Source: PaxForex Premium Analytics Portal, Technical Insight

According to the Head of the Bank of Japan H. Kuroda, speaking in the National Parliament:

If necessary, the Central Bank will not hesitate to take additional measures to mitigate monetary policy;

The world economy is expected to recover, but only at a modest pace;

The Japanese economy is showing recovery as export and production indicators reflect the recovery of foreign economies;

Japan's economy will maintain a trend of recovery, but the pace will be moderate due to concerns about COVID-19;

Price risks are bearish due to the high level of uncertainty surrounding the effects of coronavirus;

It is premature to discuss the exit from the ultra-softened policy, including curtailment of government bond and ETF purchases;

At this stage, there are no intentions to revise the monetary policy of the Central Bank.

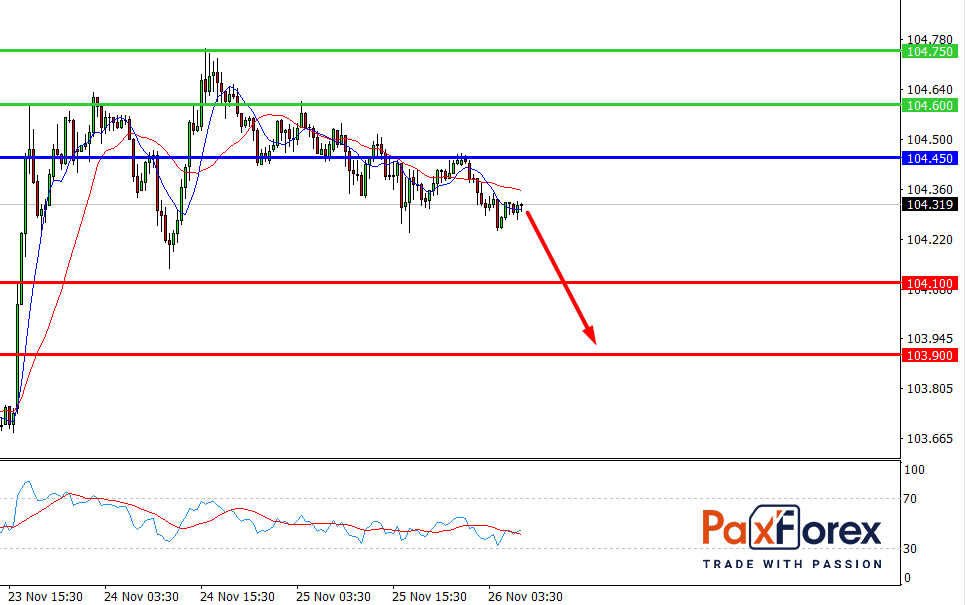

USD/JPY, 30 min

Pivot: 104.29

Analysis:

Provided that the currency pair is traded below 104.45, follow the recommendations below:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 104.29

- Take Profit 1: 104.10

- Take Profit 2: 103.90

Alternative scenario:

In case of breakout of the level 104.45, follow the recommendations below:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 104.45

- Take Profit 1: 104.60

- Take Profit 2: 104.75

Comment:

Technically RSI shows the possibility of a downtrend during the day.

Key levels:

| Resistance | Support |

| 104.75 | 104.10 |

| 104.60 | 103.90 |

| 104.45 | 103.70 |

USD/JPY, D1

Pivot: 104.35

Analysis:

While the price is below 105.65, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 104.76

- Take Profit 1: 103.10

- Take Profit 2: 102.45

Alternative scenario:

If the level 105.65 is broken-out, follow the recommendations below.

- Time frame: D1

- Recommendation: long position

- Entry point: 105.65

- Take Profit 1: 106.15

- Take Profit 2: 106.90

Comment:

RSI shows a medium-term downtrend.

Key levels:

| Resistance | Support |

| 106.90 | 103.10 |

| 106.15 | 102.45 |

| 105.65 | 101.15 |

We also advise you to pay attention to the following currency pairs for intraday trading:

EUR/USD – buy above 1.1900 with 1.1970 and 1.1990 as Take Profit targets. Alternative scenario - if the level of 1.1900 is broken-down, you should consider selling with the targets 1.1880 and 1.1865 as Take Profit.

GBP/USD - long positions above 1.3365 with 1.3435 and 1.3470 targets as Take Profit. Alternative scenario - if the level of 1.3365 is broken-down, sell with the targets 1.3335 and 1.3310 as Take Profit.

USD/CHF - sell below 0.9095 with 0.9040 and 0.9020 targets as Take Profit. Alternative scenario - if the level 0.9095 is broken-out, buy with the TP 0.9110 and 0.9130.