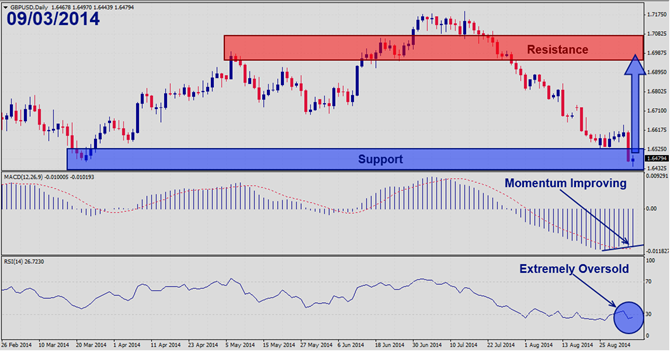

Should price action for the GBPUSD remain inside the 1.6450 to 1.6490 zone the following trade set-up is recommended: Timeframe: D1 Recommendation: Long Position Entry Level: Long Position @ 1.6470 Take Profit Zone: 1.6960 – 1.7000 Stop Loss Level: 1.6280 Should price action for the GBPUSD breakout above 1.6490 the following trade set-up is recommended: Timeframe: D1 Recommendation: Long Position Entry Level: Long Position @ Retracements in the trend; buy orders during dips Take Profit Zone: 1.6960 – 1.7000 Stop...

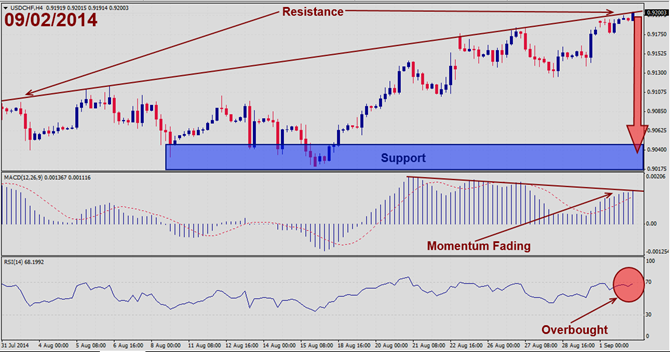

Should price action for the USDCHF remain inside the 0.9190 to 0.9210 zone the following trade set-up is recommended: Timeframe: H4 Recommendation: Short Position Entry Level: Short Position @ 0.9200 Take Profit Zone: 0.9010 – 0.9030 Stop Loss Level: 0.9250 Should price action for the USDCHF breakdown below 0.9190 the following trade set-up is recommended: Timeframe: H4 Recommendation: Short Position Entry Level: Short Position @ Retracements in the trend; sell orders during rallies Take Profit Zone: 0.9010 – 0.9030...

Should price action for the EURUSD remain inside the 1.3120 to 1.3160 zone the following trade set-up is recommended: Timeframe: H4 Recommendation: Long Position Entry Level: Long Position @ 1.3130 Take Profit Zone: 1.3400 – 1.3440 Stop Loss Level: 1.3010 Should price action for the EURUSD breakout above 1.3160 the following trade set-up is recommended: Timeframe: H4 Recommendation: Long Position Entry Level: Long Position @ Retracements in the trend; buy orders during dips Take Profit Zone: 1.3400 – 1.3440 Stop...

PaxForex finished with 480 pips in profits in August on only three closed; one gold position was closed for a profit of 300 pips and two forex positions were closed for a profit of 180 pips. Our third-quarter profit stands at 2,240 pips. We currently have fifteen open trading positions in our portfolio and expect to add to them in the coming trading week. We had the following five trading recommendations this week: Monday, August 25th – EURUSD August 25th 2014; Long @ 1.3600, 1.3475, 1.3385, 1.3280 and 1.3180 Tuesday, August...

The USDCHF has corrected rather sharp in the past week and launched a minor rally to shake off its oversold condition. After the rally it has launched another correction to retest support. This pair has formed an inverted hammer formation at its declining support line and is poised for another attempt at a rally. MACD has broken down from bullish to bearish, but holds up at its previous correction lows while its moving average remains bullish for the time being. RSI is oversold and has just crossed from extreme oversold condition...