The EU agreed to extend Brexit until October 31st 2019 amid a compromise reached. UK Prime Minister May asked for an extension until June 30th 2019 while European Council President Donald Tusk argued for a much longer extension hoping for a Brexit reversal. French President Macron remained the sole opposition and stated that a delay past June 30th 2019 would harm the EU. In the end he gave in an agreed to the October 31st extended deadline, but the UK may leave prior to that if UK Parliament can agree on May’s Brexit deal. France remained without allies in the process as even Greece, which traditionally votes with France, took another route.

May has to face Parliament today and explain why she asked and accepted a delay as many in her own party were against this move. Traders have now to deal with another six months of uncertainty, but the British Pound remained stable. The UK office tasked with a no deal Brexit stated last week that the country is fully prepared for a WTO style Brexit and France also pointed out that everything is ready to go for Brexit to occur on April 12th 2019, following the delay away from the original departure date of March 29th 2019. May has previously stated that a delay of Brexit would be unacceptable to her party and that she will fight to deliver what the British public voted for.

Following the delay, May added “The choices we now face are stark, and the timetable is clear. I do not pretend the next few weeks will be easy.” May has further angered the pro-Brexit side in her own party which is in addition to her cross-party talks with opposition Labour Marxists leader Corbyn. Some fear that Brexit may be delayed indefinitely which would be a great betrayal to the outcome of the 2016 referendum. Many EU leaders hope that this delay will ultimately lead to the UK remaining in the EU as it also forces the country to participate in next months EU parliamentary elections unless it will agree to leave by May 22nd 2019.

Forex traders priced in the delay which kept the British Pound stable for the time being, but May’s handling of Brexit could result in a political backlash. A growing number of MP’s from her own party are once again plotting to remove her. May already survived two no confidence votes and even Labour has raised the possibility of another such vote. How will forex traders react to the extended period of uncertainty? Open your PaxForex Trading Account now and join our growing community of profitable traders!

Participating in next month’s EU parliamentary elections has been ruled out by May previously as she stated it wouldn’t be right for the UK to do so. The EU hopes this extension will force participation and Greek PM Tsipras added that “This will be the greatest defeat of Brexiteers, and maybe even the beginning of the end for Brexit.” The environment in Brussels towards the UK has grown increasingly hostile. Overall Brexit is the latest sign that fundamental changes are needed in order to step away from the current political environment. While the EU will claim victory for the time being, it may be wiser to ask why the UK voted to leave the world’s largest trading bloc. Brexit is delayed again, but here are three forex trades which won’t delay your profits!

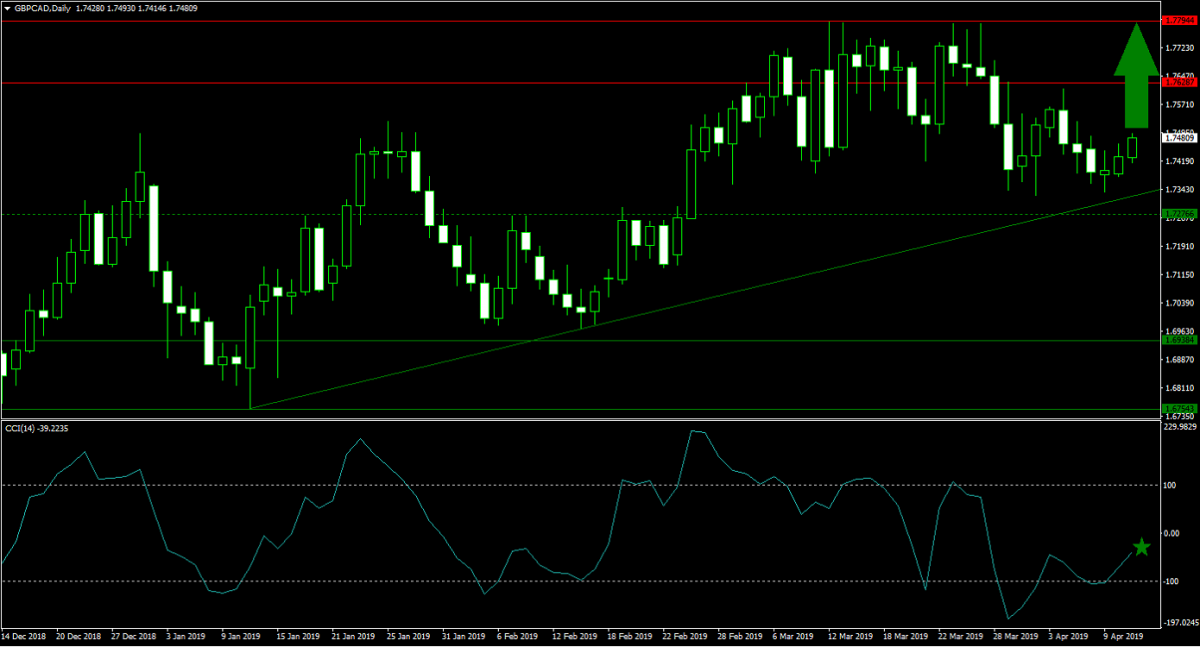

Forex Profit Set-Up #1; Buy GBPCAD - D1 Time-Frame

Given the ongoing global economic slowdown and the impact on commodity markets, the Canadian Dollar’s rally is expected to reverse. The GBPCAD has retreated from its horizontal resistance area, but the downtrend was halted as price action reached its primary ascending support level. The increase in bullish momentum is favored to take this currency pair back to the upper band of its horizontal resistance area. Forex traders are advised to buys any dips down into its primary ascending support level.

The CCI has recovered from a brief dip into extreme oversold conditions and is now on its way towards the 0 mark. Momentum is on the rise which could led to a bullish momentum crossover and further push the GBPCAD to the upside. Download your PaxForex MT4 Trading Platform today and build a profitable forex portfolio with the help of our expert analysts!

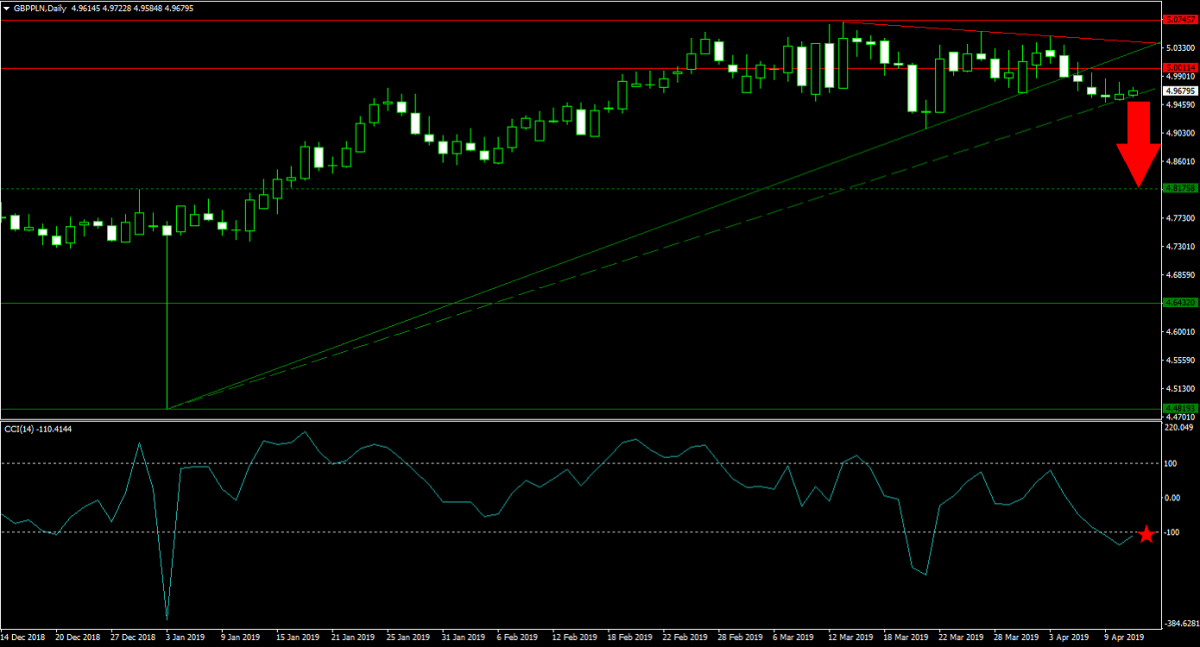

Forex Profit Set-Up #2; Sell GBPPLN - D1 Time-Frame

Poland is a thorn in the eye of the EU just as the UK is, but the most recent extension of Brexit uncertainty is expected to give forex traders a great reason to realize floating trading profits in the GBPPLN. Price action already completed a breakdown below its horizontal resistance area as well as below its primary ascending support level, turning it into resistance. More downside pressure is supplied by its primary descending resistance level as the GBPPLN reached its secondary ascending support level. A breakdown is expected to follow which will lead the way down into its next horizontal support level. Selling rallies into its primary descending resistance level is the favored trading set-up.

The CCI already slipped into extreme oversold territory, but remains well off of its previous low. With bearish momentum on the rise, this technical indicator is likely to extend its move to the downside. Subscribe to the PaxForex Daily Fundamental Analysis and grow your forex portfolio trade-by-trade with the guidance of our expert analysts!

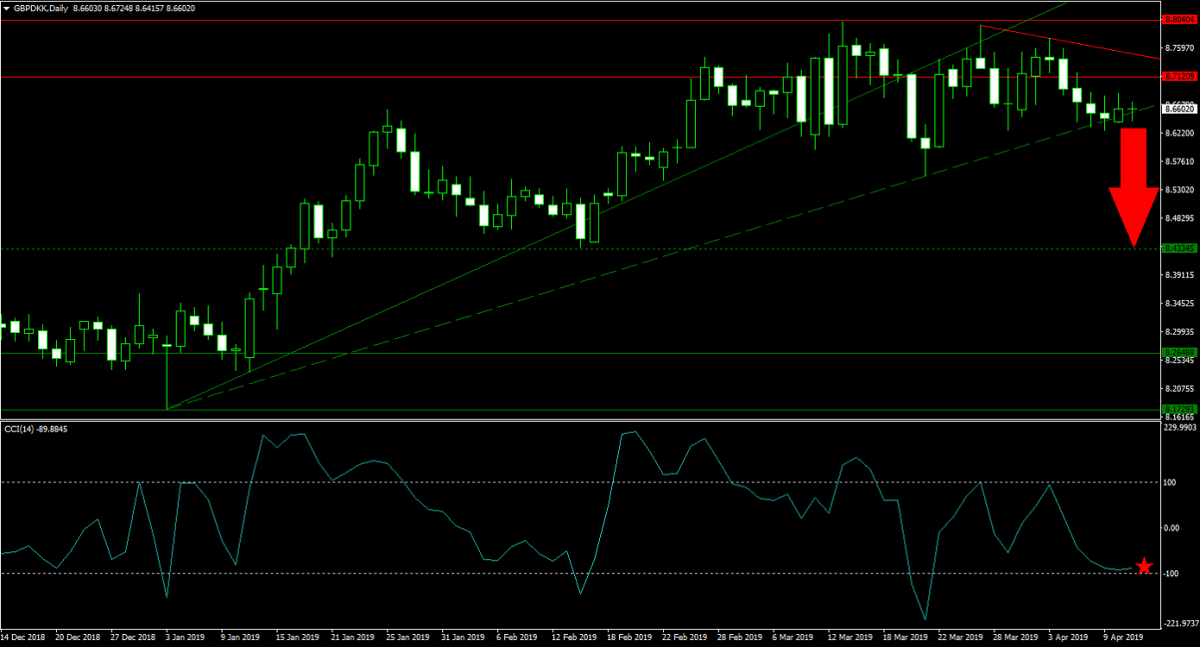

Forex Profit Set-Up #3; Sell GBPDKK - D1 Time-Frame

The GBPDKK is in a similar technical trading set-up as the GBPPLN as price action already pushed below its horizontal resistance area as well as below its primary ascending support level. Price action already attempted a breakdown below its secondary ascending support level and is trading just above and below it over the past four trading sessions. The rise in bearish momentum, enhanced by its primary descending resistance level, is favored to lead to a sustained breakdown. The GBPDKK is expected to accelerate to the downside until it will reach its next horizontal support level. Forex traders are recommended to sell any rallies into its primary descending resistance level.

The CCI paused its contraction before moving into extreme oversold conditions, but this momentum indicator is likely to resume its slide and push deep below the -100 mark which favors a breakdown in price action. Follow the PaxForex Daily Forex Technical Analysis and copy profitable trading recommendations into your own portfolio!

To receive new articles instantly Subscribe to updates.