early as Monday morning. Open your PaxForex Trading Account today in order to take advantage of the profit possibilities which lie ahead.

Philip Hammond, the Chancellor of the Exchequer, warned that the business community could not make sound decision based on a political commitment and suggested that regulators on both sides work hard in order to assure a smooth transition. Brexit negotiations will remain complex. The late and great Stephen Hawking warned British Prime Minister May and stated that 'I deal with tough mathematical questions every day, but please don’t ask me to help with Brexit.' With the Brexit transition deal around the corner, here are three forex trades for a profit boost.

Forex Profit Set-Up #1; Sell EURGBP - D1 Time-Frame

After a failed breakout above its horizontal resistance area, the EURGBP collapsed and is now exposed to an increase in downside pressure. Any favorable announcement for Brexit will have a bigger positive impact on the British Pound than on the Euro which will further push this currency pair down. Forex traders are advised to sell short-term rallies above 0.8875 as the path is clear for price action to challenge its horizontal support area.

Forex Profit Set-Up #2; Buy GBPJPY - D1 Time-Frame

This currency pair just completed a breakout above its horizontal support area and is now in a minor pull-back. Forex traders should expect the GBPJPY to reach the upper band of its horizontal support area before a short-covering rally can accelerate it to the upside. A move into its horizontal resistance area is likely. Buy orders between 146.650 and 147.000 are recommended as this trade carries plenty of upside potential with limited downside risk.

The CCI, a momentum indicator, accelerated from extreme oversold condition below -100 to above the 0 level and carries good bullish momentum which can push the GBPJPY further to the upside. Subscribe to the PaxForex Daily Fundamental Analysis and get the forex trades you need in order to add 500 pips to your trading account every month.

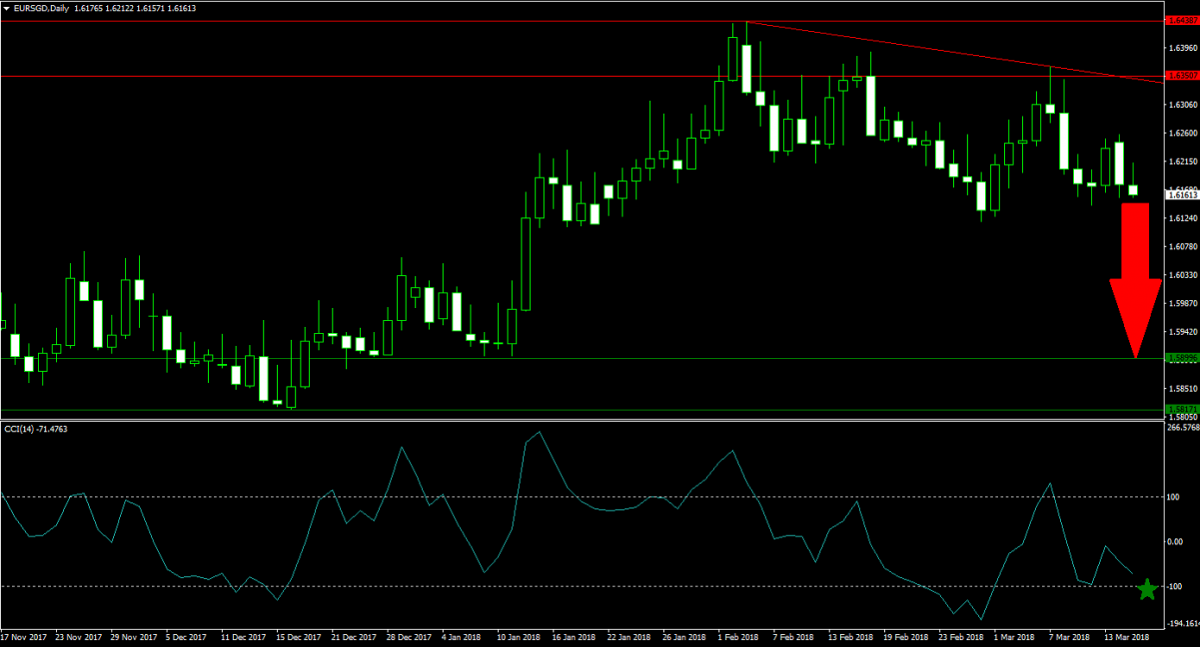

Forex Profit Set-Up #3; Sell EURSGD - D1 Time-Frame

Price action is on a clear downward trajectory after the completion of a breakdown below its horizontal resistance area which was followed by a series of lower highs and lower lows. A descending resistance level is now applying further downside pressure on the EURSGD. This currency pair is on track to challenge its horizontal support area and forex traders are advised to enter sell orders at its descending resistance level.

The CCI briefly spiked above 100 and into extreme overbought conditions, but has since reversed into negative territory. This technical indicator has more room to contract in unison with price action for the EURSGD. The PaxForex Daily Forex Technical Analysis offers forex traders the best technical trading set-ups of the day for increased profitability.

To receive new articles instantly Subscribe to updates.