Source: PaxForex Premium Analytics Portal, Technical Insight

As the head of the Central Bank of Japan, H. Kuroda said during an ongoing speech in Parliament:

- Foreign exchange rates are determined by a variety of factors;

- In recent years, the yen, dollar, and euro have shown stability;

- It is due to the course of monetary policy of the Bank of Japan, the Fed, and the ECB to achieve inflation within 2%;

- It is difficult to explain the yen's rapid rise in 2011 by the monetary base gap of Japan and other economies alone;

- The yen as a safe-haven currency tends to rise in moments of market turbulence; good thing that's not the case now;

- The current rise in Treasury yields is a reflection of optimism about economic recovery, but the COVID-19 situation remains the biggest risk factor for the outlook;

- The Central Bank is keeping a close eye on the forex situation as it affects the economy and prices.

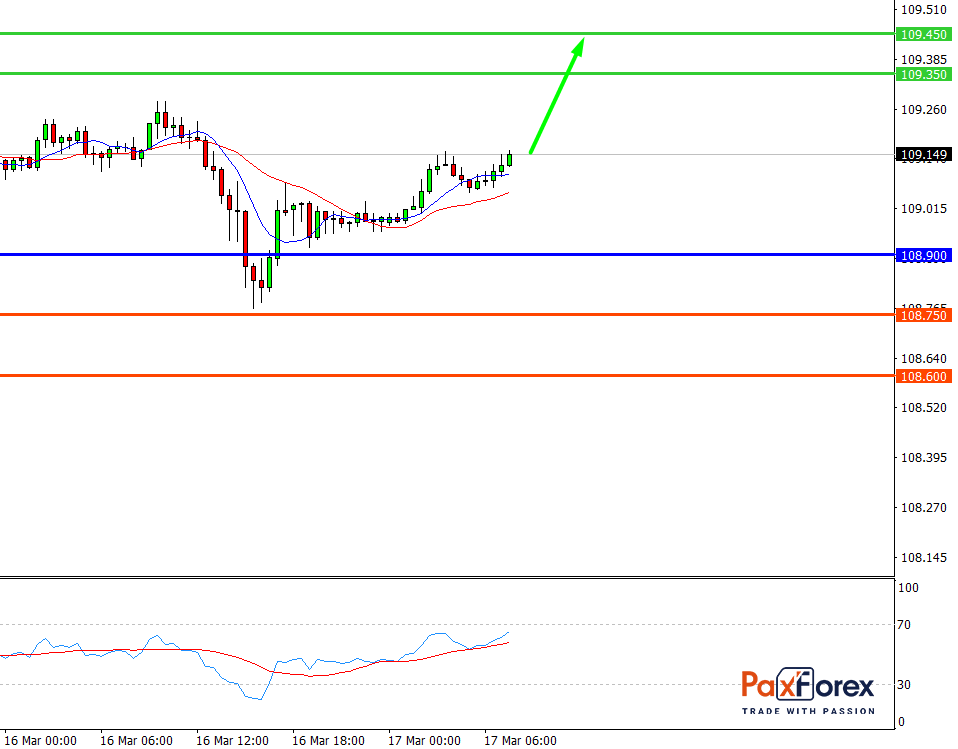

USD/JPY, 30 min

Pivot: 109.08

Analysis:

Provided that the currency pair is traded above 108.90, follow the recommendations below:

- Time frame: 30 min

- Recommendation: long position

- Entry point: 109.08

- Take Profit 1: 109.35

- Take Profit 2: 109.45

Alternative scenario:

In case of breakdown of the level 108.90, follow the recommendations below:

- Time frame: 30 min

- Recommendation: short position

- Entry point: 108.90

- Take Profit 1: 108.75

- Take Profit 2: 108.60

Comment:

Technically RSI shows the possibility of an uptrend during the day.

Key levels:

| Resistance | Support |

| 109.70 | 108.90 |

| 109.45 | 108.75 |

| 109.35 | 108.60 |

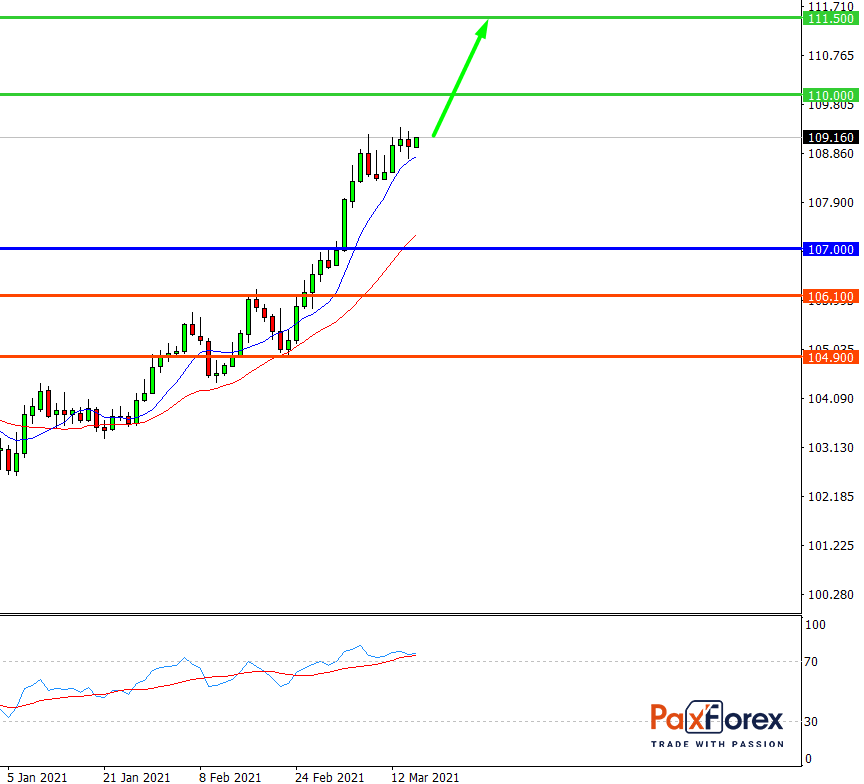

USD/JPY, D1

Pivot: 109.04

Analysis:

While the price is above 107.00, follow the recommendations below:

- Time frame: D1

- Recommendation: long position

- Entry point: 109.04

- Take Profit 1: 110.00

- Take Profit 2: 111.35

Alternative scenario:

If the level 107.00 is broken-down, follow the recommendations below:

- Time frame: D1

- Recommendation: short position

- Entry point: 107.00

- Take Profit 1: 106.10

- Take Profit 2: 104.90

Comment:

RSI shows a medium-term uptrend.

Key levels:

| Resistance | Support |

| 112.20 | 107.00 |

| 111.35 | 106.10 |

| 110.00 | 104.90 |

We also advise you to pay attention to the following currency pairs for intraday trading:

EUR/USD – sell below 1.1920 with 1.1880 and 1.1865 targets as Take Profit. Alternative scenario - if the level 1.1920 is broken-out, buy with the TP 1.1935 and 1.1950.

GBP/USD - long positions above 1.3870 with 1.3925 and 1.3950 targets as Take Profit. Alternative scenario - if the level of 1.3870 is broken-down, sell with the targets 1.3850 and 1.3830 as Take Profit.

USD/CHF - buy above 0.9240 with 0.9285 and 0.9300 as Take Profit targets. Alternative scenario - if the level of 0.9240 is broken-down, you should consider selling with the targets 0.9230 and 0.9215 as Take Profit.