Source: PaxForex Premium Analytics Portal, Technical Insight

U.S.: Consumer sentiment has improved sharply:

- US, University of Michigan: March, final Consumer Sentiment Index 84.9 vs. prelim 83.0 / forecast 83.6 / and pre. 76.8, the best result since March 2020, but it's still far from pre-survey levels;

- Assessment of current economic conditions 93.0 vs. prelim 91.5 / forecast / and pre. 86.2, the highest since March 2020;

- 6-month consumer expectations of 79.7 vs. prelim/projection 77.5 and forecast 70.7 - also at highs since March 2020;

- 1-year inflation expectations 3.1% vs. 3.1% forecast and pre. 3.3% in February, 3.0% in January, and 2.5% in December - the indicator has begun to stabilize after rising for several months;

- 5-10-year inflation expectations 2.8% vs. 2.7% and 2.7%.

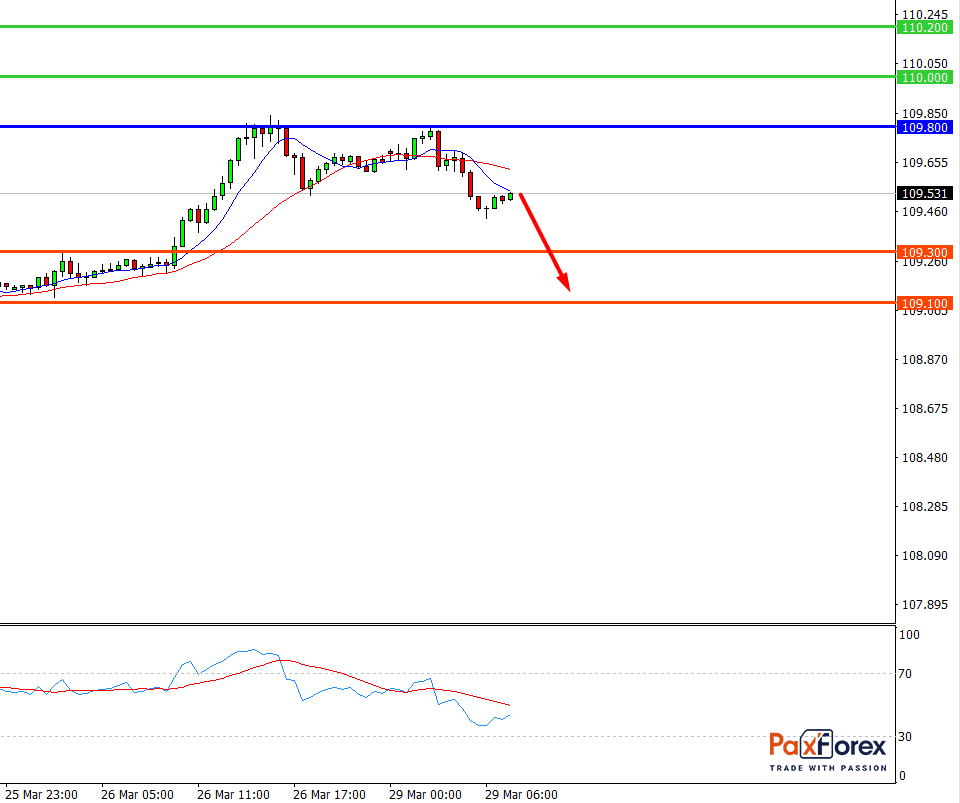

USD/JPY, 30 min

Pivot: 109.53

Analysis:

Provided that the currency pair is traded below 109.80, follow the recommendations below:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 109.53

- Take Profit 1: 109.30

- Take Profit 2: 109.10

Alternative scenario:

In case of breakout of the level 109.80, follow the recommendations below:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 109.80

- Take Profit 1: 110.00

- Take Profit 2: 110.20

Comment:

Technically RSI shows the possibility of a downtrend during the day.

Key levels:

| Resistance | Support |

| 110.20 | 109.30 |

| 110.00 | 109.10 |

| 109.80 | 108.95 |

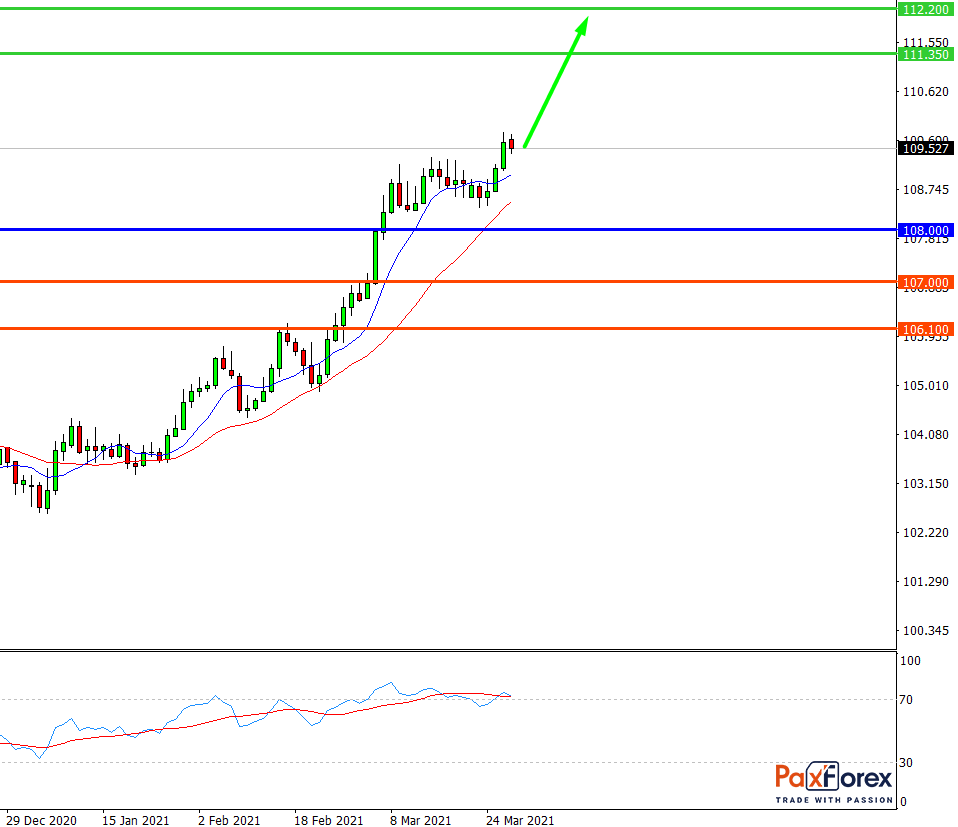

USD/JPY, D1

Pivot: 109.78

Analysis:

While the price is above 108.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 109.78

- Take Profit 1: 111.35

- Take Profit 2: 112.20

Alternative scenario:

If the level 108.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 108.00

- Take Profit 1: 107.00

- Take Profit 2: 106.10

Comment:

RSI shows a medium-term uptrend.

Key levels:

| Resistance | Support |

| 113.00 | 108.00 |

| 112.20 | 107.00 |

| 111.35 | 106.10 |

We also advise you to pay attention to the following currency pairs for intraday trading:

EUR/USD – sell below 1.1800 with 1.1760 and 1.1745 targets as Take Profit. Alternative scenario - if the level 1.1800 is broken-out, buy with the TP 1.1815 and 1.1830.

GBP/USD - short positions below 1.3800 with 1.3745 and 1.3720 targets as Take Profit. Alternative scenario - if the level of 1.3800 is broken-out, buy with the targets 1.3820 and 1.3840 as Take Profit.

USD/CHF - buy above 0.9375 with 0.9420 and 0.9440 as Take Profit targets. Alternative scenario - if the level of 0.9375 is broken-down, you should consider selling with the targets 0.9360 and 0.9345 as Take Profit.