Maybe a few week’s away from divorce negotiations is what was needed in order for UK Prime Minister May to understand that the UK may be in a much better position than consensus tries to persuade everyone. With her job on the line, May appears to have gotten back on the track to fulfil her duties as a PM and deliver on the vote to leave the EU. Prior to the summer recess, May often pushed a soft Brexit which many Brexiteers pointed out would leave the UK in a weak position.

May stated that if the UK would tumble out of the EU without a deal, the country would still be able to move ahead successfully. On her flight to South Africa, she referred to Roberto Azvedo, the World Trade Organisation Chief, in two different interviews. May noted that 'He said about a no-deal situation that it would not be a walk in the park, but it wouldn’t be the end of the world. I’ve said right from the beginning that no deal is better than a bad deal.'. Her reversal back to her original message about a no-deal suggests that pro-Brexit ministers are back in charge and have the numbers.

Last week, the UK government published 24 out of 80 papers which outlined a no-deal Brexit scenario. The published papers recommended that pharmaceutical companies should stockpile medicines, advised exporters that there will be an increase in red tape for trade with the EU and made consumers aware that goods and services purchased from the EU will become more expensive. May noted that the government is 'putting in place the preparations such that if we’re in that situation, we can make a success of it.'.

The British Pound enjoyed a short-covering rally over the past few trading sessions which resulted in the breakout above key support levels. Will May’s positive tone about Brexit spur traders to re-enter the bullish British Pound trade or should forex traders be prepared for more downside? Open your PaxForex Trading Account now and access the profitable world of forex trading. Find out why successful traders chose PaxForex as their prime broker.

Philip Hammond, the Chancellor of the Exchequer, is more pessimistic about the impact of a no-deal Brexit. His figures presented to the Parliament’s Treasury Select Committee showed the potential for £80 billion in new debt by 2033 and the loss of 7.7% of projected GDP. May quickly poured water on that fire and stated it is a work in progress and nothing new. While May claimed she remains optimistic about a good Brexit deal, she made sure to point out that there are red lines she won’t cross for a deal. She stated that 'There are certain things that I’ve made clear are non-negotiable. An end to free movement is one of them.'. Brexit no-deal no problem and here are three forex trades to take a closer look at.

Forex Profit Set-Up #1; Buy GBPUSD - D1 Time-Frame

After a completed breakout above its horizontal support area, the GBPUSD is now faced with a new test at its secondary descending resistance level which is closely followed by its primary descending resistance level. This currency pair has the momentum of a bullish sentiment shift behind it which may suffice for a double breakout which can take the GBPUSD into its next horizontal resistance area. Forex traders are advised to buy the dips down to the upper band of its horizontal support area.

The CCI has confirmed the breakout and momentum change to bullish as it spiked to the upside from extreme oversold conditions. Bullish momentum also carried it above the 0 mark and is expected to push it further to the upside. Follow the PaxForex Daily Fundamental Analysis and let our expert analysts guide you through the forex market; earn over 500 pips per month with ease.

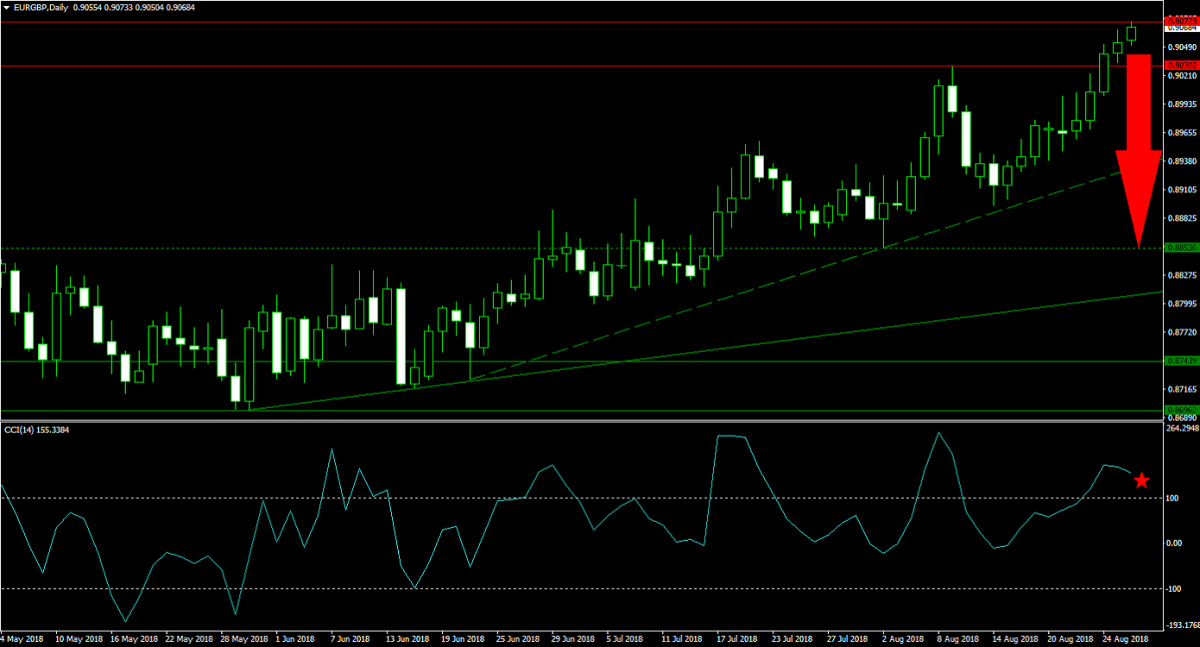

Forex Profit Set-Up #2; Sell EURGBP - D1 Time-Frame

The EURGBP is currently testing the strength of its horizontal resistance area after setting a 2018 high. With bullish momentum contracting, a breakdown is expected to materialize over the next few trading sessions. This could extend down into the next horizontal support level which is located between its primary and secondary ascending support level. Forex traders are recommended to spread their sell orders inside the horizontal resistance area.

The CCI has formed a negative divergence, which is a strong bearish trading signal, inside extreme overbought levels. A push below 100 is expected to trigger a sell-off based on profit taking which could result in a bigger move to the downside. Subscribe to the PaxForex Daily Forex Technical Analysis and simply copy-paste our trading recommendations into your own trading account; never miss a profitable trade!

Forex Profit Set-Up #3; Buy GBPCHF - D1 Time-Frame

Price action in the GBPCHF is challenging the lower band of its horizontal support area which is being intersected by its secondary descending resistance level. A double breakout is anticipated, given the decrease in bearish momentum, which will lead this currency pair into its primary descending resistance level from where a push into the next horizontal resistance level is expected. Forex traders should place their buy orders just above and below the secondary descending resistance level.

The CCI is trading in extreme oversold conditions, but is well off of its lows. This resulted in the formation of a positive divergence, a strong bullish trading signal, and an advance is expected to follow. Make a deposit into your PaxForex Trading Account now and add this trade to your portfolio. Diversify your Bitcoin and Ethereum assets and start earning more per trade through PaxForex.

To receive new articles instantly Subscribe to updates.