As the EU is scheduled to vote for Ursula von der Leyen as the next President of the European Commission and the UK is on track to announce its next Prime Minister, tensions during the latest round of Brexit negotiations have risen. According to sources, talks between EU Chief Negotiator Michel Barnier and UK Brexit Secretary Stephen Barclay have been the most hostile since 2016. The EU is preparing for a rise in tension as the bloc prepares for the Premiership of Boris Johnson who vowed to deliver on Brexit by October 31st 2019 and is prepared for a WTO type deal.

It now rumored that the EU will work on concessions in can offer the next PM in order to avoid a WTO type Brexit which many refer to as a no-deal Brexit. Johnson also hinted that if no deal will be reached, he will cancel any payment his predecessor May agreed on. Last week’s meeting hardened positions on both sides which has added a layer of uncertainty if a deal can be reached. The EU views PM front runner Johnson as an untrustworthy populist and continues to echo its call that the deal negotiated with May is not open for renegotiations.

The Irish backstop continues to be the center of division between both sides and so is the UK’s ability to strike its own trade deals while taking full control of its borders. The EU stated that there are more they can give the UK and are open to extend the deadline. Ursula von der Leyen stated “I stand ready for a further extension of the withdrawal date should more time be required for a good reason. In any case the U.K. will remain our ally, our partner and our friend.” Boris Johnson replied that it would be “insane” to the October 31st deadline.

The British Pound has come under a fresh wave of selling pressure are the chances for no deal Brexit have risen once again. Is now the time to buy the British currency which is set to surge if a deal will be reached? Open your PaxForex Trading Account now and start building a profitable forex portfolio with the assistance of our expert analysts!

Johnson also noted that he believes a no deal Brexit can pass Parliament and there is no need to suspend it while not ruling out that option. His rival Jeremy Hunt refused to guarantee that the UK will leave the EU before Christmas, but stated that he believes it can be accomplished by then. While the UK is prepared to leave the EU without a deal, especially under a Johnson premiership, the EU is unlikely to push the UK out of the EU without a deal. It appears that the UK has gained the upper hand which is why the EU fears it may be bullied into more concessions. Brexit tension rises again and here are three forex trades which will raise your account balance!

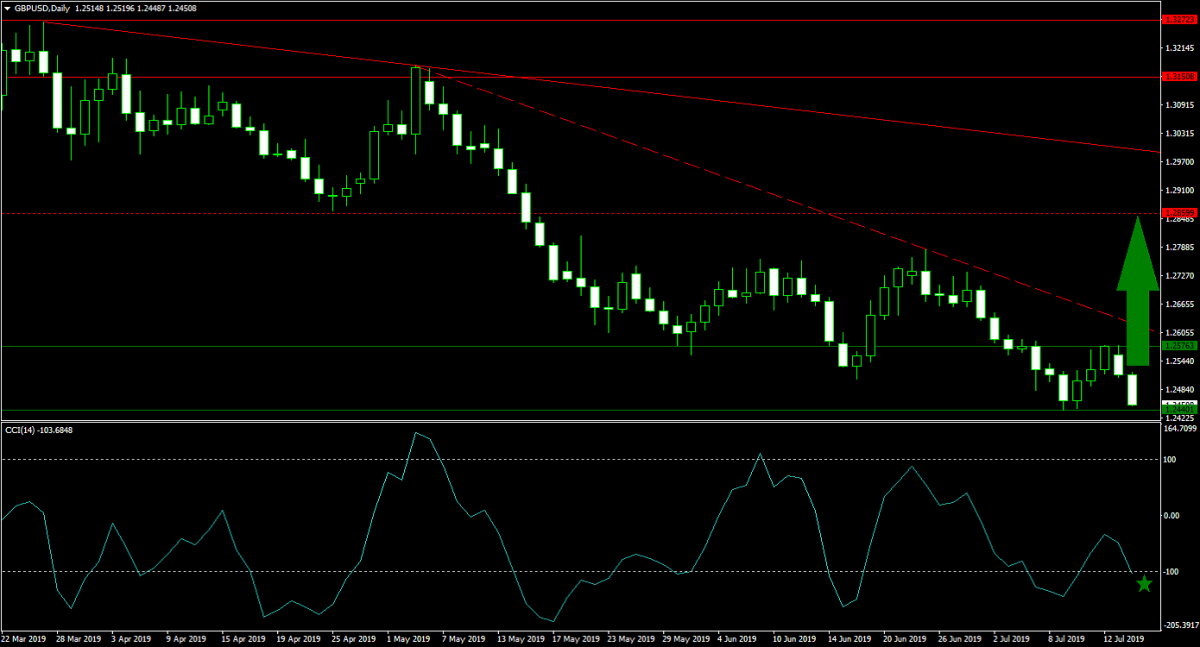

Forex Profit Set-Up #1; Buy GBPUSD - D1 Time-Frame

This currency pair has faced a steep sell-off, but with the US Federal Reserve poised to lower interest rates a short-term reversal is expected to unfold. The British Pound has been oversold which makes price action ripe for a short-covering rally. While the British currency will be faced with a rise in volatility as more news surrounding Brexit will be released and the October 31st deadline approaching, the GBPUSD is favored to push above its horizontal support area. A second breakout above its secondary descending resistance level will clear the path for a move into its next horizontal resistance level. Forex trades are recommended to spread their GBPUSD buy orders inside of its horizontal support area.

The CCI has recorded a series of higher lows which suggests that bearish momentum is weak, any further slide would now result in the formation of a positive divergence. Download your MT4 Trading Platform today and join our fast growing community of profitable forex traders!

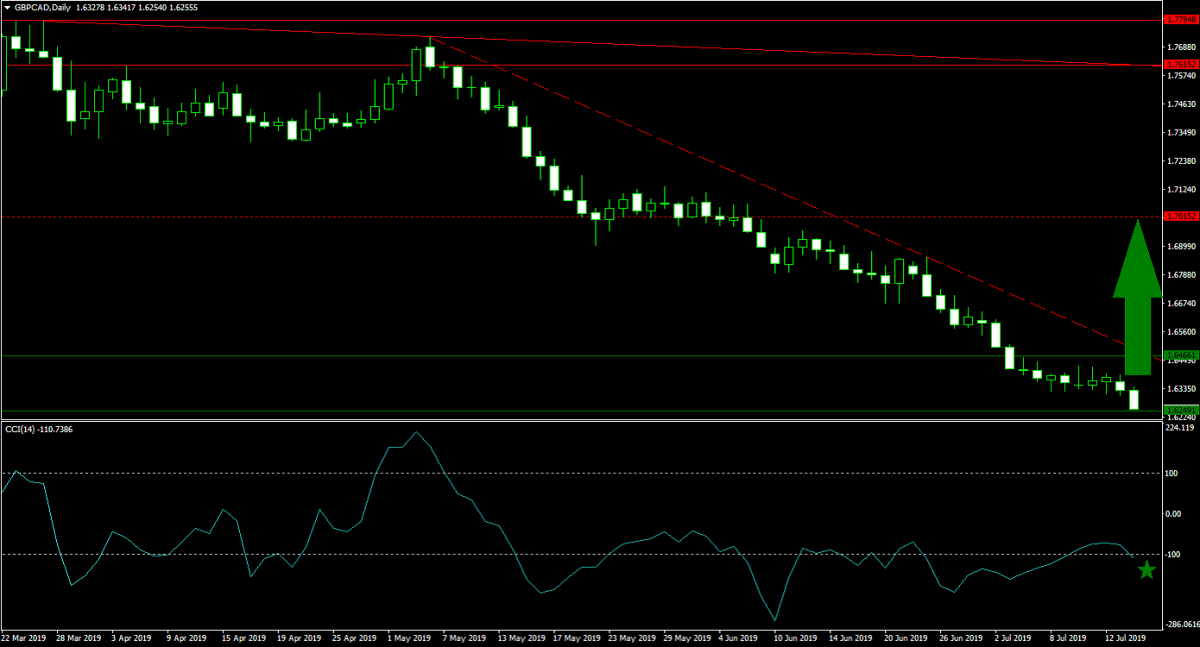

Forex Profit Set-Up #2; Buy GBPCAD - D1 Time-Frame

The Canadian Dollar has been 2019 best performing major currency, but the sharp rally has now created the right conditions for a sell-off on the back of profit taking. The long GBPCAD call is therefore more a short-term bearish Canadian Dollar trade than a bullish British Pound one. The secondary descending resistance level has crossed into the bullish support area from where a double breakout is expected to take the GBPCAD back into its next horizontal resistance level. Forex traders are advised to enter their long positions above and below the lower band of its horizontal support area.

The CCI has dipped into extreme oversold territory from where a positive divergence formed. This is a strong bullish trading signal which is favored to ignite a short-covering rally. Follow the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide to over 500 pips in monthly profits!

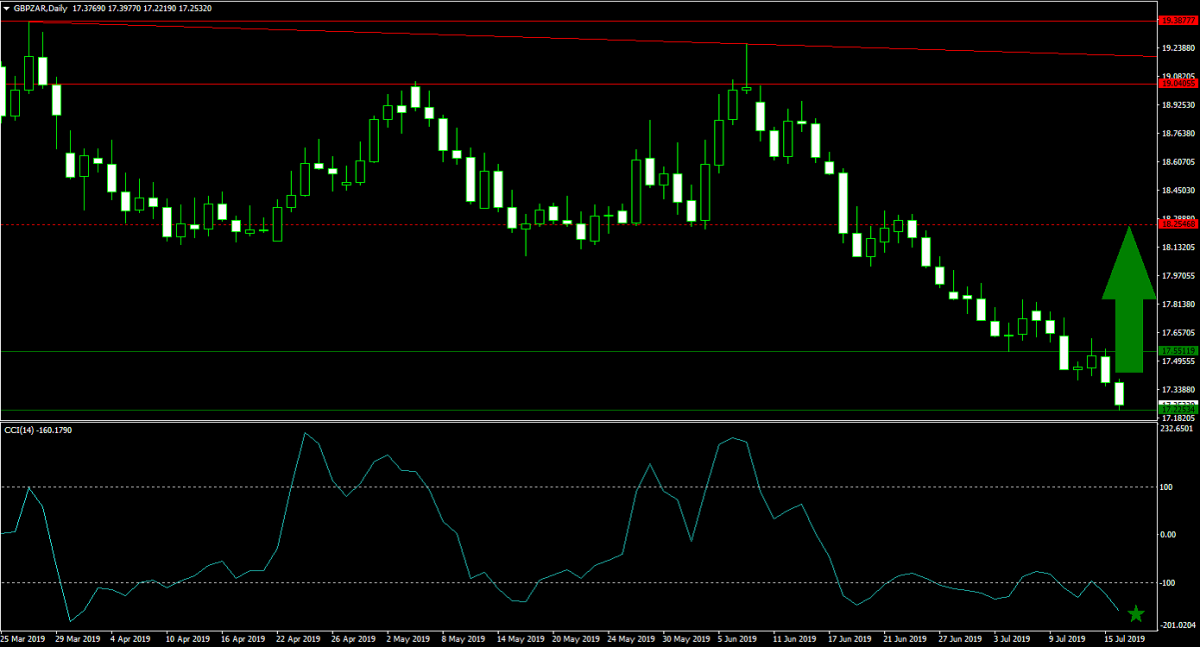

Forex Profit Set-Up #3; Buy GBPZAR - D1 Time-Frame

As the global economy cools further, commodity exporting countries such as South Africa are likely to feel the headwinds. The South African Rand has rallied sharply against the British Pound, but bearish momentum is now fading inside of its horizontal support area. A breakout in the GBPZAR is anticipated to lead price action back into its next horizontal resistance level with downside risks to this trade limited. This currency pair offers forex traders attractive short-term upside potential and buying any dips in the GBPZAR from current levels remains the favored trading approach.

The CCI is trading deep in extreme overbought conditions from where a long and shallow positive divergence formed. A move above -100 is anticipated to initiate a push to the upside. Subscribe to the PaxForex Daily Forex Technical Analysis and simply copy the recommended trades from our expert analysts into your own portfolio!

To receive new articles instantly Subscribe to updates.