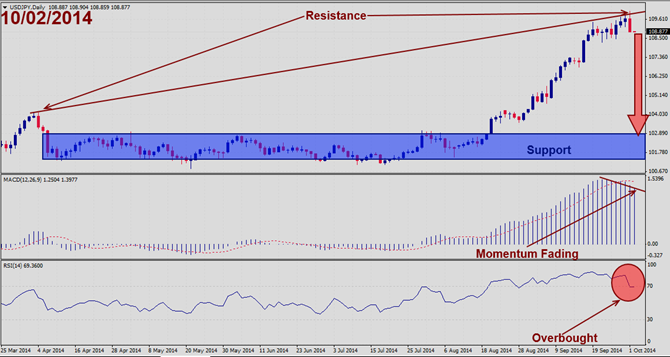

Should price action for the USDJPY remain inside the 108.70 to 109.10 zone the following trade set-up is recommended: Timeframe: D1 Recommendation: Short Position Entry Level: Short Position 108.90 Take Profit Zone: 101.80 – 102.20 Stop Loss Level: 111.20 Should price action for the USDJPY breakdown below 108.70 the following trade set-up is recommended: Timeframe: D1 Recommendation: Short Position Entry Level: Short Position @ Retracements in the trend; sell orders during rallies Take Profit Zone: 101.80 – 102.20...

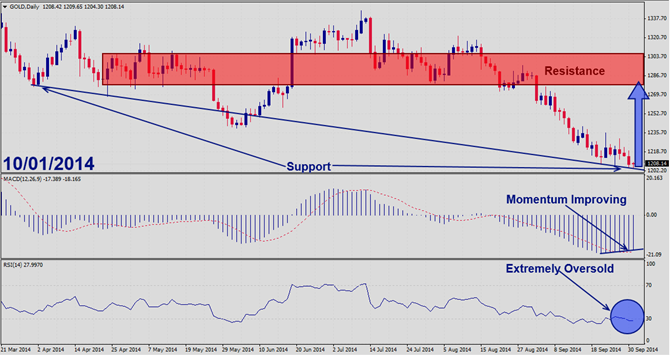

Should price action for Gold remain inside the 1,206 to 1,210 zone the following trade set-up is recommended: Timeframe: D1 Recommendation: Long Position Entry Level: Long Position @ 1,208 Take Profit Zone: 1,284 – 1,288 Stop Loss Level: 1,175 Should price action for Gold breakout above 1,210 the following trade set-up is recommended: Timeframe: D1 Recommendation: Long Position Entry Level: Long Position @ Retracements in the trend; buy orders during dips Take Profit Zone: 1,284 – 1,288 Stop Loss Level: 1,175...

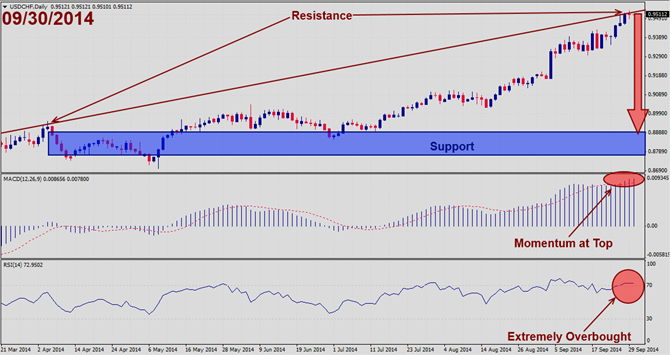

Should price action for the USDCHF remain inside the 0.9490 to 0.9530 zone the following trade set-up is recommended: Timeframe: D1 Recommendation: Short Position Entry Level: Short Position 0.9510 Take Profit Zone: 0.8780 – 0.8820 Stop Loss Level: 0.9760 Should price action for the USDCHF breakdown below 0.9490 the following trade set-up is recommended: Timeframe: D1 Recommendation: Short Position Entry Level: Short Position @ Retracements in the trend; sell orders during rallies Take Profit Zone: 0.8780 – 0.8820...

Should price action for the EURUSD remain inside the 1.2640 to 1.2680 zone the following trade set-up is recommended: Timeframe: D1 Recommendation: Long Position Entry Level: Long Position @ 1.2660 Take Profit Zone: 1.3620 – 1.3660 Stop Loss Level: 1.2430 Should price action for the EURUSD breakout above 1.2680 the following trade set-up is recommended: Timeframe: D1 Recommendation: Long Position Entry Level: Long Position @ Retracements in the trend; buy orders during dips Take Profit Zone: 1.3620 – 1....

The AUDNZD has been trading down in its bearish price channel as visible on this H4 chart. The pair currently trades at the declining resistance line from its bearish price channel. Given the fact that the formation is stable any rally should be limited to the declining resistance line. MACD has been bearish and supported the formation. This indicates that further weakness should be expected after a brief rally. RSI has reached oversold territory and offers the final indication for an upcoming rally. We recommend taking a long...