Hello and welcome back everyone, what a start we already had to 2019! There have been some really exciting developments over the past week which only added to the overall increase in bullish fundamental news flow surrounding cryptocurrencies. While institutional traders often talk about the benefits of using blockchain technology in their operations, implementation has been rather slow and near absent. One of the biggest obstacles remains a more widespread adoption of the blockchain technology as well as cryptocurrencies by institutional clients in the financial service sector. As I have pointed out on December 5th 2018 in my post titled “Bitcoin - Forex Combo Strategy: Fundamentals Stronger Than Ever”, fundamentals are getting a lot stronger which is great for a new bull cycle in 2019.

HSBC, one of the biggest banking groups in the world and head quartered in the UK, has announced that in 2018 it settled $250 billion worth of forex trades using blockchain in over 3 million forex transactions. It also stated that it processed over 150,000 cryptocurrency transactions on its own platform “FX Everywhere”. The first such transaction took place in May 2018, but the total for the year still only represents a fraction of its forex trading volume according to bank which does not disclose details for its FX business. This has been a major step forward and other banks and institutional traders are likely to follow. While implementation of blockchain is currently on a slow uptrend, at some point those who decided to wait will have to play catch-up with this trend.

The first blockchain technology transaction HSBC conducted was in the agricultural sector. It granted a letter of credit to Cargill for the transportation of produce from Argentina to Malaysia. Dutch financial firm ING issued the the letter of credit. While the use of blockchain remains fractional, the important fact is that companies start to use it and experiment with it. Better to move in the right direction at slow speed than to rush into the unknown with a crash as the final destination.

The UK based banking giant has deployed its “FX Everywhere” blockchain technology and is using it for company internal balance sheet transfers and payments. HSBC stated it not only cut costs and transfer times, but a more efficient process as no additional protocols were required to confirm transactions. In October 2018, HSBC also partner with other financial firms, such as Standard Chartered and PNB Paribas, in order to fund and create a blockchain trade finance platform named “eTrade Connect”. The goal is to improve international trade finance and reports suggests that the approval time for loans has been slashed to 4 hours from the previous 36 hours. An overall reduction in costs has also been reported, but it remains to be seen of those cost savings will be passed on to the clients and consumers of HSBC products or if the financial giant decides to book them as an increase in profits.

Many now wonder if HSBC is ready to further deploy Distributed Ledger Technology or DLT. The Acting Head of Foreign Exchange and Commodities at HSBC, Richard Bibbey, stated that “Following prosperous implementation inside the bank, we are now exploring how this technology could help multinational clients – who also have multiple treasury centers and cross-border supply chains – better manage foreign exchange flows within their organizations”. This would be another huge leap forward for the entire sector and add demand to every solid corner of the cryptocurrency space. I think that this will contribute to a bullish trend, but not unlike before which drove essentially all assets higher. 2019 could be the start of the decoupling in crytpocurrencies which means that those who have solid fundamentals behind them will advance while those who lack them will fall. This will be a further sign of a maturing market and a great positive moving forward.

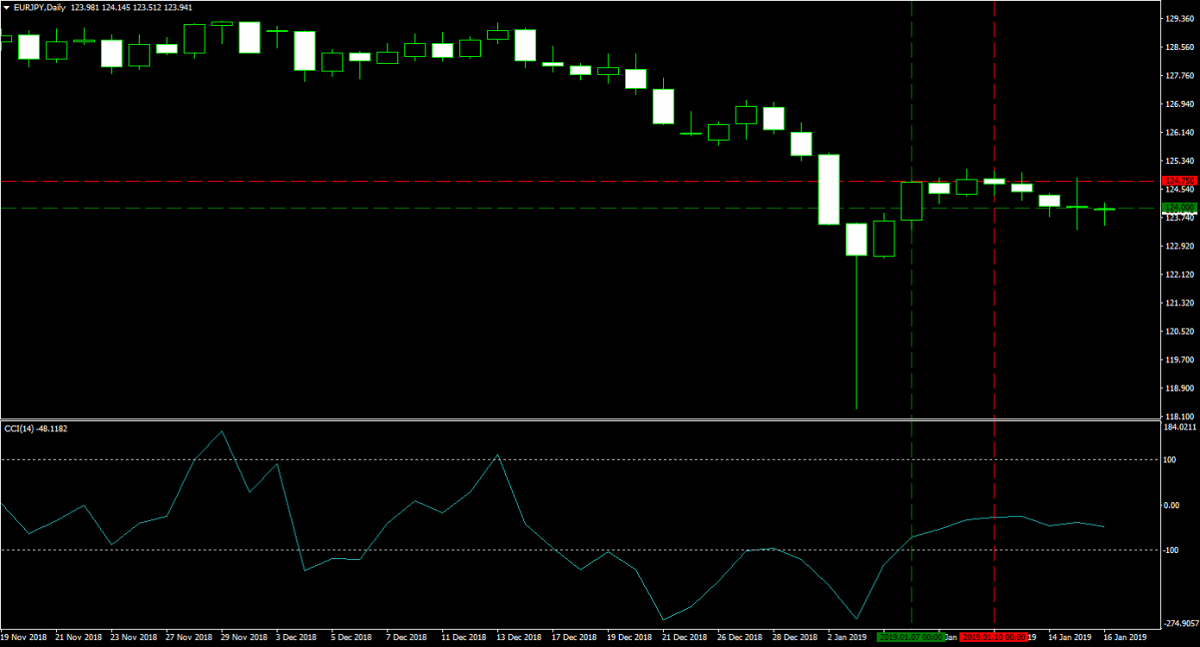

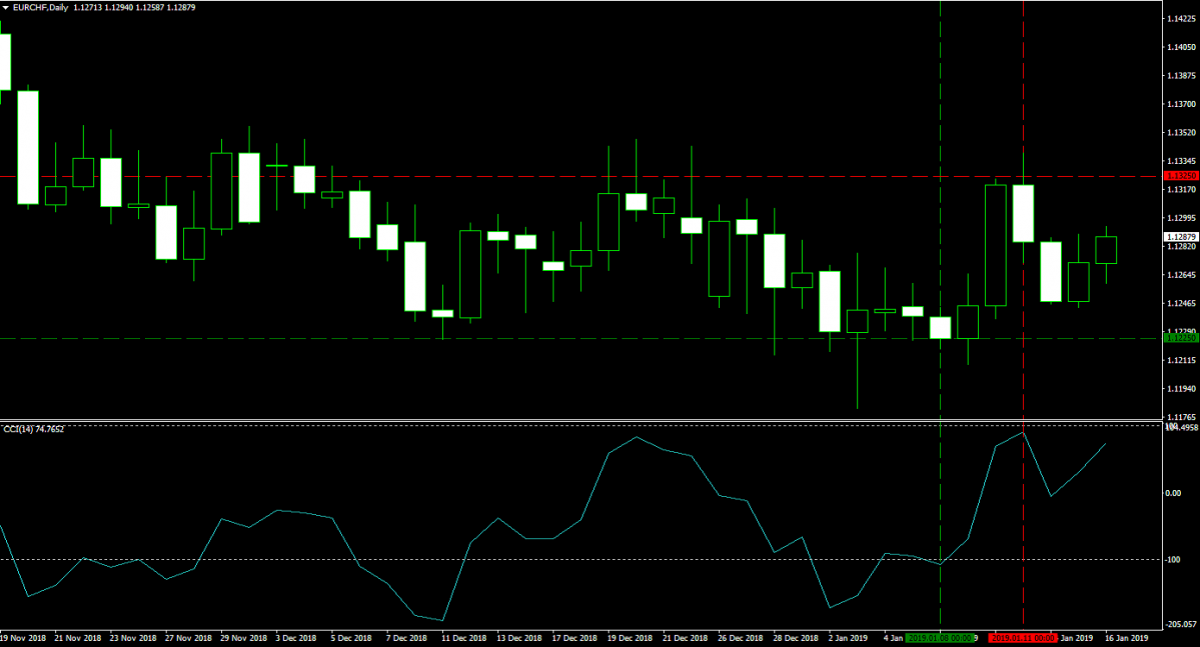

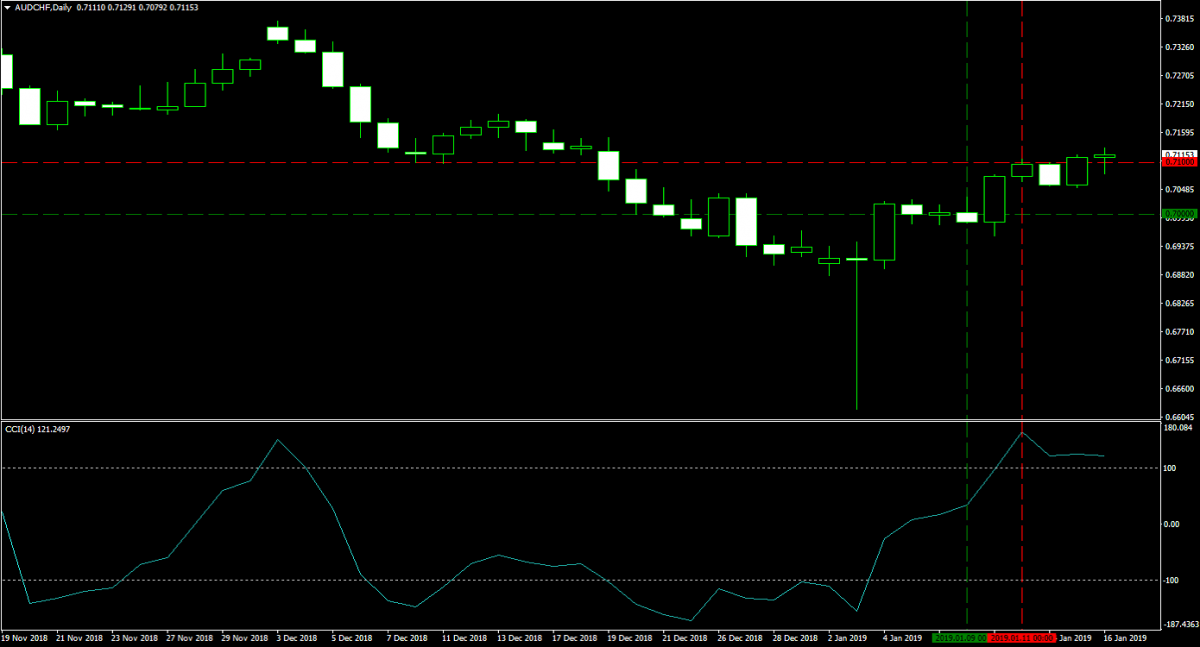

Let’s get right to my own forex trades, last week I had three open forex trades and all three were closed for a profit as the adjusted stop loss orders were triggered. My 75 lots long position in the EURJPY was closed on January 10th 2019 at 124.750 for a profit of 75 pips or $51,926. On January 11th 2019 my 75 lots long position in the EURCHF was closed at 1.1325 for a profit of 75 pips or $76,803. On the same day I also closed my 75 lots long position in the AUDCHF at 0.7100 for a profit of 100 pips or $76,803. The three images below show my completed trades.

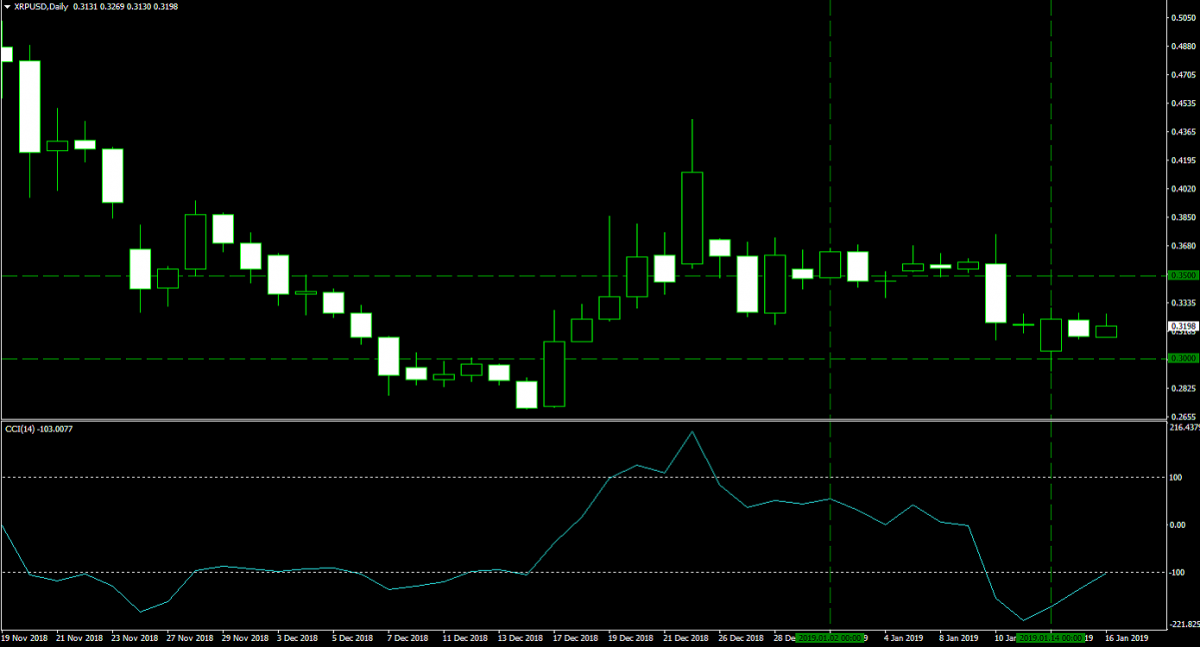

Given the improvement in the fundamentals for the cryptocurrency sector, I decided to added to my Bitcoin positions this week. On January 14th 2019 I purchased 100 Bitcoins at 3,500 for a total of $350,000. This increased my Bitcoin total to 200 Bitcoins and decreased my average entry price to $4,315 or the middle of its current horizontal resistance area. I also added 3,000 Ethers to my holdings which I bought at $111 for a total of $333,000. I now hold a total of 4,500 Ethers with an average entry price of 131.22. In addition I added 300,000 Ripple at 0.3000 for a total consideration of $90,000 and I now hold 600,000 Ripple with an average entry price of $0.3250. All this was possible due to my great forex trades over the past weeks and I want to thank the PaxForex expert analysts for their recommendations. The images below show my recent additions to my cryptocurrency portfolio.

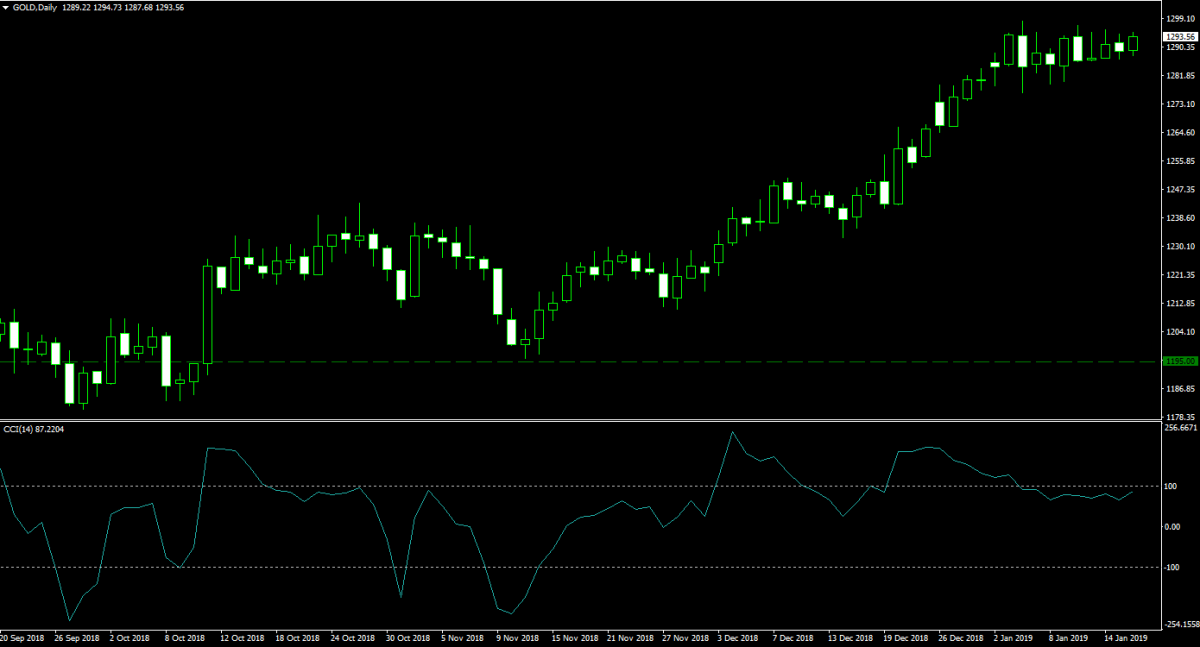

Gold has been trading in a tight range just below the 1,300 level and this pause is actually healthy for the rally which started in October of 2018. I think we will see a breakout above this key psychological resistance level soon. This bodes well for my 100 lots of Gold which I bought at $1,195 for a margin requirement of $123,179 with a pip value of $100. Patience with Gold is very important, but the overall picture remains very bullish. The image below shows my Gold position.

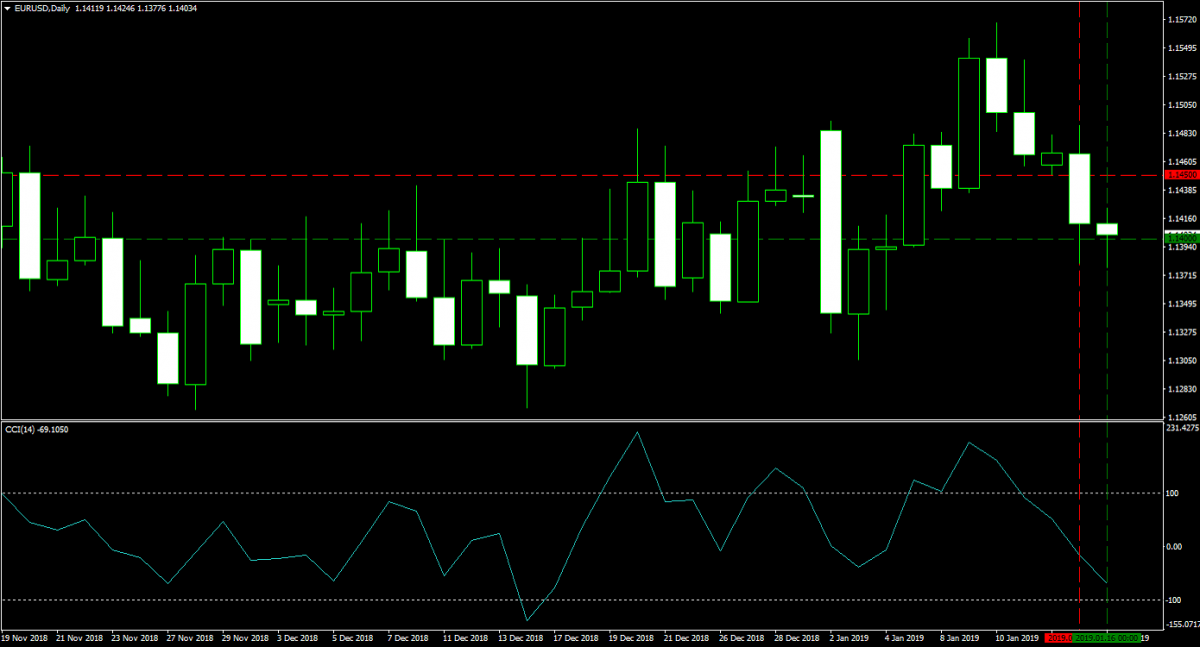

On January 15th 2019 I sold 25 lots in the EURUSD at 1.1440 according to this trading recommendation “EURUSD Fundamental Analysis – January 15th 2019”. The margin requirement was $5,700 with a pip value of $250. This trade was closed earlier today as my stop loss was triggered at 1.1390 for a profit of 50 pips or $12,500. The image below shows this short trade.

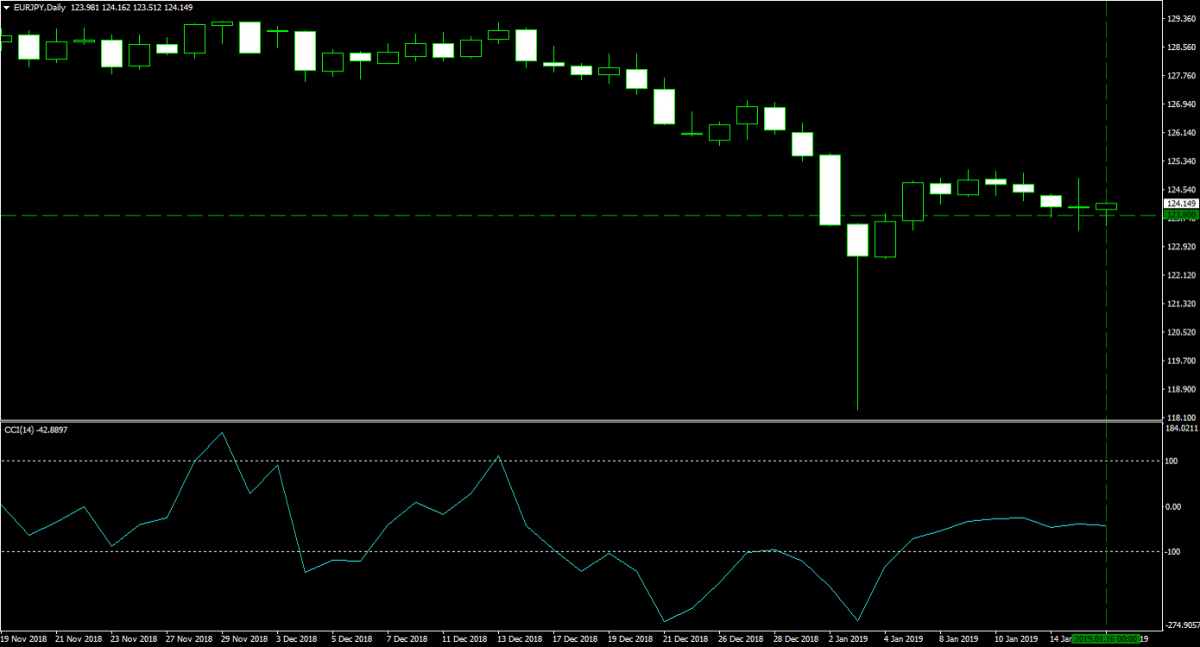

Earlier today, January 16th 2019, I bought 25 lots in the EURJPY at 123.800 for a total margin requirement of $5,700 and a pip value of $229.68. The original recommendation can be found at “EURJPY Fundamental Analysis – January 16th 2019” and while the Japanese Yen may remain in demand as a safe haven currency, I can see a short-term short-covering rally in this currency pair. You can see my entry into this position in the image below.

Let’s finish with a look at my portfolio to close this week’s update. I have 200 Bitcoins worth $711,640, 4,500 Ethers worth $525,375 and 600,000 Ripple worth $191,280. I also hold 100 lots in Gold worth $1,111,179, one open 25 lots long position in the EURJPY worth $13,279 and $52,157 in cash. My total portfolio is worth $2,604,910, up $136,850 as compared to last week and a new all-time high. When will I crack the $3,000,000 mark? Remember that I started with $12,500 late in the second-half of 2017. Join me now at PaxForex and use my Bitcoin-Forex Combo Strategy in order to grow your own portfolio. Create a better life, plant the seed now and open your PaxForex Trading Account!

To receive new articles instantly Subscribe to updates.