Michel Barnier, the EU’s chief Brexit negotiator, has ruled out a special deal for UK banks and the entire UK financial services sector in a free trade deal. This has been echoed throughout the negotiations so far. The UK economy is thriving thanks to its powerful financial services industry which has made London the financial center of the world. There is no alternative, especially not for Europe, and many companies have send letters to their heads of state asking for a favourable Brexit deal which would ensure they can continue to expand with the help of UK finance.

Two senior officials with insight to the trade talks, which have not begun yet, stated that Barnier is bluffing and that the UK will receive a special deal for UK banks and other financial firms in order to access the single market without problems. Barnier does not have the backing of the other 27 member states, many who understand the importance to their own economy's ability to access London finance. Barnier, a former French commissioner, is walking a fine line to please the hard-liners from France and Germany who want to scare other member states from leaving the EU and those who understand a good deal will be beneficial for both parties.

Poland and Italy, together with Sweden and the Netherlands, offer positive signs that EU leaders would welcome a special deal for UK financial firms. For now, Barnier continues to rule out a deal on services and said that a Canada type trade deal would be the best possible deal he could offer. It would cover trade in goods, but not services. The trade negotiations are scheduled to start in March after UK Prime Minister May agreed that the UK government would pay £39 billion pounds in order to settle the divorce bill.

2018 will be a crucial year for Brexit negotiations and many view it as a make-or-break situation for a deal which will benefit the UK as well as the EU. This will create plenty of volatility, especially in the British Pound and in the Euro, and together with it a great deal of trading opportunities. The Barnier bluff on UK banks and how to pip your forex account scenario will give all traders the chance to earn more from forex this year. Open your PaxForex trading account today and trade to a better life.

Currently the EU remains in a hard-line stance as it is still coming to realize what many thought impossible; the exit of an EU member state from the world’s largest trading bloc. As trade negotiations start in March and more clarity emerges, forex traders will react to the news which will be released. This is likely to stimulate plenty of short-term trading decisions as well as knee-jerk reactions to headlines. It is important to filter through the noise in order to understand where Brexit is headed and how traders can profit from it. Here are three trades for the Barnier bluff on UK banks and how to pip your forex account.

Forex Profit Set-Up #1; Sell EURJPY - D1 Time-Frame

This currency pair has enjoyed a strong advance fueled by better than expected economic data out of the Eurozone. As trade negotiations will start in March and economic data is set to weaken into the summer months, the EURJPY is ripe for a correction. Price action is starting a sideways trend inside of its horizontal resistance area from where a breakdown is likely to materialize which would send this currency pair down into its ascending support level. Momentum may suffice to complete a second breakdown into its next horizontal support area. Any level above 135.500 offers a solid entry opportunity.

The CCI confirmed a reduction in bullish momentum as this indicator already moved below extreme overbought conditions, above the 100 mark, as a result of the sideways trend. A further drop to below the 0 level will confirm that bearish momentum will drive the EURJPY. Download your PaxForex MT4 Trading Platform today and enter this trade before the breakdown occurs.

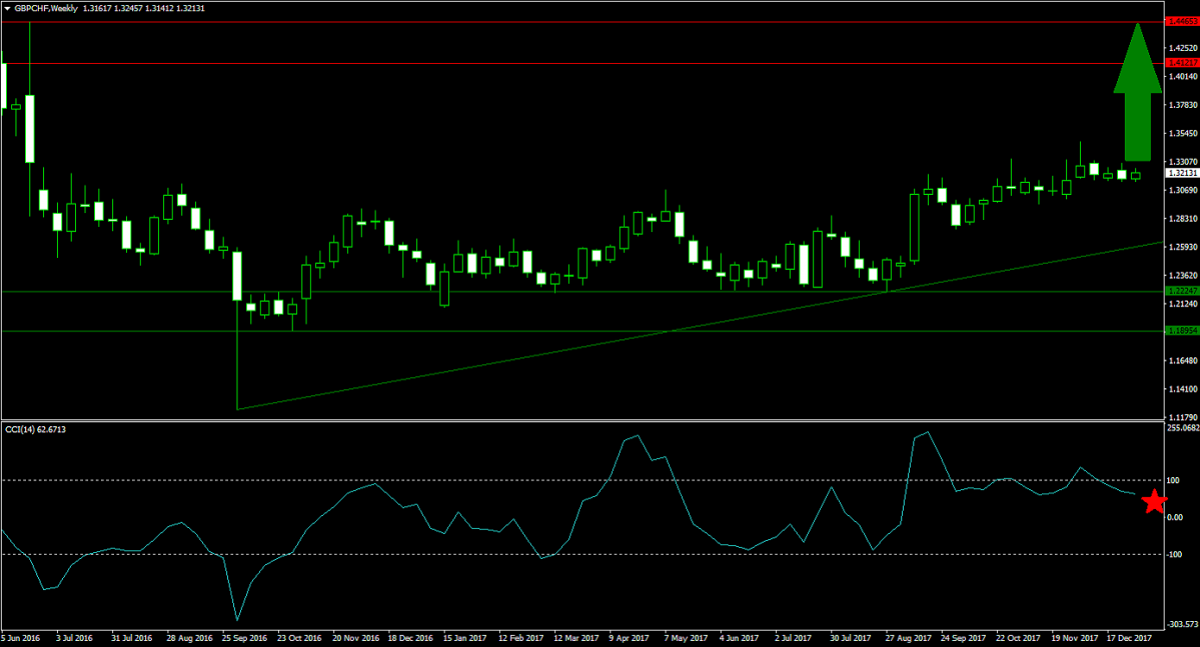

Forex Profit Set-Up #2; Buy GBPCHF - W1 Time-Frame

It is always wise to have a smart hedge in place, and the perfect counter-trade to our EURJPY short positions is a long position in the GBPCHF. Price action already completed a breakout above its horizontal support area and is expected to continue its advance until it can challenge its horizontal resistance area. This currency pair also enjoys the bullish pressures of its ascending support level which keeps downside potential contained while the upside remains very attractive from current levels. Buying the dips below 1.3200 will further add pips to your forex portfolio.

The CCI is currently trending lower in neutral territory after retreating from extreme overbought conditions, but is not expected to dip below the 0 mark. Forex traders should take any move below 50 in conjunction with a price below 1.3200 as an excellent entry point. Follow PaxForex’ Trading Recommendations in order to get the best trades every day.

Forex Profit Set-Up #3; Buy Gold - MN Time-Frame

The Gold bulls may finally have their year. Not only are there many uncertain macro-economic as well as geopolitical risks floating around, but from a technical perspective this commodity is set to accelerate to the upside. After completing a breakout above its horizontal support area, price action was rejected but its descending resistance level. This pushed Gold back down into the upper level of its horizontal support area from where it was able to bounce to the upside and break out above its descending resistance level. The path is now clear for a major advance and forex traders should by the dips below 1,300.

The CCI is currently trading above the 100 mark which identifies extreme overbought levels, but a minor dip is predicted which will take this indicator between the 0 and the 50 mark. This would present a good buying opportunity for Gold. Make sure to subscribe to the PaxForex Forex Fundamental Analysis in order to earn over 500 pips per month.

To receive new articles instantly Subscribe to updates.