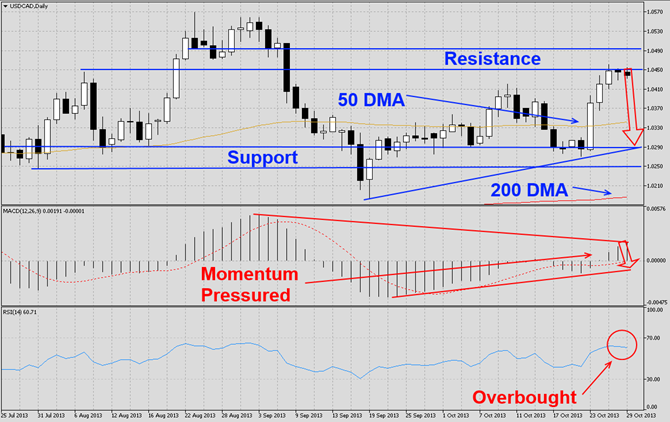

The USDCAD has rallied after briefly piercing its horizontal support level as visible in this D1 chart. This currency pair is now trading at its horizontal resistance level and should start to correct back down to its horizontal support level which is also enforced by its ascending support level. A breakdown could open the way down to its ascending 200 DMA. MACD indicates that momentum is pressured inside a triangle formation which should lead to a breakdown of momentum and potentially a bearish centerline crossover. RSI is...

The USDCAD has rallied from its lows and formed a rising wedge formation as visible in this H4 chart. The last three candlestick patterns have formed at the top of the formation which hints that a breakdown is imminent. MACD shows that momentum has faded during the last part of the rally. Watch out for a breakdown into bearish territory as the formation collapses. RSI has been trading in and out for extreme overbought and overbought territory while it also formed a negative divergence. We recommend taking a short position at 0....

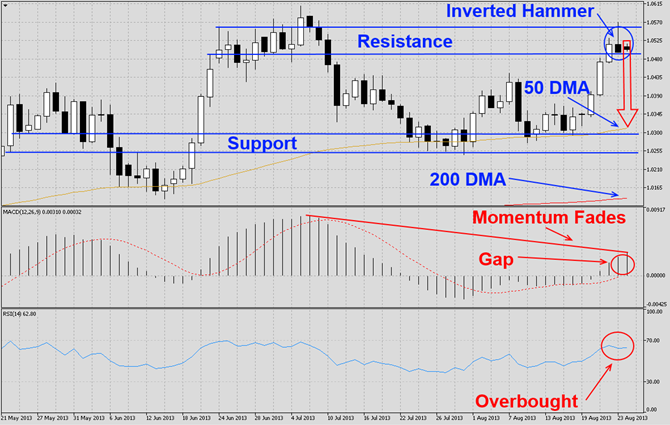

The USDCAD rallied sharply from its strong support level as visible in this D1 chart. This currency pair has now exhausted its rally as it ran into a very strong horizontal resistance zone and the top of its zone would cause the formation of a double top which is also a bearish chart pattern. Additionally we have a very solid inverted hammer candlestick which is a very bearish signal especially given its location at solid resistance levels. We expect this currency pair to correct back down to its support level, but form a higher...

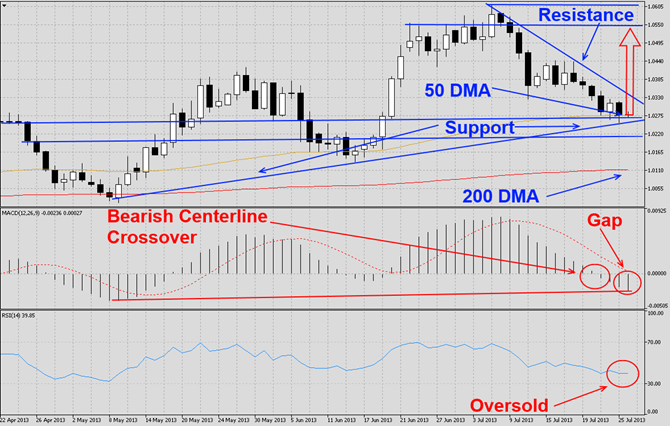

The USDCAD has corrected after it reached a multi-month high as visible in this D1 chart. This currency pair has moved lower and currently rests at solid horizontal as well as ascending support levels which are also enforced by its 50 DMA. We believe the USDCAD will attempt a rally as well as a breakout of its descending resistance level and move higher to either form a head-and-shoulders reversal pattern or a double top, both of which are bearish chart formations. MACD has completed a bearish centerline crossover which we believe...

The USDCAD has rallied sharply after it touched its 200 DMA as visible in this D1 chart. This currency pair then broke through resistance and reached a new multi-month high before retreating. The USDCAD now broken down through support levels and currently trades near support-turned-resistance which also marks the top of is underneath rising wedge formation which is a bearish chart pattern. We expect a correction to take place which would take this currency pair back down to its 200 DMA. MACD shows that bullish momentum is fading...