Source: PaxForex Premium Analytics Portal, Technical Insight

Bank of Japan Governor H. Kuroda, during an ongoing speech in Parliament, said:

- The central bank is taking extraordinary policy easing measures that no other central bank applies;

- In particular, we are talking about buying risky assets such as ETFs;

- It is a necessary measure that should help accelerate inflation to the 2% mark;

- The Central Bank takes into account that an excessive decline in yields at the far end of the curve could harm the economy;

- The Central Bank will consider the side effects of its monetary policy and the risks of financial imbalances;

- The potential impact of a growing number of new strains of the virus should be monitored closely, although Japan's overall economy is improving thanks to a strong global economic recovery.

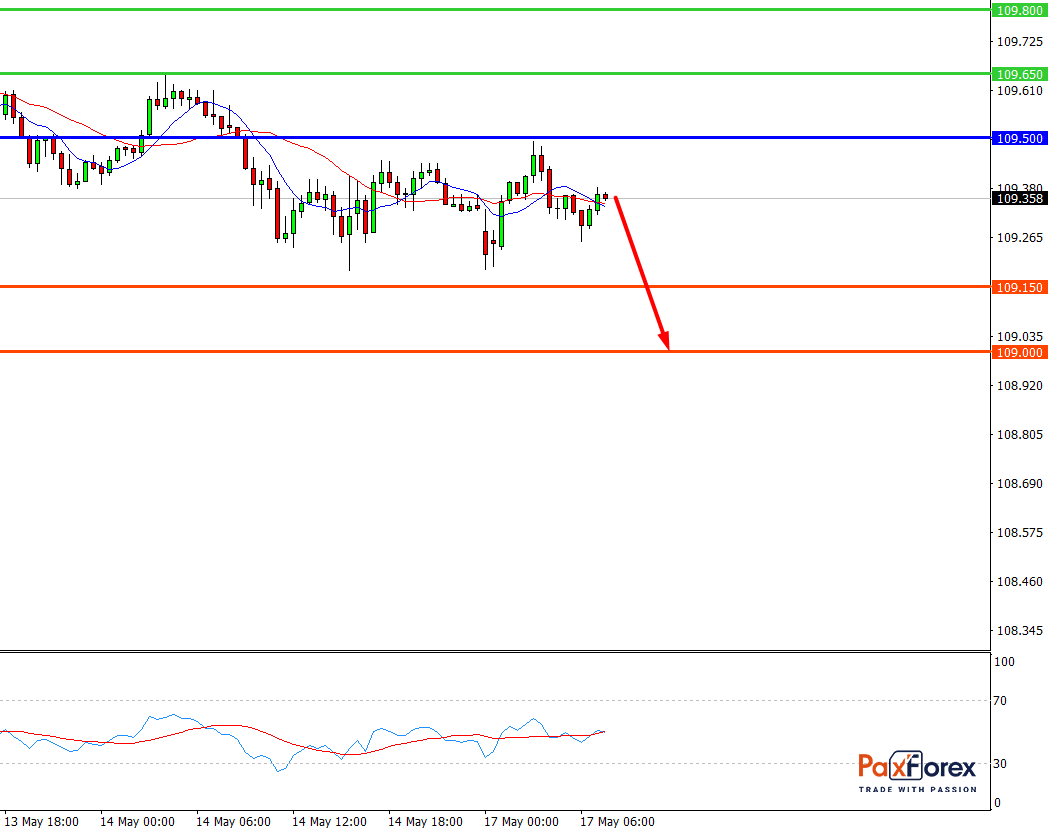

USD/JPY, 30 min

Pivot: 109.34

Analysis:

Provided that the currency pair is traded below 109.50, follow the recommendations below:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 109.34

- Take Profit 1: 109.15

- Take Profit 2: 109.00

Alternative scenario:

In case of breakout of the level 109.50, follow the recommendations below:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 109.50

- Take Profit 1: 109.65

- Take Profit 2: 109.80

Comment:

Technically RSI shows the possibility of a downtrend during the day.

Key levels:

| Resistance | Support |

| 109.80 | 109.15 |

| 109.65 | 109.00 |

| 109.50 | 108.85 |

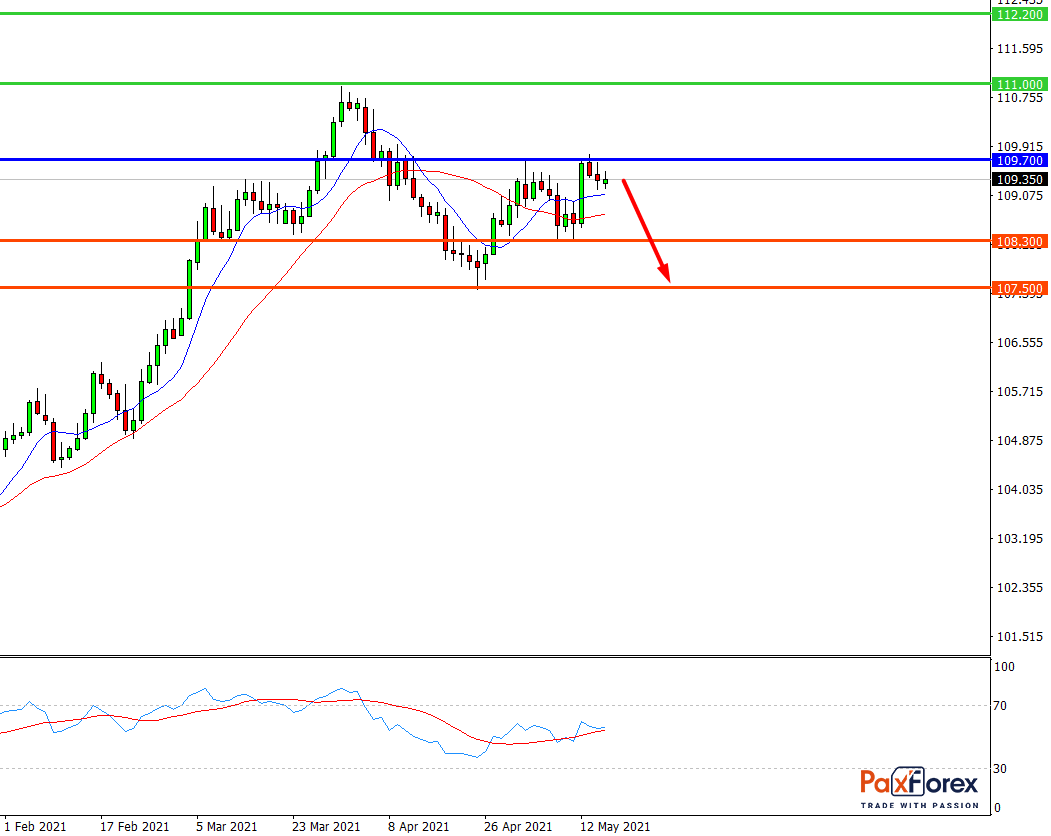

USD/JPY, D1

Pivot: 109.38

Analysis:

While the price is below 109.70, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 109.38

- Take Profit 1: 108.30

- Take Profit 2: 107.50

Alternative scenario:

If the level 109.70 is broken-out, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 109.70

- Take Profit 1: 111.00

- Take Profit 2: 112.20

Comment:

RSI shows a medium-term downtrend.

Key levels:

| Resistance | Support |

| 112.20 | 108.30 |

| 111.00 | 107.50 |

| 109.70 | 106.10 |

We also advise you to pay attention to the following currency pairs for intraday trading:

EUR/USD – buy above 1.2120 with 1.2170 and 1.2185 targets as Take Profit. Alternative scenario - if the level 1.2120 is broken-down, sell with the TP 1.2100 and 1.2080.

GBP/USD - long positions above 1.4070 with 1.4125 and 1.4145 targets as Take Profit. Alternative scenario - if the level of 1.4070 is broken-down, sell with the targets 1.4050 and 1.4035 as Take Profit.

USD/CHF - sell below 0.9035 with 0.9000 and 0.8980 as Take Profit targets. Alternative scenario - if the level of 0.9035 is broken-out, you should consider buying with the targets 0.9050 and 0.9065 as Take Profit.