The House of Commons will vote this evening, yet again, on a series of amendments to Brexit. Depending on the outcome of this evening’s votes, forex traders will hopefully get a clearer picture on the path of Brexit and the implications for the British Pound. Yesterday evening, Prime Minister May abandoned her Brexit deal which she negotiated with the EU over an 18 month period after she lost the vote by a record amount. She tried until yesterday to win concessions, but has now changed course and is backing a proposal by pro-Brexit lawmakers to rewrite the deal. May is now fighting hard to prevent Parliament to take control of Brexit which favors to eliminate the no-deal/WTO type Brexit the country originally voted for.

All eyes will be on Parliament Speaker John Bercow as he decides which amendments will be voted on by member of Parliament. He has often surprised the majority with his decisions. A lot of forex traders will pay attention today if and how the vote on the cross-party Cooper-Boles Delay Amendment will play out. This amendment seeks to prevent a no deal/WTO Brexit on March 29th and force PM May to seek an extension of Article 50. It is essentially a pause in Brexit which may send the British Pound rallying. The opposition Labour party under Corbyn backs this amendment and some calculations suggests that enough Tory rebels may get on board.

The Murrison-Brady Amendment seeks to cancel the Irish backstop, at the core of disagreements with the Parliament, and replace it with an alternative solution. The Benn Amendment calls for free-standing votes on Brexit options while the Grive Amendment favors six days of Brexit debates in order to give rank-and-file backbenchers a chance to speak up and direct the next Brexit steps. The Spelman-Dromey Amendment seeks to take the no deal/WTO Brexit option off the table as the Reeves Amendment calls for an extension of Article 50, but only if Parliament cannot reach an agreement by February 26th. The Corbyn Amendment wants to keep the UK in the EU customs union and calls for a second Brexit referendum while the Cable Amendment calls for a second Brexit vote. Finally, the Creasy-Nandy Amendment seeks an extension of Article 50 and a 250-MP strong “Citizens Assembly” in order to debate Brexit and recommend the next steps.

The British Pound is likely to experience a surge in volatility and trading volume as the pro-Brexit camp and the pro-EU camp will square off once again. Price action will definitely be impacted by which amendments will be voted on and the outcome of the votes. It may give direction of where Brexit is headed. Open your PaxForex Trading Account today and start building a profitable forex portfolio, trade-by-trade.

May and her cabinet will support the Brady Amendment in a last ditch effort to win rebels who may vote with Labour to derail Brexit. Some question if May’s change of heart may be too little too late. Reese-Mogg stated that his ERG MP’s will not back any of today’s Brexit amendments while the EU continues to remind both sides that May’s Brexit deal is not open for renegotiations. There is plenty on the line today and May has to once again fight for survival as she could lose control of Brexit, but without ERG support for any amendments it is unlikely that there will be a chance. This would send May back to Brussels in order to work on the Irish backstop. 9 Brexit Amendments, the British Pound and three forex trades to keep the profits flowing regardless of today’s outcome!

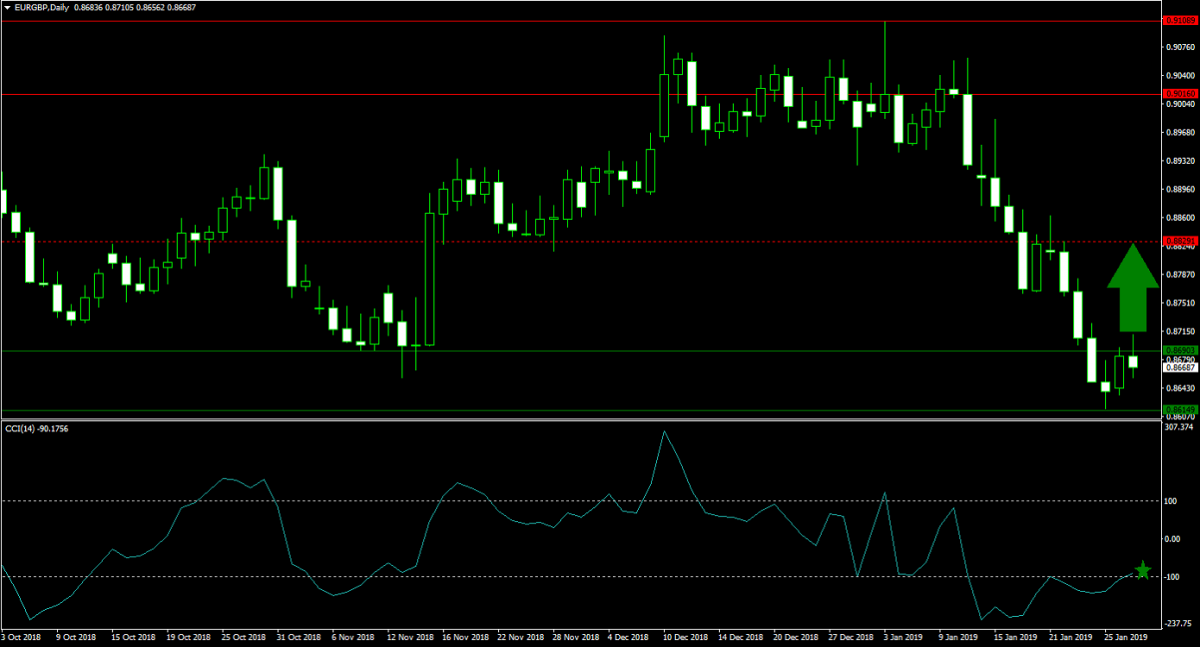

Forex Profit Set-Up #1; Buy EURGBP - D1 Time-Frame

The Euro lost plenty of ground against the British Pound as the Eurozone economy is slowing a lot faster than many anticipated. Given the high expectations for a positive outcome this evening, the risk remains that the British Pound will sell-off as forex traders book profits. The EURGBP is expected to complete a breakout above its horizontal support area and quickly advance into its next horizontal resistance level. Forex traders are advised to place their buy orders in the EURGBP below the upper band of its horizontal support area.

The CCI has already ascended from extreme oversold conditions as a positive divergence provided the necessary bullish momentum. A further advance close to the 0 mark is expected. Follow the PaxForex Daily Forex Technical Analysis and create a market beating portfolio by adding the recommended trades of our expert analysts.

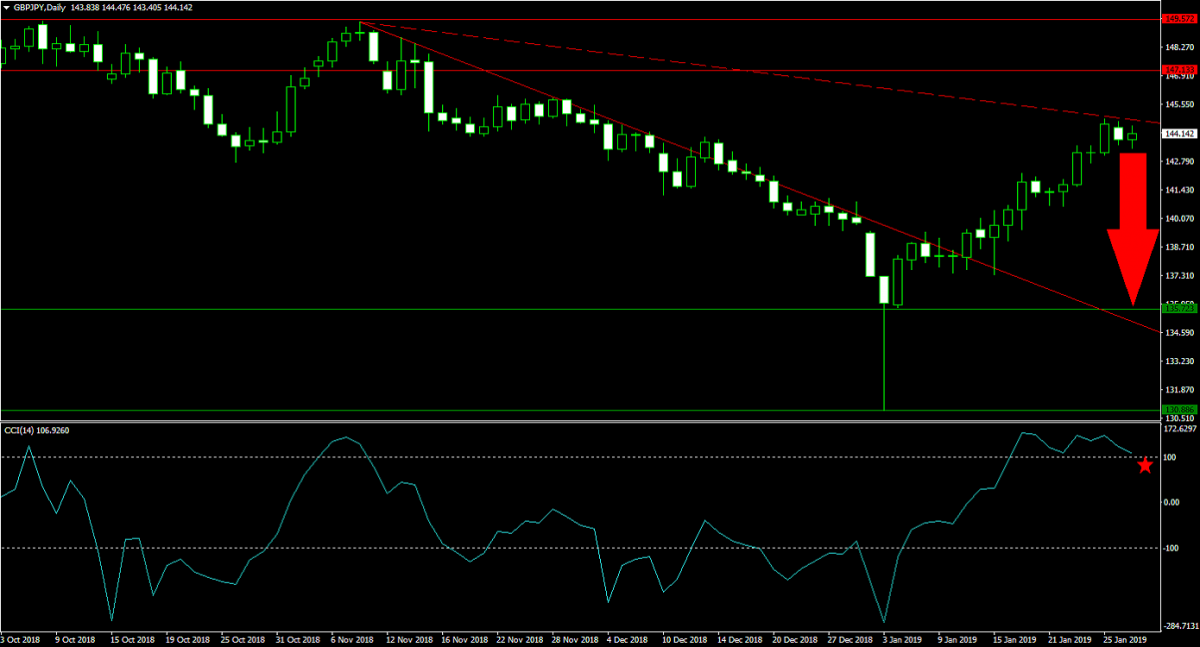

Forex Profit Set-Up #2; Sell GBPJPY - D1 Time-Frame

The Japanese Yen has endured a sell-off as risk appetite increased across the board which led to heavy Japanese Yen selling. An inflation downgrade by the Bank of Japan contributed to the move, but a disappointment this evening may result in a short-term reversal of the current uptrend in the GBPJPY. Following a breakout above its primary descending resistance level, which now turned into support, price action extended its advance into its secondary descending resistance level. Bullish momentum is now quickly fading and a reversal expected. Selling the rallies into the secondary ascending support level is favored.

The CCI accelerated into extreme overbought territory, but as bullish momentum peaked a breakdown is anticipated to materialize. A push below the 100 level is likely to trigger a sell-off on the back of profit taking. Subscribe to the PaxForex Daily Fundamental Analysis and allow our expert analysts to guide you through the fore market, yielding over 500 pips in profits per month.

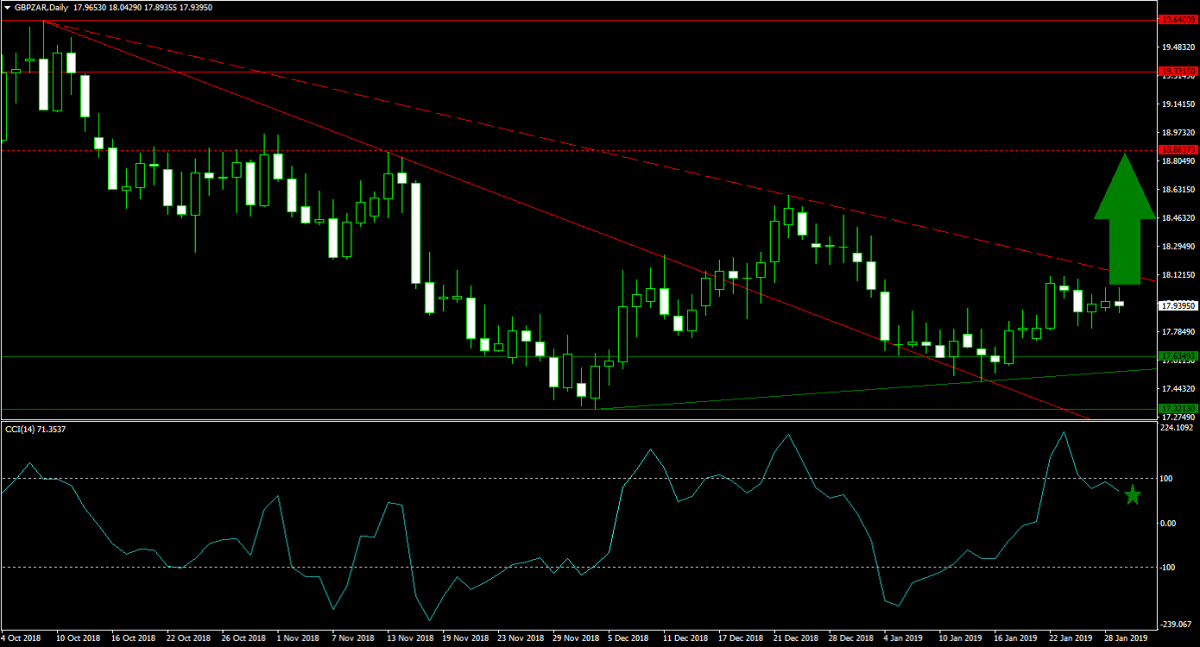

Forex Profit Set-Up #3; Buy GBPZAR - D1 Time-Frame

While it is likely that the British Pound may come under selling pressure today, the GBPZAR offers forex traders a great opportunity to enter on the long side. Despite the ultimate Brexit outcome, the British currency is expected to outperform against the South African Rand. Price action is now approaching its secondary descending resistance level, after pushing above its horizontal support area, and a breakout will open the way to a rally into its next horizontal resistance level. Forex traders are recommended to buy the dips in the GBPZAR into the upper band of its horizontal support area.

The CCI retreated from extreme overbought conditions, but with plenty of bullish momentum available, a new push above the 100 mark is expected. Download your PaxForex MT4 Trading Platform today and join our growing community of profitable forex traders; find out why more and more traders call PaxForex their home!

To receive new articles instantly Subscribe to updates.