Source: PaxForex Premium Analytics Portal, Technical Insight

As Head of Bank of Japan H. Kuroda said, the regulator expects the national economy to grow moderately in line with the trend:

There remains high uncertainty about the outlook for the economy;

The central bank does not expect Japan to return to deflation, but is keeping a close eye on price dynamics in light of current uncertainties;

In the upcoming monetary policy revision, the central bank sees no need to revisit yield curve controls;

The CB will examine various policy instruments, including yield curve controls and asset purchases, for their effectiveness;

The Central Bank should be prepared to act flexibly and take the necessary effective measures in response to possible changes in the economic or financial environment;

An extended period of ultra-low interest rates has hurt financial institution profits.

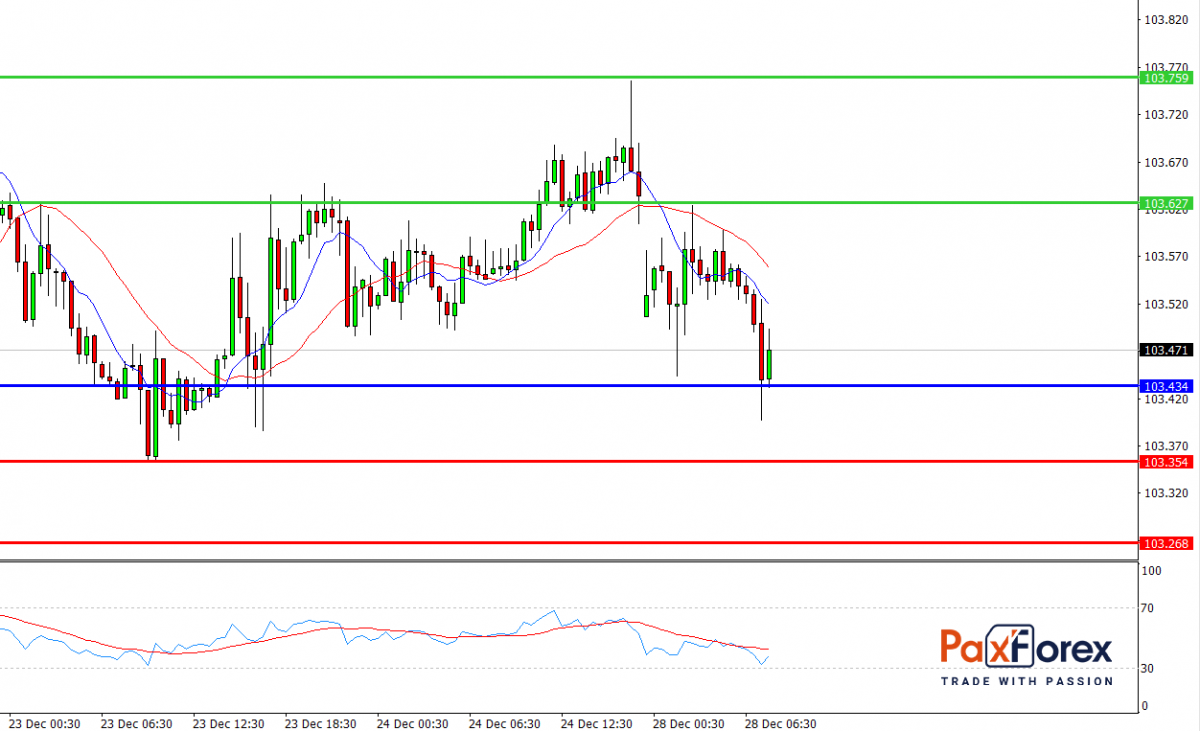

USD/JPY, 30 min

Pivot: 103.50

Analysis:

Provided that the currency pair is traded above 103.43, follow the recommendations below:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 103.50

- Take Profit 1: 103.62

- Take Profit 2: 103.75

Alternative scenario:

In case of breakdown of the level 103.43, follow the recommendations below:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 103.43

- Take Profit 1: 103.35

- Take Profit 2: 103.26

Comment:

Technically RSI shows the possibility of an uptrend during the day.

Key levels:

| Resistance | Support |

| 104.15 | 103.43 |

| 103.75 | 103.35 |

| 103.62 | 103.26 |

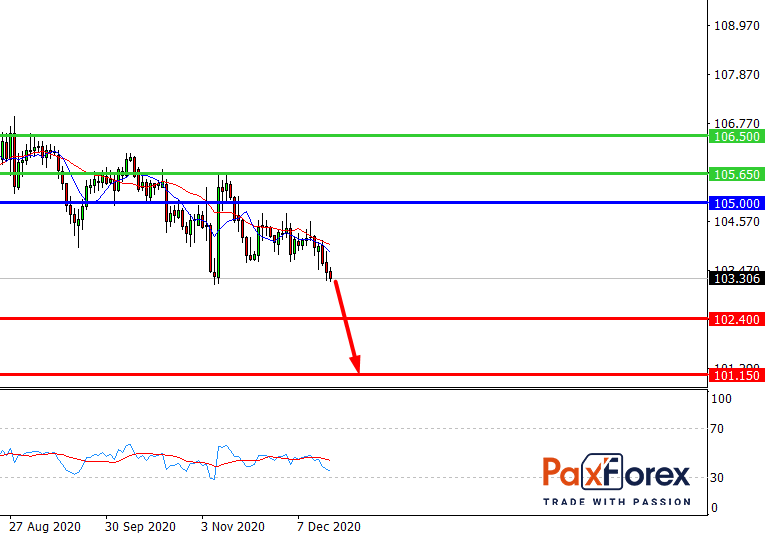

USD/JPY, D1

Pivot: 103.45

Analysis:

While the price is below 105.00, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 103.45

- Take Profit 1: 103.10

- Take Profit 2: 102.45

Alternative scenario:

If the level 105.00 is broken-out, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 105.00

- Take Profit 1: 105.65

- Take Profit 2: 106.50

Comment:

RSI shows a medium-term downtrend.

Key levels:

| Resistance | Support |

| 106.50 | 102.40 |

| 105.65 | 101.15 |

| 105.00 | 100.50 |

We also advise you to pay attention to the following currency pairs for intraday trading:

EUR/USD – buy above 1.2185 with 1.2255 and 1.2270 as Take Profit targets. Alternative scenario - if the level of 1.2185 is broken-down, you should consider selling with the targets 1.2155 and 1.2145 as Take Profit.

GBP/USD - short positions below 1.3595 with 1.3540 and 1.3500 targets as Take Profit. Alternative scenario - if the level of 1.3595 is broken-out, buy with the targets 1.3625 and 1.3650 as Take Profit.

USD/CHF - buy above 0.8870 with 0.8915 and 0.8945 targets as Take Profit. Alternative scenario - if the level 0.8870 is broken-down, sell with the TP 0.8840 and 0.8915.