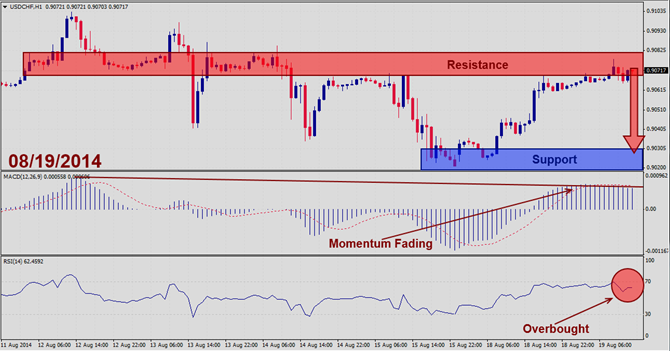

Should price action for the USDCHF remain inside the 0.9060 to 0.9080 zone the following trade set-up is recommended: Timeframe: H1 Recommendation: Short Position Entry Level: Short Position @ 0.9070 Take Profit Zone: 0.9020 – 0.9040 Stop Loss Level: 0.9100 Should price action for the USDCHF breakdown below 0.9060 the following trade set-up is recommended: Timeframe: H1 Recommendation: Short Position Entry Level: Short Position @ Retracements in the trend; sell orders during rallies Take Profit Zone: 0.9020 – 0.9040...

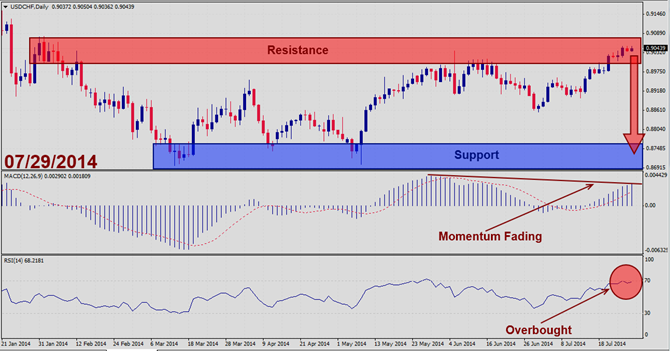

Should price action for the USDCHF remain inside the 0.9050 to 0.9090 zone the following trade set-up is recommended: Timeframe: D1 Recommendation: Short Position Entry Level: Short Position @ 0.9080 Take Profit Zone: 0.8720 – 0.8760 Stop Loss Level: 0.9220 Should price action for the USDCHF breakdown below 0.9050 the following trade set-up is recommended: Timeframe: D1 Recommendation: Short Position Entry Level: Short Position @ Retracements in the trend; sell orders during rallies Take Profit Zone: 0.8720 – 0.8760...

Should price action for the USDCHF remain inside the 0.9020 to 0.9060 zone the following trade set-up is recommended: Timeframe: D1 Recommendation: Short Position Entry Level: Short Position @ 0.9040 Take Profit Zone: 0.8720 – 0.8760 Stop Loss Level: 0.9180 Should price action for the USDCHF breakdown below 0.9020 the following trade set-up is recommended: Timeframe: D1 Recommendation: Short Position Entry Level: Short Position @ Retracements in the trend; sell orders during rallies Take Profit Zone: 0.8720 – 0.8760...

The USDCHF has corrected rather sharp in the past week and launched a minor rally to shake off its oversold condition. After the rally it has launched another correction to retest support. This pair has formed an inverted hammer formation at its declining support line and is poised for another attempt at a rally. MACD has broken down from bullish to bearish, but holds up at its previous correction lows while its moving average remains bullish for the time being. RSI is oversold and has just crossed from extreme oversold...

The USDCHF has corrected after it ran into its 200 DMA and currently dances around its new temporary support level as visible on this H4 chart. The last ten candlestick patterns have indicated a new support level and we believe this pair will use it to launch a small rally. MACD confirms the formation of a new support level and RSI has traded in extreme oversold territory for an extended period of time. Look out for a breakout into oversold territory and above which should accelerate the rally. We recommend taking a long...