With time running out for the EU and the UK to reach a Brexit compromise, some try to create the illusion that a such a compromise is imminent. This is very inaccurate and misleading. While both sides are entangled in negotiations in order to resolve what currently appears to be the biggest problem, the Irish border, even a compromise is far off. While officials acknowledge that some progress has been made, they warn that obstacles remain before a compromise may be reached.

Current negotiations to reach a compromise on what is called the Irish border backstop are partially stuck because many fear the agreed backstop will become reality. This would dictate the future relationship between the EU and UK. Negotiators try to determine how the Irish border will function after Brexit. The only land border the UK will share with the EU will be between Ireland and Northern Ireland which needs to remain all but invisible. Another issue is the sea border between Northern Ireland the UK.

The DUP, which props up Theresa May’s Tories in Parliament to giver her a slim majority, stated that a border between Northern Ireland and the UK is a red line they will not cross and neither is a hard border between Ireland and Northern Ireland. Technology is likely to play a key role in creating a soft border, but no agreement has been reached. May’s deputy David Lidington commented that “It’s too early to be putting champagne on ice. We’ve got a fair way to go still. There are still differences between our position and that of the European Commission, but we’re working very hard to overcome them.”

Over the past few month the British Pound strengthened as many expected a Brexit compromise to be all but guaranteed which would lead to a Brexit deal in November. Brexit Compromise? Not so fast! With a range of unresolved issues and difference, how will the British Pound react over the next few months? Open your PaxForex Trading Account in order to build a market beating portfolio with the help of our expert analysts.

A backstop deal which would keep the UK in the EU customs union until a solution is unlikely to pass Parliament. The European Research Group with over 60 members as well as the DUP and its 10 members will not support such a compromise. Boris Johnson and David Davis, both who quit May’s cabinet due to protest of her handling Brexit, are vocal against accepting the EU customs union. German Chancellor Merkel tried to add pressure by stating that “We’re going on the principle that the faster we’re done, the better.” Brexit Compromise? Not so fast! Here are three forex trades which will pip your balance!

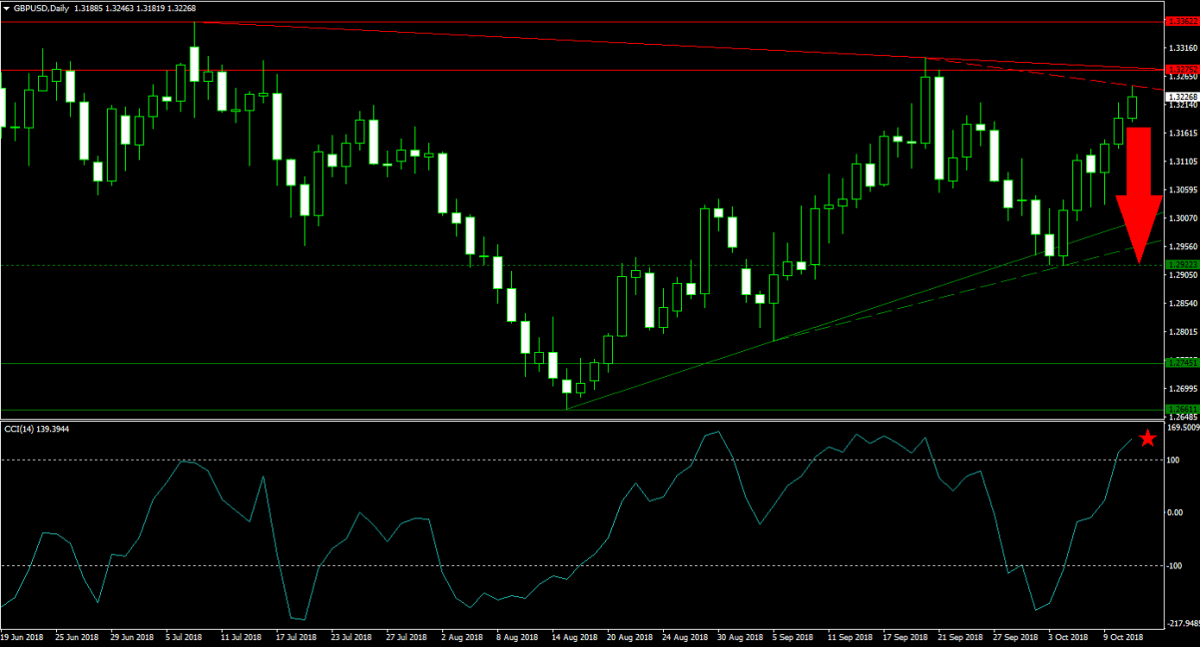

Forex Profit Set-Up #1; Sell GBPUSD - D1 Time-Frame

The most recent advance in the GBPUSD ran into triple resistance; from the lower band of its horizontal resistance area as well as its primary and secondary descending resistance level. This makes price action vulnerable for a counter-trend correction on the back of profit taking. This currency pair is now predicted to drop below its primary and secondary ascending support level in order to challenge its next horizontal support level. Forex traders are advised to sell the rallies in the GBPUSD.

The CCI has moved into extreme overbought territory and is approaching its previous highs which are not expected to be eclipsed. A drop below the +100 mark is likely to trigger the expected profit-taking sell-off. Never miss out on a profitable trading opportunity published by our expert analysts; subscribe to the PaxForex Daily Forex Technical Analysis and profit from our trading recommendations!

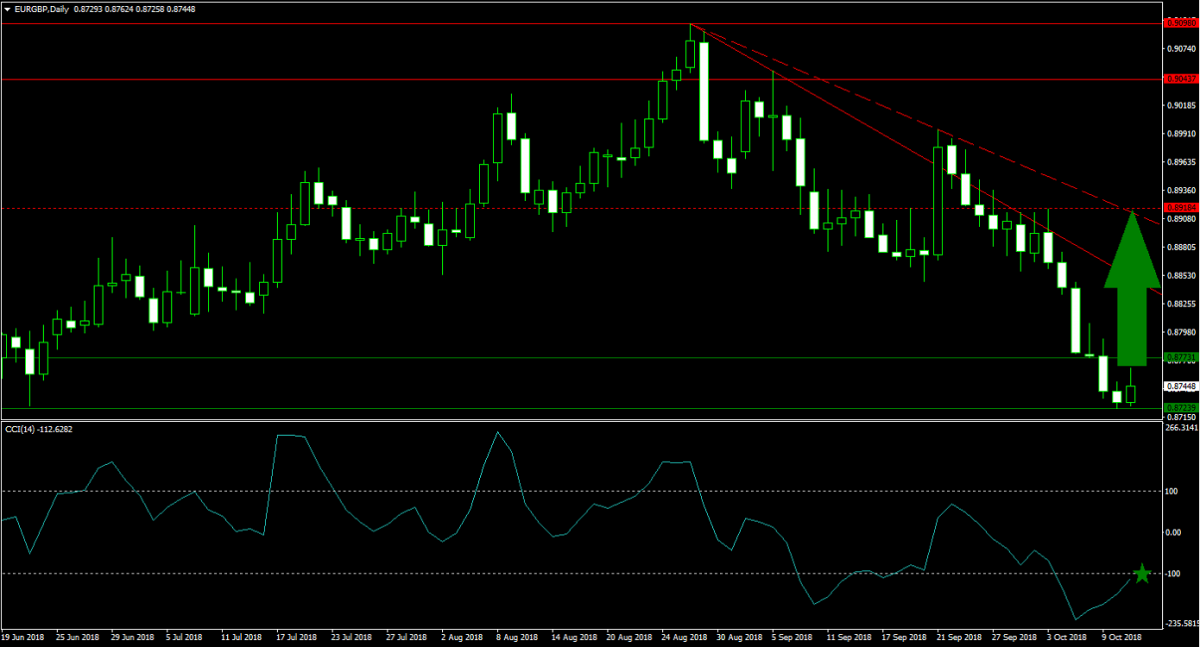

Forex Profit Set-Up #2; Buy EURGBP - D1 Time-Frame

The EURGBP is currently in the process of confirming the lower band of its horizontal support area. Today’s candlestick has formed an inverted hammer which is a strong bullish signal. Price action is predicted to enter a short-covering rally from current levels which will include a triple breakout; above its horizontal support area, above its primary descending resistance level and above its secondary descending resistance level. Buy orders in the EURGBP are recommended as this currency pair is set to move into its next horizontal resistance level.

The CCI plunged deep into extreme oversold conditions and recorded a new low, but has since reversed and is on it way to push above the -100 level. This is likely to initiate a short-covering rally. Earn over 500 pips per month simply by allowing our expert analysts guide your forex portfolio through the market. Follow PaxForex Daily Fundamental Analysis and join our growing community of profitable forex traders!

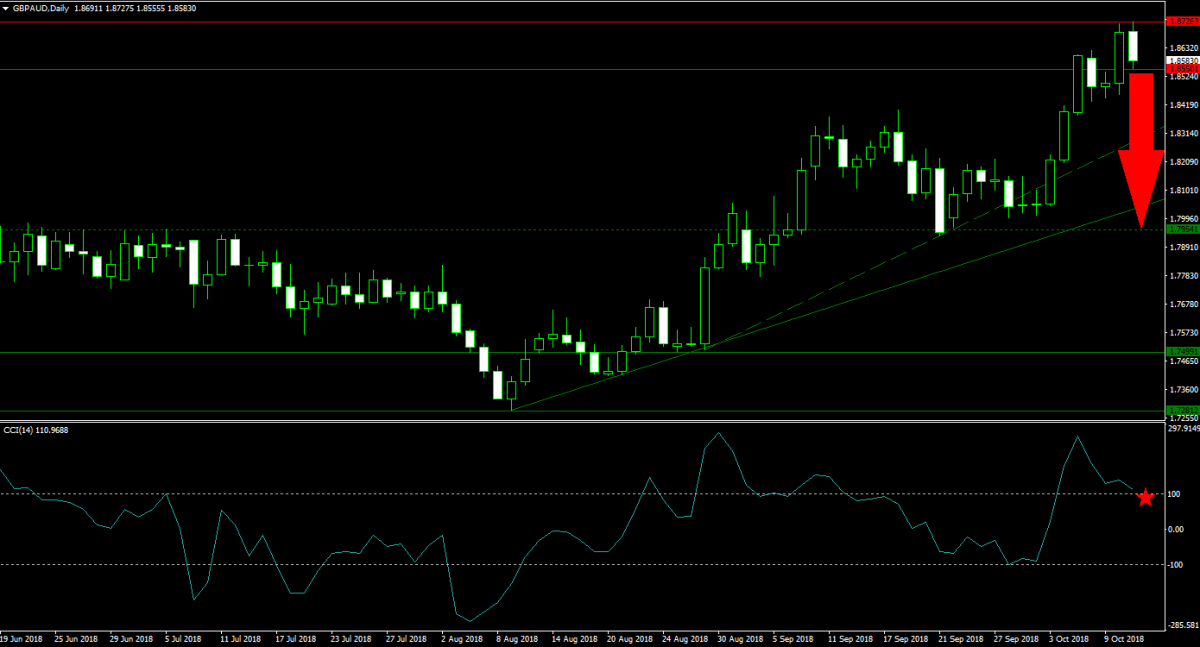

Forex Profit Set-Up #3; Sell GBPAUD - D1 Time-Frame

After the upper band of its horizontal resistance area rejected price action, the GBPAUD is now on the verge of a breakdown. This will result in a bearish momentum shift and is expected to force price action to the downside. The GBPAUD is anticipated to complete a double breakdown, below its secondary ascending support level and its primary ascending support level, and test its next horizontal support level. Forex traders should place their sell orders just above and below the lower band of its horizontal resistance area.

The CCI moved into extreme overbought territory, but quickly reversed direction and is now descending from its peak. More bearish momentum is likely to accumulate once this momentum indicator drops below the +100 mark which could see the sell-off accelerate. Download your PaxForex MT4 Trading Platform now and find out why more and more successful forex traders call PaxForex their home!

To receive new articles instantly Subscribe to updates.